TIDMLFI

Date: 29th February 2012

On behalf of: London Finance & Investment Group P.L.C. ("Lonfin", "the

Company" or "the Group")

Embargoed until: 14.30hrs (UK Time) 16.30hrs (SA Time)

London Finance & Investment Group P.L.C.

Interim Results

Lonfin (LSE: LFI, JSE: LNF), today announces its unaudited interim results for

the six months ended 31st December 2011 and dividend declaration.

Chairman's Statement

Introduction

As an investment company our target is to achieve growth in shareholder value

in real terms over the medium to long term. In the short term our results can

be influenced by overall stock market performance, particularly the valuation

of our Strategic Investments. We continue to believe that a combination of

Strategic Investments and a General Portfolio is the most effective way of

achieving our aims. Strategic Investments are significant investments in

smaller UK quoted companies where we have expectations of above average growth

over the medium to longer term and these are balanced by a General Portfolio

which consists of investments in major U.K. and European equities.

At 31st December 2011, we held three Strategic Investments in which we have

board representation: our associated company Western Selection P.L.C., MWB

Group Holdings Plc and Finsbury Food Group plc. Detailed comments on our

Strategic Investments are given below.

Results

Our net assets per share decreased 7% to 32.7p at 31st December 2011 from 35.0p

at 30th June 2011. Our Strategic Investments decreased in value by 8%. Our

General Portfolio decreased by 9%, compared with the increases of 21% in the

FTSE 100 index, a decrease of 10% in the FTSEurofirst 300 index and a decrease

of 19% in AIM over the half year. At the close of business on 15th February

2012, our net asset value was 34.6p.

The Group profit before exceptional items and tax for the half year was GBP32,000

compared to a profit of GBP250,000 for the same period last year. This was in the

main due to no profits being realised from the General Portfolio. Including the

exceptional profit of GBP2,132,000 arising from the disposal of the property and

the recognition of the net decrease in the fair value of our investments, our

profit after tax and minority interest was GBP1,108,000 (2010 profit: GBP2,005,000)

giving profits per share of 3.6p (2010 - 6.4p).

Strategic Investments

Western Selection P.L.C. ("Western")

The Group owns 7,860,515 Western shares, representing 43.8% of Western's issued

share capital.

On 28th February 2012, Western announced a loss after tax of GBP86,000 for its

half year to 31st December 2011 and a loss per share of 0.5p (2010: profit

1.8p). Western's net assets at market value were GBP12,113,000 equivalent to 67p

per share, a decrease of 19% from 84p at 30th June 2011. Western has announced

an increased interim dividend of 0.8p per share, an increase of 23% on the

prior year.

The market value of the Company's investment in Western at 31st December 2011

was GBP2,987,000 representing 29% of the net assets of Lonfin. The underlying

value of the investment in Western, valuing Western's own investments at market

value, was GBP5.4 million (30th June 2011: GBP5.6 million).

I am the Chairman of Western and Mr. Robotham is a Non-Executive Director.

Western has strategic investments in Creston plc, Northbridge Industrial

Services PLC, Swallowfield plc. and Hartim Limited. Extracts from Western's

announcement on its strategic investments are set out below:

Creston plc("Creston")

Creston is a marketing services group with a strategy to grow within its

sector to become a substantial, diversified international marketing

services group. Creston's results for the half-year to 30th September 2011

show a profit after tax of GBP2,821,000 (2010: loss - GBP133,000). Creston

declared an interim dividend of 0.83p per share, an increase of 11% on the

prior year.

Creston has recently announced the acquisition of the Corkery Group, a New

York based health and medical public relations company, complementing

Creston's US healthcare company Cooney/Waters. Further information about

Creston is available on its website: www.creston.com.

Western owns 3,000,000 shares in Creston (4.9%) with a market value at

31st December 2011 of GBP2,070,000 (30th June 2011: GBP2,752,000), being 16%

of Western's assets.

Northbridge Industrial Services plc ("Northbridge")

Northbridge hires and sells specialist industrial equipment to utility

companies, the oil and gas sector, shipping, construction and the public

sector. The product range includes loadbanks, transformers, generators,

compressors and oil tools. It has grown by acquisition of companies in the

UK, Dubai, Azerbaijan and Australia and through investing further in those

companies to make them more successful. Further information about

Northbridge is available on its website: www.northbridgegroup.co.uk.

Northbridge's latest results, for the half year to 30th June 2011, showed

profit of GBP1,656,000 (2010: GBP1,024,000). Northbridge declared an interim

dividend of 1.75p per share, an increase of 13% on the prior year.

Western owns 2,200,000 shares, representing 14.4% of Northbridge's share

capital. The value of this investment has been volatile and at 31st

December 2011 was GBP4,576,000 (30th June 2011: GBP6,094,000), representing

37% of Western's assets. The value of this investment has increased

substantially since 31st December 2011.

Swallowfield plc ("Swallowfield")

Swallowfield is a full service provider for global and household brands

operating in the cosmetics and personal care and household goods

marketplace. It offers a flexible and tailored service including: contract

filling, market analysis, design, formulation and testing of products,

packaging design and sourcing and distribution of stock. Further

information about Swallowfield is available on its website:

www.swallowfield.com.

Swallowfield's latest results, for the half year to 31st December 2011,

showed profit of GBP535,000 (31st December 2010: GBP519,000) against a

background of customer uncertainty and rising input costs. Swallowfield

declared an interim dividend of 2.2p, unchanged on the prior year.

At 31st December 2011, Western owned 1,869,149 shares in Swallowfield

(16.53% of their issued share capital). The market value of the Company's

holding in Swallowfield on 31st December 2011 was GBP2,187,000 (30th June

2011: GBP2,444,000) representing 18% of the Company's assets.

Hartim Limited ("Hartim")

Hartim offers a complete export sales, marketing and logistical services

to a number of well known UK branded fast moving consumer goods companies.

This investment was acquired on 28th March 2009 and is accounted for as an

associated company.

Hartim's estimated results for the year ended 31st December 2011 showed a

profit of GBP168,000 (2010 GBP540,000) after tax and before exceptional items.

These results are explained above, are a credible achievement under

challenging world wide conditions, and still represent a reasonable return

on our investment.

At 31st December 2011, Western owned 49.5% of Hartim. The carrying value

of the Company's investment in Hartim on 31st December 2011 was GBP1,300,000

(30th June 2011: GBP1,465,000) representing 11% of the Company's assets.

Finsbury Food Group plc ("Finsbury Food")

The Group owns 8,000,000 shares in Finsbury Food, representing 15.2% of their

share capital. The market value of our holding was GBP2,160,000 on 31st December

2011 compared to a cost of GBP1,893,000; this represents 21% of the net assets of

Lonfin.

Finsbury Food is a supplier of ambient cakes to most of the UK's major

supermarket chains and speciality breads to Waitrose including gluten-free and

low fat products. Further information about Finsbury Food is available on its

website: www.finsburyfoods.co.uk.

I am a Non-Executive Director of Finsbury.

MWB Group Holdings Plc ("MWB")

The Group owns 2,000,000 shares, representing 1.2% of MWB's issued share

capital. The market value of the holding at 31st December, 2011 was GBP290,000

(30th June 2011 - GBP775,000) which represents 3% of the net assets of Lonfin.

MWB is a hotel, serviced offices and retail group that is in the process of

realising its assets through an orderly disposal programme. Further information

about MWB is available on its website: www.mwb.co.uk.

I am a Non-Executive Director of MWB.

General Portfolio

The General Portfolio is diverse and consists of U.K. and European blue chip

equities, most of which have significant international exposure. The list of

these investments is set out at the end of this announcement.

Dividends

The Board has declared an interim of 0.35p payable on Thursday 12th April 2012

to shareholders on the register at the close of business on Friday 23rd March

2012.

Outlook

World stock markets have rebounded considerably over the last six months,

however we remain cautious about the outlook for 2012 and have positioned the

general portfolio accordingly. It is the intention of the Board to reinvest the

proceeds of the sale of our property into our General Portfolio, as and when

buying opportunities arise.

David C. Marshall

Chairman

Interim dividend

The declared interim dividend is 0.35p per share (2010 - 0.30p) and will be

paid on Thursday 12th April 2012 to those members registered at the close of

business on Friday 23rd March 2012. Shareholders on the South African register

will receive their dividend in South African Rand converted from sterling at

the closing rate of exchange on Friday 24th February 2012.

Salient dates for dividend

Last day to trade (SA) Thursday 15th March 2012

Shares trade ex dividend (SA) Friday 16th March 2012

Shares trade ex dividend (UK) Wednesday 21st March 2012

Record date (UK & SA) Friday 23rd March 2012

Pay date Thursday 12th April 2012

Shareholders are hereby advised that the exchange rate to be used will be GBP 1

= ZAR 12.04. This has been calculated as the average of the bid/ask spread at

16h00 (United Kingdom time) being the close of business on Friday 24th February

2012. Consequently the dividend of 0.35p will be equal to 4.214 South African

cents.

No dematerialisation or rematerialisation of share certificates, nor transfer

of shares between the registers in London and South Africa will take place

between Friday 16th March 2012 and Friday 23rd March 2012, both dates

inclusive.

Unaudited Consolidated Statement of Comprehensive Income

Year

Half year ended ended

31st December 30th June

2011 2010 2011

Restated

GBP000 GBP000 GBP000

Operating Income .

Dividends received 102 97 251

Interest and sundry income 25 20 94

Profit on sales of investments, including - 255 266

provisions

-------- -------- --------

127 372 611

Management services income 199 245 398

-------- -------- --------

326 617 1,009

-------- -------- --------

Administrative expenses

Investment operations (144) (142) (314)

Management services (150) (225) (435)

-------- -------- --------

Total administrative expenses (294) (367) (749)

-------- -------- --------

Operating profit 32 250 260

Unrealised changes in the carrying value of (925) 1,828 1,995

investments

Exceptional profit on sale of property 2,132 - -

Interest payable (6) (53) (110)

-------- -------- --------

Profit on ordinary activities before taxation 1,233 2,025 2,145

Tax on result of ordinary activities (102) (5) (19)

-------- -------- --------

Profit on ordinary activities after taxation 1,131 2,020 2,126

Minority interest (23) (15) (8)

-------- -------- --------

Total comprehensive income - profit attributable 1,108 2,005 2,118

to members of the holding company

-------- -------- --------

Reconciliation of headline earnings

Earnings per share 3.6p 6.4p 6.8p

Adjustment for unrealised changes in the carrying (3.6)p (5.8)p (6.4)p

value of investments and exceptional items, net of

tax

-------- -------- -------

Headline (loss)/earnings per share (0.0)p 0.6p 0.4p

-------- -------- -------

Interim dividend 0.35p 0.30p 0.30p

Final dividend 0.30p

Total in respect of the year 0.60p

Unaudited ConsolidatedChanges in Shareholders' Equity

31st December 30th June

2010 2011 2011

GBP000 GBP000 GBP000

Total comprehensive income 1,108 2,005 2,118

Shares issued - - 2

Dividends paid to equity shareholders (94) (94) (187)

-------- ------- --------

1,014 1,911 1,849

Equity shareholders' funds at start of period 9,189 7,256 7,340

-------- ------- --------

Equity shareholders' funds at end of period 10,203 9,167 9,189

======== ======= ========

Unaudited Consolidated Statement of Financial Position

Non-current assets

Tangible assets - 372 367

Principle investments:-

MWB Group Holdings Plc 290 880 775

Finsbury Food Group plc 2,160 1,840 1,700

Western Selection P.L.C. 2,987 3,262 3,458

-------- -------- ------

5,437 6,354 6,300

-------- -------- ------

Current assets

Listed investments 4,240 4,691 4,668

Trade and other receivables 348 269 260

Cash, bank balances and deposits 2,591 50 21

-------- -------- -------

7,179 5,010 4,949

-------- -------- --------

Total Assets 12,616 11,364 11,249

======== ====== =======

Capital and Reserves

Called up share capital 1,560 1,560 1,560

Share premium account 2,320 2,320 2,320

Revaluation reserve - 330 330

Unrealised profits and losses on investments (2,675) (1,827) (1,750)

Share of undistributed profits and losses of 996 854 904

subsidiaries and associates

Company's retained realised profits and losses 8,002 5,930 5,825

-------- -------- ------

Equity shareholders funds 10,203 9,167 9,189

Trade and other payables falling due within one 2,298 2,098 1,968

year

Non-controlling equity interest 115 99 92

-------- -------- -------

12,616 11,364 11,249

======== ======== ========

Unaudited Statement of Cash Flow

Year

Half year ended ended

31st December 30th June

2011 2010 2011

GBP000 GBP000 GBP000

Profit before taxation 1,233 2,025 2,145

-------- -------- -------

Adjustments for non-cash and non-operating

expenses:-

Depreciation charges - 5 10

Unrealised changes in the carrying value of fixed 496 (1,919) (1,995)

asset investments

Exceptional profit on sale of property (2,132) - -

Net interest paid 6 53 110

-------- -------- --------

(1,630) (1,861) (1,875)

-------- -------- --------

Tax paid (102) (5) (19)

-------- -------- --------

Changes in working capital:-

(Increase)/Decrease in debtors (88) 24 34

Increase/(Decrease) in creditors 196 7 (6)

Decrease in current asset investments 429 139 285

-------- -------- --------

537 170 313

-------- -------- --------

Cash inflow on operating activities 38 329 564

-------- -------- --------

Investment activities

Net proceeds from sale of property 2,498 - -

-------- -------- --------

Cash flows from financing

Net interest paid (6) (53) (110)

Shares issued - - 2

Drawdown/(Repayment) of loan facilities 134 (149) (265)

Equity dividend paid (94) (94) (187)

-------- -------- --------

Net cash inflow/(outflow) from financing 34 (296) (560)

-------- -------- --------

Increase in cash and cash equivalents 2,570 33 4

Cash and cash equivalents at start of period 21 17 17

-------- -------- --------

Cash and cash equivalents at end of period 2,591 50 21

======= ======== ========

Reconciliation of net cash flow to movement in net debt

At start Cash At end of

of period Flow Period

Half year ended 31st December GBP000 GBP000 GBP000

2011

Cash at bank 21 2,570 2,591

Bank loan (1,816) (134) (1,950)

-------- -------- --------

(1,795) 2,436 641

2010 ======== ======= ========

Cash at bank 17 33 50

Bank loan (2,081) 149 (1,932)

-------- -------- --------

(2,064) 182 (1,882)

======== ======== ========

Year ended 30th June 2011

Cash at bank 17 4 21

Bank loan (2,081) 265 (1,816)

-------- -------- --------

(2,064) 269 (1,795)

======== ======= ========

Market Value of General Portfolio

31st December 2011 Current

Value

GBP000 %

Royal Dutch Shell 268 6.3

British American Tobacco 266 6.3

Nestle 254 6.0

Imperial Tobacco 217 5.1

Schindler 215 5.1

Diageo 208 4.9

Pernod-Ricard 207 4.9

Novartis 192 4.5

Unilever 190 4.5

L'Oreal 189 4.5

Henkel 189 4.5

Heineken 173 4.1

Investor 168 4.0

Beiersdorf 165 3.9

Total 156 3.8

Danone 162 3.8

ABB 161 3.8

BASF 157 3.7

Reckitt Benckiser 156 3.7

DSM 155 3.7

Carlsberg 132 3.1

BHB Billiton 131 3.1

Holcim 128 3.0

-------- --------

4,240 100.0

======== ========

Notes:-

1. The results for the half-year are unaudited. The information contained in

this report does not constitute statutory accounts within the meaning of

the Companies Act 2006. The statutory accounts of the Group for the year

ended 30th June 2011 have been reported on by the Company's auditors and

have been delivered to the Registrar of Companies. The report of the

auditors was unqualified.

2. This report has been prepared in accordance with the accounting policies

contained in the Company's Annual Report and Accounts 2011, International

Financial Reporting Standards and comply with IAS34.

3. The calculation of earnings per share is based on the weighted average

number of shares in issue for the period and the profit on ordinary

activities after tax.

END

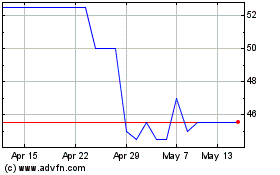

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Mar 2024 to Apr 2024

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Apr 2023 to Apr 2024