Hawaiian Electric Beats Earnings, Misses Rev - Analyst Blog

August 12 2013 - 10:05AM

Zacks

Hawaiian Electric

Industries Inc. (HE) posted second quarter 2013 earnings

of 41 cents per share, beating the Zacks Consensus Estimate of 38

cents. Also, earnings came in ahead of the year-ago figure by a

penny.

The results reflect higher bank earnings compared to the same

quarter last year. The positives were partly offset by lower

utility earnings due to a customer refund recorded in the

quarter.

Operating Statistics

Total revenue at the end of the reported quarter was $796.7

million, down 6.7% year over year. Reported results were also below

the Zacks Consensus Estimate of $830.0 million.

Segment Net Income

Electric Utility: Segment net income

declined 2.4% year over year to $28.7 million. The results reflect

higher depreciation expense, higher customer service costs and

relatively flat revenue owing to the customer refund granted in its

recent final rate case decision. However, these were partially

offset by lower operations and maintenance (O&M) expenses

because of the temporary delays in overhauls and reversals of

previously expensed costs.

Banking: Hawaiian Electric’s Banking

segment recorded net income of $15.9 million in the reported

quarter, up 12.2% from $14.2 million in the year-ago quarter. The

increase reflects a lower provision for loan losses of $2 million,

$1 million of which related to the strategic third quarter sale of

American's credit card portfolio, and $1 million higher gains on

sales of investment securities. However, these were partially

offset by lower mortgage banking income and higher non-interest

expense.

Overall, the segment continued to deliver solid results in second

quarter 2013 with a return on average equity of 12.6% and a return

on average assets of 1.25%.

Other: The segment digested a quarterly

net loss of $4.0 million, narrower than the year-ago loss of $4.8

million.

Financial Update

Cash and cash equivalents as of Jun 30, 2013, were $153.7 million,

down from $219.7 million as of Dec 31, 2012. Long-term debt, net

was $1,422.9 million, approximately flat year over year. Net cash

provided by (used in) operating activities was $130.8 million in

the first half of 2013 versus ($3.6) million in the year-earlier

period.

Guidance

Recently, Hawaiian Electric lowered its earnings guidance for 2013.

The lowered guidance reflects Maui Electric Company, Limited’s

(MECO) 2012 test year final rate case decision and order (D&O)

issued by the Public Utilities Commission of the State of Hawaii

(“PUC”).

The company expects adjusted earnings per share in the range of

$1.54 to $1.64 and GAAP earnings in the range of $1.52 to $1.62 per

share. The guidance reflects $7.8 million lower MECO annual

revenues as a result of the final D&O. With its first quarter

results, the company had issued 2013 earnings guidance in the range

of $1.58 to $1.68 per share.

For Hawaiian Electric Company, Inc., the company expects adjusted

earnings per share in the range of $1.19 to $1.25 and GAAP earnings

per share in the range of $1.17 to $1.23.

Zacks Rank

The company presently retains a short-term Zacks Rank #3

(Hold).

Going forward, we expect the company to benefit from investment in

local infrastructure. The company made $140 million of

infrastructure investments in the first half of 2013. Also, its

common stock offering would bring in capital, and a more modern

electric grid and lower-cost renewable energy would benefit

customers. The company is trying to reduce its dependence on oil

and is constantly seeking ways to increase the use of lower-cost

renewables.

Year to date, Hawaiian Electric Company has already provided nearly

18% of customers' electricity usage from renewable sources. This is

higher than the 2015 renewable portfolio standard of 15%.

We are nevertheless concerned about lower electricity volume sales,

a tourism-dependant Hawaiian economy and the volatile Japanese

economy.

Stocks that are well placed in the energy space are Zacks Ranked #1

(Strong Buy) Huaneng Power International, Inc.

(HNP) and UNS Energy Corp. (UNS), and Zacks Ranked

#2 (Buy) Alliant Energy Corp. (LNT).

HAWAIIAN ELEC (HE): Free Stock Analysis Report

HUANENG POWER (HNP): Free Stock Analysis Report

ALLIANT ENGY CP (LNT): Free Stock Analysis Report

UNS ENERGY CORP (UNS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

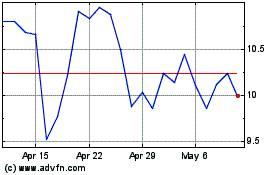

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Apr 2023 to Apr 2024