TIDMHILS

RNS Number : 2316V

Hill & Smith Hldgs PLC

06 August 2015

Hill & Smith Holdings PLC

Half Year Results (unaudited) for the 6 months ended 30 June

2015

Continued strong trading

Infrastructure investment in UK and US fuelling growth

Hill & Smith Holdings PLC, the international group with

leading positions in the manufacture and supply of infrastructure

products and galvanizing services to global markets, announces its

unaudited results for the six months ended 30 June 2015.

Financial results

Change

--------------------------

30 June 30 June Reported Constant

2015 2014 % currency

%

------------------------ ---------- ---------- -------------- ----------

Revenue GBP233.0m GBP223.8m + 4 + 4

Underlying(*) :

Operating profit GBP26.3m GBP22.5m + 17 + 14

Operating margin 11.3% 10.1% + 120bps

Profit before taxation GBP24.8m GBP20.8m + 19 + 16

Earnings per share 24.2p 20.3p + 19 + 16

Statutory:

Profit before taxation GBP7.1m GBP16.0m - 56

Basic earnings per

share 5.6p 14.6p - 62

Dividend per share 7.1p 6.4p + 11

Net Debt GBP89.2m GBP98.5m

------------------------ ---------- ---------- -------------- ----------

*All underlying profit measures exclude certain non-operational

items, which are as defined in the Financial Statements. References

to an underlying profit measure throughout this announcement are

made on this basis.

Key points:

-- Continued strong trading, +5% organic revenue growth;

underlying operating margin +120bps to 11.3%

-- 82% of revenue and 92% of underlying operating profit

generated from UK and US operations, where infrastructure

investment and economic outlook remain favourable

-- Underlying operating profit up 17% to GBP26.3m:

- Roads up 35%, driven primarily by the UK Government's 'Road

Investment Strategy' with its focus on managed motorways, which are

at the core of the Group's product offering

- Utilities up 13%, reflecting strong performance in the UK

offsetting weaker pipe supports performance

- Galvanizing up 10% as a result of exceptional growth in US infrastructure volumes

-- Further net debt reduction to GBP89.2m (2014: GBP98.5m); Net

Debt:EBITDA multiple of 1.3 times (31 December 2014: 1.5 times)

-- Interim dividend increased by 11% to 7.1p

Derek Muir, Chief Executive, said:

"Hill & Smith is very well positioned in markets,

particularly in the UK and US, where the economic outlook remains

favourable and where increased infrastructure spending - most

notably on roads and utilities - is fuelling demand for our

products and services.

"As a result, after a very strong finish to last year, the first

half has seen continued robust trading overall which has driven

improvements in underlying operating margins across all three

segments - Roads, Utilities and Galvanizing.

"Our encouraging performance is in line with the Board's

expectations and, whilst mindful of the challenging comparators

from our record second half earnings performance last year, the

continued weakness in mainland Europe and the general global

economic uncertainty, we continue to expect 2015 to be a year of

good progress."

For further information, please contact:

Hill & Smith Holdings PLC Tel: +44 (0)121

704 7430

Derek Muir, Group Chief Executive

Mark Pegler, Group Finance Director

MHP Communications Tel: +44 (0)20

3128 8100

John Olsen/Andrew Leach/Ollie Hoare

Notes to Editors

Hill & Smith Holdings PLC is an international group with

leading positions in the design, manufacture and supply of

infrastructure products and galvanizing services to global markets.

It serves its customers from facilities principally in the UK,

France, USA, Thailand, Sweden, Norway, India and Australia.

The Group's operations are organised into three main business

segments:

Infrastructure Products - Utilities, supplying products and

services such as pipe supports for the power and liquid natural gas

markets, energy grid components, "GRP" railway platforms and flood

prevention barriers, plastic drainage pipes, industrial flooring,

handrails, access covers and security fencing.

Infrastructure Products - Roads, supplying products and services

such as permanent and temporary road safety barriers, street

lighting columns, bridge parapets, gantries, temporary car parks,

variable road messaging solutions and traffic data collection

systems.

Galvanizing Services which provides zinc and other coatings for

a wide range of products including fencing, lighting columns,

structural steel work, bridges, agricultural and other products for

the infrastructure and construction markets.

Headquartered in the UK and quoted on the London Stock Exchange

(LSE: HILS.L), Hill & Smith Holdings PLC employs some 3,900

staff across 55 sites, principally in 8 countries.

Business Review

Introduction

Hill & Smith has continued to perform well in the six months

to 30 June 2015.

Infrastructure investment in our key UK and US markets continues

to be strong, underpinning the performance of our operations in

Roads, Utilities and Galvanizing. Improving returns from the UK

operations resulted in them generating half of the Group's

underlying operating profit in the period (2014: 43%). The

diversity and strength of our businesses within their respective

markets continues to underpin our performance, which has shown

improved underlying operating margins across all three

divisions.

Results

Revenue increased by 4% to GBP233.0m (2014: GBP223.8m) with no

material currency translation impacts. Adjusting for a net revenue

reduction of GBP2.4m arising from acquisitions and disposals,

organic revenue grew by GBP11.0m or 5%. Underlying operating margin

improved to 11.3% (2014: 10.1%) with an underlying operating profit

of GBP26.3m (2014: GBP22.5m), including favourable currency

translation of GBP0.5m and a GBP0.7m benefit in respect of

acquisitions and disposals.

Underlying profit before taxation at GBP24.8m was 19% higher

than the previous year (2014: GBP20.8m). Despite the strong

underlying trading performance, statutory profit before taxation

reduced to GBP7.1m (2014: GBP16.0m) reflecting the one off, non

cash impairment of goodwill and intangible assets relating to the

2011 acquisition of The Paterson Group, Inc., amounting to

GBP15.8m.

Underlying earnings per share at 24.2p was up 19% compared to

the previous year (2014: 20.3p). Basic earnings per share was 5.6p

(2014: 14.6p).

Net debt fell to GBP89.2m (31 December 2014: GBP96.0m; 30 June

2014: GBP98.5m) including a beneficial currency translation impact

of GBP1.4m.

Dividend

The Board has declared an interim dividend of 7.1p per share

(2014: 6.4p), representing an 11% increase on the corresponding

period last year. The interim dividend will be paid on 5 January

2016 to shareholders on the register on 20 November 2015.

Outlook

The Group continues to benefit from the industrial and

geographical spread of its markets and businesses, which provide a

resilient base as well as opportunities for growth. Generating 82%

of revenue and 92% of underlying operating profit from its UK and

US operations, the Group principally operates in markets where the

overall economic outlook remains favourable. This, coupled with the

implementation of strategic initiatives to fuel higher returns from

the Group's portfolio, provides momentum to our drive for increased

shareholder value. We do however remain mindful of the challenging

comparators from our record second half earnings performance in

2014, the continued market weakness in mainland Europe and the

general global economic uncertainty.

Overall, our encouraging performance to date has been in line

with expectations and, with a marginal bias to the second half, we

continue to expect 2015 to be a year of good progress for the

Group.

Operational Review

Infrastructure Products

GBPm Constant

Currency

%

-------------- ---- ----------

+/-

2015 2014 %

---------------------- ------ ------ ---- ----------

Revenue 163.4 158.7 +3 +2

---------------------- ------ ------ ---- ----------

Underlying operating

profit 12.5 10.0 +25 +23

---------------------- ------ ------ ---- ----------

Underlying operating

margin % 7.6 6.3

---------------------- ------ ------ ---- ----------

Overall revenue increased to GBP163.4m (2014: GBP158.7m)

including a GBP1.5m positive impact from exchange movements.

Organic revenue growth was GBP5.6m, or 4% at constant currency.

Underlying operating profit was GBP12.5m (2014: GBP10.0m), an

increase of GBP2.5m, including a positive currency translation

impact of GBP0.2m. Operating margin improved to 7.6% (2014:

6.3%).

Roads

GBPm Constant

Currency

%

------------ ---- ----------

+/-

2015 2014 %

---------------------- ----- ----- ---- ----------

Revenue 64.6 59.3 +9 +13

---------------------- ----- ----- ---- ----------

Underlying operating

profit 7.3 5.4 +35 +35

---------------------- ----- ----- ---- ----------

Underlying operating

margin % 11.3 9.1

---------------------- ----- ----- ---- ----------

In the UK, the implementation of the Department for Transport's

Road Investment Strategy ("RIS") is progressing as planned. In

April, Highways England was formed (previously the Highways Agency)

as a Government owned company with the objective of delivering a

transformational investment plan in the nation's strategic road

network. The RIS aims to provide certainty of road investment

funding over the period 2015/16 to 2020/21, improve the

connectivity and condition of the existing network and,

importantly, increase capacity, with projects that will deliver

1,300 additional lane miles. The focus of the drive to add capacity

will be additional 'Smart', or managed motorways, which is at the

core of the Group's product offering in the UK.

Demand for permanent and temporary safety barrier continued to

be strong and utilisation of our temporary safety barrier rental

fleet was high. Our bridge parapet safety product also experienced

higher volumes compared to the prior period. Utilisation of the

temporary safety barrier rental fleet is currently forecast to

soften during the summer months as major projects complete before

new ones are ready to start. However, utilisation is expected to

return to higher levels by the end of the year and through

2016.

The integration of Variable Message Signs ("VMS"), acquired in

July 2014, has progressed to plan and the combined organisation has

a wider product offering to support Highways England in its roll

out of its Smart motorway programme. During the period VMS won

contracts for the supply of remote control temporary traffic signs

on the M1 and M3 motorways as part of the enhanced safety

initiative by Highways England, and its order book remains

encouraging for the second half.

Despite lower volumes following the completion of PFI projects,

our lighting column business performed exceptionally well with

profitability similar to the prior period. The strategy of

diversifying both products and markets continues to deliver

significant benefits.

Outside the UK, our Scandinavian business performed well with

profitability ahead year on year despite adverse currency movements

impacting its competitiveness on imported Group products. The

outlook in the Scandinavian market remains favourable and we have

recently invested further in the business to expand its range and

depth of products. Despite the evident market opportunity, the

performances of our other international businesses in France, USA,

India and Australia remain disappointing with overall profitability

behind the prior period. The French lighting column market remains

difficult due to over-capacity and a weak local economy. In the

USA, Zoneguard, our temporary safety barrier, continues to gain

acceptance among contractors but progress remains slower than

expected. India and Australia remain 'start-up' businesses with the

opportunity for growth in niche markets and we expect to see an

improved performance over the next twelve months.

Utilities

GBPm

------------ ---- ----------

Constant

+/- Currency

2015 2014 % %

---------------------- ----- ----- ---- ----------

Revenue 98.8 99.4 -1 -4

---------------------- ----- ----- ---- ----------

Underlying operating

profit 5.2 4.6 +13 +8

---------------------- ----- ----- ---- ----------

Underlying operating

margin % 5.3 4.6

---------------------- ----- ----- ---- ----------

Revenues were marginally below the prior year at GBP98.8m (2014:

GBP99.4m) principally driven by the prior year disposal of two

businesses, the impact of which was to decrease revenues by GBP7.6m

year on year. Operating margins improved to 5.3% (2014: 4.6%).

Organic revenue growth was GBP3.1m, or 3%, with positive currency

translation and acquisitions contributing GBP3.5m and GBP0.4m

respectively. Underlying operating profit was GBP5.2m (2014:

GBP4.6m) including a positive currency impact of GBP0.2m.

Our US utilities businesses, comprising composite material and

power transmission substation operations, performed well with

revenue and profitability marginally ahead of prior year despite

poor weather during the first quarter which delayed construction

projects, principally in the north east. Our substation utility

business saw increased success in packaging work supplying

structural steel together with the electrical components. They also

gained momentum with framework agreements, which now account for

50% of their revenue. Our composite waterfront products were

installed in the New York area giving pier protection to both new

and existing bridges. Composite utility poles were also supplied to

Baja, Mexico after the hurricane damage experienced earlier in the

year.

Our pipe supports business in the USA also experienced

disruption from the adverse weather conditions in the first quarter

although second quarter trading was more encouraging. The continued

absence of major traditional power projects is being partly

compensated for by delivery of pipe supports to new ethylene and

fertilizer plants. Demand in the industrial pipe hanger business

improved throughout the period and overall, although results remain

below our expectations, revenue and profitability were ahead of the

prior period. On 30 April 2015 the Group completed the acquisition

of Novia Associates, Inc. ("Novia"), a vibration and seismic

control manufacturer located in New Hampshire, USA. In 2014 Novia

had revenue of $3.5m and adjusted EBITDA of $0.3m. Net

consideration was $2.8m. Novia will extend the product offering of

our US pipe supports business and the first two months of trading

has been in line with our expectations.

As previously reported, our pipe supports business outside of

the US entered the year with a lower order book than we would

usually expect. The lower volumes adversely impacted operational

gearing in our UK and Thailand facilities and resulted in a

disappointing first half performance below our expectations.

However, our Indian facility experienced good demand levels and

performed in line with expectations. Encouragingly, and despite

continued low oil prices, order intake improved dramatically during

the second quarter across all three regions with projects for a

pulp and paper mill in Indonesia and three packages on Dahej and

Mundra LNG terminals in India. The thermal power market in India

remains encouraging with all three of our plants in Thailand, India

and the UK supplying products in the second half. We enter the

second half with an order book of GBP12.2m, significantly ahead of

the GBP7.6m at 31 December 2014. Operational improvements in people

and processes made over previous periods should now enable

successful execution and delivery of the enlarged order book and we

look forward to a better second half performance.

In the UK, our utilities businesses have performed strongly year

on year. The industrial flooring operation continues to benefit

from single site operation and investments made in property and

machinery to improve volume and productivity. During the period we

were successful in delivery of handrail and platforms for Crossrail

train maintenance depots and the Cygnus gas field wellhead

platform. The order book and outlook remains healthy.

Our plastic pipe business is currently benefitting from a strong

housing sector with volumes significantly ahead year on year. The

transition to AMP6 projects is slower than originally projected but

enquiry levels are significant. Recent capital investment to drive

productivity improvements is reaping rewards.

Ongoing Government investment in the UK rail network and the

protection of critical infrastructure sites has provided higher

volumes for our security fencing operation, which performed well.

Supply of solar frames was similar to the prior period despite the

removal of certain tax subsidies earlier in the year.

The housing market, principally new build, for Birtley and

Expamet continues to perform strongly with the supply of lintels

and doors ahead of expectations and prior year.

Galvanizing Services

GBPm

------------ ---- ----------

Constant

+/- Currency

2015 2014 % %

---------------------- ----- ----- ---- ----------

Revenue 69.6 65.1 +7 +8

---------------------- ----- ----- ---- ----------

Underlying operating

profit 13.8 12.5 +10 +8

---------------------- ----- ----- ---- ----------

Underlying operating

margin % 19.8 19.2

---------------------- ----- ----- ---- ----------

Revenue increased by 7% to GBP69.6m (2014: GBP65.1m), despite

negative currency movements of GBP0.9m. Underlying operating profit

increased by GBP1.3m to GBP13.8m (2014: GBP12.5m) including GBP0.3m

positive currency impact. Overall volumes were 3% ahead of the same

period in the prior year primarily due to strong output in the US.

Operating margins remained strong at 19.8% (2014: 19.2%) despite

some volatility in zinc prices notably in non US$ denominated

currencies.

USA

Volumes were 32% ahead of the same period in 2014. Adjusting for

the new plant in Memphis, underlying volumes from existing plants

were up 21%. Weather patterns were similar to 2014 with poor

conditions in the first quarter delaying construction sites. Second

quarter volumes were exceptional as projects accelerated to catch

up from the first quarter weather impact. Alternative energy

projects have been strong with solar work in particular standing

out. Whilst some of the additional volume attracts a lower margin,

overall the business performed ahead of expectations.

The new plant in Memphis commenced production at the end of

November 2014. Volumes have steadily improved throughout the first

half resulting in profitable trading in the second quarter and

break even overall in the period. The performance bodes well for

the rest of the year and the future.

France

Despite recent economic stimulus from the European Central Bank,

the French and wider mainland European economies remain subdued.

Volumes in France fell 12% year on year. Excluding the impact of

the one off contract for the Bordeaux Stadium, which completed in

early 2014, underlying volumes fell 8%. Pricing discipline and cost

control enabled us to maintain margins in line with the prior

period.

UK

Headline volumes in the UK fell 5% year on year with the

principal driver being our decision to close our Hereford plant,

the smaller of our two structural galvanizing baths, in December

2014 as part of our drive to optimise our network and increase

returns. The closure has been completed to plan and encouragingly

we have retained a higher proportion of the existing customer base

than expected. Structural steel customers are now serviced from our

Chesterfield plant where we have invested significantly to expand

and upgrade facilities. Excluding the impact of the Hereford plant

closure, underlying volumes were similar to the prior year. The

lower cost base more than offset the reduced volumes resulting in

profitability marginally ahead of the prior period.

Financial Review

Cash generation and financing

Cash generated from operations during the period was GBP26.9m

(2014: GBP15.2m), the improvement on last year reflecting higher

underlying profits and working capital efficiencies. The working

capital outflow in the period, which arises from normal seasonal

trading patterns, was GBP5.6m (2014: GBP10.5m) and overall working

capital as a percentage of annualised sales improved to 14.4% at 30

June 2015 (2014: 15.0%) with a reduction in debtor days to 58 days

(30 June 2014: 60 days; 31 December 2014: 60 days). There were no

material net impacts on the period end balance from movements in

zinc and commodity prices. Cash spend of GBP0.7m was incurred in

respect of the costs of closure of one of the Group's operating

sites announced in December 2014.

Capital expenditure of GBP8.4m (2014: GBP16.8m) represents a

multiple of depreciation and amortisation of 1.0 times (2014: 2.3

times), reflecting a more normal level of spend following the

significant outlay in the prior year on construction of Zoneguard

temporary road safety barrier in the UK and the new galvanizing

facility in Memphis, Tennessee.

Group net debt at 30 June 2015 was GBP89.2m, a reduction of

GBP6.8m since 31 December 2014 (GBP96.0m) including a favourable

exchange impact of GBP1.4m principally resulting from the

appreciation of Sterling against the Euro during the period.

Change in net debt

6 months 6 months Year ended

ended ended 31 December

30 June 30 June 2014 GBPm

2015 GBPm 2014 GBPm

Change in net debt

Operating profit 9.1 18.1 41.1

Non-cash items 25.7 12.3 23.2

-------------------------------------- ------------ ------------ --------------

Operating cash flow before

movement in working capital 34.8 30.4 64.3

Net movement in working capital (5.6) (10.5) (5.1)

Change in provisions and employee

benefits (2.3) (4.7) (5.5)

-------------------------------------- ------------ ------------ --------------

Operating cash flow 26.9 15.2 53.7

Tax paid (5.9) (4.3) (9.3)

Net financing costs paid (1.5) (1.7) (3.2)

Capital expenditure (8.4) (16.8) (35.9)

Proceeds on disposal of non-current

assets 0.9 0.2 0.7

-------------------------------------- ------------ ------------ --------------

Free cash flow 12.0 (7.4) 6.0

Dividends paid (5.0) (4.7) (12.4)

Acquisitions (1.5) - (0.2)

Disposals - 0.1 0.5

Amortisation of refinancing

costs (0.2) - (0.3)

Issue of new shares 1.1 0.2 0.3

Satisfaction of long term

incentive payments (1.0) (1.0) (2.4)

-------------------------------------- ------------ ------------ --------------

Net debt decrease/(increase) 5.4 (12.8) (8.5)

Effect of exchange rate fluctuations 1.4 1.5 (0.3)

Net debt at the beginning

of the period (96.0) (87.2) (87.2)

-------------------------------------- ------------ ------------ --------------

Net debt at the end of the

period (89.2) (98.5) (96.0)

-------------------------------------- ------------ ------------ --------------

The net debt to EBITDA ratio under the Group's principal banking

facility fell to 1.3 times at 30 June 2015 (31 December 2014: 1.5

times), driven by the positive impact of working capital

efficiencies, reduced capital expenditure and growth in EBITDA.

Interest cover was 23.5 times (31 December 2014: 20.6 times).

Tax

The underlying effective tax rate for the period was 24.0% (year

ended 31 December 2014: 24.0%) and is the estimated effective rate

for the full year. The tax charge for the period was GBP2.7m (2014:

GBP4.6m), including a GBP3.2m credit in respect of non-underlying

charges, principally representing the unwind of deferred tax

liabilities on the amortisation and impairment of acquisition

intangible assets. The underlying income statement tax charge is in

line with the cash tax charge of GBP5.9m (2014: GBP4.3m).

Finance costs

Net financing costs for the period were GBP2.0m (2014: GBP2.1m)

with an underlying element of GBP1.5m (2014: GBP1.7m). Underlying

operating profit covered net underlying finance costs 17.5 times

(2014: 13.2 times). The non-underlying element of finance costs of

GBP0.5m (2014: GBP0.4m) represents the net cost of pension fund

financing of GBP0.3m and GBP0.2m amortisation of refinancing fees

capitalised in the prior year.

Non-underlying items

The total non-underlying items charged to operating profit in

the Consolidated Income Statement amounted to GBP17.2m (2014:

GBP4.4m) and were made up of the following:

Income

Statement Cash in

charge the year Non-cash

------------------------------ ------------ ---------- ---------

GBPm GBPm GBPm

Impairment of acquired

intangible assets (15.8) - (15.8)

Business reorganisation

costs 0.2 - 0.2

Acquisition costs (0.4) (0.4) -

Amortisation of acquisition

intangibles (1.1) - (1.1)

Losses on sale of properties (0.1) 0.4 (0.5)

Total (17.2) - (17.2)

------------------------------ ------------ ---------- ---------

-- The impairment charge of GBP15.8m represents a full

impairment of the goodwill and acquired intangible assets relating

to the Group's acquisition of The Paterson Group in March 2011.

Despite an improvement in performance in the second quarter of

2015, first half results remain below expectations and, overall,

the business continues to generate levels of profitability that are

significantly below those anticipated at acquisition, largely

driven by changes in the US power generation market including the

hiatus in nuclear spend. As a result an impairment review was

performed at the half year (see note 6) and has resulted in a full

impairment of the goodwill and acquired intangible assets.

-- The credit of GBP0.2m in respect of business reorganisation

costs reflects the net release of provisions made in the prior year

in respect of site closures, following the favourable settlement of

the exposures previously provided.

-- Acquisition costs of GBP0.4m comprise GBP0.1m for the

acquisition of Novia Associates, Inc. on 30 April 2015 and GBP0.3m

relating to the aborted acquisition of W. Corbett & Co

Galvanizing.

-- Amortisation of acquisition intangibles was GBP1.1m.

-- Losses on sales of properties during the year were GBP0.1m.

Assets held for sale

The Group holds a number of properties that are currently being

actively marketed for disposal and which have therefore been

classified as assets held for sale at 30 June 2015, at a value of

GBP1.0m (31 December 2014: GBP1.5m). The reduction in the period

reflects the disposal of one of these properties.

Acquisition

On 30 April 2015 the Group completed the acquisition of Novia

Associates, Inc., a US-based business operating in a similar market

to our pipe supports operations. Net consideration for the

acquisition was GBP1.8m, of which GBP0.3m is deferred and payable

in April 2016.

Pensions

Following the triennial valuation of the Group's UK defined

benefit pension arrangements at April 2012, the Group has agreed

deficit reduction plans in place that require cash contributions

amounting to GBP2.5m for the three years to April 2016, followed by

payments of GBP2.3m for a further seven years. The triennial

valuation as at 5 April 2015 is underway and negotiations with the

Trustees have commenced. Whilst it is too early to predict the

outcome of these discussions it is expected that the results will

be presented in the Annual Report at 31 December 2015.

Principal Risks and Uncertainties

The Group has a process for identifying, evaluating and managing

the principal risks and uncertainties it faces. Details of these

principal risks and uncertainties are contained on pages 17 to 21

of the Group's Annual Report and Accounts for the year ended 31

December 2014. It is the Director's opinion that these are the

risks and uncertainties that could impact the performance of the

Group and that they remain applicable to the current financial

year.

Whilst for the six months ended 30 June 2015 there has been no

significant change in the overall scope of the principal risks and

uncertainties referred to above, the Board has implemented an

educational programme to further strengthen risk management

procedures including, inter alia, contractual management and

competition law compliance. The Directors do not envisage that any

of these additional measures will have a material impact upon the

expected performance of the Group for the remainder of the

financial year.

Going Concern

The Group continues to meet its day to day working capital and

other funding requirements through a combination of long term

funding and short term overdraft borrowings. The Group's principal

financing facility is a GBP210m multi-currency revolving credit

agreement which expires in April 2019.

The Group actively manages its strategic, commercial and day to

day operational risks and through its Treasury function operates

Board approved financial policies, including hedging policies that

are designed to ensure that the Group maintains an adequate level

of funding headroom and effectively mitigates foreign exchange and

other financial risks.

After making due enquiry, the Directors have reasonable

expectation that the Company and its subsidiaries have adequate

resources to continue in operational existence for the foreseeable

future and therefore adopt the going concern principle.

Directors' Responsibility Statement

We confirm that to the best of our knowledge:

-- The condensed set of financial statements has been prepared

in accordance with IAS 34: Interim Financial Reporting as adopted

by the EU;

-- The interim management report includes a fair review of the information required by:

a) DTR 4.2.7R of the Disclosure and Transparency Rules, being an

indication of important events that have occurred during the first

six months of the financial year and their impact on the condensed

set of financial statements; and a description of the principal

risks and uncertainties for the remaining six months of the year;

and

b) DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period including any changes in the related party transactions

described in the last Annual Report that could do so.

This report was approved by the Board of Directors on 6 August

2015 and is available on the Company's website (www.hsholdings.com)

under the "Latest News" or "Press Release" sections.

W H Whiteley D W Muir M Pegler

Chairman Chief Executive Finance Director

6 August 2015

Condensed Consolidated Income Statement

Six months ended 30 June 2015

6 months ended 6 months ended Year ended

30 June 2015 30 June 2014 31 December

2014

------------------------------------ ----------------------------------- -----------------------------------

Non- Non- Non-

Underlying underlying(*) Total Underlying underlying(*) Total Underlying underlying(*) Total

Notes GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

---------------- ------ ----------- -------------- ------- ----------- -------------- ------ ----------- -------------- ------

4,

Revenue 5 233.0 - 233.0 223.8 - 223.8 454.7 - 454.7

---------------- ------ ----------- -------------- ------- ----------- -------------- ------ ----------- -------------- ------

Trading profit 26.3 - 26.3 22.5 - 22.5 49.2 - 49.2

Amortisation

of acquisition

intangibles 6 - (1.1) (1.1) - (1.0) (1.0) - (2.1) (2.1)

Business

reorganisation

costs 6 - 0.2 0.2 - - - - (2.6) (2.6)

Acquisition

costs 6 - (0.4) (0.4) - - - - (0.1) (0.1)

(Loss)/profit

on sale of

properties 6 - (0.1) (0.1) - - - - 0.4 0.4

Impairment loss

on initial

classification

as held for

sale 6 - - - - (3.5) (3.5) - - -

Impairment of

intangible

assets 6 - (15.8) (15.8) - - - - - -

Profit/(loss)

on disposals

of

subsidiaries 6 - - - - 0.1 0.1 - (3.7) (3.7)

---------------- ------ ----------- -------------- ------- ----------- -------------- ------ ----------- -------------- ------

Operating 4,

profit 5 26.3 (17.2) 9.1 22.5 (4.4) 18.1 49.2 (8.1) 41.1

Financial

income 7 0.2 - 0.2 0.2 - 0.2 0.5 - 0.5

Financial

expense 7 (1.7) (0.5) (2.2) (1.9) (0.4) (2.3) (3.7) (1.0) (4.7)

---------------- ------ ----------- -------------- ------- ----------- -------------- ------ ----------- -------------- ------

Profit before

taxation 24.8 (17.7) 7.1 20.8 (4.8) 16.0 46.0 (9.1) 36.9

Taxation (5.9) 3.2 (2.7) (5.0) 0.4 (4.6) (11.1) 1.5 (9.6)

---------------- ------ ----------- -------------- ------- ----------- -------------- ------ ----------- -------------- ------

Profit for the

period

attributable

to owners of

the parent 18.9 (14.5) 4.4 15.8 (4.4) 11.4 34.9 (7.6) 27.3

---------------- ------ ----------- -------------- ------- ----------- -------------- ------ ----------- -------------- ------

Basic earnings

per share 9 24.2p 5.6p 20.3p 14.6p 45.0p 35.1p

Diluted

earnings

per share 9 24.0p 5.6p 20.1p 14.4p 44.4p 34.7p

---------------- ------ ----------- -------------- ------- ----------- -------------- ------ ----------- -------------- ------

Dividend per

share -

Interim 10 7.1p 6.4p 6.4p

---------------- ------ ----------- -------------- ------- ----------- -------------- ------ ----------- -------------- ------

*The Group's definition of non-underlying items is included in

note 6.

Condensed Consolidated Statement of Comprehensive Income

Six months ended 30 June 2015

6 months 6 months

ended ended Year

30 June 30 June ended

2015 2014 31 December

GBPm GBPm 2014

GBPm

--------------------------------------------- --------- --------- --------------

Profit for the period 4.4 11.4 27.3

---------------------------------------------- --------- --------- --------------

Items that may be reclassified subsequently

to profit or loss

Exchange differences on translation

of overseas operations (7.4) (7.1) 1.2

Exchange differences on foreign currency

borrowings denominated as net investment

hedges 1.5 1.6 (0.1)

Effective portion of changes in fair

value of cash flow hedges (0.1) (0.1) (0.1)

Transfers to the Income Statement

on cash flow hedges 0.2 0.2 0.3

Taxation on items that may be reclassified - - -

to profit or loss

Items that will not be reclassified

subsequently to profit or loss

Actuarial loss on defined benefit

pension schemes - - (3.6)

Taxation on items that will not be

reclassified to profit or loss - - 0.8

---------------------------------------------- --------- --------- --------------

Other comprehensive income for the

period (5.8) (5.4) (1.5)

---------------------------------------------- --------- --------- --------------

Total comprehensive income for the

period attributable to owners of

the parent (1.4) 6.0 25.8

---------------------------------------------- --------- --------- --------------

Condensed Consolidated Statement of Financial Position

As at 30 June 2015

30 June 30 June 31 December

2015 2014 2014

Notes GBPm GBPm GBPm

-------------------------------- ------ -------- -------- ------------

Non-current assets

Intangible assets 108.1 122.3 126.1

Property, plant and equipment 123.6 115.0 128.7

Other receivables - - 0.3

-------------------------------- ------ -------- -------- ------------

231.7 237.3 255.1

-------------------------------- ------ -------- -------- ------------

Current assets

Assets held for sale 1.0 5.6 1.5

Inventories 59.4 55.1 57.9

Trade and other receivables 100.9 99.1 92.7

Cash and cash equivalents 11 3.9 3.6 6.7

-------------------------------- ------ -------- -------- ------------

165.2 163.4 158.8

-------------------------------- ------ -------- -------- ------------

Total assets 396.9 400.7 413.9

-------------------------------- ------ -------- -------- ------------

Current liabilities

Liabilities held for sale - (1.8) -

Trade and other liabilities (91.8) (87.8) (87.7)

Current tax liabilities (9.1) (8.5) (8.9)

Provisions for liabilities and

charges (1.0) (1.1) (1.4)

Interest bearing borrowings 11 (0.4) (0.4) (1.1)

-------------------------------- ------ -------- -------- ------------

(102.3) (99.6) (99.1)

-------------------------------- ------ -------- -------- ------------

Net current assets 62.9 63.8 59.7

-------------------------------- ------ -------- -------- ------------

Non-current liabilities

Other liabilities (0.2) (0.1) (0.2)

Provisions for liabilities and

charges (2.0) (2.5) (2.8)

Deferred tax liability (4.2) (8.2) (7.6)

Retirement benefit obligation (19.9) (18.5) (21.1)

Interest bearing borrowings 11 (92.7) (101.7) (101.6)

-------------------------------- ------ -------- -------- ------------

(119.0) (131.0) (133.3)

-------------------------------- ------ -------- -------- ------------

Total liabilities (221.3) (230.6) (232.4)

-------------------------------- ------ -------- -------- ------------

Net assets 175.6 170.1 181.5

-------------------------------- ------ -------- -------- ------------

Equity

Share capital 19.6 19.4 19.5

Share premium 32.7 31.7 31.7

Other reserves 4.5 4.5 4.5

Translation reserve (5.0) (5.7) 0.9

Hedge reserve (0.3) (0.5) (0.4)

Retained earnings 124.1 120.7 125.3

-------------------------------- ------ -------- -------- ------------

Total equity 175.6 170.1 181.5

-------------------------------- ------ -------- -------- ------------

Condensed Consolidated Statement of Changes in Equity

Six months ended 30 June 2015

Share Share Other Translation Hedge Retained Total

capital premium reserves reserves reserves earnings equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

-------------------------- --------- --------- ---------- ------------ ---------- ---------- --------

Opening balance 19.5 31.7 4.5 0.9 (0.4) 125.3 181.5

Comprehensive income

Profit for the period - - - - - 4.4 4.4

Other comprehensive

income for the period - - - (5.9) 0.1 - (5.8)

Transactions with

owners recognised

directly in equity

Dividends - - - - - (5.0) (5.0)

Credit to equity

of share-based payments - - - - - 0.4 0.4

Satisfaction of long

term incentive payments - - - - - (1.9) (1.9)

Own shares held by

employee benefit

trust - - - - - 0.9 0.9

Shares issued 0.1 1.0 - - - - 1.1

-------------------------- --------- --------- ---------- ------------ ---------- ---------- --------

Closing balance 19.6 32.7 4.5 (5.0) (0.3) 124.1 175.6

-------------------------- --------- --------- ---------- ------------ ---------- ---------- --------

Six months ended 30 June 2014

Share Share Other Translation Hedge Retained Total

capital premium reserves reserves reserves earnings equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

-------------------------- --------- --------- ---------- ------------ ---------- ---------- --------

Opening balance 19.4 31.5 4.5 (0.2) (0.6) 114.5 169.1

Comprehensive income

Profit for the period - - - - - 11.4 11.4

Other comprehensive

income for the period - - - (5.5) 0.1 - (5.4)

Transactions with

owners recognised

directly in equity

Dividends - - - - - (4.7) (4.7)

Credit to equity

of share-based payments - - - - - 0.5 0.5

Satisfaction of long

term incentive payments - - - - - (1.0) (1.0)

Shares issued - 0.2 - - - - 0.2

-------------------------- --------- --------- ---------- ------------ ---------- ---------- --------

Closing balance 19.4 31.7 4.5 (5.7) (0.5) 120.7 170.1

-------------------------- --------- --------- ---------- ------------ ---------- ---------- --------

Year ended 31 December 2014

Share Share Other Translation Hedge Retained Total

capital premium reserves reserves reserves earnings equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

-------------------------- --------- --------- ---------- ------------ ---------- ---------- --------

Opening balance 19.4 31.5 4.5 (0.2) (0.6) 114.5 169.1

Comprehensive income

Profit for the year - - - - - 27.3 27.3

Other comprehensive

income for the period - - - 1.1 0.2 (2.8) (1.5)

Transactions with

owners recognised

directly in equity

Dividends - - - - - (12.4) (12.4)

Credit to equity

of share-based payments - - - - - 0.9 0.9

Satisfaction of long

term incentive payments - - - - - (1.0) (1.0)

Own shares acquired

by employee benefit

trust - - - - - (1.4) (1.4)

Tax taken directly

to the Consolidated

Statement of Changes

in Equity - - - - - 0.2 0.2

Shares issued 0.1 0.2 - - - - 0.3

-------------------------- --------- --------- ---------- ------------ ---------- ---------- --------

Closing balance 19.5 31.7 4.5 0.9 (0.4) 125.3 181.5

-------------------------- --------- --------- ---------- ------------ ---------- ---------- --------

Other reserves represents the premium on shares issued in

exchange for shares of subsidiaries acquired and GBP0.2m capital

redemption reserve.

Condensed Consolidated Statement of Cash Flows

Six months ended 30 June 2015

Notes 6 months 6 months Year ended

ended ended 31 December

30 June 30 June 2014

2015 2014 GBPm

GBPm GBPm

------------------------------ ------ --------- --------- -------------

Profit before tax 7.1 16.0 36.9

Add back net financing

costs 2.0 2.1 4.2

------------------------------ ------ --------- --------- -------------

Operating profit 9.1 18.1 41.1

Adjusted for non-cash

items:

Share-based payments 0.4 0.5 1.2

Impairment loss on initial - 3.5 -

classification as held

for sale

Loss/(gain) on disposal

of non-current assets 0.1 - (0.3)

(Profit)/loss on disposal

of subsidiaries - (0.1) 3.7

Depreciation 7.9 7.0 14.2

Amortisation of intangible

assets 1.5 1.4 3.0

Impairment of non-current

assets 6 15.8 - 1.4

------------------------------ ------ --------- --------- -------------

25.7 12.3 23.2

------------------------------ ------ --------- --------- -------------

Operating cash flow before

movement in working capital 34.8 30.4 64.3

Increase in inventories (3.0) (3.8) (4.3)

Increase in receivables (9.4) (12.0) (2.7)

Increase in payables 6.8 5.3 1.9

Decrease in provisions

and employee benefits (2.3) (4.7) (5.5)

------------------------------ ------ --------- --------- -------------

Net movement in working

capital (7.9) (15.2) (10.6)

------------------------------ ------ --------- --------- -------------

Cash generated by operations 26.9 15.2 53.7

Income taxes paid (5.9) (4.3) (9.3)

Interest paid (1.7) (1.9) (3.7)

------------------------------ ------ --------- --------- -------------

Net cash from operating

activities 19.3 9.0 40.7

Interest received 0.2 0.2 0.5

Proceeds on disposal

of non-current assets 0.9 0.2 0.7

Purchase of property,

plant and equipment (8.0) (16.3) (34.6)

Purchase of intangible

assets (0.4) (0.5) (1.3)

Acquisition of subsidiary (1.5) - -

Disposals of subsidiaries - 0.1 0.5

------------------------------ ------ --------- --------- -------------

Net cash used in investing

activities (8.8) (16.3) (34.2)

Issue of new shares 1.1 0.2 0.3

Satisfaction of long

term incentive payments (1.0) (1.0) (2.4)

Dividends paid 10 (5.0) (4.7) (12.4)

Costs associated with

refinancing - (1.4) (1.5)

New loans and borrowings 15.0 21.9 39.2

Repayment of loans and

borrowings (23.1) (13.6) (32.7)

Repayment of obligations

under finance leases - (0.2) (0.3)

------------------------------ ------ --------- --------- -------------

Net cash (used in)/raised

from financing activities (13.0) 1.2 (9.8)

------------------------------ ------ --------- --------- -------------

Net decrease in cash (2.5) (6.1) (3.3)

Cash at the beginning

of the period 6.7 10.0 10.0

Effect of exchange rate

fluctuations (0.3) (0.3) -

------------------------------ ------ --------- --------- -------------

Cash at the end of the

period 11 3.9 3.6 6.7

------------------------------ ------ --------- --------- -------------

1. Basis of preparation

Hill & Smith Holdings PLC is incorporated in the UK. The

Condensed Consolidated Interim Financial Statements of the Company

have been prepared on the basis of International Financial

Reporting Standards, as adopted by the EU ('Adopted IFRSs') that

are effective at 4 August 2015 and in accordance with IAS34:

Interim Financial Reporting, comprising the Company, its

subsidiaries and its interests in jointly controlled entities

(together referred to as the 'Group').

As required by the Disclosure and Transparency Rules of the

Financial Services Authority, the Condensed Consolidated Interim

Financial Statements have been prepared applying the accounting

policies and presentation that were applied in the preparation of

the Company's published Consolidated Financial Statements for the

year ended 31 December 2014 (these statements do not include all of

the information required for full Annual Financial Statements and

should be read in conjunction with the full Annual Report for the

year ended 31 December 2014). The following standards and

interpretations, which were not effective as at 30 June 2015 and

have not been early adopted by the Group, will be adopted in future

accounting periods (*denotes standards and interpretations that

have been EU endorsed):

-- Amendment to IAS 19 - Employee Benefits*

-- Annual improvements to IFRSs 2010-2012*

-- Annual improvements to IFRSs 2011-2013*

-- IFRS 9 - Financial Instruments

-- Amendments to IAS 1 - Presentation of financial statements

-- Annual improvements to IFRSs 2012 - 2014

-- Amendments to IFRS 11 - Accounting for Acquisitions of Interests in Joint Operations

-- Amendments to IAS 16 and IAS 38 - Clarification of Acceptable

Methods of Depreciation and Amortisation

-- IFRS 15 - Revenue Recognition

The comparative figures for the financial year ended 31 December

2014 are not the Company's statutory accounts for that financial

year. Those accounts have been reported on by the Company's auditor

and delivered to the Registrar of Companies. The report of the

auditor (i) was unqualified, (ii) did not include a reference to

any matters to which the auditor drew attention by way of emphasis

without qualifying their report, and (iii) did not contain a

statement under Section 498 (2) or (3) of the Companies Act

2006.

These Condensed Consolidated Interim Financial Statements have

not been audited or reviewed by an auditor pursuant to the Auditing

Practices Board's Guidance on Financial Information.

The Financial Statements are prepared on the going concern

basis. This is considered appropriate given that the Company and

its subsidiaries have adequate resources to continue in operational

existence for the foreseeable future.

2. Financial risks, estimates, assumptions and judgements

The preparation of the Condensed Consolidated Interim Financial

Statements requires management to make judgements, estimates and

assumptions that affect the application of accounting policies and

the reported amounts of assets and liabilities, income and expense.

Actual results may differ from estimates.

In preparing these Condensed Consolidated Interim Financial

Statements, the significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those that applied to the

Consolidated Financial Statements as at and for the year ended 31

December 2014.

3. Exchange rates

The principal exchange rates used were as follows:

6 months 6 months Year ended

ended ended 31 December

30 June 2015 30 June 2014 2014

------------------- ------------------- -------------------

Average Closing Average Closing Average Closing

------------------------ -------- --------- -------- --------- -------- ---------

Sterling to Euro (GBP1

= EUR) 1.37 1.41 1.22 1.25 1.24 1.28

Sterling to US Dollar

(GBP1 = USD) 1.52 1.57 1.67 1.71 1.65 1.56

Sterling to Thai Bhat

(GBP1 = THB) 50.23 53.16 54.32 55.47 53.50 51.32

Sterling to Swedish

Krona (GBP1 = SEK) 12.76 13.05 10.90 11.43 11.30 12.07

------------------------ -------- --------- -------- --------- -------- ---------

4. Segmental information

The Group has three reportable segments which are Infrastructure

Products - Roads, Infrastructure Products - Utilities and

Galvanizing Services. Several operating segments that have similar

economic characteristics have been aggregated into these reporting

segments.

Income Statement

6 months ended 6 months ended

30 June 2015 30 June 2014

------------------------- ---------------------------------- ----------------------------------

Underlying Underlying

Revenue Result result* Revenue Result result*

GBPm GBPm GBPm GBPm GBPm GBPm

------------------------- ---------- --------- ----------- ---------- --------- -----------

Infrastructure Products

- Utilities 98.8 (11.9) 5.2 99.4 0.5 4.6

Infrastructure Products

- Roads 64.6 7.1 7.3 59.3 5.2 5.4

------------------------- ---------- --------- ----------- ---------- --------- -----------

Infrastructure Products

- Total 163.4 (4.8) 12.5 158.7 5.7 10.0

Galvanizing Services 69.6 13.9 13.8 65.1 12.4 12.5

------------------------- ---------- --------- ----------- ---------- --------- -----------

Total Group 233.0 9.1 26.3 223.8 18.1 22.5

------------------------- ---------- ----------

Net financing costs (2.0) (1.5) (2.1) (1.7)

------------------------- ---------- --------- ----------- ---------- --------- -----------

Profit before taxation 7.1 24.8 16.0 20.8

Taxation (2.7) (5.9) (4.6) (5.0)

------------------------- ---------- --------- ----------- ---------- --------- -----------

Profit after taxation 4.4 18.9 11.4 15.8

------------------------- ---------- --------- ----------- ---------- --------- -----------

Year ended 31

December 2014

------------------------------------- ----------------------------------

Underlying

Revenue Result result*

GBPm GBPm GBPm

------------------------------------- ---------- --------- -----------

Infrastructure Products - Utilities 195.2 5.4 9.2

Infrastructure Products - Roads 127.7 12.5 13.3

------------------------------------- ---------- --------- -----------

Infrastructure Products - Total 322.9 17.9 22.5

Galvanizing Services 131.8 23.2 26.7

------------------------------------- ---------- --------- -----------

Total Group 454.7 41.1 49.2

------------------------------------- ----------

Net financing costs (4.2) (3.2)

------------------------------------- ---------- --------- -----------

Profit before taxation 36.9 46.0

Taxation (9.6) (11.1)

------------------------------------- ---------- --------- -----------

Profit after taxation 27.3 34.9

------------------------------------- ---------- --------- -----------

(*) Underlying result is stated before non-underlying items as

defined in note 6 and is the measure of segment profit used by the

Chief Operating Decision Maker, who is the Chief Executive. The

Result columns are included as additional information.

Galvanizing Services provided GBP2.7m revenues to Infrastructure

Products - Roads (six months ended 30 June 2014: GBP3.1m, the year

ended 31 December 2014: GBP5.9m) and GBP0.9m revenues to

Infrastructure Products - Utilities (six months ended 30 June 2014:

GBP0.9m, the year ended 31 December 2014: GBP1.8m). Infrastructure

Products - Utilities provided GBP1.9m revenues to Infrastructure

Products - Roads (six months ended 30 June 2014: GBP0.7m, the year

ended 31 December 2014: GBP3.6m). These internal revenues, along

within revenues generated within each segment, have been eliminated

on consolidation.

The Group presents the analysis of continuing operations revenue

by geographical market, irrespective of origin:

6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2015 2014 2014

GBPm GBPm GBPm

-------------------------- --------- --------- -------------

UK 121.3 109.7 220.4

Rest of Europe 38.0 49.9 95.1

North America 65.6 53.7 113.7

Asia and the Middle East 7.6 9.0 21.1

Rest of World 0.5 1.5 4.4

-------------------------- --------- --------- -------------

Total 233.0 223.8 454.7

-------------------------- --------- --------- -------------

5. Operating profit

6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2015 2014 2014

GBPm GBPm GBPm

---------------------------------------- --------- --------- -------------

Revenue 233.0 223.8 454.7

Cost of sales (148.6) (145.9) (296.9)

---------------------------------------- --------- --------- -------------

Gross profit 84.4 77.9 157.8

Distribution costs (10.8) (11.0) (22.9)

Administrative expenses(*) (65.0) (49.3) (95.3)

(Loss)/gain on disposal of non-current

assets (0.1) - 0.3

Other operating income 0.6 0.5 1.2

---------------------------------------- --------- --------- -------------

Operating profit 9.1 18.1 41.1

---------------------------------------- --------- --------- -------------

(*) In the 6 months ended 30 June 2015 including a GBP15.8m

impairment charge in respect of goodwill and acquired intangible

assets (2014: nil).

6. Non-underlying items

Non-underlying items are disclosed separately in the

Consolidated Income Statement where the quantum, nature or

volatility of such items would otherwise distort the underlying

trading performance of the Group. The following are included by the

Group in its assessment of non-underlying items:

-- Gains or losses arising on disposal, closure, restructuring

or reorganisation of businesses that do not meet the definition of

discontinued operations

-- Amortisation of intangible fixed assets arising on acquisitions

-- Expenses associated with acquisitions

-- Impairment charges in respect of tangible or intangible fixed assets

-- Changes in the fair value of derivative financial instruments

-- Significant past service items or curtailments and

settlements relating to defined benefit pension obligations

resulting from material changes in the terms of the schemes

-- Net financing costs or returns on defined benefit pension obligations

-- Costs incurred as part of significant refinancing activities.

The tax effect of the above is also included.

Details in respect of the non-underlying items recognised in the

current and prior year are set out below.

Six months ended 30 June 2015

Non-underlying items included in operating profit comprise the

following:

-- Amortisation of acquired intangible fixed assets of GBP1.1m.

-- Acquisition expenses of GBP0.4m, of which GBP0.1m relates to

the acquisition of Novia Associates, Inc. on 30 April 2015 and

GBP0.3m relates to the aborted acquisition of W Corbett & Co

Galvanizing.

-- Losses on disposal of properties of GBP0.1m.

-- A credit in respect of business reorganisations of GBP0.2m,

reflecting the net release of provisions made in previous years in

respect of site closures following a favourable settlement during

the period of the exposures identified.

-- An impairment charge of GBP15.8m in respect of goodwill and

acquired intangible assets. As set out in the Finance Review, the

current and forecast financial performance of The Paterson Group

(part of the Infrastructure Products - Utilities segment) is below

that assumed in the impairment review performed as at 31 December

2014 and, overall, the business continues to generate levels of

profitability that are significantly below those anticipated at

acquisition. As a result, an impairment review was performed at 30

June 2015, based on the Board's revised expectation of future

profitability and cash generation. The impairment review concluded

that the carrying values of the assets of the business were less

than their recoverable amount (determined by reference to the Value

in Use) by GBP15.8 million, allocated to the goodwill (GBP8.2

million) and the remaining book value of acquired intangible assets

(GBP7.6 million) arising on acquisition. The basis for determining

the Value in Use, including the discount rate and rate of future

growth, was consistent with that used in the annual impairment

review performed as at 31 December 2014.

Non-underlying items included in financial expense represent the

net financing cost on pension obligations of GBP0.3m (2014:

GBP0.4m) and a GBP0.2m charge in respect of amortisation of costs

associated with refinancing.

Year ended 31 December 2014

Non-underlying items included in operating profit comprise the

following:

-- Business reorganisation costs of GBP2.6m, principally

relating to redundancies and other net costs associated with site

closures including the Joseph Ash Galvanizing plant at Hereford.

The net costs included asset impairment charges of GBP1.4m.

-- Amortisation of acquired intangible fixed assets of GBP2.1m.

-- Acquisition expenses of GBP0.1m relating to acquisitions made by the Group during the year.

-- Profits on disposal of properties of GBP0.4m.

-- A net loss on disposal of subsidiaries of GBP3.7m. On 23

April 2014 the Group disposed of its 50% interest in the shares of

Staco Redman Limited for a consideration of GBP0.3m, while on 18

August 2014 the Group disposed of its subsidiary Bromford Iron

& Steel Company Limited and JA Envirotanks, a trading division

of Joseph Ash Limited, for a combined consideration of GBP1.3m. The

details of these disposals are set out below:

Staco Bromford JA

Redman Iron Envirotanks

Ltd & GBPm

GBPm Steel

Co Ltd Total

GBPm GBPm

------------------------------- -------- --------- ------------- ------

Property, plant and equipment - 1.8 0.1 1.9

Inventories - 2.1 0.5 2.6

Current assets 0.1 1.3 0.9 2.3

Cash and cash equivalents 0.2 0.1 0.1 0.4

Current liabilities (0.1) (1.4) (0.5) (2.0)

Deferred tax - (0.1) - (0.1)

------------------------------- -------- --------- ------------- ------

Net assets 0.2 3.8 1.1 5.1

------------------------------- -------- --------- ------------- ------

Consideration:

Cash consideration 0.3 0.4 0.4 1.1

Deferred consideration - 0.5 - 0.5

Less costs to sell - (0.1) (0.1) (0.2)

------------------------------- -------- --------- ------------- ------

Profit/(loss) on disposal 0.1 (3.0) (0.8) (3.7)

------------------------------- -------- --------- ------------- ------

Non-underlying items included in financial income and expense

represent the net financing cost on pension obligations of GBP0.7m

and financial expenses associated with refinancing of GBP0.3m.

7. Net financing costs

6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2015 2014 2014

GBPm GBPm GBPm

------------------------------------------- --------- --------- -------------

Interest on bank deposits 0.2 0.2 0.5

------------------------------------------- --------- --------- -------------

Financial income 0.2 0.2 0.5

------------------------------------------- --------- --------- -------------

Interest on bank loans and overdrafts 1.7 1.9 3.7

Interest on finance leases and hire - - -

purchase contracts

------------------------------------------- --------- --------- -------------

Total interest expense 1.7 1.9 3.7

Financial expenses related to refinancing 0.2 - 0.3

Interest cost on net pension scheme

deficit 0.3 0.4 0.7

------------------------------------------- --------- --------- -------------

Financial expense 2.2 2.3 4.7

------------------------------------------- --------- --------- -------------

Net financing costs 2.0 2.1 4.2

------------------------------------------- --------- --------- -------------

8. Taxation

Tax has been provided on the underlying profit at the estimated

effective rate of 24.0% (2014: 24.0%) for existing operations for

the full year.

9. Earnings per share

The weighted average number of ordinary shares in issue during

the period was 78.0m, diluted for the effect of outstanding share

options 78.8m (six months ended 30 June 2014: 77.8m and 78.8m

diluted, the year ended 31 December 2014: 77.8m and 78.8m

diluted).

Underlying earnings per share are shown below as the Directors

consider that this measurement of earnings gives valuable

information on the underlying performance of the Group:

6 months 6 months Year ended

ended ended 31 December

30 June 2015 30 June 2014 2014

---------------- ---------------- ----------------

Pence Pence Pence

per GBPm per GBPm per GBPm

share share share

----------------------------- ------- ------- ------- ------- ------- -------

Basic earnings 5.6 4.4 14.6 11.4 35.1 27.3

Non-underlying items(*) 18.6 14.5 5.7 4.4 9.9 7.6

----------------------------- ------- ------- ------- ------- ------- -------

Underlying earnings 24.2 18.9 20.3 15.8 45.0 34.9

----------------------------- ------- ------- ------- ------- ------- -------

Diluted earnings 5.6 4.4 14.4 11.4 34.7 27.3

Non-underlying items(*) 18.4 14.5 5.7 4.4 9.7 7.6

----------------------------- ------- ------- ------- ------- ------- -------

Underlying diluted earnings 24.0 18.9 20.1 15.8 44.4 34.9

----------------------------- ------- ------- ------- ------- ------- -------

(*) Non-underlying items as detailed in note 6.

10. Dividends

Dividends paid in the period were the prior year's interim

dividend of GBP5.0m (2014: GBP4.7m). The final dividend for 2014 of

GBP9.1m (2014: GBP7.8m) was paid on 3 July 2015. Dividends declared

after the Balance Sheet date are not recognised as a liability, in

accordance with IAS10. The Directors have proposed an interim

dividend for the current year of GBP5.6m, 7.1p per share (2014:

GBP5.0m, 6.4p per share).

11. Analysis of net debt

6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2015 2014 2014

GBPm GBPm GBPm

--------------------------------------- --------- --------- -------------

Cash and cash equivalents 3.9 3.6 6.7

Interest bearing loans and borrowings

due within one year (0.4) (0.4) (1.1)

Interest bearing loans and borrowings

due after more than one year (92.7) (101.7) (101.6)

--------------------------------------- --------- --------- -------------

Net debt (89.2) (98.5) (96.0)

--------------------------------------- --------- --------- -------------

6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2015 2014 2014

GBPm GBPm GBPm

-------------------------------------- --------- --------- -------------

Change in net debt

Operating profit 9.1 18.1 41.1

Non-cash items 25.7 12.3 23.2

-------------------------------------- --------- --------- -------------

Operating cash flow before movement

in working capital 34.8 30.4 64.3

Net movement in working capital (5.6) (10.5) (5.1)

Change in provisions and employee

benefits (2.3) (4.7) (5.5)

-------------------------------------- --------- --------- -------------

Operating cash flow 26.9 15.2 53.7

Tax paid (5.9) (4.3) (9.3)

Net financing costs paid (1.5) (1.7) (3.2)

Capital expenditure (8.4) (16.8) (35.9)

Proceeds on disposal of non-current

assets 0.9 0.2 0.7

-------------------------------------- --------- --------- -------------

Free cash flow 12.0 (7.4) 6.0

Dividends paid (note 10) (5.0) (4.7) (12.4)

Acquisitions (1.5) - (0.2)

Disposals - 0.1 0.5

Amortisation of costs associated

with refinancing revolving credit

facilities (0.2) - (0.3)

Issue of new shares 1.1 0.2 0.3

Satisfaction of long term incentive

payments (1.0) (1.0) (2.4)

-------------------------------------- --------- --------- -------------

Net debt decrease/(increase) 5.4 (12.8) (8.5)

Effect of exchange rate fluctuations 1.4 1.5 (0.3)

Net debt at the beginning of the

period (96.0) (87.2) (87.2)

-------------------------------------- --------- --------- -------------

Net debt at the end of the period (89.2) (98.5) (96.0)

-------------------------------------- --------- --------- -------------

12. Financial instruments

The table below sets out the Group's accounting classification

of its financial assets and liabilities and their fair values as at

30 June. The fair values of all financial assets and liabilities

are not materially different to the carrying values.

Total

Designated Amortised carrying

at cost value Fair

fair GBPm GBPm value

value GBPm

GBPm

------------------------------------ ------------- ------------ ---------- --------

Cash and cash equivalents - 3.9 3.9 3.9

Interest bearings loans due within

one year - (0.4) (0.4) (0.4)

Interest bearing loans due after

more than one year - (92.7) (92.7) (92.7)

Derivative assets 0.1 - 0.1 0.1

Derivative liabilities (0.3) - (0.3) (0.3)

Other assets - 95.2 95.2 95.2

Other liabilities - (79.3) (79.3) (79.3)

------------------------------------ ------------- ------------ ---------- --------

Total at 30 June 2015 (0.2) (73.3) (73.5) (73.5)

------------------------------------ ------------- ------------ ---------- --------

Fair value hierarchy

The table below analyses financial instruments carried at fair

value, by valuation method. The different levels have been defined

as follows:

Level 1 : unadjusted quoted prices in active markets for

identical assets or liabilities.

Level 2 : inputs other than quoted prices included within Level

1 that are observable for the asset or liability, either as a

direct price or indirectly derived from prices.

Level 3 : inputs for the asset or liability that are not based

on observable market data.

Level Level Level Total

1 2 3 GBPm

GBPm GBPm GBPm

---------------------------------- ------- ------ ------ ------

Derivative financial assets - 0.1 - 0.1

Derivative financial liabilities - (0.3) - (0.3)

---------------------------------- ------- ------ ------ ------

At 30 June 2015 - (0.2) - (0.2)

---------------------------------- ------- ------ ------ ------

At 30 June 2015 the Group did not have any liabilities

classified at Level 1 or Level 3 in the fair value hierarchy. There

have been no transfers in any direction in the period.

The Group determines Level 2 fair values for its financial

instruments based on broker quotes, tested for reasonableness by

discounting expected future cash flows using market interest rates

for a similar instrument at the measurement date.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BUGDIUDGBGUU

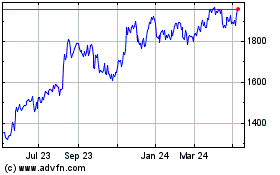

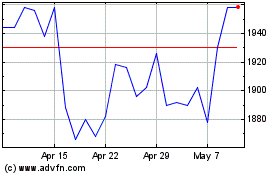

Hill & Smith (LSE:HILS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hill & Smith (LSE:HILS)

Historical Stock Chart

From Apr 2023 to Apr 2024