HSBC Unit Appeals Fine by Hong Kong Regulator

May 04 2016 - 8:20AM

Dow Jones News

HONG KONG—A unit of HSBC Holdings PLC is appealing what would be

the largest fine ever imposed by Hong Kong's securities

regulator.

Lawyers representing HSBC Private Bank (Suisse) SA on Wednesday

began their appeal of the 605 million Hong Kong dollars (US$78

million) fine handed down in July of last year by the Securities

and Futures Commission. The regulator in a civil case has alleged

misconduct surrounding products sold to HSBC's private banking

clients between 2003 and 2008, including notes that were issued and

or guaranteed by Lehman Brothers Holdings Inc.

The details of the case haven't previously been made public.

The regulator alleged that the unit should have told clients

about the risks associated with Lehman Brothers in the summer of

2008, and also said certain private banking clients were sold

financial products that were too risky for them, a lawyer for HSBC

said on Wednesday.

In addition to the fine, the Securities and Futures Commission

has sought to revoke a license from the HSBC entity and prevent it

from advising on securities in Hong Kong.

HSBC is appealing the fine and the revocation, a spokesman said,

declining to comment further on the case. A spokesman for the

Securities and Futures Commission declined to comment on the

hearing.

Anthony Neoh, counsel for the bank and a former chairman of the

Securities and Futures Commission, said during Wednesday's hearing

that the fine "cannot be justified" and that HSBC "couldn't

forecast" Lehman's eventual bankruptcy in September 2008. Lehman

had high credit quality that didn't change very much until the firm

went bankrupt, he said.

He said the Securities and Futures Commission was "wrong" not to

take into account the "contractual relationship between bankers and

clients." The nature of a private-banking relationship is

"different," he said, than a relationship a bank has with a retail

customer. Private banks require clients to have higher minimums of

investible assets that can run into the millions of dollars.

A lawyer familiar with the proceedings said complaints from HSBC

clients over the financial products came from those with so-called

execution accounts, for which the bank handled clients' orders and

trades but didn't give investment advice or recommendations.

Private banking clients are considered knowledgeable investors

who agreed to take on risks and retain control of their

investments, the person added.

The hearing, which is being held in the city's Securities and

Futures Appeals Tribunal, is expected to continue this week and

next and possibly a few days in August.

Write to Julie Steinberg at julie.steinberg@wsj.com

(END) Dow Jones Newswires

May 04, 2016 08:05 ET (12:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

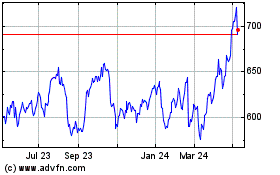

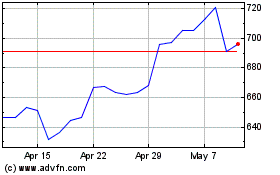

Hsbc (LSE:HSBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hsbc (LSE:HSBA)

Historical Stock Chart

From Apr 2023 to Apr 2024