Head N.V. / HEAD NV and HTM Sport GmbH Announce the Unaudited

Results for the Three and Six Months ended 30th June 2014. .

Processed and transmitted by NASDAQ OMX Corporate Solutions. The

issuer is solely responsible for the content of this

announcement.

Amsterdam - 7th August

2014 - Head NV (VSX: HEAD; U.S. OTC: HEDYY.PK), a leading global

manufacturer and marketer of sports equipment, announced the

following results today.

Sales for the first six months of 2014 were up

2.0% compared to the prior year driven primarily by Winter Sports,

offset by exchange rate movements. At constant currency the sales

for the first six months of 2014 would have increased by 4.2%.

Winter Sports sales for the first six months were

up 6.5% compared to the same period in 2013. This, however, is not

a key delivery period for the division and consists mainly of close

out sales for the 2013/2014 season and some deliveries of bindings

under contract manufacturing agreements for the 2014/2015

season.

Our Winter Sports pre-orders for the 2014/2015

season, which have broadly been collected now, are impacted by the

weather conditions during the prior season. During this season,

southern parts of Europe and the USA experienced good snowfall, but

the weather in our core markets of Central and Northern Europe was

unseasonably warm and this will negatively influence the winter

sports market in 2014. However, we believe that whilst the market

overall may decline, we may gain market share in some countries.

Our bookings at this stage have improved compared to those achieved

in the same period in 2013.

The small decline in the overall Racquet Sports

division performance was mainly due to the negative exchange rate

impact coupled with tough market conditions for racquets that

resulted in lower volumes of racquets sold. The decline of tennis

ball volumes in the first quarter reversed in the second quarter

resulting in a broadly stable performance for tennis balls for the

first six months of 2014 compared to the first six months of

2013.

Our Diving division sales for the first six months

benefited from the inclusion of the newly acquired SSI Group.

Excluding the impact of SSI, the sales of equipment have declined

due to tough conditions in some markets, for example the adverse

weather conditions and the continued economic crisis in Southern

Europe and political turmoil in the Middle East.

Sportswear sales for the six months were broadly

flat mainly due to higher revenues for Summer and Winter

Sportswear, partly offset by lower sales of bags in the UK

market.

Gross margins for the six months to 30th June 2014

have improved from 40.9% to 44.3% mainly due to higher licensing

revenues and lower cost of sales for our bindings, tennis ball and

diving business.

The adjusted operating loss for the six months to

30th June 2014

decreased from €8.8m to €8.1m as a result of the improved gross

profit (€5.8m) offset by increased costs of €5.1m mainly due to the

inclusion of the newly acquired SSI Group, higher Winter Sport

advertising and higher departmental selling expenses.

The net interest increased by €0.6m as the average

debt in the first six months of 2014 was higher than in 2013. The

cost incurred in the first six months of 2013 for the share option

scheme (ESOP) reverted to income in the first six months of 2014 as

the share-price declined over the period.

As a result of the foregoing factors the net loss

for the six months to 30th June 2014

decreased by €0.7m compared to the net loss for the six months to

30th June

2013.

Net cash provided by operating activities

increased by €0.8m in the first six months to 30th June

2014 mirroring the reduction in the net loss for the period.

Net debt increased by €33.4m from 30th June 2013 to

30th June 2014

due predominantly to the share buy back that took place in the

second quarter of 2014 (€23.8m) and the payments for the

acquisitions in the period.

For 2014, based on our current order book, we are

anticipating a further recovery of our Winter Sports division and

along with the impact of our acquisition our sales should grow

modestly for the year. However the impact of currency fluctuations

and some higher marketing and investment costs mean that overall we

believe our operating results will be broadly in line with those

achieved in 2013.

Our interim financial statements for the period

ended 30th of June 2014

can be found on our website at

www.head.com/corporate/investors/quarterly_reports.php.

About Head

HEAD NV is a leading global manufacturer and

marketer of premium sports equipment and apparel.

HEAD NV's ordinary shares are listed on the Vienna

Stock Exchange ("HEAD").

Our business is organized into five divisions:

Winter Sports, Racquet Sports, Diving, Sportswear and Licensing. We

sell products under the HEAD (alpine skis, ski bindings, ski boots,

snowboard and protection products, tennis, racquetball, paddle and

squash racquets, tennis balls and tennis footwear, sportswear and

swimming products), Penn (tennis balls and racquetball balls),

Tyrolia (ski bindings) and Mares and SSI (diving) brands.

For more information, please visit our website:

www.head.com

Analysts, investors, media

and others seeking financial and general information, please

contact:

Clare Vincent, Investor Relations

Tel: +44 207 499 7800

Fax: +44 207 491 7725

E-mail: Investor-Relations@head.com

Gunter Hagspiel, Chief Financial Officer

Tel: +43 5574 608

Fax: +43 5574 608 130

E-mail: g.hagspiel@head.com

Forward-Looking

Statements

This press release includes forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

When used in this press release, the words "anticipate", "believe",

"could", "estimate", "expect", "intend", "may", "plan", "predict",

"project", "will" and similar terms and phrases, including

references to assumptions, as they relate to Head NV, its

management or third parties, identify forward-looking statements.

Forward-Looking statements include statements regarding Head NV's

business strategy, financial condition, results of operations, and

market data, as well as any other statements that are not

historical facts. These statements reflect beliefs of Head NV's

management as well as assumptions made by its management and

information currently available to Head NV. Although Head NV

believes that these beliefs and assumptions are reasonable, the

statements are subject to numerous factors, risks and uncertainties

that could cause actual outcomes and results to be materially

different from those projected. These Factors include, but are not

limited to, the following: global economic turmoil, weather and

other factors beyond our control, competitive pressures and trends

in the sporting goods industry, our ability to implement our

business strategy, our liquidity and capital expenditures, our

ability to obtain financing, our ability to compete, including

internationally, our ability to introduce new and innovative

products, legal proceedings and regulatory matters, our ability to

fund our future capital needs, and general economic conditions.

These factors, risks and uncertainties expressly qualify all

subsequent oral and written forward-looking statements attributable

to Head NV or persons acting on its behalf.

Head NV

Prins Bernhardplein 200,

1097 JB Amsterdam

Shares:

ISIN: NL0000238301

Stock Market: Official Market of the Vienna Stock Exchange

Bond:

ISIN: CH0222437011

Market: SIX Swiss Exchange

The press release can also be

downloaded from the following link:

Results Q2 2014

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Head N.V. via Globenewswire

HUG#1846934

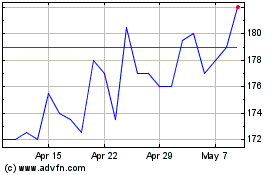

Headlam (LSE:HEAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Headlam (LSE:HEAD)

Historical Stock Chart

From Apr 2023 to Apr 2024