HSBC Holdings PLC Statement re Bank of England 2016 stress test

November 30 2016 - 3:50AM

Dow Jones News

TIDMHSBA

RNS Number : 5228Q

HSBC Holdings PLC

30 November 2016

STATEMENT ON THE BANK OF ENGLAND

2016 STRESS TEST RESULTS

HSBC Holdings plc ('HSBC') notes the publication today of the

results of the Bank of England's 2016 concurrent stress test

exercise. The Bank of England's results show that, under the

hypothetical stress scenario, HSBC's common equity tier 1 ('CET1')

ratio would fall to a low point of 9.1%, well above HSBC's CET1

hurdle rate and systemic reference point ratios of 6.1% and 7.3%,

respectively.

The Bank of England's stress scenario has been designed under

the new annual cyclical scenario framework and modelled a

hypothetical synchronised global downturn with growth in Hong Kong

and China and other emerging market economies in which HSBC

operates being particularly adversely affected. Under this severe

scenario, the results demonstrate the impact of our strategic

actions and the Group's continued capital strength.

The results incorporate management actions that have been

accepted by the Bank of England for the purposes of this exercise

and CRD IV restrictions in the year of low point CET1 ratio. Under

adverse economic circumstances, we would in practice consider a

variety of management actions depending on the particular

prevailing circumstances. Our intention, as evidenced by past

actions, is to maintain a conservative and prudent stance on

capital management.

The Bank of England's 2016 stress test results are available to

view in full on the Bank of England's website at:

http://www.bankofengland.co.uk/financialstability/Documents/fpc/results301116.pdf

Investor enquiries

to:

Mark Phin +44 (0) 20 7992 investorrelations@hsbc.com

Rebecca Self 6923 investorrelations@hsbc.com

+44 (0) 20 7992

5897

Media enquiries

to:

Heidi Ashley +44 (0) 20 7992 heidi.ashley@hsbc.com

Gillian James 2045 gillian.james@hsbcib.com

+44 (0) 20 7992

0516

Notes to editors:

1. HSBC's results reflect the sale of our entire business in

Brazil, comprising HSBC Bank Brasil S.A - Banco Multiplo and HSBC

Servicios e Participacoes Ltda, on 1 July 2016.

2. The regulatory treatment of our investment in Bank of

Communications Co., Limited ('BoCom') changed from proportional

consolidation of BoCom's risk-weighted assets ('RWAs') to a

deduction from capital (subject to regulatory thresholds) at 30

September 2016. Our results do not reflect this change in the

regulatory treatment. We have included the proportional

consolidation of BoCom's RWAs in our results.

3. HSBC's CET1 hurdle rate of 6.1% is the sum of the CRD IV

minimum CET1 ratio of 4.5% and our Pillar 2A CET1 capital

requirement of 1.6%.

4. HSBC's CET1 systemic reference point of 7.3% is the sum of

our hurdle rate and current phased-in G-SIB buffer in the year of

our low point CET1 ratio (1.25%). Our current G-SIB buffer is being

phased in from 1 January 2016 (0.625%) to 1 January 2019

(2.5%).

HSBC Holdings plc

HSBC Holdings plc, the parent company of the HSBC Group, is

headquartered in London. The Group serves customers worldwide from

around 4,400 offices in 71 countries and territories in Europe,

Asia, North and Latin America, and the Middle East and North

Africa. With assets of US$2,557bn at 30 September 2016, HSBC is one

of the world's largest banking and financial services

organisations.

ends/all

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCAKKDKFBDKCDN

(END) Dow Jones Newswires

November 30, 2016 03:35 ET (08:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

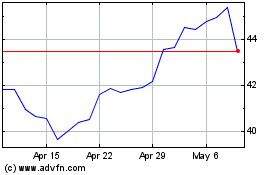

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

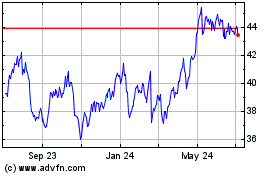

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024