Second Quarter Highlights:

- Adjusted net loss was $147 million

or $0.52 per share compared to net income of $432 million or $1.38

per share in the prior-year quarter; lower hydrocarbon prices

reduced second quarter 2015 adjusted net income by approximately

$740 million, after-tax

- Net loss was $567 million

compared to net income of $931 million in the second quarter of

2014

- Oil and gas production increased to

391,000 barrels of oil equivalent per day (boepd) compared to

319,000 boepd in the second quarter of 2014

- Oil and gas production in the Bakken

was 119,000 boepd, up from 80,000 boepd in the year-ago

quarter

- Announced sale of 50% interest in

Bakken Midstream, resulting in $3 billion of cash proceeds

- Capital and exploratory expenditures

totaled $1.1 billion in the second quarter down from $1.3 billion

in the prior-year quarter

- Liza-1 well completed on the

Stabroek Block, offshore Guyana; announced as a significant

discovery by the operator

Hess Corporation (NYSE:HES) today reported an adjusted net loss,

which excludes items affecting comparability, of $147 million

or $0.52 per common share, for the second quarter of 2015

compared with adjusted net income of $432 million or

$1.38 per share in the second quarter of 2014. Lower realized

selling prices reduced adjusted net income by approximately $740

million after-tax compared with the prior-year quarter. In

addition, second quarter 2015 results benefitted from higher

production, lower cash operating costs and reduced exploration

expenses that were partially offset by higher depreciation,

depletion, and amortization expense. On an unadjusted basis, the

Corporation reported a net loss of $567 million for the second

quarter of 2015, including a noncash goodwill impairment charge of

$385 million, and net income of $931 million in the prior-year

quarter.

“We achieved strong operating

performance in the quarter and delivered significant and immediate

value to our shareholders with the sale of a 50 percent interest in

our Bakken midstream assets,” Chief Executive Officer John Hess

said. “We remain confident that our financial strength, resilient

portfolio and proven operating capabilities position us well in the

current low oil price environment as well as for a future price

recovery.”

After-tax income (loss) by major operating activity was as

follows:

Three Months Ended Six Months Ended June 30,

June 30, (unaudited) (unaudited)

2015

2014

2015

2014

(In millions, except per share amounts)

Net Income (Loss)

Attributable to Hess Corporation

Exploration and Production $ (502 ) $ 1,049 $ (816 ) $ 1,570 Bakken

Midstream 32 7 59 (6 ) Corporate, Interest and Other (83 )

(82 ) (172 ) (226 ) Net income (loss) from

continuing operations (553 ) 974 (929 ) 1,338 Discontinued

operations (14 ) (43 ) (27 ) (21 ) Net

income (loss) attributable to Hess Corporation $ (567 ) $ 931 $

(956 ) $ 1,317 Net income (loss) per share (diluted) $ (1.99

) $ 2.96 $ (3.37 ) $ 4.13

Adjusted Net Income

(Loss) Attributable to Hess Corporation

Exploration and Production $ (96 ) $ 475 $ (317 ) $ 1,002 Bakken

Midstream 32 7 59 (6 ) Corporate, Interest and Other (83 )

(73 ) (168 ) (157 ) Adjusted net income (loss)

from continuing operations (147 ) 409 (426 ) 839 Discontinued

operations — 23 — 39 Adjusted net

income (loss) attributable to Hess Corporation $ (147 ) $ 432 $

(426 ) $ 878 Adjusted net income (loss) per share (diluted)

$ (0.52 ) $ 1.38 $ (1.50 ) $ 2.75 Weighted average number of

shares (diluted) 284.3 314.1 283.9

318.7

Exploration and Production:

The Corporation’s Exploration and

Production activities had a net loss of $502 million in the

second quarter of 2015, compared with net income of

$1,049 million in the second quarter of 2014. Adjusted net

loss was $96 million in the second quarter of 2015 compared

with adjusted net income of $475 million in the second quarter

of 2014.

The Corporation’s average

worldwide crude oil selling price, including the effect of hedging,

was down 45 percent to $55.83 per barrel in the second quarter of

2015 from $102.16 per barrel in the second quarter of last

year. The average worldwide natural gas liquids selling price was

$11.06 per barrel, down from $36.59 per barrel in the year-ago

quarter while the average worldwide natural gas selling price was

$4.49 per mcf in the second quarter of 2015 compared with

$6.35 per mcf in the second quarter a year-ago.

Oil and gas production was

391,000 boepd, up 23 percent from 319,000 boepd in the

second quarter of 2014. Assets contributing to the volume growth

were primarily the Bakken shale play (39,000 boepd), the Utica

shale play (19,000 boepd), the Joint Development Area of

Malaysia/Thailand (11,000 boepd) and the Gulf of Mexico (9,000

boepd). Asset sales reduced production by 9,000 boepd.

Operational Highlights for the Second Quarter of

2015:

Bakken (Onshore U.S.): Net

production from the Bakken increased approximately 49 percent

to 119,000 boepd from the prior-year quarter due to continued

drilling activities. The Corporation brought 67 gross operated

wells on production in the second quarter of 2015 bringing the

year-to-date total to 137 wells. Drilling and completion costs per

operated well averaged $5.6 million in the second quarter of

2015, down 24 percent from the year-ago quarter. During the second

quarter, the Corporation operated 8 rigs.

Utica (Onshore U.S.): On

the Corporation’s joint venture acreage, 10 wells were drilled

and net production averaged 22,000 boepd in the second quarter of

2015 compared with 3,000 boepd in the prior-year quarter.

Gulf of Mexico (Offshore

U.S.): Net production from the Gulf of Mexico was up compared

to the prior-year quarter with higher volumes from Tubular Bells,

which totaled 23,000 boepd in the second quarter of 2015, being

partially offset by lower production from the Conger and Llano

Fields. At the Corporation’s non-operated Sicily exploration

prospect in the Keathley Canyon area (Hess 25 percent), the

operator successfully completed drilling and logging activities in

the second quarter. The well was drilled to a depth of 30,214 feet

and is being evaluated. The drilling of an appraisal well to

further evaluate the discovery is expected late this year or in

early 2016.

Guyana (Offshore): On the

Stabroek Block (Hess 30 percent), the operator announced a

significant oil discovery at the Liza #1 well and is now in the

process of evaluating the resource potential on the block. The

operator recently commenced the acquisition of 17,000 square

kilometers of 3D seismic.

Bakken Midstream:

The Corporation’s Bakken Midstream

activities had net income of $32 million in the second quarter of

2015 compared to $7 million in the prior-year quarter primarily due

to higher throughput throughout the system. In July 2015, the

Corporation completed the sale of a 50 percent interest in its

Bakken Midstream assets for cash consideration of $2.7 billion. The

joint venture incurred $600 million of debt in July with proceeds

distributed equally to both partners, resulting in total after-tax

cash proceeds net to Hess of approximately $3.0 billion. These

transactions will be reflected in the Corporation’s third quarter

results. As a result of the joint venture transaction, Hess has

reported its Bakken-related midstream operations as a separate

Midstream segment in its consolidated financial statements and will

begin disclosing certain historical and forward-looking financial

information for this segment.

Capital and Exploratory Expenditures:

Capital and exploratory

expenditures were $1,071 million in the second quarter of 2015 down

from $1,256 million in the prior-year quarter of which $1,006

million and $1,208 million, respectively, relate to Exploration and

Production activities. Second quarter 2015 Exploration and

Production expenditures reflect reduced activity in assets

including the Bakken, the Utica, Norway and Equatorial Guinea,

partly offset by expenditures associated with development of the

North Malay Basin project and exploratory activities in the Gulf of

Mexico and Guyana.

Liquidity:

Net cash provided by operating

activities was $541 million in the second quarter of 2015,

compared with $911 million in the second quarter of 2014. At

June 30, 2015, cash and cash equivalents totaled $931 million

compared with $2,444 million at December 31, 2014. Total debt

was $5,957 million at June 30, 2015 compared with

$5,987 million at December 31, 2014. The Corporation’s debt to

capitalization ratio at June 30, 2015 was 22.0 percent,

compared with 21.2 percent at December 31, 2014. In July 2015,

the Corporation received after-tax cash proceeds of approximately

$3 billion from the Bakken Midstream joint venture transaction

described above.

During the second quarter, the Corporation hedged an additional

20,000 barrels per day of crude oil production for the remainder of

2015 by entering into West Texas Intermediate crude collars with a

floor price of $60 per barrel and a ceiling price of $80 per

barrel. The Corporation’s crude oil hedging program for the

remainder of 2015 is detailed on page 18.

Discontinued Operations:

Losses from discontinued

operations amounted to $14 million in the second quarter of 2015

compared to $44 million in the prior-year quarter. The Corporation

completed the sale of its energy trading partnership (HETCO) in the

first quarter of 2015. Financial results for the second quarter of

2014 have been recast to report HETCO as discontinued operations in

the consolidated income statement on page 7.

Items Affecting Comparability of Earnings Between

Periods:

The following table reflects the

total after-tax income (expense) of items affecting comparability

of earnings between periods:

Three Months Ended

Six Months Ended June 30, June 30, (unaudited) (unaudited)

2015

2014

2015

2014

(In millions) Exploration and Production $ (406 ) $ 574 $ (499 ) $

568 Bakken Midstream — — — — Corporate, Interest and Other — (9 )

(4 ) (69 ) Discontinued operations (14 ) (66 )

(27 ) (60 ) Total items affecting comparability of earnings

between periods $ (420 ) $ 499 $ (530 ) $ 439

Second quarter 2015 results

include a goodwill impairment charge of $385 million associated

with the Corporation’s onshore reporting unit. As a result of

establishing the Bakken Midstream business as a separate operating

segment in the second quarter of 2015, U.S. GAAP required the

reallocation of goodwill to the Bakken Midstream segment and a

goodwill impairment test for each of the Corporation’s reporting

units. The nontaxable impairment charge for the onshore reporting

unit caused the Corporation’s effective tax rate in the quarter to

be substantially less than normal. In addition, the Corporation

recognized after-tax charges totaling $21 million ($21 million

pre-tax) associated with terminated international office space.

Reconciliation of U.S. GAAP to Non-GAAP measures:

The following table reconciles reported net income (loss)

attributable to Hess Corporation and adjusted net income

(loss):

Three Months Ended Six Months Ended

June 30, June 30, (unaudited) (unaudited)

2015

2014

2015

2014

(In millions) Net income (loss) attributable to Hess Corporation $

(567 ) $ 931 $ (956 ) $ 1,317 Less: Total items affecting

comparability of earnings between periods (420 ) 499

(530 ) 439 Adjusted net income (loss) attributable to

Hess Corporation $ (147 ) $ 432 $ (426 ) $ 878

Hess Corporation will review second quarter financial and

operating results and other matters on a webcast at 10 a.m. today.

For details about the event, refer to the Investor Relations

section of our website at www.hess.com.

Hess Corporation is a leading global independent energy company

engaged in the exploration and production of crude oil and natural

gas. More information on Hess Corporation is available at

www.hess.com.

Forward-looking Statements

Certain statements in this release may constitute

"forward-looking statements" within the meaning of Section 21E of

the United States Securities Exchange Act of 1934, as amended, and

Section 27A of the United States Securities Act of 1933, as

amended. Forward-looking statements are subject to known and

unknown risks and uncertainties and other factors which may cause

actual results to differ materially from those expressed or implied

by such statements, including, without limitation, uncertainties

inherent in the measurement and interpretation of geological,

geophysical and other technical data. Estimates and projections

contained in this release are based on the Company’s current

understanding and assessment based on reasonable assumptions.

Actual results may differ materially from these estimates and

projections due to certain risk factors discussed in the

Corporation’s periodic filings with the Securities and Exchange

Commission and other factors.

Non-GAAP financial measure

The Corporation has used a non-GAAP financial measure in this

earnings release. “Adjusted net income (loss)” presented in this

release is defined as reported net income (loss) attributable to

Hess Corporation excluding items identified as affecting

comparability of earnings between periods. We believe that

investors’ understanding of our performance is enhanced by

disclosing this measure. This measure is not, and should not be

viewed as, a substitute for U.S. GAAP net income (loss). A

reconciliation of reported net income (loss) attributable to Hess

Corporation (U.S. GAAP) to adjusted net income (loss) is provided

in the release.

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

SUPPLEMENTAL FINANCIAL DATA

(UNAUDITED)

(IN MILLIONS)

Second Second First Quarter

Quarter Quarter

2015

2014

2015

Income

Statement

Revenues and Non-operating Income Sales and other operating

revenues

$

1,953

$

2,829

$

1,538 Gains on asset sales, net — 779 — Other, net (18 )

(25 ) 12 Total revenues and non-operating income

1,935 3,583 1,550 Costs and Expenses

Cost of products sold (excluding items shown separately below) 356

421 278 Operating costs and expenses 503 545 506 Production and

severance taxes 45 78 36 Exploration expenses, including dry holes

and lease impairment 90 460 269 General and administrative expenses

151 143 147 Interest expense 86 85 85 Depreciation, depletion and

amortization 1,028 785 956 Impairment 385 — —

Total costs and expenses 2,644 2,517 2,277

Income (loss) from continuing operations before income taxes

(709 ) 1,066 (727 ) Provision (benefit) for income taxes

(156 ) 92 (351 ) Income (loss) from continuing

operations (553 ) 974 (376 ) Income (loss) from discontinued

operations, net of income taxes (14 ) (44 )

(13 ) Net income (loss) (567 ) 930 (389 ) Less: Net income

(loss) attributable to noncontrolling interests — (1

) — Net income (loss) attributable to Hess Corporation $

(567 ) $ 931 $ (389 ) See "Discontinued Operations" on page

5 for basis of presentation.

Cash Flow

Information

Net cash provided by (used in) operating activities (*) $

541 $ 911 $ 362 Net cash provided by (used in) investing activities

(1,016 ) 232 (1,152 ) Net cash provided by (used in) financing

activities (100 ) (226 ) (148 ) Net increase

(decrease) in cash and cash equivalents $ (575 ) $ 917 $ (938 )

(*) Includes changes in working

capital.

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

SUPPLEMENTAL FINANCIAL DATA

(UNAUDITED)

(IN MILLIONS)

First half

2015

2014

Income

Statement

Revenues and Non-operating Income Sales and other operating

revenues

$

3,491

$

5,502 Gains on asset sales, net — 789 Other, net (6 )

(116 ) Total revenues and non-operating income 3,485

6,175 Costs and Expenses Cost of products sold (excluding

items shown separately below) 634 785 Operating costs and expenses

1,009 1,040 Production and severance taxes 81 140 Exploration

expenses, including dry holes and lease impairment 359 579 General

and administrative expenses 298 285 Interest expense 171 166

Depreciation, depletion and amortization 1,984 1,511 Impairment

385 — Total costs and expenses 4,921

4,506 Income (loss) from continuing operations before income

taxes (1,436 ) 1,669 Provision (benefit) for income taxes

(507 ) 331 Income (loss) from continuing operations (929 )

1,338 Income (loss) from discontinued operations, net of

income taxes (27 ) 13 Net income (loss) (956 )

1,351 Less: Net income (loss) attributable to noncontrolling

interests — 34 Net income (loss) attributable to Hess

Corporation $ (956 ) $ 1,317 See "Discontinued Operations"

on page 5 for basis of presentation.

Cash Flow

Information

Net cash provided by (used in) operating activities (*) $

903 $ 2,069 Net cash provided by (used in) investing activities

(2,168 ) (30 ) Net cash provided by (used in) financing activities

(248 ) (1,648 ) Net increase (decrease) in cash and

cash equivalents $ (1,513 ) $ 391

(*) Includes changes in working

capital.

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

SUPPLEMENTAL FINANCIAL DATA

(UNAUDITED)

(IN MILLIONS)

June 30, December 31,

2015

2014

Balance Sheet

Information

Cash and cash equivalents

$

931

$

2,444 Other current assets 2,995 4,243 Property, plant and

equipment – net 27,298 27,517 Other long-term assets

4,334 4,374 Total assets $

35,558 $ 38,578 Current maturities of long-term debt

$ 69 $ 68 Other current liabilities 3,424 4,783 Long-term debt

5,888 5,919 Other long-term liabilities 5,074 5,488 Total equity

excluding other comprehensive income (loss) 22,539 23,730

Accumulated other comprehensive income (loss)

(1,436 ) (1,410 ) Total liabilities and equity $

35,558 $ 38,578

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

SUPPLEMENTAL FINANCIAL DATA

(UNAUDITED)

(IN MILLIONS)

Second

Second First Quarter Quarter Quarter

2015

2014

2015

Capital and

Exploratory Expenditures

Exploration and Production United States Bakken

$

331

$

385

$

434 Other Onshore 110 186 80 Total Onshore 441

571 514 Offshore 188 157 279 Total United

States 629 728 793 Europe 82 162 115

Africa 58 119 88 Asia and other 237 199 248

Capital and Exploratory Expenditures - Exploration and Production

1,006 1,208 1,244 Bakken Midstream 65

48 40 Total Capital and

Exploratory Expenditures $ 1,071 $ 1,256 $ 1,284 Total

exploration expenses charged to income included above $ 58 $ 54 $

47 First half

2015

2014

Capital and

Exploratory Expenditures

Exploration and Production United States Bakken $ 765 $ 765 Other

Onshore 190 355 Total Onshore 955 1,120 Offshore

467 319 Total United States 1,422 1,439

Europe 197 307 Africa 146 219 Asia and other 485

394 Capital and Exploratory Expenditures - Exploration and

Production 2,250 2,359 Bakken Midstream 105

121 Total Capital and Exploratory

Expenditures $ 2,355 $ 2,480 Total exploration expenses

charged to income included above $ 105 $ 132

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

EXPLORATION AND PRODUCTION EARNINGS

(UNAUDITED)

(IN MILLIONS)

Second Quarter 2015 United States

International

Total

Sales and other operating revenues $ 1,259 $ 694 $ 1,953

Other, net (13 ) (4 ) (17 ) Total revenues and

non-operating income 1,246 690 1,936

Costs and Expenses Cost of products sold (excluding items shown

separately below) 382 4 386 Operating costs and expenses 181 254

435 Production and severance taxes 44 1 45 Bakken Midstream tariffs

116 — 116 Exploration expenses, including dry holes and lease

impairment 48 42 90 General and administrative expenses 79 18 97

Depreciation, depletion and amortization 609 395 1,004

Impairment

385 — 385 Total costs and expenses

1,844 714 2,558 Results of operations before

income taxes (598 ) (24 ) (622 ) Provision (benefit) for income

taxes (69 ) (51 ) (120 ) Net income (loss)

attributable to Hess Corporation $ (529 )

(a)

$ 27

(b)

$ (502 ) Second Quarter 2014 United States

International

Total

Sales and other operating revenues $ 1,653 $ 1,176 $ 2,829

Gains on asset sales, net 62 704 766 Other, net (12 )

(16 ) (28 ) Total revenues and non-operating income

1,703 1,864 3,567 Costs and Expenses Cost of

products sold (excluding items shown separately below) 412 32 444

Operating costs and expenses 190 308 498 Production and severance

taxes 67 11 78 Bakken Midstream tariffs 58 — 58 Exploration

expenses, including dry holes and lease impairment 208 252 460

General and administrative expenses 68 9 77 Depreciation, depletion

and amortization 413 349 762 Total costs and

expenses 1,416 961 2,377 Results of

operations before income taxes 287 903 1,190 Provision (benefit)

for income taxes 114 27 141 Net income (loss)

attributable to Hess Corporation $ 173

(a)

$ 876

(b)

$ 1,049 (a) The after-tax realized results from crude

oil hedging activities amounted to a loss of $1 million in the

second quarter of 2015 and a loss of $2 million in the second

quarter of 2014. Unrealized changes in crude oil hedging contracts

which are included in Other operating revenues, amounted to a gain

of $3 million in the second quarter of 2015 and loss of $2 million

in the second quarter of 2014. (b) The after-tax realized

loss from crude oil hedging activities amounted to $8 million in

the second quarter of 2015 and loss of $2 million in the second

quarter of 2014. Unrealized changes in crude oil hedging contracts,

which are included in Other operating revenues, amounted to a loss

of $16 million after-tax in the second quarter of 2015 and was

immaterial in the second quarter of 2014.

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

EXPLORATION AND PRODUCTION EARNINGS

(UNAUDITED)

(IN MILLIONS)

First Quarter 2015 United States

International

Total

Sales and other operating revenues $ 937 $ 601 $ 1,538

Other, net (7 ) 18 11 Total revenues and

non-operating income 930 619 1,549

Costs and Expenses Cost of products sold (excluding items shown

separately below) 344 (38 ) 306 Operating costs and expenses 213

230 443 Production and severance taxes 34 2 36 Bakken Midstream

tariffs 102 — 102 Exploration expenses, including dry holes and

lease impairment 36 233 269 General and administrative expenses 76

10 86 Depreciation, depletion and amortization 528

404 932 Total costs and expenses 1,333 841

2,174 Results of operations before income taxes (403

) (222 ) (625 ) Provision (benefit) for income taxes (142 )

(169 ) (311 ) Net income (loss) attributable to Hess

Corporation $ (261 ) $ (53 )

(a)

$ (314 ) (a) The after-tax realized gains from crude

oil hedging activities amounted to $1 million in the first quarter

of 2015. Unrealized changes in crude oil hedging contracts, which

are included in Other operating revenues, amounted to gain of $10

million after-tax.

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

EXPLORATION AND PRODUCTION EARNINGS

(UNAUDITED)

(IN MILLIONS)

First Half 2015 United States

International

Total

Sales and other operating revenues $ 2,196 $ 1,295 $ 3,491

Other, net (20 ) 14 (6 ) Total revenues and

non-operating income 2,176 1,309 3,485

Costs and Expenses Cost of products sold (excluding items shown

separately below) 726 (34 ) 692 Operating costs and expenses 394

484 878 Production and severance taxes 78 3 81 Bakken Midstream

tariffs 218

—

218 Exploration expenses, including dry holes and lease impairment

84 275 359 General and administrative expenses 155 28 183

Depreciation, depletion and amortization 1,137 799 1,936

Impairment

385

—

385 Total costs and expenses 3,177 1,555

4,732 Results of operations before income taxes

(1,001 ) (246 ) (1,247 ) Provision (benefit) for income taxes

(211 ) (220 ) (431 ) Net income (loss)

attributable to Hess Corporation $ (790 )

(a)

$ (26 )

(b)

$ (816 ) First Half 2014 United States

International

Total

Sales and other operating revenues $ 3,198 $ 2,304 $ 5,502

Gains on asset sales, net 62 714 776 Other, net (14 )

(20 ) (34 ) Total revenues and non-operating income

3,246 2,998 6,244 Costs and Expenses Cost of

products sold (excluding items shown separately below) 826 11 837

Operating costs and expenses 371 565 936 Production and severance

taxes 125 15 140 Bakken Midstream tariffs 77 — 77 Exploration

expenses, including dry holes and lease impairment 255 324 579

General and administrative expenses 124 31 155 Depreciation,

depletion and amortization 764 710 1,474 Total

costs and expenses 2,542 1,656 4,198

Results of operations before income taxes 704 1,342 2,046 Provision

for income taxes 278 198 476 Net income (loss)

attributable to Hess Corporation $ 426

(a)

$ 1,144

(b)

$ 1,570 (a) The after-tax realized loss from crude

oil hedging activities amounted to $1 million in the first six

months of 2015 and a loss of $2 million in the first six months of

2014. Unrealized changes in crude oil hedging contracts, which are

included in Other operating revenues, amounted to gains of $3

million after-tax in the first six months of 2015 and a loss of $2

million after-tax in the first six months of 2014. (b) The

after-tax realized loss from crude oil hedging activities amounted

to $7 million in the first six months of 2015 and was immaterial in

the first six months of 2014. Unrealized changes in crude oil

hedging contracts, which are included in Other operating revenues,

amounted to a loss of $6 million after-tax in the first six months

of 2015 and gain of $3 million after-tax in the first six months of

2014.

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

EXPLORATION AND PRODUCTION SUPPLEMENTAL

OPERATING DATA (UNAUDITED)

Second Second First

Quarter

Quarter

Quarter

2015

2014

2015

Operating

Data

Net Production Per

Day (in thousands)

Crude oil - barrels United States Bakken 85 64 79 Other Onshore

11 9 11 Total Onshore 96 73 90 Offshore

61 54 50 Total United States 157 127

140 Europe 39 36 36 Africa 48 51 52 Asia 2

2 2 Total 246 216 230

Natural gas liquids - barrels United States Bakken 22 8 19 Other

Onshore 12 5 9 Total Onshore 34 13 28 Offshore

6 7 6 Total United States 40 20

34 Europe 2 1 1 Total 42

21 35 Natural gas - mcf United States Bakken

71 48 58 Other Onshore 95 50 79 Total Onshore

166 98 137 Offshore 98 83 65 Total United

States 264 181 202 Europe 41 35 36 Asia

and other 312 275 336 Total 617

491 574 Barrels of oil equivalent 391

319 361

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

EXPLORATION AND PRODUCTION SUPPLEMENTAL

OPERATING DATA (UNAUDITED)

First half

2015

2014

Operating

Data

Net Production Per

Day (in thousands)

Crude oil - barrels United States Bakken 82 61 Other Onshore

11 9 Total Onshore 93 70 Offshore 55 53 Total

United States 148 123 Europe 38 37 Africa 50

49 Asia 2 4 Total 238 213

Natural gas liquids - barrels United States Bakken 21 5 Other

Onshore 10 4 Total Onshore 31 9 Offshore 6

7 Total United States 37 16 Europe

1 1 Total 38 17 Natural gas -

mcf United States Bakken 65 31 Other Onshore 87 38

Total Onshore 152 69 Offshore 82 81 Total United

States 234 150 Europe 39 36 Asia and other

324 345 Total 597 531 Barrels of

oil equivalent 376 319

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

EXPLORATION AND PRODUCTION SUPPLEMENTAL

OPERATING DATA (UNAUDITED)

Second Second First Quarter Quarter Quarter

2015

2014

2015

Sales Volumes Per

Day (in thousands)

Crude oil - barrels 250 222 219 Natural gas liquids -

barrels 42 21 35 Natural gas - mcf 617 491 574 Barrels of

oil equivalent 395 325 349

Sales Volumes (in

thousands)

Crude oil - barrels 22,729 20,193 19,708 Natural gas liquids -

barrels 3,848 1,942 3,119 Natural gas - mcf 56,179 44,662

51,641 Barrels of oil equivalent 35,940 29,578 31,434

First half

2015

2014

Sales Volumes Per

Day (in thousands)

Crude oil - barrels 234 210 Natural gas liquids - barrels 38 17

Natural gas - mcf 596 530 Barrels of oil equivalent 372 315

Sales Volumes (in

thousands)

Crude oil - barrels 42,436 37,943 Natural gas liquids - barrels

6,967 3,064 Natural gas - mcf 107,820 96,019 Barrels of oil

equivalent 67,373 57,010

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

EXPLORATION AND PRODUCTION SUPPLEMENTAL

OPERATING DATA (UNAUDITED)

Second Second First

Quarter

Quarter

Quarter

2015

2014

2015

Operating

Data

Average Selling

Prices

Crude oil - per barrel (including hedging) United States Onshore $

50.33 $ 93.84 $ 39.01 Offshore 57.82 100.42 43.55 Total United

States 53.25 96.62 40.62 Europe 60.88 111.03 53.31 Africa 59.70

108.83 52.93 Asia 59.37 106.33 48.44 Worldwide 55.83 102.16 45.08

Crude oil - per barrel (excluding hedging) United States

Onshore $ 50.54 $ 93.84 $ 39.01 Offshore 57.82 101.09 43.55 Total

United States 53.38 96.90 40.62 Europe 62.39 111.39 53.17 Africa

61.00 109.10 52.82 Asia 59.37 106.33 48.44 Worldwide 56.40 102.45

45.04 Natural gas liquids - per barrel United States Onshore

$ 9.47 $ 36.99 $ 14.22 Offshore 15.82 32.21 15.71 Total United

States 10.46 35.39 14.47 Europe 27.53 55.77 27.58 Worldwide 11.06

36.59 14.91 Natural gas - per mcf United States Onshore $

1.81 $ 4.36 $ 2.07 Offshore 2.13 4.01 2.31 Total United States 1.93

4.22 2.15 Europe 7.35 10.51 7.95 Asia and other 6.27 7.24 5.95

Worldwide 4.49 6.35 4.74

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

EXPLORATION AND PRODUCTION SUPPLEMENTAL

OPERATING DATA (UNAUDITED)

First half

2015

2014

Operating

Data

Average Selling

Prices

Crude oil - per barrel (including hedging) United States Onshore $

44.85 $ 91.67 Offshore 52.11 99.89 Total United States 47.56 95.19

Europe 57.42 110.10 Africa 56.54 108.65 Asia 56.85 104.66 Worldwide

50.99 100.96 Crude oil - per barrel (excluding hedging)

United States Onshore $ 44.97 $ 91.67 Offshore 52.11 100.24 Total

United States 47.63 95.33 Europe 58.18 110.06 Africa 57.18 108.62

Asia 56.85 104.66 Worldwide 51.28 101.03 Natural gas liquids

- per barrel United States Onshore $ 11.58 $ 40.91 Offshore 15.77

33.14 Total United States 12.26 37.54 Europe 27.56 60.16 Worldwide

12.78 39.41 Natural gas - per mcf United States Onshore $

1.93 $ 4.87 Offshore 2.20 4.18 Total United States 2.03 4.52 Europe

7.63 11.01 Asia and other 6.11 7.23 Worldwide 4.61 6.72

The following is a summary of the Corporation’s commodity

hedging program:

Brent

West Texas

Intermediate

Q3 and Q4 2015

Hedging program:

Daily production(bopd) 50,000 20,000 Ceiling price $80 $80 Floor

price $60 $60 Program finishing date December 31, 2015 December 31,

2015

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

BAKKEN MIDSTREAM EARNINGS

(UNAUDITED)

(IN MILLIONS)

Second Second First Quarter Quarter Quarter

2015

2014

2015

Income

Statement

Revenues and Non-operating Income Total revenues and

non-operating income $ 145 $ 81 $ 130 Costs and Expenses

Operating costs and expenses 68 47 63 General and administrative

expenses 3 2 2 Depreciation, depletion and amortization 22 20 21

Interest expense 1 1 1 Total costs and

expenses 94 70 87 Results of operations

before income taxes 51 11 43 Provision (benefit) for income taxes

19 4 16 Net income (loss) attributable to Hess

Corporation $ 32 $ 7 $ 27 First half

2015

2014

Income

Statement

Revenues and Non-operating Income Total revenues and

non-operating income $ 275 $ 129 Costs and Expenses

Operating costs and expenses 131 104 General and administrative

expenses 5 4 Depreciation, depletion and amortization 43 29

Interest expense 2 1 Total costs and expenses

181 138 Results of operations before income taxes 94

(9 ) Provision (benefit) for income taxes 35 (3 ) Net

income (loss) attributable to Hess Corporation $ 59 $ (6 )

The reported amounts above represent 100 percent of the Bakken

Midstream operating segment. On July 1, 2015, the Corporation

completed the sale of a 50 percent interest in its Bakken Midstream

segment. Our partner’s 50 percent share of net income will be

presented as a noncontrolling interest charge in the Bakken

Midstream income statements beginning in the third quarter of

2015.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150729005488/en/

For Hess CorporationInvestor Contact:Jay

Wilson212-536-8940orMedia Contact:Sard Verbinnen &

CoMichael Henson/Patrick Scanlan212-687-8080

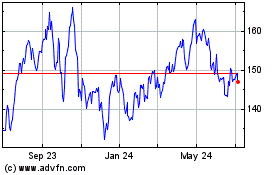

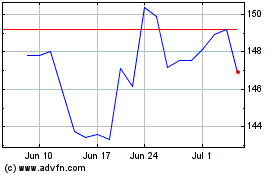

Hess (NYSE:HES)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hess (NYSE:HES)

Historical Stock Chart

From Apr 2023 to Apr 2024