TIDMHSBA

RNS Number : 0369I

HSBC Holdings PLC

25 August 2016

Value of the network

HSBC Holdings plc

Interim Report 2016

Connecting customers

to opportunities

HSBC aims to be where the growth is, enabling businesses to thrive and economies to prosper,

and ultimately helping people to fulfil their hopes and realise their ambitions.

As a reminder Overview 02 Key highlights

Reporting currency 06 Group Chairman's Statement

We use US dollars. 08 Group Chief Executive's Review

Adjusted measures 10 Strategic actions

We supplement our IFRSs figures 12 Financial overview

with adjusted measures used by management Risk overview

internally. These

measures are highlighted with the following

symbol:

In this document we use the

following abbreviations to refer

to reporting periods.

1H16 First half of 2016

2H15 Second half of 2015

1H15 First half of 2015

Ø For a full list of abbreviations

see page 150.

---------------------- -------------------------------------------

Interim 18 Financial summary

Management Report 35 Global businesses

46 Geographical regions

52 Other information

60 Risk

88 Capital

---------------------- -------------------------------------------

Financial Statements 101 Financial Statements

107 Notes on the Financial

Statements

139 Statement of Directors'

Responsibilities

140 Independent Review

Report by

PricewaterhouseCoopers LLP

to

HSBC Holdings plc

---------------------- -------------------------------------------

Additional Information 141 Shareholder information

149 Cautionary statement

regarding

forward-looking statements

150 Abbreviations

153 Index

Cover image:

Tsing Ma Bridge carries road and rail

traffic to Hong Kong International Airport

and accommodates

large container ships. At HSBC, we help

customers across the world to trade and

invest internationally.

HSBC HOLDINGS PLC

1

Overview

Key highlights

We are one of the most international banking and financial services organisations

in the world.

Group For the half-year to 30 June 2016

Our operating model consists of four global businesses

and five geographical regions supported

by 11 global functions.

Performance highlights for 1H16 u

- Reported profit before tax fell by $3.9bn or 29%,

reflecting a $3.5bn fall in revenue. In

addition, reported results included a $0.8bn impairment

relating to the goodwill of Global

Private Banking ('GPB') in Europe.

- On a reported basis, revenue decreased by $3.5bn or

11% and loan impairment charges increased

by $0.9bn. This was partly offset by lower operating

expenses of $0.6bn or 3%.

- Adjusted revenue fell by 4%, with continued momentum

in Commercial Banking ('CMB') more

than offset by Global Banking and Markets ('GB&M') and

Retail Banking and Wealth Management

('RBWM'), reflecting challenging market conditions.

- Adjusted operating expenses fell by 4%, reflecting

the continuing effects of our cost-saving

initiatives and focus on cost management. This was

despite continued investment in regulatory

programmes and compliance as well as inflationary

impacts.

- Through management initiatives we managed to further

reduce our risk-weighted assets ('RWAs')

by $48bn, and therefore the amount of capital we are

required to hold.

Reported revenue

(1H15: $32.9bn)

$29.5bn

Reported profit before tax

(1H15: $13.6bn)

$9.7bn

Adjusted profit before tax

(1H15: $12.6bn)

$10.8bn

At 30 June 2016

Risk-weighted assets

(31 Dec 2015: $1,103bn)

$1,082bn

Common equity tier 1 ratio

(31 Dec 2015: 11.9%)

12.1%

Total assets

(31 Dec 2015: $2,410bn)

$2,608bn

HSBC HOLDINGS PLC

2

Key highlights

7.4% -0.5% $0.20

Return on equity Adjusted jaws Dividends per ordinary share in respect of 1H16

(see page 15)

Our global businesses

Retail Banking and Wealth Commercial Banking Global Banking and Global Private Banking

Management ('RBWM') ('CMB') Markets ('GB&M') ('GPB')

We help millions of people We support approximately We provide financial We help high net worth

across the world to manage two million business services and products to individuals and their

their finances, buy their customers in 55 countries companies, governments families to grow, manage

homes, and with banking products and institutions. Our and preserve their

save and invest for the and services to help them comprehensive range of wealth.

future. Our Insurance and operate and grow. Our products and solutions,

Asset Management customers range from small across capital financing,

businesses support all enterprises focused advisory and transaction

our global businesses in primarily on their banking services, can be

meeting their customers' domestic markets, through combined and customised

needs. to large companies to meet clients' specific

operating globally. objectives.

Reported profit/(loss)

before tax $4.3bn $4.0bn $(0.6)bn

$2.4bn

-------------------------- -------------------------- ------------------------- -------------------------

Adjusted profit before tax

$2.8bn

$4.1bn $4.1bn $0.2bn

-------------------------- -------------------------- ------------------------- -------------------------

Risk-weighted assets

$176.1bn

$414.8bn $437.1bn $18.5bn

-------------------------- -------------------------- ------------------------- -------------------------

Geographical regions

Key 4. North America

1. Europe 5. Latin America

2. Asia

3. Middle East and North Africa

HSBC HOLDINGS PLC

3

Overview | Key highlights

Global business snapshot u

RBWM

Higher Retail Banking revenue, but - Personal lending adjusted revenue grew in

challenging market conditions in Wealth Latin America as unsecured lending balances

Management grew

- Adjusted profit before tax fell by in our Mexico business.

$0.9bn, including $0.8bn from our Principal - Adjusted costs fell by $0.3bn, driven by

RBWM business a strong focus on cost management, the

driven by lower Wealth Management income in impact

Hong Kong and France, and higher loan of transformation programmes and other

impairment cost-saving initiatives.

charges and other credit risk provisions - Lending balances in the US Consumer and

('LICs') in Brazil (up $0.2bn). Mortgage lending ('CML') run-off portfolio

- Adjusted revenue in Principal RBWM Retail fell

Banking rose as asset and deposit balances from continued run-off, and sales of

grew $4.7bn, with a reduction in associated

($8.2bn and $32.5bn, respectively). costs.

- Return on risk-weighted assets ('RoRWA')

was 4.0% in 1H16 for Principal RBWM on a

reported

basis.

CMB

Adjusted revenue growth of $0.1bn in a - Positive adjusted jaws of 1.7% reflected

challenging environment revenue growth, disciplined cost management

- Adjusted profit before tax fell by 6% due and

to higher LICs across a small number of lower full-time equivalent employees

markets. ('FTEs').

- Adjusted revenue growth of 2% was driven - Management initiatives drove a further

by continued balance growth in Global $11bn reduction in RWAs in 1H16, leading to

Liquidity a cumulative

and Cash Management ('GLCM') and in Credit reduction of $34bn since our Investor Update

and Lending, which was partly offset by in June 2015.

lower revenue

in Global Trade and Receivables Finance

('GTRF') reflecting weaker world trade due

to reduced

demand and lower commodity prices.

GB&M

Client-facing GB&M revenue down by 8% in - Progress continued in our transformational

challenging market conditions cost-saving initiatives (total costs down

- Adjusted profit before tax fell by $1.1bn $0.2bn),

or 21%. Despite a decline in revenue (down with headcount now at its lowest since

$0.9bn) February 2014.

from reduced client flows amid challenging - RWAs remained broadly unchanged in 1H16.

market conditions, notably in Equities and This included a total of $23bn of RWA

Foreign reductions

Exchange, revenue grew in our Rates and through management actions, leading to a

GLCM businesses demonstrating the value of cumulative reduction of $94bn since our

our diversified Investor

business model. Update in June 2015.

- Our market share in Global Debt Capital

Markets increased by 14% against an overall

market

growth of just 2%.

GPB

Continued repositioning of our GPB business

- Adjusted profit before tax fell by 23%,

reflecting challenging market conditions in - We broadened our product base through

Europe collaboration with the Asset Management

and Asia, despite a 9% fall in costs. Group in RBWM

- We continued to grow the parts of the to support future growth.

business that fit our desired model, - Within our reported results, we recognised

attracting net a $0.8bn impairment relating to the goodwill

new money of $5bn, notably in the UK, with of the business in Europe. For further

more than 50% coming from collaboration details, see Note 20 on page 137.

with other

global businesses.

HSBC HOLDINGS PLC

4

Key highlights

Regions snapshot

Europe

Cost reduction against a backdrop of - Although revenue decreased, in CMB

challenging market conditions there was strong revenue growth in the

- Adjusted profit before tax fell by UK and Germany,

$0.7bn or 28%, driven by challenging in part driven by lending balance

market conditions growth.

in client-facing GB&M and in life - We reduced costs by $0.2bn through

insurance manufacturing in RBWM from cost management initiatives, more than

adverse market updates. offsetting the

effects of investment and inflation.

This fall included the benefit of an

increased bank levy

credit of $0.1bn relating to a prior

year charge.

Asia

Revenue headwinds from adverse market - We reduced costs by $0.2bn through

conditions cost management initiatives, more than

- Adjusted profit before tax fell by offsetting the

$0.6bn or 8%, driven by lower revenues effects of inflation and investment as

in RBWM both we aim to grow our business in China's

from wealth distribution income Pearl River

reflecting weak market sentiment and Delta and the ASEAN region.

from life insurance manufacturing - We strengthened our leading position

due to adverse market updates coupled in the internationalisation of China's

with challenging market conditions in renminbi currency

our client-facing and for the fifth consecutive year

GB&M business. achieved the Asiamoney Best Overall

- RoRWA remained strong at 3.1%. Offshore RMB Product

and Services Award.

Middle East and North Africa

Strong performance, supported by robust - This decline in operating expenses

cost management despite a low oil price reflected the impact of cost-saving

environment initiatives which

- Adjusted profit before tax rose by more than offset continued investment in

$0.1bn or 12%, primarily due to compliance.

increased revenue across - We grew revenue across our strategic

all our global businesses, especially trade corridors and in the majority of

GB&M. the cross-business

- Operating expenses fell $58m or 9% synergies we track, including a 34%

with reductions in RBWM, GB&M and CMB increase in revenue from GLCM products

and across our sold to GB&M customers.

priority countries.

North America

Lower profit before tax from higher - We continued to focus on trade

LICs, partly mitigated by cost corridors, with revenue growth from our

reductions US commercial clients

- Adjusted profit before tax fell by and their international subsidiaries.

$0.2bn or 24% as cost savings were more - The run-off of the US CML run-off

than offset portfolio continued, its profit before

by higher LICs, notably related to the tax fell due to

mining, and oil and gas sectors. lower revenue, and LICs increased.

Portfolio sales totalled $4.7bn in

1H16.

Latin America

Continued progress in strategic - Growth initiatives in Mexico resulted

initiatives with a strong business in a 18% increase in lending balances

performance and an increase

- Adjusted profit before tax fell by in market share across core retail

$0.3bn driven by a decrease in Brazil of portfolios. Revenue increased, while

$0.4bn, reflecting cost growth was controlled,

an increase in LICs, partly offset by an resulting in positive jaws.

increase in profit before tax in Mexico - The sale of our operations in Brazil

and Argentina completed on 1 July 2016.

from revenue growth.

Ø For detailed information

on our financial performance,

see pages 20 to 30.

HSBC HOLDINGS PLC

5

Overview

Group Chairman's

Statement

Amid a turbulent period, nothing cast doubt on the strategic direction and

priorities we laid

out just over a year ago.

The first half of 2016 was characterised by spikes of

uncertainty which greatly impacted business and market confidence.

This was reflected in lower volumes of customer activity and higher

levels of market volatility. Concern over the sustainable level of

economic growth in China was the most significant feature of the

first quarter and, as this moderated, uncertainty over the upcoming

UK referendum on membership of the European Union intensified.

Demand for credit for investment slowed as a consequence. Equity

market activity was also markedly lower, particularly in Hong Kong,

reflecting both economic uncertainty and weaker market pricing,

which was exacerbated by net selling from sovereign funds impacted

by lower oil prices. The period ended with exceptional volatility

as financial markets reacted to the UK referendum decision to leave

the EU, a result that had not been anticipated.

HSBC came through this period securely as our diversified

business model and geographic profile again demonstrated resilience

in difficult market conditions.

Pre-tax profits of $9.7bn on a reported basis were $3.9bn, 29%

lower than in the first half of 2015. On the adjusted basis used to

assess management performance, pre-tax profits were $10.8bn, some

14% lower than in the comparable period. Most of the decline in

respect of our global business revenues reflected weaker

market-facing activity, where lower transaction volumes evidenced

customer restraint in uncertain times. Credit-related income

remained solid although impairment charges rose against

historically low levels. We made progress against our cost

challenges, in reducing legacy assets and taking actions to release

capital from secondary activities.

As a consequence, our common equity tier 1 capital position,

which is critical to our capacity to sustain our dividend,

strengthened to 12.1% from 11.9% at the beginning of the year. The

sale of our Brazilian operations which closed on 1 July is expected

to add a further 0.7 of a percentage point in the third quarter.

Earnings per share were $0.32 (1H15: $0.48). Our first two

dividends in respect of the year, of $0.20 in aggregate, were in

line with our plans and the prior year.

Reflecting this strengthened capital position, the Board has

determined to return to shareholders $2.5bn, approximately half of

the capital released through the sale of Brazil, by way of a share

buy-back to be executed during the second half of the year.

The Board has also determined that in light of the current

uncertain economic and geo-political environment, together with our

projections for an extended period of low interest rates, it would

be appropriate to remove a timetable for reaching our target return

on equity in excess of 10%. While the target remains intact and

appropriate, the current guidance which points to the end of next

year is no longer considered achievable. In addition, the Board is

planning in this environment on the basis of sustaining the annual

dividend in respect of the year at its current level for the

foreseeable future.

Strategic direction remains clear

Nothing that has happened in this turbulent period casts doubt

on the strategic direction and priorities we laid out just over a

year ago. Our focus on the Pearl River Delta remains a key

priority. We see growing movement in public policy decisions

towards needed infrastructure investment on a massive scale,

notably through the Belt and Road initiative in China, to underpin

increased urbanisation across Asia, the Middle East and Africa, and

in support of the transition to a lower carbon economy. Capital

markets development in both Europe and Asia remains essential to

diversify funding sources, to address demographic ageing and to

expand the role of 'green' bond finance. Outward investment from

China is growing fast and is expected to accelerate.

Internationalisation of the renminbi is also expected to accelerate

as a consequence of all of the above. HSBC is well positioned for

all of these mega trends, with clear evidence of this contained

within the Group Chief Executive's Review.

HSBC HOLDINGS PLC

6

Regulatory policy must be aligned with public policy support for

growth

At the end of June we, along with the rest of the banking

industry, submitted analysis to the Basel Committee on Banking

Supervision in response to their request for a quantitative impact

assessment around new proposals, inter alia, aimed at reducing the

complexity of the regulatory framework and improving comparability.

How the regulatory community responds to this consultation, due by

the end of this year, is of huge importance to our customers and

our shareholders. Any substantial further increase in capital

requirements, which is quite possible within the range of outcomes

implied by industry-wide impact studies, could have a major impact

on the availability and cost of credit, as well as on the return on

capital our industry is able to generate. Such constraints would

also lean against the increased public policy emphasis on

stimulating economic growth at a time of elevated

uncertainties.

We therefore welcome statements from within the regulatory

community and, most recently, in the communiqué from the G20

Finance Ministers and Central Bank Governors meeting in Chengdu,

China, that these proposals should not lead to a significant

broad-based increase in overall capital requirements. This is

consistent with our view that satisfactory levels of capital have

been achieved in most banks through the already extensive revisions

to the regulatory capital framework. These, together with

improvements in risk management and stress testing, have

contributed to financial stability, with significantly increased

levels of regulatory capital now in place. Near finalisation of the

principal resolution regimes have also significantly extended the

range of capacity available to absorb losses in the event of

failure. A revised calibration that failed to take this progress

into account would, in our view, risk undermining that

progress.

UK referendum on EU membership

As a consequence of the UK referendum decision to leave the

European Union, we are entering a new era for the UK and UK

business. The work to establish fresh terms of trade with our

European and global partners will be complex and time-consuming.

Our first priorities have been to offer support to our colleagues

working outside their home country who may feel unsettled, as well

as proactively reaching out to and working with our customers as

they prepare for the new environment.

Now is a time for calm consideration of all the issues at hand

and careful assessment of how prosperity, growth and a dynamic

economy for both the UK and the rest of Europe can be ensured

following an orderly transition period. Critical elements include

securing the best possible outcome on continuing terms of trade and

market access, and ensuring the UK remains attractive for inward

investment and has access to all the skills necessary to be fully

competitive.

HSBC's experience in facilitating and financing trade for over

150 years has shown the value and importance of open trading

relationships - for individuals, businesses, communities and

nations. We believe that such an open trading relationship must be

at the centre of the new relationship between the UK and the EU,

and indeed the rest of the world. We aim to do our part in making

the transition for our customers to the new arrangements as smooth

as possible.

Board changes

Since we last reported to shareholders we have welcomed David

Nish to the Board. David most recently served as Chief Executive

Officer of Standard Life plc between 2010 and 2015, having

originally joined as its Group Finance Director in 2006. He brings

to HSBC considerable relevant experience in financial services, in

financial accounting and reporting, as well as a wide-ranging

understanding of all aspects of corporate governance. David has

also joined the Group Audit Committee.

Outlook

It is evident that we are entering a period of heightened

uncertainty where economics risks being overshadowed by political

and geo-political events. We are entering this environment strongly

capitalised and highly liquid. More importantly, given our history

we have considerable experience within the senior management ranks

of responding to severe stress events, experience that was deployed

most recently in successfully dealing with the market volatility

which followed the UK referendum decision on EU membership.

Re-positioning our own European business once the future of the

UK's current 'passporting' arrangements for financial services is

clarified in the upcoming negotiations will add to the very heavy

workload already in place to address the regulatory and

technological changes that are reshaping our industry. On behalf of

the Board let me therefore close my statement by once again

recognising the dedicated commitment and effort by all of our

239,000 colleagues to implement these changes and so position HSBC

for future success.

Douglas Flint

Group Chairman

3 August 2016

HSBC HOLDINGS PLC

7

Overview

Group Chief

Executive's Review

Our highly diversified, universal banking business model helped to drive growth

and capture

market share in a number of areas.

Performance

We performed reasonably well in the first half in the face of

considerable uncertainty. Profits were down against a strong first

half of 2015, but our highly diversified, universal banking

business model helped to drive growth in a number of areas. We also

captured market share in many of the product categories that are

central to our strategy.

We completed the sale of our Brazil business to Banco Bradesco

S.A. in July. This transaction reduces Group risk-weighted assets

by around $40bn and would increase the Group's common equity tier 1

ratio from 12.1% at 30 June 2016 to 12.8%.

Global Banking and Markets weathered a large reduction in client

activity in January and February, but staged a partial recovery in

the second quarter. Equities and Foreign Exchange had a difficult

half, but Rates performed well on the back of increased client

volumes. Global Banking and Markets also achieved some of its

strongest rankings for Debt Capital Markets and Mergers and

Acquisitions. Improved collaboration with Commercial Banking was

cited as a major factor in the naming of HSBC as 'World's Best

Investment Bank' and 'World's Best Bank for Corporates' at the

Euromoney Awards for Excellence 2016. The citation also highlighted

HSBC's diversified and differentiated business model, and described

HSBC as 'one of the most joined-up firms in the industry'.

Retail Banking and Wealth Management was also affected by

reduced client activity. This led to lower revenue in our Wealth

businesses, albeit against last year's strong second quarter which

was boosted by the Shanghai-Hong Kong Stock Connect. While the

revenue environment was challenging, we were able to capture our

highest ever share of the Hong Kong mutual fund market by providing

the right products to help clients manage the current economic

environment. Higher lending balances in Mexico and increased

customer deposits in all but one region compensated partly for the

reduction in revenue from Wealth Management, with positive

implications for future growth.

Commercial Banking performed well on the back of targeted loan

growth in the UK and Mexico, and higher client balances in Global

Liquidity and Cash Management. We maintained our position as the

world's number one trade finance bank, with revenue growth and

market share gains in Receivables Finance and Supply Chain Finance.

We are in an excellent position to capitalise when global trade

starts to recover.

Global Private Banking attracted $5bn of net new money in the

first half, more than half of which came through greater

collaboration with our other Global Businesses. This demonstrates

the value that the Private Bank brings to our clients from across

the Group and the important role it plays within our universal

banking business model.

Loan impairment charges increased, mainly in the oil and gas,

and metals and mining sectors, and in Brazil due to weakness in the

Brazilian economy. We remain confident of our credit quality.

HSBC HOLDINGS PLC

8

Strategy

We are now more than a year into implementing our strategic

actions to improve returns and gain the maximum value from our

international network. We have made good progress in the most

pressing areas but have further to go in others, due largely to

external factors.

In the first half of the year we removed an extra $48bn of

risk-weighted assets from the business, around half of which came

from Global Banking and Markets. This takes us more than 60% of the

way towards our target and keeps us on track to deliver the savings

we promised by the end of 2017. These savings were in addition to

the $40bn reduction from the completion of the sale of our

operations in Brazil in July.

We continue to make material progress in cutting costs. In the

first half of 2016 we reduced our cost base compared with the first

half of 2015, in spite of inflation and continued investment in

compliance, regulatory programmes and growth. We have achieved this

through tight cost control, operational enhancements and better use

of digital platforms, improving our service to customers in the

process. We are on track to hit the top end of our $4.5-5.0bn cost

savings target range.

We are on the way to restoring profitability in our businesses

in Mexico and the US. These are important businesses for the wider

Group.

Having commenced the reshaping and de-risking of our Mexico

operations in 2012, we have been rebuilding the business since the

start of 2015. Since then, we have expanded our share of the cards,

personal loans and mortgage markets, and grown our trade finance

and international payments operations. As a consequence, adjusted

revenues were up by 12% in Retail Banking and Wealth Management and

27% in Commercial Banking. Adjusted profits in our Mexico business

were up 37% on the same period last year.

In the US, we have invested in Commercial Banking, and Global

Banking and Markets to increase revenue from our network. We have

also made rapid progress in cutting costs and removing wholesale

risk-weighted assets. We have continued to wind down our US CML

run-off portfolio quickly and efficiently, disposing of an extra

$4.7bn of legacy assets in the first half of 2016. This progress,

along with further improvements in our capital planning and

management processes, helped the US business to achieve a

non-objection to the capital plan it submitted as part of this

year's Federal Reserve Comprehensive Capital Analysis and Review

('CCAR'). This plan includes a proposed dividend payment to HSBC

Holdings plc in 2017, which would be the first such payment to the

Group from our US business since 2007.

Two-thirds of our adjusted profit before tax, or $7.2bn, came

from Asia in the first half of 2016, up from 62% in the same period

last year. We have continued to develop our Asia businesses,

particularly Asset Management and Insurance, and our operations in

the ASEAN region and the Pearl River Delta. We increased revenue in

all four areas compared with the same period last year and

increased assets under management in Asia by 7%. We also maintained

our leadership of the market for renminbi business, topping the

Asiamoney Offshore RMB Poll for 'Best Overall Provider of Offshore

RMB Products and Services' for the fifth year in a row.

There are areas where we have more to do. Our pivot to Asia

depends on our ability to redeploy the capital that we have made

available. While we have clearly demonstrated that we can release

capital by reducing risk-weighted assets, the global slow-down has

delayed the process of redistributing that capital in Asian growth

markets. This will not happen until we judge it to be in the best

interests of shareholders.

We are continuing to implement Global Standards throughout

HSBC.

Share buy-back

Our strong capital position and stable earnings mean that we are

able to retire some of the equity that we no longer require to

support the Brazil business. Having received the appropriate

regulatory clearances, we will therefore execute a $2.5bn share

buy-back in the second half of the year.

Looking forward

Following the outcome of the referendum on the UK's membership

of the European Union, there has been a period of volatility and

uncertainty which is likely to continue for some time. We are

actively monitoring our portfolio to quickly identify any areas of

stress, however it is still too early to tell which parts may be

impacted and to what extent.

While the economic environment remains difficult, the action we

have taken has already put us in a far better position for when

normal conditions return. HSBC is stronger, leaner and better

connected than it was last June. There is much still to do, but we

are making progress in all of the areas within our control. In the

meantime, our balanced and diversified business model, strong

liquidity and strict cost management make us highly resilient.

Stuart Gulliver

Group Chief Executive

3 August 2016

HSBC HOLDINGS PLC

9

Overview

Strategic actions

We have made significant progress against the actions outlined in our June 2015

Investor Update.

Capturing value from our international network

In June 2015, we outlined a series Redeploying capital to grow our

of strategic actions to make the business

most of our competitive At the heart of our business is

advantages and respond to a our international network. We are

changing environment. focusing efforts to grow

These actions are focused on our businesses by looking at

improving efficiency in how we use customers' needs across products,

our resources, and on investing geographies and supply chains.

for growth in line with our In 1H16, revenue from transaction

strategy. Each action has targets banking products was down by 1%

defined to the end of 2017. overall due to deteriorating

The table opposite contains a macroeconomic conditions, however,

summary of our progress in 1H16 we grew revenues in our GLCM

with additional details provided business. In 2016, we were

below. named Best Bank for Corporates by

Resizing and simplifying our Euromoney and Best Supply-Chain

business Finance Bank Global by Trade

We have made significant progress Finance Awards.

in resizing and simplifying our We continue to invest for growth

business. In 1H16, management in Asia. In China's Pearl River

actions reduced RWAs in client Delta, we increased the

facing GB&M and legacy credit by number of new RBWM and CMB clients

$23bn and we completed asset by 66% and 34%, respectively,

sales totalling $4.7bn from our US compared with 1H15, and grew

Consumer and Mortgage Lending our mortgage loan books by more

('CML') run-off portfolio. than 35%. We are also using our

As part of our initiative to network to connect clients

optimise our network, we completed into and out of China, including

the sale of HSBC Bank Brazil Chinese investments linked to the

on 1 July 2016, and will continue government's Belt and Road

to serve the international and initiative.

cross-border needs of our In the ASEAN region, we developed

large corporate clients in Brazil a new automated statutory payments

through HSBC Brasil S.A. - Banco de platform for companies

Investimento. across the region. We grew

In the NAFTA region, we grew revenues from international

adjusted revenues in Mexico by 12% subsidiaries of our ASEAN-region

compared with 1H15, supported clients.

by market share gains in RBWM In Singapore, we completed the

across key lending products. They transfer of our RBWM business to

include a doubling of personal our locally incorporated

loans issued compared with 1H15. In subsidiary,

the US, we grew revenues and HSBC Bank Singapore.

increased cost efficiency We remain recognised as the

while continuing to support our leading bank for international RMB

clients internationally. Revenues products and services. We

from international subsidiaries were the first bank to facilitate

of our US clients increased by 13% overseas institutional investment

compared with 1H15. into the China interbank

Our cost-saving programme has shown bond market under newly relaxed

good progress and we are on track regulations, and were among the

to meet our target first foreign banks to complete

set for the end of 2017. Operating RMB cross-border settlement for

expenses fell by 4% compared with individuals, as permitted in the

1H15, facilitated by Guangdong Free Trade Zone.

increased efficiency in our Finally, we continue to make

processes. For example, we have progress in implementing our

shortened the average time it Global Standards programme to help

takes to open accounts for CMB protect customers and the wider

clients by 30% since 1H15, and we financial system from financial

decreased the number of high crime.

value manual payments by 64%

compared with 1H15.

Selected awards and recognition

2016

Euromoney Awards for Excellence

2016

Best Bank for Corporates

Best Investment Bank

Trade Finance Awards 2016

Best Supply-Chain Finance Bank

Global

Asiamoney Offshore RMB Poll

Best Overall Offshore RMB

Products/Services

HSBC HOLDINGS PLC

10

Strategic actions

Progress against strategic actions (announced in our Investor Update in June 2015)

Strategic actions Targeted outcome Progress during six months Key performance indicators

by the end of 2017 to 30 June 2016

Actions to resize and simplify the Group

Reduce Group - Group RWA reduction: - $48bn further reduction in - RWA reduction from

risk-weighted assets $290bn 1H16, notably in GB&M management actions: circa

('RWAs') - Return GB&M $172bn (circa 61% of 2015-17

by circa $290bn to Group target target on a constant

profitability; <1/3 currency basis)

of Group RWAs

Optimise - Reduced footprint - Completed sale of Brazil - Present in 71 countries

global network business (effective 1 July and territories at end of

2016); maintained a Brazil 1H16 (down from 73 at end of

presence 2014)

to serve large corporate

clients' international needs

Rebuild NAFTA region - US profit before tax circa - Successfully achieved a - US (excluding CML run-off

profitability $2bn non-objection to our US portfolio) adjusted profit

- Mexico profit before tax capital plan, which includes before tax: $0.2bn (down 27%

circa $0.6bn a dividend on 1H15)

payment to HSBC Holdings in - Mexico adjusted profit

2017, as part of the before tax: $0.1bn (up 37%

Comprehensive Capital on 1H15)

Analysis and Review

('CCAR')

- Mexico market share gains

across key RBWM lending

products

Set up UK ring-fenced bank - Completed by 2018 - Implementation continuing - Implementation in progress

according to plan

Deliver $4.5-5.0bn of cost - 2017 exit rate - $0.9bn cost savings - Adjusted costs (excluding

savings to equal 2014 operating realised in 1H16 Brazil) down 4% on 1H15

expenses - Positive jaws in the

second quarter of 2016

compared with second quarter

of 2015

- Circa 4k FTE reduction in

1H16

Actions to redeploy capital and invest

----------------------------------------------------------------------------------------------------------------------

Deliver growth above GDP - Revenue growth - GLCM revenue up 7% on 1H15 - Transaction banking

from international network of international network driven by growth in deposits revenue: $7.7bn (down 1% on

above GDP and US rate rises 1H15)

- GTRF revenue down 6% on - Revenue synergies: $5.5bn

1H15, reflecting a decline (down 14% on 1H15)

in market conditions

Investments in Asia - - Market share gains - Awarded Asia's Best - Guangdong loans: $4.7bn

prioritise and accelerate - Circa 10% Investment Bank and Asia's (up 14% on 1H15)

growth per annum in assets Best Bank for Financing by - ASEAN adjusted revenue:

under management Euromoney $1.6bn (up 1% on 1H15)

in Asia - Launched digital banking - Asset Management assets

platform (HSBCnet) for SMEs under management distributed

in Guangdong allowing faster in Asia: $138bn (up 7% on

payment 1H15)

services with Hong Kong - Insurance manufacturing

- Growing business around new business premiums in

China's Belt and Road Asia:

initiative, including energy $1.2bn (up 13% on 1H15)

sector deals

linking China to Malaysia

and Egypt

Grow business from renminbi - $2.0-2.5bn revenue - 52% RMB qualified foreign - RMB internationalisation

('RMB') internationalisation institutional investor revenue, from offshore

('RQFII') custodian market business partly or wholly

share (in Securities denominated in

Services); ranked first in RMB as well as selected

all active RQFII markets' products in mainland China:

market share $0.7bn (down 32% on 1H15)

- Joint lead manager for

China's Ministry of Finance

RMB3bn bond in the UK, the

first sovereign

RMB bond issued outside of

China

Global Standards - - Implementation completed - Strengthened procedures in - Implementation in progress

safeguarding against line with anti-money

financial crime laundering and sanctions

policies

- Continued to enhance

supporting infrastructure,

including systems related to

customer due

diligence, transaction

monitoring and screening

HSBC HOLDINGS PLC

11

Overview

Financial overview

Reported results Half-year to

This table shows our

reported

results for the last three

half-years, ended 30 June

2016 ('1H16'), 31 December

2015 ('2H15')

and 30 June 2015 ('1H15').

Reported profit before tax

of $9.7bn in 1H16 was $3.9bn

or 29% lower than in 1H15.

This decrease

was in part due to the

non-recurrence of a gain on

the partial sale of our

shareholding in

Industrial Bank of $1.4bn in

1H15, and from an impairment

of $0.8bn relating to the

goodwill

of our GPB business in 1H16

in Europe. It was also

driven by transformation

activities to

deliver cost reductions and

productivity outcomes

('costs-to-achieve') of

$1.0bn in 1H16 and

the adverse effect of

foreign currency movements.

Excluding the effects of

significant items and

currency translation, profit

before tax fell

by $1.8bn or 14% from 1H15.

We describe the drivers of

our adjusted performance on

pages 13 $m 30 Jun 30 Jun 31 Dec

and 14. Reported results 2016 2015 2015

Net interest income 15,760 16,444 16,087

Net fee income 6,586 7,725 6,980

Net trading income 5,324 4,573 4,150

Other income 1,800 4,201 (360)

------------------------------------------------

Net operating income before loan impairment

charges and other credit risk provisions

('revenue') 29,470 32,943 26,857

------------------------------------------------ ------- ------- -------

Loan impairment charges and other credit risk

provisions ('LICs') (2,366) (1,439) (2,282)

------------------------------------------------ ------- ------- -------

Net operating income 27,104 31,504 24,575

------------------------------------------------ ------- ------- -------

Total operating expenses (18,628) (19,187) (20,581)

------------------------------------------------ ------- ------- -------

Operating profit 8,476 12,317 3,994

------------------------------------------------ ------- ------- -------

Share of profit in associates and joint ventures 1,238 1,311 1,245

------- ------- -------

Profit before tax 9,714 13,628 5,239

------------------------------------------------ ------- ------- -------

Reported revenue of $29.5bn in 1H16 - a gain of $0.6bn on disposal of Reported operating expenses of

was $3.5bn or 11% lower than in our membership interest in Visa $18.6bn were $0.6bn or 3% lower than

1H15. This was in part Europe in 1H16; and in 1H15. This reduction

due to a decrease in significant - fair value movements on our own was partly driven by the continuing

items totalling $0.6bn and the debt designated at fair value from impact of our cost-saving

adverse effect of currency changes in credit spreads initiatives, and the favourable

translation between the periods of of $1.2bn in 1H16 compared with effects of currency translation

$1.6bn. Significant items included: $0.7bn in 1H15. between the periods of $1.0bn.

- the non-recurrence a $1.4bn gain Significant items increased

on the partial sale of our by $1.1bn, and included:

shareholding in Industrial Reported LICs of $2.4bn were $0.9bn - costs-to-achieve of $1.0bn;

Bank Co. Ltd ('Industrial Bank') higher than in 1H15. This reflected - an impairment of $0.8bn relating

recognised in 1H15; an increase in Brazil to the goodwill of our GPB business

from a deterioration in its economy in Europe (please

of $0.3bn. In addition, LICs rose in refer to Note 20 on page 137 for

our GB&M and CMB further details); and

businesses, notably in the oil and - settlements and provisions

gas sector. This was partly offset relating to legal matters of $0.7bn

by the favourable effects in 1H16 compared with $1.1bn

of currency translation between the in 1H15.

periods of $0.2bn. Reported income from associates of

$1.2bn decreased marginally from

1H15.

For further details of our reported

results, see pages 20 to 30.

HSBC HOLDINGS PLC

12

Financial overview

Adjusted performance

Our reported results are prepared in To arrive at adjusted performance, Ø For reconciliations of our

accordance with IFRSs as detailed in we adjust for: reported results to an adjusted

the Financial Statements - the year-on-year effects of basis, including lists of

on page 107. We also present foreign currency translation; and significant items, see pages 53 to

adjusted performance measures to - the effect of significant items 58.

align internal and external that distort year-on-year

reporting, identify and quantify comparisons

items management believes to be and are excluded in order to

significant, and provide understand better the underlying

insight into how management assesses trends in the business.

period-on-period performance.

Adjusted performance measures are

highlighted with the following

symbol: u

Half-year to

Adjusted results

This table shows our adjusted results

for 1H16. These are discussed in more detail $m 30 June 30 June

on the following pages. Adjusted results 2016 2015

Net operating income before loan impairment charges

and other credit risk provisions (revenue) 27,868 29,178

------- -------

Loan impairment charges and other credit risk provisions ('LICs') (2,366) (1,279)

------- -------

Total operating expenses (15,945) (16,605)

-------------------------------------------------------------------------------------------- ------- -------

Operating profit 9,557 11,294

-------------------------------------------------------------------------------------------- -------- ----------

Share of profit in associates and joint ventures 1,238 1,256

-------------------------------------------------------------------------------------------- ------- -------

Profit before tax 10,795 12,550

-------------------------------------------------------------------------------------------- ------- -------

Adjusted profit before tax - In RBWM, revenue decreased by By contrast, current account and

On an adjusted basis, profit before $0.9bn or 7%, mainly in our savings revenue increased,

tax of $10.8bn was $1.8bn or 14% Principal RBWM business (down reflecting growth in customer

lower than in 1H15. Despite by $0.7bn) following a strong deposits, notably in Hong Kong and

a fall in operating expenses of performance in 1H15, while revenue the UK. Personal lending revenue was

$0.7bn, the reduction in profit in our US CML run-off portfolio broadly unchanged,

before tax was driven by lower fell $0.2bn. The reduction in Wealth with growth in unsecured lending,

revenue and higher LICs. Management of $0.9bn was driven by notably in Mexico from increased

Adjusted revenue lower revenue in life balances, offset by lower

Adjusted revenue of $27.9bn was insurance manufacturing in both credit card revenue in the UK due to

$1.3bn or 4% lower. Notably: Europe and Asia because of adverse regulatory changes and spread

- In GB&M, total revenue was $0.9bn market updates as a result compression in mortgages.

or 9% lower against a strong of equities movements, as well as In our US CML run-off portfolio,

performance in 1H15. This lower investment distribution revenue decreased by $0.2bn

was driven by a decrease in our revenue in Asia due to lower reflecting lower average lending

client-facing business (down $0.6bn retail securities and mutual funds balances and the impact of portfolio

or 8%), notably Markets turnover. sales.

(down $0.4bn) and Principal - In GPB, revenue fell by $0.2bn or

Investments (down $0.1bn). The fall 14% driven by lower brokerage and

in Markets was principally trading activity in

in Equities (down $0.5bn) and both Europe and Asia reflecting

Foreign Exchange (down $0.1bn), due adverse market sentiment in

to market volatility which unfavourable market conditions.

led to reduced client activity.

However, revenue was higher in Rates

due to increased client

activity and in Global Liquidity and

Cash Management, which continued to

perform well. In

legacy credit, revenue was $0.2bn

lower, due to higher revaluation

losses in 1H16.

HSBC HOLDINGS PLC

13

Overview | Financial overview

Adjusted performance continued

These factors were partly offset: Adjusted LICs Adjusted operating expenses

- In CMB, revenue rose by $0.1bn or Our LICs of $2.4bn were $1.1bn Our adjusted operating expenses of

2% driven by Global Liquidity and higher than in 1H15, notably $16.0bn in 1H16 fell by $0.7bn or 4%

Cash Management from reflecting an increase in Brazil compared with 1H15,

higher average balances, notably in of $0.3bn in RBWM and CMB related to despite inflationary pressures and

Hong Kong and the UK, together with the deterioration in the local increases in regulatory programmes

higher margins in economy. In addition, and compliance. This

Argentina, as well as in Credit and LICs also increased across our GB&M included an increased credit

Lending, primarily from continued and CMB businesses: relating to the prior-year bank levy

loan growth in the UK. - In GB&M, LICs were $0.4bn compared charge of $0.1bn. Excluding

This was partly offset by lower with a marginal release in 1H15, this, costs in 1H16 were $0.6bn

revenue in Global Trade and driven by higher individually lower. This reflects the continuing

Receivables Finance, notably in assessed provisions, notably in the effect of our cost-saving

Hong Kong reflecting reduced demand oil and gas, and metals and mining initiatives and a strong focus on

and lower trade lending due to lower sectors. cost management. These resulted in a

interest rates in - In CMB, the increase from $0.5bn reduction in full-time

mainland China. However, we continue to $0.8bn reflected higher equivalent staff in 1H16 of 3,900.

to increase market share in Hong individually assessed provisions The initiatives which have helped us

Kong. in Canada and Spain, as well as decrease our costs include:

- In 'Other' revenue grew by $0.4bn, Brazil. Collectively assessed - In RBWM, our branch

primarily reflecting the fair value provisions also rose in the rationalisation programme;

measurement and UK and Brazil. - In GB&M significantly lower

presentation of long-term debt -In RBWM, LICs rose from $0.8bn to headcount, and better use of our

issued by HSBC Holdings and related $1.1bn, mainly in Brazil ($0.2bn global service centres. GB&M

hedging instruments. This higher). also benefited from lower

included higher favourable fair performance-related costs.

value movements relating to the - In CMB, a simplified organisation

economic hedging of interest structure and process optimisation

and exchange rate risk on our within our lending,

long-term debt and related on-boarding and servicing platforms,

derivatives. although overall costs in CMB were

broadly unchanged.

- These cost savings were also

supported by the benefits of

transformational activities in

our technology, operations and other

functions, primarily from process

automation and organisational

re-design.

Adjusted income from associates

Our share of income from associates

of $1.2bn was marginally lower than

in 1H15. The majority

of this income was from our

investments in Bank of

Communications Co., Limited

('BoCom') and

The Saudi British Bank.

1H16 1H15 Variance

$m $m $m %

Principal RBWM 10,423 11,116 (693) (6)

RBWM US run-off portfolio 414 577 (163) (28)

CMB 7,279 7,141 138 2

Client-facing GB&M and BSM 8,882 9,558 (676) (7)

Legacy credit (100) 96 (196) (204)

GPB 971 1,125 (154) (14)

Other (including Intersegment) (1) (435) 434 (100)

-------------------------------

Total 27,868 29,178 (1,310) (4.5)

-------------------------------

1H16 1H15 Variance

-------------------------------- -------------------------------- ----------------------

Group Group Group

excluding excluding excluding

Brazil $m Brazil $m Group$m Brazil $m Brazil $m Group$m Brazil $m Group$m

Revenue 26,337 1,531 27,868 27,547 1,631 29,178 (1,210) (1,310)

LICs (1,618) (748) (2,366) (877) (402) (1,279) (741) (1,087)

Operating

expenses (14,886) (1,059) (15,945) (15,522) (1,083) (16,605) 636 660

Income from

associates 1,239 (1) 1,238 1,257 (1) 1,256 (18) (18)

Adjusted

profit

before tax 11,072 (277) 10,795 12,405 145 12,550 (1,333) (1,755)

----------- --------- --------- ------- --------- --------- ------- --------- -------

HSBC HOLDINGS PLC

14

The strategic actions set out on Ø For detailed information

page 11 are being undertaken on our financial performance,

to support our aim of achieving our medium-term financial targets. see pages 20 to 30.

Delivering on our Group financial targets

Return on equity

Our medium-term target is to achieve a return on equity

('RoE') of more than 10%. This target

is modelled on a CET1 ratio in the range of 12% to 13%.

In 1H16, we achieved an RoE of 7.4% compared with 10.6%

in 1H15.

Adjusted jaws

Our target is to grow revenue faster than operating

expenses on an adjusted basis. This is

referred to as positive jaws. In 1H16, adjusted revenue

fell by 4.5%, whereas our adjusted

operating expenses reduced by 4.0%. Jaws was therefore

negative 0.5%.

Jaws was affected by our revenue performance in 1H16.

Adjusted revenue fell by 3.8% in the

first quarter of 2016 ('1Q16') against the first

quarter of 2015 ('1Q15'), and this had increased

to 4.5% by the end of 1H16, reflecting the challenging

economic environment.

However, adjusted operating expenses fell by 1.0% in

the first quarter of 2016 and this increased

to a fall of 4.0% by the end of 1H16, as we continued

with our progress on our cost-saving

plans set out at our Investor Update.

In the second quarter of 2016 ('2Q16') our adjusted

jaws was positive 1.4%, despite a reduction

in adjusted revenue of 5.3% compared with the second

quarter of 2015 ('2Q15'), as our adjusted

operating expenses were 6.7% lower.

Understanding jaws

Jaws measures the difference between revenue and cost

growth rates. Positive jaws is where

the revenue growth rate exceeds the cost growth rate. We

calculate jaws on an adjusted basis

as described on page 18.

Dividends

In the current uncertain environment we plan to sustain

the annual dividend in respect of

the year at its current level for the foreseeable

future. Growing our dividend in the future

depends on the overall profitability of the Group,

delivering further release of the less

efficiently deployed capital and meeting regulatory

capital requirements in a timely manner.

Actions to address these points are core elements of

the investor update in June 2015.

HSBC HOLDINGS PLC

15

Overview

Risk overview

We actively manage risk to protect

and enable the business.

Managing risk

As a provider of banking and To ensure that risks are managed ø Our risk management

financial services, managing risk in a consistent way across the framework and the material risk

is part of our core day-to-day Group, we employ an enterprise types associated with our banking

activities. Our success in doing risk management framework at all and insurance manufacturing

so is due to our clear risk levels of the organisation and operations are provided on pages

appetite, which is aligned to across all risk types. It 101 and 105, respectively, of

our strategy. We set out the ensures that we have appropriate the Annual Report and Accounts

aggregate level and types of risk oversight of and effective 2015.

that we are willing to accept accountability for the management

in order to achieve our medium- of risk. This framework is

and long-term strategic objectives underpinned by our risk culture

in our risk appetite statement. and reinforced by the HSBC Values

This statement is approved by the and our Global Standards.

Board and includes:

- risks that we accept as part of

doing business, such as credit The Global Risk function, led by

risk and market risk; the Group Chief Risk Officer, who

- risks that we incur to generate is an executive Director,

income, such as operational risk, is responsible for enterprise-wide

which are managed to risk oversight and is independent

remain below an acceptable of the sales and trading

tolerance; and functions of the Group's

- risks for which we have zero businesses. This independence

tolerance, such as reputational helps ensure an appropriate

risk. balance

in risk/return decisions, and

appropriate independent challenge

and assurance.

Top and emerging risks

Our top and emerging risks During 1H16, we made one change to Ø Our approach to identifying

framework helps enable us to our top and emerging risks. 'IT and monitoring top and emerging

identify current and systems infrastructure risks is described on page

forward-looking and resilience' was added as a new 103 of the Annual Report and

risks so that we may take action thematic risk due to the need to Accounts 2015.

that either prevents them ensure core banking systems

crystallising or limits their remain robust as digital and

effect. mobile banking services continue

Top risks are those that may have to evolve.

a material impact on the financial

results, reputation

or business model of the Group in In addition, two thematic risks

the year ahead. Emerging risks are were renamed to better reflect the

those that have large issues facing HSBC. We

unknown components and may form use the new names in the table

beyond a one-year horizon. If that follows.

these risks were to occur, they Our current top and emerging risks

could have a material effect on are summarised on the next page.

HSBC.

HSBC HOLDINGS PLC

16

Risk overview

Risk Trend Mitigants

Externally driven

Geopolitical risk é We conducted physical security risk

reassessments in higher risk locations in

which we operate

in response to the heightened threat of

terrorism, and we enhanced procedures and

training

where required.

Economic outlook é We undertook scenario analysis and stress

and capital flows tests in the lead up to the UK referendum on

EU

membership to identify vulnerabilities in the

event of a vote to leave the EU and potential

mitigating actions, and closely engaged with

the Prudential Regulation Authority on

liquidity

planning.

=======================================================

Turning of the credit cycle è Stress tests were conducted on our oil and gas

portfolio on $25 and $20 per barrel price

scenarios.

This sector remains under enhanced monitoring

with risk appetite and new lending

significantly

curtailed.

Cyber threat and unauthorised access è We took part in an industry-wide cyber

to systems resilience exercise, and incorporated lessons

learned

into our new and existing cyber programmes,

which are designed to mitigate specific cyber

risks and enhance our control environment.

======================================================= =======

* Regulatory developments with adverse impact on business è We actively engaged with regulators and

model and profitability policymakers to help ensure that new

regulatory requirements,

such as the recent Basel Committee on Banking

Supervision consultation on reducing variation

in credit risk RWAs, are considered fully and

can be implemented in an effective manner.

=======================================================

US deferred prosecution agreement and related é We are continuing to take concerted action to

agreements and remediate anti-money laundering ('AML') and

consent orders sanctions compliance deficiencies and to

implement Global Standards. We also continue

to embed

our Affiliate Risk Forum to further mitigate

financial crime risk issues arising from

operations

conducted within the HSBC network.

==============================================

Regulatory focus on conduct of business and financial è We are focusing on embedding our global AML

crime and sanctions policies and procedures. We

further

enhanced our management of conduct in areas

including the treatment of potentially

vulnerable

customers, market surveillance, employee

training and performance management.

======================================================= ======= ==============================================

Internally driven

================================================================================================================

IT systems infrastructure and resilience é We are investing in specialist teams and our

systems capability to help ensure strong

digital

capabilities, delivery quality and resilience

within our customer journeys.

* Impact of organisational change and regulatory demands è We have increased our focus on resource

on employees planning and employee retention, and are

developing

initiatives to equip line managers with skills

to both manage change and support their

employees.

=======================================================

Execution risk è The Group Change Committee monitored the

status of the high priority programmes across

the

Group that support the strategic actions,

facilitating resource prioritisation and

increased

departmental coordination.

==============================================

Third-party risk management è We are implementing a framework to provide a

holistic view of third-party risks which will

help enable the consistent risk assessment of

any third-party service against key criteria,

combined with associated control monitoring,

testing and assurance throughout the

third-party

lifecycle.

Model risk é We implemented a new global policy on model

risk management and are rolling out an

enhanced

model governance framework globally to address

key internal and regulatory requirements. We

continue to strengthen the capabilities of the

independent model review team.

Data management è We continued to enhance our data governance,

quality and architecture to help enable

consistent

data aggregation, reporting and management.

======================================================= ======= ==============================================

é Risk heightened during 1H16

è Risk remained at the same level as 31 December 2015

* Thematic risk renamed during 1H16

HSBC HOLDINGS PLC

17

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR AKQDNKBKDBFB

(END) Dow Jones Newswires

August 25, 2016 05:01 ET (09:01 GMT)

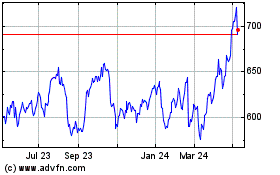

Hsbc (LSE:HSBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

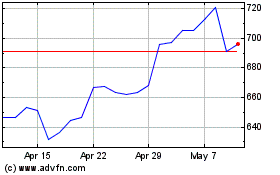

Hsbc (LSE:HSBA)

Historical Stock Chart

From Apr 2023 to Apr 2024