Headquarters of Merged Stock Exchange Would Move From London

June 28 2016 - 1:20PM

Dow Jones News

FRANKFURT—A top German regulator Tuesday raised the bar for the

planned $30 billion merger of Deutsche Bö rse AG and London Stock

Exchange Group PLC, saying the headquarters of a combined exchange

would have to be moved away from London.

His statement is the strongest call yet for altering the

structure of the planned merger following the U.K.'s vote to leave

the European Union. German politicians and Germany's largest

association of small investors have called on Deutsche Bö rse's top

management around Chief Executive Carsten Kengeter to rework plans

so the merged companies' new headquarters wouldn't be in

London.

"It is hard to imagine" that the most important exchange

operator in the euro zone would be steered from a headquarters

outside the EU, Felix Hufeld, president of BaFin, the country's

financial watchdog, told reporters Tuesday.

He signaled the merger plans can still be realized despite

Brexit, saying there has to "be an adjustment" regarding the

location of the holding company that is slated to house both

exchange groups. Mr. Hufeld said it wouldn't be politically smart

to have large parts of the euro-denominated trading of certain

asset classes outside the EU.

Industry observers said a possible solution was to let the deal

go ahead as planned and assure regulators that the company's base

would be moved to Frankfurt after the transaction closed, which is

planned for the first quarter of next year.

Many observers were skeptical about such a scenario because any

relocation would necessarily lead to a change in the planned

management setup, a thorny issue that could be time consuming.

BaFin can't veto the tie-up, but Mr. Hufeld's comments are

significant nonetheless because BaFin is the authority being

consulted by decision makers, including the state of Hesse which

has to approve the deal that would create the world's biggest

exchange group by revenue.

Following Brexit, German politicians have called for moving the

headquarters of the combined entity to Frankfurt.

Thorsten Schaefer-Gü mbel, deputy party leader of Germany's

Social Democrats and opposition leader in the Hesse state

parliament, on Monday said "the deal is basically dead in the

current conditions that foresee the holding's headquarters in

London" and certain business units operating out of London.

Mr. Schaefer-Gü mbel added the deal's "fundamental assumptions

need to be changed now." Even though Mr. Schaefer-Gü mbel isn't

directly responsible for the deal, his comments echo statements

from other local politicians in Hesse. The state's economy

minister, the Green Party's Tarek Al-Wazir, ultimately has to

approve the transaction. He has so far refrained from public

statements.

Deutsche Bö rse's investor base appears to be split over whether

to support the deal after Brexit. Several large investors still

support the merger because it makes economic sense despite the

U.K.'s leaving the EU, according to a person familiar with the

matter.

Others demur. "Deutsche Bö rse's top personnel should critically

re-evaluate their merger plans and massively amend or bury them,"

said Klaus Nieding, a representative of German shareholder

association DSW, on Monday. Germany's market supervisor "cannot

agree to London as the location" for the new company, he said.

Write to Madeleine Nissen at Madeleine.Nissen@wsj.com and Eyk

Henning at eyk.henning@wsj.com

(END) Dow Jones Newswires

June 28, 2016 13:05 ET (17:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

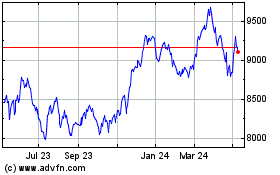

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

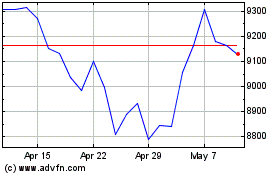

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2023 to Apr 2024