TIDMHOC

RNS Number : 6872C

Hochschild Mining PLC

21 January 2015

__________________________________________________________________________________

21 January 2015

Production Report for the 12 months ended 31 December 2014

2014 Highlights

-- Full year production of 22.2 million attrib. silver

equivalent ounces substantially exceeding 21.0 million target

-- Main operation all-in sustaining costs per silver equivalent

ounce expected to fall by up to 5% in 2014, within guidance

(2013:$18.6/oz)

-- Total cash of approximately $115 million as at 31 December

2014

2015 Outlook

-- Further progress achieved at Inmaculada Advanced Project:

o 2015 production target of 6-7 million silver equivalent ounces

remains in place despite some construction delays

o Overall project 86% complete

o Plant construction 85% complete vs 57% in Q3; contractor

expected to commission plant in Q2 2015

o Key underground development plan ahead of schedule - 157,449

tonnes of development mineral already stockpiled

o Remaining construction capital expenditure of $72 million in

2015

-- Core operation mine plans revised to deliver profitable

ounces in lower precious metal price environment

-- 2015 attributable production target of 24.0 million silver

equivalent ounces

-- 2015 all-in sustaining costs expected to be $15-16 per silver

equivalent ounce

-- 6.0 million silver ounces sold forward for 2015 at $17.75 per

ounce

-- 38,000 gold ounces already sold forward for 2015 at $1,300

per ounce

Ignacio Bustamante, Chief Executive Officer commented:

"Despite the complex precious metal environment, our core assets

have once again surpassed their annual target, this time by almost

6%. Several cost cutting initiatives were also successfully

implemented during the year materially improving our operations'

competitiveness for the year ahead. The Company will grow its

production to 24 million silver equivalent ounces in 2015 while

maintaining the management's focus on reducing costs and improving

efficiencies.

Our flagship Inmaculada project is close to completion, with the

mine itself already ramping up and the plant construction moving

towards its final stages. We are excited about Inmaculada as it

will not only be the cornerstone of our production base in Peru but

also will contribute significantly to reinforcing our strong cash

cost position."

__________________________________________________________________________________

A conference call will be held at 2.30pm (London time) on

Wednesday 21 January 2015 for analysts and investors.

Dial in details as follows:

UK: +44 (0) 20 3139 4830

Pin: 16963109#

A recording of the conference call will be available for one

week following its conclusion, accessible from the following

telephone number:

UK: +44 (0) 20 3426 2807

Pin: 653659#

__________________________________________________________________________________

Overview

In Q4 2014, the Company delivered attributable production of 5.6

million silver equivalent ounces, comprised of 4.1 million ounces

of silver and 24.4 thousand ounces of gold. This has brought the

total for 2014 to 22.2 million silver equivalent ounces, a 6%

increase on the 2014 production target of 21.0 million ounces and

comprised of 16.2 million ounces of silver and 101 thousand ounces

of gold.

The Company reiterates that it expects its 2014 main operation

all-in sustaining costs per silver equivalent ounce to have fallen

by up to 5% (2013: $18.6/ounce).

Production

Arcata

At Arcata, total silver equivalent production in Q4 was 1.8

million ounces (Q4 2013: 1.6 million ounces), a 17% improvement on

the previous quarter. Full year silver equivalent production at

Arcata was 6.8 million ounces, a very creditable 13% improvement on

the 2013 result (6.0 million ounces) and was principally driven by

a planned move to higher grade areas of the mine.

Pallancata

At Pallancata, as a result of the Company's adjustment of mine

plans to ensure the extraction of profitable ounces, as detailed in

the November 2014 Operational Update, tonnage in the fourth quarter

was moved downwards with grades increasing and resulting in

production of 1.9 million silver equivalent ounces (Q4 2013: 2.6

million ounces). For the full year, Pallancata produced 8.0 million

silver equivalent ounces (2013: 9.3 million ounces) with the fall

in the second half reflecting the scheduled move to thinner veins

in the mix.

San Jose

The San Jose operation delivered a strong quarter with 3.6

million silver equivalent ounces produced, a 21% improvement on the

Q3 2014 result (2.9 million ounces) and was the result of higher

tonnage and higher silver and gold grades. In 2014 as a whole, San

Jose again proved to be a very consistent performer with increased

tonnage offsetting lower grades and resulting in almost flat

year-on-year production of 12.1 million silver equivalent ounces

(2013: 12.3 million ounces).

Average realisable prices and sales

Average realisable precious metal prices in Q4 2014 (which are

reported before the deduction of commercial discounts and include

the effects of the announced hedging agreements) were $1,222/ounce

for gold and $16.95/ounce for silver (Q4 2013: $1,209/ounce for

gold and $19.74/ounce for silver). For the full year 2014, average

realisable precious metal prices were $1,279/ounce for gold and

$18.87/ounce for silver (2013: $1,338/ounce for gold and

$22.12/ounce for silver).

Brownfield exploration(1)

Arcata

In Q4 2014, 7,203 metres have been drilled at Arcata.

Significant intercepts included:

Vein Results

------------ -----------------------------------------

DDH739-LM14: 1.42m at 12.42 g/t Au &

Pamela Sur 2,245 g/t Ag

------------ -----------------------------------------

DDH743-LM14: 0.86m at 0.95 g/t Au &

Pamela 303 g/t Ag

------------ -----------------------------------------

DDH741-LM14: 1.05m at 1.14 g/t Au &

Socorro+400 479 g/t Ag

------------ -----------------------------------------

DDH742-LM14: 0.97m at 11.12 g/t Au &

Lucero 1,437 g/t Ag

------------ -----------------------------------------

DDH742-LM14: 2.55m at 8.47 g/t Au &

Sorpresa 4 1,930 g/t Ag

------------ -----------------------------------------

DDH737-GE14: 0.81m at 3.11g/t Au & 1,824

Tunel 3 g/t Ag

------------ -----------------------------------------

Pallancata

In Q4, 2,924 metres of drilling was carried out at Pallancata

focusing on potential areas such as East Larissa, Isis, East

Pallancata, Pucanta and Emilia NW. Mapping campaigns were carried

out over 686ha including areas such as Ranichico, Yanacochita,

Roiropata and Yurika.

San Jose

In Q4 2014,2,111 metres were drilled at San Jose with mapping of

the south side of the San Jose area covering an area of 211ha.

Significant results include:

Vein Results

------- ------------------------------------

DDH-SJD1483: 0.94m at 9.51 g/t Au &

Karina 1,318 g/t Ag

------- ------------------------------------

Advanced Project

Inmaculada

During the fourth quarter at the Inmaculada project,

construction of the plant was continued by the EPC contractor,

Graña y Montero, and has currently reached 85% completion. Delays

remain at the plant site itself and, in particular, the concrete

foundations for the plant's SAG mill were found to not meet

contractual technical specifications and are consequently having to

be rebuilt. The effect of this and other previously mentioned minor

delays is that the plant is now expected to be commissioned in the

second quarter of 2015.

However, continuing good progress in the originally envisaged

bottleneck area of mine development has been made by the Hochschild

team and is expected to ensure that a stockpile of approximately

263,000 tonnes will be available for processing on completion of

the plant. Consequently, the Company reiterates that the overall

production forecast of 6-7 million silver equivalent ounces for

2015 remains in place.

A total of 15,406 metres of tunnelling and 2,445 metres of raise

boring have been carried out to date at the project. In addition,

construction continued in the fourth quarter on the tailings dam,

warehouses, laboratories and workshops as well as work on the paste

backfill plant.

Construction capital expenditure at the project to date is $348

million with the remaining construction capital expenditure for

2015 expected to be $72 million bringing the total to $420

million.

Exploration pipeline

Highlights of the exploration programme during the period are

provided below.

Mexico

During Q4 2014, the Company decided to close its exploration

office in Chihuahua and focus on financing and supporting the

Riverside Resources Joint Venture in the Sonora gold belt from the

head office. The venture continues to explore new opportunities in

this prolific, low-cost mineral district.

Peru

Exploration efforts during Q4 2014 were focused on the Corina

project, optioned from Lara Exploration earlier in 2014. Company

community relations teams are currently negotiating access

agreements that would allow the Company to drill in late 2015,

subject to government permit approvals.

Financial position

Total cash was approximately $115 million as at 31 December

2014. On 21 October, Hochschild announced that following maturity

of its 5.75 per cent senior unsecured convertible bonds on 20

October 2014, all outstanding convertible bonds have been redeemed.

As a result, the principal amount of $114.9 million has been repaid

in full, financed from existing cash resources.

In early October, Hochschild successfully secured a $100 million

medium term loan facility with Scotiabank which was subsequently

drawn down on 29 October. In addition, the Company reinforced its

liquidity position further this month by utilising its lines of

credit in Peru to secure short term funding of $50 million at

advantageous rates, bringing the current cash level to

approximately $170 million.

On 19 January 2015, the Company signed agreements to hedge the

sale of 6,000,000 ounces of silver at $17.75 per ounce for 2015.

This is in addition to the previous agreement to hedge 38,000

ounces of gold for 2015 at $1,300 per ounce.

Outlook

As previously disclosed, the mine plans of the Arcata and

Pallancata operations have been optimised with the operational

focus expected to be on accessible ore areas requiring reduced

capital expenditure with cut-off grades reflecting the current

weaker metal price environment. Plant throughput is expected to be

reduced to 1,500 tonnes per day at Arcata and 1,800 tonnes per day

at Pallancata, with the San Jose operation in Argentina continuing

at its current level. The resulting production target for 2015 from

the three current operations plus the Inmaculada project (expected

to deliver 6-7 million silver equivalent ounces) is 24 million

silver equivalent ounces.

The disciplined focus on profitable ounces at all operations

with reduced levels of sustainable capital expenditure for 2015 is

expected to have a positive effect on the Company's overall costs

with the all-in sustaining cost for the Company now expected to be

reduced to between $15 to $16 per ounce in 2015 with the full

effect expected to be felt in the second half of the year.

Sustaining capital expenditure for current operations is budgeted

at approximately $45 million, in part reflecting a significant

temporary cut in mine development capital expenditure. Additional

mine development capital expenditure at Inmaculada is expected to

be approximately $33 million in 2015.

__________________________________________________________________________________

Enquiries:

Hochschild Mining plc

Charles Gordon +44 (0)20 3714 9040

Head of Investor Relations

Finsbury

Charles O'Brien +44 (0)20 7251 3801

Public Relations

__________________________________________________________________________________

About Hochschild Mining plc

Hochschild Mining plc is a leading precious metals company

listed on the London Stock Exchange (HOCM.L / HOC LN) with a

primary focus on the exploration, mining, processing and sale of

silver and gold. Hochschild has almost fifty years' experience in

the mining of precious metal epithermal vein deposits and currently

operates three underground epithermal vein mines, two located in

southern Peru and one in southern Argentina. Hochschild also has

numerous long-term projects throughout the Americas.

PRODUCTION & SALES INFORMATION*

TOTAL GROUP PRODUCTION

Q4 Q3 Q4 12 mths 12 mths

2014

2014 2014 2013 2013

------------------------- ------- ------- ------------ -------- --------

Silver production

(koz) 5,075 4,298 5,475 19,357 19,754

Gold production (koz) 37.72 32.34 43.80 147.03 175.22

Total silver equivalent

(koz) 7,338 6,239 8,103 28,179 30,267

Total gold equivalent

(koz) 122.31 103.98 135.05 469.65 504.45

Silver sold (koz) 5,236 3,659 5,742 18,981 19,555

Gold sold (koz) 40.00 26.47 43.56 142.77 168.56

------------------------- ------- ------- ------------ -------- --------

Total production includes 100% of all production, including

production attributable to Hochschild's joint venture partner at

San Jose as well as production in 2013 from the recently-sold Moris

operation.

ATTRIBUTABLE GROUP PRODUCTION

Q4 Q3 Q4 12 mths 12 mths

2014

2014 2014 2013 2013

----------------------- ------- ------- ------- -------- --------

Silver production

(koz) 4,115 3,546 4,622 16,187 16,639

Gold production (koz) 24.38 21.06 30.80 100.89 126.80

Silver equivalent

(koz) 5,578 4,810 6,470 22,241 24,247

Gold equivalent (koz) 92.96 80.17 107.83 370.68 404.11

----------------------- ------- ------- ------- -------- --------

Attributable production for Q4 2014 and Full Year 2014 includes

100% of all production from Arcata, Pallancata and Ares and 51%

from San Jose. Comparatives for 2013 have been restated to include

100% of production from Pallancata and also include production from

the now-sold Moris operation.

QUARTERLY PRODUCTION BY MINE

ARCATA

Product Q4 Q3 Q4 12 mths 12 mths

2014

2014 2014 2013 2013

---------------------------- ------------ ------------ ------------- ------------------ ------------------

Ore production (tonnes

treated) 186,486 149,888 244,125 701,947 900,861

Average grade silver

(g/t) 307 319 242 286 217

Average grade gold

(g/t) 0.90 0.90 0.81 0.85 0.74

Silver produced (koz) 1,579 1,353 1,337 5,827 4,984

Gold produced (koz) 4.40 3.74 4.32 16.89 16.83

Silver equivalent produced

(koz) 1,843 1,578 1,597 6,841 5,994

Silver sold (koz) 1,550 1,124 1,404 5,621 4,924

Gold sold (koz) 4.06 3.02 4.42 15.66 15.95

---------------------------- ------------ ------------ ------------- ------------------ ------------------

ARES

Product Q4 Q3 Q4 12 mths 12 mths

2014

2014 2014 2013 2013

---------------------------- ------- ------- ------------- ------------------ ------------------

Ore production (tonnes

treated) - - 91,602 167,331 329,095

Average grade silver

(g/t) - - 86 110 82

Average grade gold

(g/t) - - 2.00 2.34 2.39

Silver produced (koz) - 8 195 534 757

Gold produced (koz) - 0.17 4.90 11.63 23.40

Silver equivalent produced

(koz) - 19 489 1,232 2,162

Silver sold (koz) 17 6 214 540 761

Gold sold (koz) - 0.45 5.27 11.45 23.25

---------------------------- ------- ------- ------------- ------------------ ------------------

PALLANCATA

Product Q4 Q3 Q4 12 mths 12 mths

2014

2014 2014 2013 2013

---------------------------- ------------- ------------ ------------- ------------------ ------------------

Ore production (tonnes

treated) 256,299 271,074 291,740 1,051,068 1,088,712

Average grade silver

(g/t) 224 199 285 238 264

Average grade gold

(g/t) 1.00 0.89 1.14 1.03 1.13

Silver produced (koz) 1,537 1,402 2,198 6,527 7,628

Gold produced (koz) 6.09 5.41 6.97 24.34 27.83

Silver equivalent produced

(koz) 1,902 1,727 2,616 7,988 9,298

Silver sold (koz) 1,506 1,381 2,378 6,502 7,567

Gold sold (koz) 5.80 5.11 7.51 24.02 26.67

---------------------------- ------------- ------------ ------------- ------------------ ------------------

Comparatives from 2013 for Pallancata have been restated to 100%

of production.

SAN JOSE

Product Q4 Q3 Q4 12 mths 12 mths

2014

2014 2014 2013 2013

---------------------------- ------------ ------------ ------------ ----------------- -----------------

Ore production (tonnes

treated) 152,689 141,666 156,150 571,017 536,937

Average grade silver

(g/t) 454 388 399 404 425

Average grade gold

(g/t) 6.19 5.66 6.03 5.77 6.42

Silver produced (koz) 1,959 1,535 1,741 6,469 6,357

Gold produced (koz) 27.23 23.02 26.53 94.16 98.83

Silver equivalent produced

(koz) 3,593 2,916 3,333 12,119 12,286

Silver sold (koz) 2,163 1,150 1,742 6,316 6,278

Gold sold (koz) 30.13 17.89 25.25 91.28 94.76

---------------------------- ------------ ------------ ------------ ----------------- -----------------

The Company has a 51% interest in San Jose.

*Silver equivalent production assumes a gold/silver ratio of

60:1

Forward looking statements

This announcement may contain forward looking statements. By

their nature, forward looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that will or may occur in the future. Actual results,

performance or achievements of Hochschild Mining plc may, for

various reasons, be materially different from any future results,

performance or achievements expressed or implied by such forward

looking statements.

The forward looking statements reflect knowledge and information

available at the date of preparation of this announcement. Except

as required by the Listing Rules and applicable law, the Board of

Hochschild Mining plc does not undertake any obligation to update

or change any forward looking statements to reflect events

occurring after the date of this announcement. Nothing in this

announcement should be construed as a profit forecast.

- ends -

(1) Please note that in line with industry-wide standards, all

mineralised intersections in this release are quoted as calculated

true widths.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCPGUUPGUPAGRU

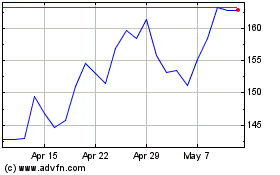

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Apr 2023 to Apr 2024