Higher Prices Aid Statoil's Growth - Analyst Blog

May 09 2012 - 1:29PM

Zacks

Statoil ASA’s (STO) first-quarter 2012 earnings

of 91 cents per ADR marched past the Zacks Consensus Estimate of 78

cents. The quarterly result also showed a significant improvement

from the year-earlier earnings of 65 cents per ADR, attributable to

higher liquids and gas prices.

Adjusted net income after tax came in at NOK16.8 billion (US$2.9

billion), up from the year-earlier level of NOK 11.9 billion

(US$2.1 billion).

Total revenue leaped 29% year over year to NOK195.4 billion

($33.7 billion), aided by higher liquids and gas prices as well as

higher volumes of both liquids and gas sold.

Operational Performance

In the reported quarter, equity and entitlement production

increased 11% and 12%, respectively, from the year-earlier quarter.

The increase was attributable to the start-up of new fields

Peregrino, Pazflor and Gulfaks, production ramp-up at existing

fields, commissioning of the newly acquired Bakken field as well as

higher gas sales. However, riser challenges, higher well

maintenance charges and natural decline on mature fields partly

offset the increase.

Total oil and gas equity production averaged 2.193 million

barrels of oil equivalent per day (MMBOE/d) in the first quarter

compared with 1.971 MMBOE/d in the year-earlier period. Of the

total quarterly output, 55% was oil and 45% was natural gas.

Total oil and gas entitlement production averaged 1.970 MMBOE/d

during the quarter (52% oil and 48% natural gas) compared with

1.765 MMBOE/d in the year-earlier period.

Total oil and gas liftings were 1.955 MMBOE/d, compared with

1.700 MMBOE/d in the prior-year quarter. The company’s realized oil

prices averaged $111.5 per barrel, up 11% year over year, while

natural gas price realization averaged NOK2.26 per standard cubic

meter, up 15% from the year-earlier level.

Financials

During the quarter, total capital investment was NOK27.9 billion

(US$4.8 billion) and operating cash flows were NOK 19.2 billion

(US$3.3 billion). Net debt-to-capitalization ratio was 14.6%

(versus 21.1% in the preceding quarter).

Guidance

Management said that it would deliver a compound annual equity

production growth rate (CAGR) of around 3% between 2010 and 2012.

Statoil aims to hit equity production of above 2.5 million barrels

of oil equivalent in 2020. The growth is expected to come from new

projects between 2014 and 2016, resulting in a CAGR of 2% to 3% for

the period 2012 to 2016.

The second stream of projects is expected within the 2016−2020

period that would likely lead to a CAGR of 3% to 4%. 2013

production is expected somewhere around the 2012 level.

The company expects organic capital expenditures of around US$17

billion and exploration activity of about $3 billion for 2012.

Outlook

In the reported quarter, Statoil delivered strong exploration

results, adding significantly to its resource base by making three

high impact discoveries. The company made significant discoveries

in offshore Norway, Tanzania and Brazil.

Recently, Statoil and Russian state-owned oil company OAO

Rosneft have entered into an agreement under which the Norwegian

oil giant will jointly explore and develop Russian offshore

deposits in the Barents Sea and Sea of Okhotsk. The venture is

expected to involve an investment of approximately $100 billion

over decades.

Statoil intends to finance the initial exploration initiatives

of the four licenses, covering more than 100,000 square kilometers

of area, in order to validate the commercial viability.

Importantly, the deal also enables the duo to conduct joint

technical studies on two onshore Russian assets — West Siberia’s

North-Komsomolskoye field and the Stavropol shale oil play in

south-west Russia.

Following a surge in global oil demand, we see the Norwegian oil

major as benefiting from this cooperation alliance with the world’s

largest hydrocarbon-producing nation. The latest deal follows

similar accords that Rosneft struck with Italy's Eni

SpA (E) and U.S. energy behemoth ExxonMobil

Corporation (XOM) for the exploration of oil in Russia's

Arctic.

Of late, Statoil announced its plan to introduce a new rig

concept to enhance the recovery rate of the mature fields on the

NCS. The company has awarded an eight-year contract to Aker

Solutions to attain heavy well intervention and light drilling

services on the Norwegian Continental Shelf.

The technologically advanced Cat-B rig has been mainly designed

for industrialization of drilling and intervention services in

existing production wells. We believe Statoil’s venture to improve

recovery of resources in mature fields is commendable.

Although near-term hiccups remain in the company’s production

outlook, we have a favorable stance on Statoil’s long-term

production growth given its growing upstream presence in the

emerging basins of the Caspian Sea, West Africa and the deepwater

U.S. Gulf of Mexico.

Our long-term Neutral recommendation remains unchanged and the

company holds a Zacks #3 Rank (short-term Hold rating).

ENI SPA-ADR (E): Free Stock Analysis Report

STATOIL ASA-ADR (STO): Free Stock Analysis Report

EXXON MOBIL CRP (XOM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

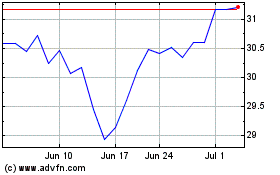

ENI (NYSE:E)

Historical Stock Chart

From Mar 2024 to Apr 2024

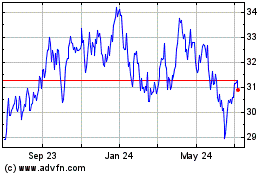

ENI (NYSE:E)

Historical Stock Chart

From Apr 2023 to Apr 2024