TIDMHOC

RNS Number : 8198B

Hochschild Mining PLC

06 April 2017

Hochschild Mining plc

("the Company")

2016 Annual Financial Report and 2017 Annual General Meeting

("AGM")

Following the release of the Company's 2016 full year results

announcement on 8 March 2017 (the "Preliminary Announcement"), the

Company announces it has published its Annual Report and Accounts

for the year ended 31 December 2016 (the "2016 Annual Report").

In accordance with LR 9.6.1, the following documents have been

submitted to the National Storage Mechanism and will be available

for inspection at www.Hemscott.com/nsm.do

-- 2016 Annual Report

-- 2017 AGM circular (incorporating the Notice of 2017 AGM)

-- 2017 AGM proxy card (incorporating the Notice of Availability

of the 2016 Annual Report and 2017 AGM circular)

The 2016 Annual Report and the 2017 AGM circular are also

available on the Company's website at www.hochschildmining.com

The appendices to this announcement contain the information

required to be disclosed under DTR 6.3.5 which has been reproduced

from the 2016 Annual Report and should be read in conjunction with

the Preliminary Announcement.

All page references and cross-references in the appendices are

to the 2016 Annual Report.

APPICES

Appendix 1

Risk Management (reproduced from pages 35 to 39 of the 2016

Annual Report)

As with all businesses, management of the Group's operations and

execution of its growth strategies are subject to a number of

risks, the occurrence of which could adversely affect the

performance of the Group. The Group's risk management framework is

premised on the continued monitoring of the prevailing environment,

the risks posed by it, and the evaluation of potential actions to

mitigate those risks.

The Risk Committee is responsible for implementing the Group's

policy on risk management and monitoring the effectiveness of

controls in support of the Group's business objectives. It meets

four times a year and more frequently if required. The Risk

Committee comprises the CEO, the Vice Presidents and the head of

the internal audit function. A 'live' risk matrix is reviewed which

maps the significant risks faced by the business and updated at

each Risk Committee meeting and the most significant risks as well

as potential actions to mitigate those risks are reported to the

Group's Audit Committee, which has oversight of risk management on

behalf of the Board.

2016 RISKS

The key business risks affecting the Group set out in this

report remain largely unchanged compared to those disclosed in the

2015 Risk Management report, with the exception that:

-- the risks associated with the Delivery of Projects are no

longer considered to be significant as the Inmaculada asset

transitioned to a core operation in the second half of 2015;

and

-- Refinancing Risk has been removed as a significant risk

following the recovery in the commodities sector and the

improvement in the Group's balance sheet.

The year-on-year changes in the profile of specific risks can be

explained as follows:

-- Operational Performance risks are considered by the Board to

have reduced following the commencement of production at

Inmaculada; and

-- Community Relations, Safety and Legal/Regulatory risks are

regarded as having heightened due to (a) the above-mentioned

transition of Inmaculada since the impact of those risks could

become more severe in the context of an operating asset and (b) the

changing social and political environment in the countries where

the Group operates.

In addition, in order to provide a more accurate view of the

change in the profile of environmental-related risks, the table

below distinguishes between changes in the level of (a) the

environmental

risks arising from operations, which are considered to have

reduced in light of the infrastructure work carried out during the

year; and (b) the risks arising from regulatory action which are

considered to have increased as a reflection of the regulator's

more stringent approach

1. FINANCIAL RISKS

Commodity Price

Change in risk profile vs 2015: UNCHANGED

Impact

Adverse movements in precious metal prices could materially

impact the Group in various ways beyond a reduction in the results

of operations. These include impacts on the feasibility of

projects, the economics of the mineral resources and heightened

personnel and sustainability related risks

Mitigation

-- Constant focus on maintaining a low cost of production and an

efficient level of administrative expense

-- Flexible hedging policy that allows the Group to contract

hedges to mitigate the effect of price movements taking into

account the Group's asset mix and forecast production

See Our Market Overview on pages 12 to 13 for further

details

Commentary

The focus on conserving capital and optimising cash flow

continued in 2016 through:

-- controlling operating and administrative costs;

-- optimising sustaining capital expenditure;

-- reducing debt; and

-- reducing working capital.

In addition to the above, the Inmaculada mine, which started

commercial production in the second half of 2015, brought about a

reduction in average production costs and diluted fixed costs.

Even though no part of 2017 production has been hedged, the

Group's flexible policy enables the Board to approve hedging

contracts to protect cashflow as and when appropriate.

2. OPERATIONAL RISKS

Operational Performance

Change in risk profile vs 2015: REDUCED

Impact

Failure to meet production targets and manage the cost base

could adversely impact the Group's profitability.

Mitigation

-- Close monitoring by management of operational performance, costs and capital expenditure

-- Negotiation of long-term supply contracts where appropriate

Commentary

2016 budgets across the Group focused on maintaining controlled

levels of administrative expenses and sustaining capital

expenditure.

Production goals at all operations were met or, in the case of

Inmaculada, exceeded with the focus on the extraction of profitable

ounces.

The Group benefited from operational flexibility through a

full-year's production at Inmaculada.

Management closely monitors the wide range of risks that could

affect operational performance to, among other things, ensure the

adequacy and safety of key mining components, such as tailing dams,

waste rock deposits and pipelines to service ongoing operations.

Close liaison between relevant departments ensures that

procurement, construction and any permitting are undertaken as

appropriate.

Business Interruption

Change in risk profile vs 2015: HIGHER

Impact

Assets used in the Group's operations may break down and cause

stoppages with material effects.

Mitigation

-- Insurance coverage to protect against major risks

-- Management reporting systems to support appropriate levels of inventory

-- Annual inspections by insurance brokers and insurers with

recommendations addressed in order to mitigate operational

risks

Commentary

In light of the transition of Inmaculada from project to core

asset and the high proportion of production sourced from that

asset, the change in the risk profile vs 2015 reflects its

heightened impact.

Mitigating actions during the year include the following:

-- Insurance advisors conducted site visits and completed a full

review of operational risks to ensure that adequate property damage

and business interruption risk management processes and insurance

policies are in place at our operations.

-- Management reporting systems ensured that an appropriate

level of inventory of critical parts is maintained.

-- Adequate preventative maintenance programmes, supported by

the SAP Maintenance Module, are in place at the operating

units.

Exploration & Reserve and Resource Replacement

Change in risk profile vs 2015: UNCHANGED

(a) Impact

The Group's operating margins and future profitability depend

upon its ability to find mineral resources and to replenish

reserves.

(a) Mitigation

-- Implementing and maintaining an annual exploration drilling plan

-- Ongoing evaluation of acquisition and joint venture

opportunities to acquire additional ounces

-- High-end software programmes implemented to improve the estimate mineral resources

(a) Commentary

In 2016 all brownfield exploration goals were achieved,

including the discovery of additional resources at the Pablo vein

at Pallancata.

The continued focus on cost control has resulted in our

exploration activity being primarily focused on current

operations.

In 2017, exploration of new projects and appraisal of

acquisition/joint venture opportunities restarted given the Group's

improved financial position.

As mentioned in the CEO's statement, the Company has undertaken

a conservative re-evaluation of its Reserves and Resources which

(a) reflects lower commodity price assumptions and (b) excludes

material that has a low probability of being mined.

(b) Impact

Reserves stated in this Annual Report are estimates.

(b) Mitigation

-- Engagement of independent experts to undertake annual audit

of mineral reserve and resource estimates

-- Adherence to the JORC Code and guidelines therein

(b) Commentary

The Group has engaged P&E Consultants to undertake the

annual audit of mineral reserve and resource estimates.

See pages 139 to 141 for further details

(a) Personnel: Recruitment and Retention

Change in risk profile vs 2015: LOWER

Impact

Inability to retain or attract personnel through a shortage of

skilled personnel.

Mitigation

-- The Group's approach to recruitment and retention provides

for the payment of competitive compensation packages, well defined

career plans and training and development opportunities

Commentary

The Group has continued with its initiatives to improve the

retention of employees. These include the use of non-financial

benefits (e.g. flexible working arrangements for Head Office staff)

and tailored personal development plans.

The improvement in the sector as a whole is the principal reason

why the profile of this risk has reduced relative to 2015.

(b) Personnel: Labour Relations

Change in risk profile vs 2015: UNCHANGED

Impact

Failure to maintain good labour relations with workers and/or

unions may result in work slowdown, stoppage or strike.

Mitigation

-- Development of a tailored labour relations strategy focusing

on profit sharing, working conditions, management style,

development opportunities, motivation and communication

Commentary

Given the losses incurred in previous years by the Peruvian

operating entity, there continues to be no statutory profit sharing

for Peruvian mineworkers.

Management has conducted monthly meetings with mineworkers and

unions during 2016 to ensure a complete understanding of their

requirements and concerns and to keep all parties updated on the

Group's financial performance with the aim of preparing the

groundwork for the 2017 union negotiations.

3. MACRO-ECONOMIC RISKS

Political, Legal and Regulatory

Change in risk profile vs 2015: HIGHER

Impact

Changes in the legal, tax and regulatory landscape could result

in significant additional expense, restrictions on or suspensions

of operations and may lead to delays in the development of current

operations and projects.

Mitigation

-- Local specialist personnel continually monitor and react, as necessary, to policy changes

-- Active dialogue with governmental authorities

-- Participation in local industry organisations

Commentary

As an electoral year, 2016 saw the mining industry in Peru

become the subject of heightened political debate. In the period

leading to the elections and during the transition to a new

administration, no new governmental measures were taken and various

permitting processes saw their timelines extended which continues

to be the case.

Even though the new government that assumed office in July 2016

is supportive of business, the risk of social conflicts has become

heightened in certain parts of the country to which the authorities

remain sensitive.

In addition, a number of new laws were introduced during the

year relating to, among other things (a) the permissible limits of

chemicals in stored tailings and (b) various aspects of health and

safety at mining operations.

In Argentina, 2016 was marked by relative stability following

the Presidential elections in October 2015 where the new government

placed inward investment as a key priority.

With regards to specific developments:

-- the Supreme Court agreed to hear the merits of the Company's

claim challenging the constitutionality of a proposed Reserves tax

which was subsequently withdrawn by the relevant Province; and

-- in late 2016, the Argentinian Government removed the benefit

received by those exporting through Patagonian ports.

3. SUSTAINABILITY RISKS

Health and Safety

Change in risk profile vs 2015: HIGHER

Impact

Group employees working in the mines may be exposed to health

and safety risks.

Failure to manage these risks may result in occupational

illness, accidents, a work slowdown, stoppage or strike and/or may

damage the reputation of the Group and hence its ability to

operate.

Mitigation

-- Health & Safety operational policies and procedures

reflect the Group's zero tolerance approach to accidents

-- Use of world class DNV safety management systems

-- Dedicated personnel to ensure the safety of employees at the

operations via stringent controls, training and prevention

programmes

-- Rolling programme of training, communication campaigns and

other initiatives promoting safe working practices

-- Use of reporting and management information systems to

monitor the incidence of accidents and enable preventative measures

to be implemented

Commentary

The change in risk profile vs 2015 primarily reflects:

-- the fact that Inmaculada was an operating asset for the whole of 2016; and

-- the increased use of less mechanised processes at Pallancata

in light of the narrower veins being mined.

In 2016, the Group achieved its on-going objective of Zero

Fatalities for the third consecutive year. As reported earlier in

the Chairman's statement and Sustainability Report, the Board was

saddened to report the fatalities that occurred at the Inmaculada

mine in the first quarter of 2017.

Further details on the accident and the steps being taken to

reinforce the Group's safety values can be read in the

Sustainability Report on page 30

Environmental

Change in risk profile vs 2015:

(a) In relation to those risks arising from the Group's

environmental performance/infrastructure: LOWER

(b) In relation to those risks arising from the increased

oversight of the environmental regulator: HIGHER

Impact

The Group may be liable for losses arising from environmental

hazards associated with the Group's activities and production

methods, ageing infrastructure, or may be required to undertake

corrective actions or extensive remedial clean-up action or pay for

governmental remedial clean-up actions or be subject to fines

and/or penalties.

Mitigation

-- The Group has a team responsible for environmental management

-- The Group has adopted a number of policies and procedures to

limit and monitor its environmental impact

Commentary

Environmental permitting and oversight have become more

rigorous, leading to delays in project execution and increases in

fines from the environmental regulator.

In 2016, the Group has taken a series of measures to mitigate

this risk, including:

-- establishing a Permitting Committee, with the participation

of all relevant departments, that meets bi-weekly to assess the

status of all permitting applications and ensure that the process

is carried out as efficiently as possible;

-- the launch of new Environmental Key Performance Indicators;

-- implementation of state-of-the-art water quality management

tool that allows for real time monitoring of all water discharges

from the operations;

-- completing the staffing of the environmental team with

professionals working in related operational and environmental

management roles;

-- strengthening our environmental culture, improving overall

housekeeping throughout our operations, reducing water consumption

and solid waste generation;

-- continuing to improve water treatment infrastructure, at

Pallancata, Inmaculada, Arcata and the closed Sipan mine; and

-- reviewed and updated Mine Closure Plans, in some cases with

the support of internationally renowned environmental

consultants

Community Relations

Change in risk profile vs 2015: HIGHER

Impact

Communities living in the areas surrounding Hochschild's

operations may oppose the activities carried out by the Group at

existing mines or, with respect to development projects and

prospects, may invoke their rights to be consulted under new

laws.

These actions may result in loss of productions, increased costs

and decreased revenues and in longer lead times and additional

costs for exploration and bringing assets into production and lead

to an adverse impact on the Group's ability to obtain the relevant

permissions for current or future projects.

Mitigation

-- Constructive engagement with local communities

-- Community Relations strategy focuses on promoting education,

health and nutrition, and sustainable development

-- Allocation of budget and personnel for the provision of community support activities

-- Policy to actively recruit workers from local communities

Commentary

The higher risk profile vs 2015 reflects the increase in the

incidence of social conflicts in the areas surrounding the Group's

operations. Such conflicts have led to temporary stoppages at other

mining operations such as Las Bambas and Constancia.

Protests by a community close to the Pallancata mine resulted in

a blockade by community members from November 2016 until

mid-January 2017. Even though the mine stopped producing from 1

December, Pallancata's targeted production was not impacted.

Government intervention resulted in the lifting of the blockade

after an informal mediation between the Company and the relevant

community representatives.

Working groups with stakeholders groups near Inmaculada continue

to meet periodically.

In addition, the Group continues to actively engage with other

local communities to fully understand their needs and to implement

an action plan, to the extent possible.

The risk of additional stoppages or blockades will continue to

be present if the working groups do not reach long-term agreements

between the parties involved.

Further details on the Group's activities to mitigate

sustainability risks can be found in the Sustainability report on

pages 29 to 34

Appendix 2

Related-Party Balances and Transactions (reproduced from pages

116 and 117 of the 2016 Annual Report)

30 Related-party balances and transactions

(a) Related-party accounts receivable and payable

The Group had the following related-party balances and

transactions during the years ended 31 December 2016 and 2015. The

related parties are companies owned or controlled by the main

shareholder of the parent company or associates.

Accounts receivable Accounts payable

as at 31 December as at 31 December

--------------------- --------------------

2016 2015 2016 2015

US$000 US$000 US$000 US$000

---------- --------- --------- ---------

Current related

party balances

Cementos Pacasmayo

S.A.A.(1) 71 11 94 40

Total 71 11 94 40

------------------- ---------- --------- --------- ---------

(1) The account receivable relates to reimbursement of expenses

paid by the Group on behalf of Cementos Pacasmayo S.A.A. The

account payable relates to the payment of rentals.

As at 31 December 2016 and 2015, all other accounts are, or

were, non-interest bearing.

No security has been granted or guarantees given by the Group in

respect of these related party balances.

Principal transactions between affiliates are as follows:

Year ended

-----------------

2016 2015

US$000 US$000

------- -------

Income

Gain on sale of Asociation Sumac Tarpuy to Inversiones ASPI S.A. 811 -

Expenses

Donation to the Universidad de Ingenieria y Tecnologia "UTEC" (1,000) -

Expense recognised for the rental paid to Cementos Pacasmayo S.A.A. (200) (285)

---------------------------------------------------------------------- ------- -------

Transactions between the Group and these companies are on an

arm's length basis.

(b) Compensation of key management personnel of the Group

As at 31 December

-------------------

Compensation of key management 2016 2015

personnel (including directors) US$000 US$000

--------- --------

Short-term employee benefits 5,459 5,613

Long Term Incentive Plan,

Deferred Bonus Plan and Restricted

Share Plan 6,622 2,641

Total compensation paid to

key management personnel 12,081 8,254

------------------------------------ --------- --------

This amount includes the remuneration paid to the Directors of

the parent company of the Group of US$5,487,769 (2015:

US$4,155,759).

(c) Participation in rights issue by Pelham Investment

Corporation ("Pelham") and Inversiones ASPI SA ("ASPI")

As at the record date of the Rights Issue, Eduardo Hochschild

held his investment in the Company through Pelham. Following

receipt of its entitlement under the Rights Issue, Pelham

transferred, for nil consideration, its Nil Paid Rights in respect

of 74,745,101 new ordinary shares to ASPI an entity that is also

under the control of Eduardo Hochschild. Under the terms of an

irrevocable undertaking signed between Pelham, ASPI and the

Company, it was agreed that:

(i) ASPI would, among other things, subscribe for at least

68,887,508 new ordinary shares at an issue price of 47 pence per

new ordinary share (the "Subscription Commitment"); and

(ii) the Company would, among other things, pay ASPI a fee of 1%

of the Subscription Commitment of approximately US$500,000.

Appendix 3

Statement of Directors' Responsibilities (reproduced from page

43 of the 2016 Annual Report)

The Directors confirm that to the best of their knowledge:

-- the financial statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair view

of the assets, liabilities, financial position and profit of the

Company and the undertakings included in the consolidation taken as

a whole; and

-- the Management Report includes a fair review of the

development and performance of the business and the position of the

Company and the undertakings included in the consolidation taken as

a whole, together with a description of the principal risks and

uncertainties that they face.

On behalf of the Board

Raj Bhasin

Company Secretary

7 March 2017

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACSSSMFSMFWSELL

(END) Dow Jones Newswires

April 06, 2017 06:49 ET (10:49 GMT)

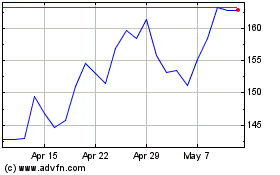

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Apr 2023 to Apr 2024