Federal prosecutors say fraudulent cash trades came at a

client's expense

By Christopher M. Matthews

When a top executive at HSBC Holdings PLC was told a client had

approved a huge currency exchange that stood to enrich the bank by

millions, federal prosecutors say he couldn't believe his luck.

"Ohhhh, f -- ing Christmas," replied Mark Johnson, the bank's

global head of foreign-exchange cash trading, according to a

transcript of a call recorded in 2011.

Now, his luck has turned. The details of the call were spelled

out in a criminal complaint unsealed by federal prosecutors in

Brooklyn on Wednesday, hours after Mr. Johnson was arrested by

federal agents at New York's John F. Kennedy International

Airport.

Prosecutors charged Mr. Johnson and a colleague, Stuart Scott,

the former HSBC European head of currency trading, of fraudulently

front-running a $3.5 billion currency trade for a client, in a deal

that netted millions in profits for the bank.

Mr. Johnson, 50 years old, appeared in Brooklyn federal court

Wednesday afternoon. He didn't enter a plea, and was released on $1

million bail. His lawyer declined to comment.

Mr. Scott, 43, hasn't been arrested. His lawyer, Richard Beizer,

didn't respond to requests for comment.

Mr. Johnson's arrest adds to a long list of legal woes for HSBC.

In the highest-profile case, the bank avoided criminal charges over

money laundering by entering a $1.9 billion settlement and

five-year deferred prosecution agreement with the Justice

Department in 2012.

The crimes alleged Wednesday predate that settlement and are

unlikely to affect it, a person familiar with the matter said.

The bank also paid $614 million in 2014 to settle allegations it

rigged benchmark currency rates. Mr. Scott was fired shortly after

that settlement. The bank is still under investigation by the

Justice Department for alleged rigging of the foreign-exchange

market, and the charges filed Tuesday grew out of that probe,

people familiar with the matter said.

An HSBC spokeswoman said "HSBC has been and continues to

cooperate with the DOJ's FX investigation."

According to the complaint, Messrs. Johnson and Scott traded

before executing an exchange of about $3.5 billion worth of dollars

into British pounds -- proceeds from a sale of part of the client's

stake in an Indian subsidiary. The pair in late 2011 used

confidential information about the deal and the conversion to make

lucrative trades for themselves and HSBC, and to the detriment of

the client, prosecutors alleged.

The two men are each charged with one count of conspiracy to

commit wire fraud.

Messrs. Johnson and Scott weren't accused on Wednesday of

rigging exchange rates, the focus of the broader investigation, but

were instead accused of a practice commonly referred to as

front-running.

The investigation into the two men and the bank is continuing,

one of the people familiar with the matter said.

According to the complaint, HSBC won the bidding to help the

victim company execute the currency conversion. The company planned

to convert the money to pounds and pay it out to shareholders.

In the days and hours leading up to the $3.5 billion

transaction, Messrs. Johnson and Scott stockpiled millions of

pounds in HSBC accounts, federal prosecutors alleged.

When the client went through with the transaction in December

2011, the two men executed it in a way that drove up the price of

the pound, according to the complaint.

This allowed them to sell the currency they had purchased at a

higher price while diminishing the client's proceeds, because the

conversion to pounds was done at a higher rate.

In a conference call in November 2011 discussing the coming

transaction, an unnamed HSBC supervisor told Mr. Scott they should

ramp up the market for British pound in a way that wouldn't draw

suspicion from the client, according to the complaint.

"[W]e don't want...to push the market too much high[er] and at

the same time we want to make money on this," the supervisor said

on the call, the complaint said.

When the client noticed the price of the pound rising the day of

the transaction, Messrs. Johnson and Scott falsely blamed it on

purchases by a Russian bank, according to the complaint.

The plan netted $3 million in trading profits and $5 million in

fees for HSBC, prosecutors said.

A report last week by the Republican staff of a U.S. House of

Representatives committee found that former Attorney General Eric

Holder overruled an internal recommendation to prosecute the

British bank for having opened up the U.S. financial system to

countries under sanctions and drug traffickers, allegations that

HSBC admitted to as part of the 2012 settlement.

More recently, HSBC was part of a global probe of banks'

activities in foreign-exchange markets. Five banks paid billions in

fines and four pleaded guilty to criminal charges in May 2015 as

part of the Justice Department's piece of that investigation.

The charges are the first against individuals to come out of the

foreign exchange probe. As previously reported by The Wall Street

Journal, prosecutors have used undercover cooperators and had

indicated as long ago as 2014 that charges were near. But building

cases has been a slow process.

Prosecutors had planned to charge Mr. Johnson at a later date

but moved to arrest him Tuesday evening because they feared he was

leaving the country, a person familiar with the matter said.

Mr. Johnson's lawyer said in court Wednesday that HSBC was

actually in the process of transferring Mr. Johnson from the U.K.

to the U.S., and he was in New York making preparations for his

wife and six children.

--Margot Patrick and Aruna Viswanatha contributed to this

article.

Corrections & Amplifications

The criminal complaint against Mark Johnson was filed Tuesday,

before his arrest. A previous version of this article misstated

that the unsealing of the complaint Wednesday was before his

arrest.

Write to Christopher M. Matthews at

christopher.matthews@wsj.com

(END) Dow Jones Newswires

July 21, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

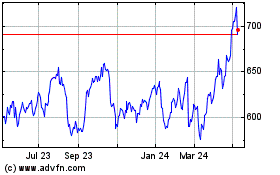

Hsbc (LSE:HSBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

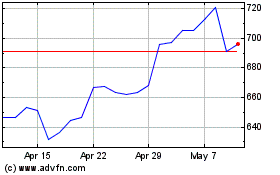

Hsbc (LSE:HSBA)

Historical Stock Chart

From Apr 2023 to Apr 2024