TIDMHOC

RNS Number : 2240K

Hochschild Mining PLC

15 April 2015

15 April 2015

2014 Annual Report and 2015 Annual General Meeting ("AGM")

Following the release of the Company's 2014 full year results

announcement on 18 March 2015 (the "Preliminary Announcement"), the

Company announces it has published its Annual Report and Accounts

for the year ended 31 December 2014 (the "2014 Annual Report").

In accordance with LR 9.6.1, the following documents have been

submitted to the National Storage Mechanism and will be available

for inspection at www.Hemscott.com/nsm.do

-- The 2014 Annual Report

-- The 2015 AGM Circular (incorporating the Notice of 2015 AGM)

-- The 2015 AGM Proxy Card (incorporating the Notice of Availability of

the 2014 Annual Report and 2015 AGM Circular)

The 2014 Annual Report and the 2015 AGM Circular are also

available on the Company's website at www.hochschildmining.com

The appendices to this announcement contain the information

required to be disclosed under DTR 6.3.5 which has been reproduced

from the 2014 Annual Report and should be read in conjunction with

the Preliminary Announcement.

All page references and cross-references in the appendices are

to the 2014 Annual Report.

__________________________________________________________________________________

APPENDICES

Appendix 1

Risk Management (reproduced from pages 30 to 35 of the 2014

Annual Report)

As with all businesses, management of the Group's operations and

execution of its growth strategies are subject to a number of

risks, the occurrence of which could adversely affect the

performance of the Group. The Group's risk management framework is

premised on the continued monitoring of the prevailing environment,

the risks posed by it, and the evaluation of potential actions to

mitigate those risks. The Risk Committee is responsible for

implementing the Group's policy on risk management and monitoring

the effectiveness of controls in support of the Group's business

objectives. It meets four times a year and more frequently if

required. The Risk Committee comprises the CEO, the Vice Presidents

and the head of the internal audit function. A 'live' risk matrix

is compiled and updated at each Risk Committee meeting and the most

significant risks as well as potential actions to mitigate those

risks are reported to the Group's Audit Committee, which has

oversight of risk management on behalf of the Board.

The key business risks affecting the Group set out in this

report remain unchanged compared to those disclosed in the 2013

Risk Management report however, as indicated in this report, the

profile of a number of risks has increased relative to 2013

reflecting the ongoing challenges resulting from the lower and more

volatile precious metal price environment.

1. FINANCIAL RISKS

(i) Commodity Price

Change in risk profile vs 2013: HIGHER

Impact

Adverse movements in precious metals' prices could materially

impact the Group in various ways beyond a reduction in the results

of operations. These include impacts on the feasibility of projects

and heightened personnel and sustainability related risks.

Mitigation

-- Constant focus on maintaining low cost base

-- Initiatives identified for implementation in the

event of a low price environment (included within

the Cash Optimisation Plan - see commentary (right))

-- Flexible hedging policy that allows the Company

to approve hedges to mitigate the effect of price

movements taking into account the Group's asset

mix and forecast production

See Market Overview on page 5 for further details

2014 Commentary

The Group maintained the pressure on lowering costs and

improving efficiencies through the Cash Optimisation Plan, with its

focus on conserving capital and optimising cash flow primarily

through:

-- reductions in operating and administrative costs;

-- minimising sustaining capital expenditure; and

-- refocusing the Group's exploration strategy.

Significant progress was made in the Inmaculada project, which

will considerably contribute to reduce average production costs and

will materially dilute fixed costs once in operation.

Financial liquidity was ensured via the issue of $350m Senior

Notes, a $100m credit facility and short term lines available to

the Group.

The Group hedged part of its 2014 silver and gold production to

protect cashflow. For further details see page 19 of the Financial

Review.

(ii) Counterparty credit risk

Change in risk profile vs 2013: UNCHANGED

Impact

The Group may risk financial resources through the failure of

financial institutions.

Mitigation

Surplus cash invested with a diverse list of select highly rated

financial institutions within investment limits set by the

Board

2014 Commentary

Management has continued to operate its policy with oversight by

the Board without any change during the year.

2. OPERATIONAL RISKS

(i) Operational Performance

Change in risk profile vs 2013: HIGHER

Impact

Failure to meet production targets and manage the cost base

could adversely impact the Group's profitability.

Mitigation

-- Close monitoring by management of operational performance,

costs and capital expenditure

-- Negotiation of long-term supply contracts where

appropriate

-- Exploration to increase high quality resources

2014 Commentary

Administrative expenses and sustaining capex trended

significantly downwards during 2014, primarily as a result of the

cost savings initiatives implemented under the Cash Optimisation

Plan.

Production goals at all operations were met and 2015 mine plans

were thoroughly reviewed to ensure a focus on the extraction of

profitable ounces.

Significant progress was made at the Inmaculada project, which,

when in production, will materially improve the operational

flexibility of the Group.

(ii) Delivery of Projects

Change in risk profile vs 2013: HIGHER

Impact

Unanticipated delays in delivering projects could have negative

consequences including delaying cash inflows and increasing capital

costs, which could ultimately reduce profitability.

Mitigation

-- Teams comprising specialist personnel and world

class consultants and contractors are involved

in all aspects of project planning and execution

-- Project teams meet with senior management on a

weekly basis to monitor ongoing progress against

project schedules

2014 Commentary

During the year, senior management of the Group and the EPC

Contractor met regularly to monitor progress at the Inmaculada

Project against schedule which by the end of the year reached 86%

completion.

Despite a number of delays, the plant is expected to be

commissioned in Q2 2015.

Further details on Inmaculada can be found on page 12

(iii) Business Interruption

Change in risk profile vs 2013: UNCHANGED

Impact

Assets used in operations may break down and insurance policies

may not cover against all forms of risks.

Mitigation

-- Adequate insurance coverage

-- Management reporting systems to support appropriate

levels of inventory

-- Annual inspections by insurance brokers and insurers

with recommendations addressed in order to mitigate

operational risks

-- Availability of contingency power supplies at all

operating units

2014 Commentary

Insurance advisors conducted site visits and completed a full

review of operational risks to ensure that adequate property damage

and business interruption risk management processes and insurance

policies are in place at our operations.

Management reporting systems ensured that an appropriate level

of inventory of critical parts is maintained.

Adequate preventative maintenance programmes, supported by the

SAP Maintenance Module, are in place at the operating units.

(iv) Exploration & Reserve and Resource Replacement

Change in risk profile vs 2013: HIGHER

Impact 1

The Group's operating margins and future profitability depend

upon its ability to find mineral resources and to replenish

reserves.

Mitigation

-- Implementing and maintaining an annual exploration

drilling plan

-- Ongoing evaluation of acquisition and joint venture

opportunities to acquire additional ounces

2014 Commentary

The continued focus on cost reduction in 2014 through the Cash

Optimisation Plan resulted in a refocusing of exploration activity

supported by a budget of over $20 million which targeted brownfield

exploration at current operations, Inmaculada and the resourcing of

activity at select sites in Mexico and Peru.

In 2015, exploration activity will be primarily focused on

brownfield exploration in order to maintain or improve our resource

base. As a direct consequence of the continued low price

environment, the level of greenfield exploration and appraisal of

acquisition/joint venture opportunities has been significantly

reduced.

The substantial reduction in sustaining capital expenditure in

2015 could affect the Group's ability to replace reserves at its

historic rates.

Change in risk profile vs 2013: UNCHANGED

Impact 2

Reserves stated in this Annual Report are estimates

Mitigation

-- Engagement of independent experts to undertake

annual audit of mineral reserve and resource estimates

-- Adherence to the JORC code and guidelines therein

2014 Commentary

The Group engaged P&E Consultants to undertake the annual

audit of mineral reserve and resource estimates.

See page 166 for further details

(v)(a) Personnel: Recruitment and Retention

Change in risk profile vs 2013: HIGHER

Impact

Inability to retain or attract personnel through a shortage of

skilled personnel.

Mitigation

-- The Group's approach to recruitment and retention

provides for the payment of competitive compensation

packages, well defined career plans and training

and development opportunities

2014 Commentary

Due to the low price environment, there has been a significant

headcount reduction during the course of the year, but key

personnel have been retained.

In the case of critical position holders, retention awards have

been granted under the Restricted Share Plan which was approved by

shareholders in December 2014.

Also, the Group has implemented a number of low cost/high impact

initiatives to improve the retention of employees. These include

the use of non-financial benefits (e.g. flexible working

arrangements for Head Office staff).

(v)(b) Personnel: Labour Relations

Change in risk profile vs 2013: UNCHANGED

Impact

Failure to maintain good labour relations with workers and/or

unions may result in work slowdown, stoppage or strike.

Mitigation

Development of a tailored labour relations strategy focusing on

profit sharing, working conditions, management style, development

opportunities, motivation and communication

2014 Commentary

The reduction in profitability due to lower precious metal

prices has resulted in no statutory profit sharing for Peruvian

mineworkers.

Management has conducted monthly meetings with mineworkers and

unions during 2014 to ensure complete understanding of their

requirements and concerns and to keep all parties updated on the

Group's financial performance with the aim of preparing the

groundwork for the 2015 union negotiations.

3. MACROECONOMIC RISKS

(i) Political, Legal and Regulatory Risks

Change in risk profile vs 2013: HIGHER

Impact

Changes in the legal, tax and regulatory landscape could result

in significant additional expense, restrictions on or suspensions

of operations and may lead to delays in the development of current

operations and projects.

Implementation of exchange controls could impede the Group's

ability to convert or remit hard currency out of its operating

countries.

Mitigation

-- Local specialised personnel continually monitor

and react, as necessary, to policy changes

-- Active dialogue with governmental authorities

-- Participation in local industry organisations

2014 Commentary

During the year, the authorities in Peru and Argentina either

adopted new measures or revised their approach with respect to

certain aspects which impact the mining sector.

Of these, key developments are:

-- new environmental regulations which have increased

the powers of, and the scale of fines levied by,

the relevant regulators;

-- new permitting requirements which will lead to

longer permitting periods and costs;

-- the continued consultation on the law requiring

the prior consultation with indigenous communities,

which is expected to be implemented in the first

half of 2015.

By the virtue of the fact that 2015 is a pre-electoral year in

Peru, the mining sector is expected to be subject to heightened

political debate with consequences for, amongst other things,

labour and community relations and the regulatory regime.

In Argentina:

-- at a national Federal Government level, foreign

exchange controls were tightened during the year

as a result of the country's sovereign debt default;

-- following the implementation of a new regional

tax on mining companies' reserves in 2013, the

Company launched a challenge regarding its constitutionality

of the provincial law. The Supreme Court has decided

to hear the case;

-- increased requirements on the import of spare parts

has placed more pressure on the Group's San Jose

operation; and

-- the Province of Santa Cruz recently increased the

yearly fee for maintaining certain mining concessions

by almost 400%.

4. SUSTAINABILITY RISKS

(i) Health and Safety

Change in risk profile vs 2013: UNCHANGED

Impact

Group employees working in the mines may be exposed to health

and safety risks.

Failure to manage these risks may result in occupational

illness, accidents, a work slowdown, stoppage or strike and/or may

damage the reputation of the Group and hence its ability to

operate

Mitigation

-- Health & Safety operational policies and procedures

reflect the Group's zero tolerance approach to

accidents

-- Use of world class DNV safety management systems

-- Dedicated personnel to ensure the safety of employees

at the operations via stringent controls, training

and prevention programmes

-- Rolling programme of training, communication campaigns

and other initiatives promoting safe working practices

-- Use of reporting and management information systems

to monitor the incidence of accidents and enable

preventative measures to be implemented

2014 Commentary

For the first time since the Company's IPO in 2006, the Group

achieved its on-going objective of Zero Fatalities in 2014. This is

reflected in the year-on-year reduction in the accident severity

index for the year, of c. 75% from 598 to 149.

However, the year-on-year accident frequency rate has increased

by c. 48% (from 2.08 to 3.07) primarily due to the fact that

accident monitoring has been extended to cover the main contractor

and sub-contractors at the Inmaculada project which entered into

the higher-risk construction phase.

The Group's DNV safety management information systems at the

operating units have been given a 7 rating under the International

System Rating System (v6) with Inmaculada achieving a 6 rating.

As previously reported, a behaviour-based safety tool has been

developed and implemented at all units.

(ii) Environmental

Change in risk profile vs 2013: HIGHER

Impact

The Group may be liable for losses arising from environmental

hazards associated with the Group's activities and production

methods, ageing infrastructure, or may be required to undertake

corrective actions or extensive remedial clean-up action or pay for

governmental remedial clean-up actions or be subject to fines

and/or penalties.

Mitigation

-- The Group has a team responsible for environmental

management

-- The Group has adopted a number of policies and

procedures to limit and monitor its environmental

impact

-- Use of leading environmental management information

systems

-- The Group conducts annual reviews of its mine closure

plans for its operating units

2014 Commentary

During the year, the environmental regulator (OEFA) increased

its oversight activities leading to a significant increase in fines

and administrative actions. In addition, there has been an overall

increase in the trend of criminal actions pursued by rural

communities and third-parties in respect of environmental

issues.

The Cash Optimisation Plan has also affected the environmental

budget resulting in the postponement of capital expenditure for

infrastructure improvements.

During the year, the Group:

-- succeeded in recertifying the operations in Peru

and Argentina as compliant with ISO 14001 for the

next 3 years; and

-- restructured its Environmental team following the

appointment of a new Corporate Environmental Manager.

(iii) Community Relations

Change in risk profile vs 2013: HIGHER

Impact

Communities living in the areas surrounding Hochschild's

operations may oppose the activities carried out by the Group at

existing mines or, with respect to development projects and

prospects, may invoke their rights to be consulted under new laws.

These actions may result in longer lead times and additional costs

for exploration and in bringing assets into production and lead to

an adverse impact on the Group's ability to obtain the relevant

permissions for current or future projects.

Mitigation

-- Constructive engagement with local communities

-- Community Relations strategy focuses on promoting

education, health and nutrition, and sustainable

development

-- Allocation of budget and personnel for the provision

of community support activities

-- Policy to actively recruit workers from local communities

2014 Commentary

Despite the reduction of budgets for the Group's community

welfare activities as part of the Cash Optimisation Plan, the Group

continued to pursue a number of initiatives benefiting the

communities including:

-- the establishment of local co-operatives to promote

sustainable economic development by enabling communities

to trade in local produce; and

-- building on the successes of the Travelling Doctor

programme by extending its reach and the scope

of its services, and of the award-winning Digital

Chalhuanca project.

Further details on the Group's activities to mitigate

sustainability risks can be found in the Sustainability report on

pages 20 to 29

Appendix 2

Related-Party Transactions (reproduced from pages 136 and 137 of

the 2014 Annual Report)

32 Related-party balances and transactions

(a) Related-party accounts receivable and payable

The Group had the following related-party balances and

transactions during the years ended 31 December 2014 and 2013. The

related parties are companies owned or controlled by the main

shareholder of the parent company or associates.

Accounts receivable Accounts payable

as at 31 December as at 31 December

--------------------- --------------------

2014 2013 2014 2013

US$000 US$000 US$000 US$000

---------- --------- --------- ---------

Current related

party balances

Cementos Pacasmayo

S.A.A.(1) 45 111 49 16

Total 45 111 49 16

------------------- ---------- --------- --------- ---------

(1 The account receivable relates to reimbursement of expenses

paid by the Group on behalf of Cementos Pacasmayo S.A.A. The

account payable relates to the payment of rentals.)

As at 31 December 2014 and 2013 all other accounts are, or were,

non-interest bearing.

No security has been granted or guarantees given by the Group in

respect of these related party balances.

Principal transactions between affiliates are as follows:

Year ended

--------------

2014 2013

US$000 US$000

------ ------

Income

Dividend recognised for Gold

Resource Corp. investment

(note 19) - 2,633

Expenses

Expense recognised for the

rental paid to Cementos Pacasmayo

S.A.A. (185) (164)

(b) Compensation of key management personnel of the Group

As at 31 December

-----------------

Compensation of key management 2014 2013

personnel (including directors) US$000 US$000

----------------- -------

Short-term employee benefits 5,369 5,781

Termination benefits - 77

Long Term Incentive Plan 679 (434)

Others 1

Total compensation paid to

key management personnel 6,048 5,425

--------------------------------- ----------------- -------

This amount includes the remuneration paid to the Directors of

the parent company of the Group of US$4,005,780 (2013

US$4,410,956), out of which US$160,462 (2013: US$193,831) relates

to pension payments.

(c) Participation in placing by Inversiones Pacasmayo S.A.

("IPSA")

IPSA, a company controlled by Eduardo Hochschild, participated

in a placing of the Company's Ordinary Shares ('Shares') in October

2013 by subscribing for 16,905,066 Shares at a price of 155p per

Share.

Appendix 3

Statement of Directors' Responsibilities (reproduced from page

39 of the 2014 Annual Report)

The Directors confirm that to the best of their knowledge:

-- the financial statements, prepared in accordance

with the applicable set of accounting standards,

give a true and fair view of the assets, liabilities,

financial position and profit of the Company and

the undertakings included in the consolidation

taken as a whole

-- the Management report (which comprises the Strategic

report, this Directors' report and the other parts

of this Annual Report incorporated therein by reference)

includes a fair review of the development and performance

of the business and the position of the Company

and the undertakings included in the consolidation

taken as a whole, together with a description of

the principal risks and uncertainties that they

face.

On behalf of the Board

Raj Bhasin

Company Secretary

17 March 2015

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUSSNRVVASAAR

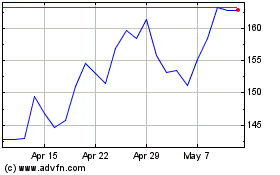

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Apr 2023 to Apr 2024