Gulf Keystone Petroleum Ltd. Report on Payments to Govts (4988J)

June 29 2017 - 2:00AM

UK Regulatory

TIDMGKP

RNS Number : 4988J

Gulf Keystone Petroleum Ltd.

29 June 2017

.

29 June 2017

Gulf Keystone Petroleum Ltd. (LSE: GKP)

("Gulf Keystone", "GKP" or "the Company")

Report on Payments to Governments for the year 2016

Introduction

This report sets out details of the payments made to governments

by Gulf Keystone Petroleum Ltd and its subsidiary undertakings

('Gulf Keystone') for the year ended 31 December 2016 as required

under the Disclosure and Transparency Rules of the UK Financial

Conduct Authority (the 'DTRs') and in accordance with our

interpretation of the draft Industry Guidance issued for the UK's

Report on Payments to Government Regulations 2014, as amended in

December 2015 (the 'Regulations'). The DTRs require companies in

the UK and operating in the extractive sector to publicly disclose

payments to governments in the countries where they undertake

exploration, prospection, development and extraction of oil and

natural gas deposits or other materials.

This report is available to download on the Gulf Keystone

website:

http://www.gulfkeystone.com/investor-centre/presentations-and-reports.

Basis for preparation

Total payments below GBP86,000 made to a government are excluded

from this report as permitted under the Regulations.

All of the payments made in relation to the Shaikan Production

Sharing Contract ('PSC') in the Kurdistan Region of Iraq ('KRI')

have been made to the Ministry of Natural Resources ('MNR') of the

Kurdistan Regional Government ('KRG').

Estimated production entitlements

Production entitlements are the host government's share of

production during the reporting period from the Shaikan Field

operated by Gulf Keystone. The figures reported have been produced

on an entitlement basis rather than on a liftings basis. Production

entitlements are paid in-kind and the monetary value disclosed is

derived from management's calculation of estimated revenue from the

field.

Royalties

Royalties represent royalties paid in-kind to governments during

the year for the extraction of oil. The terms of the Royalties are

described within the Shaikan PSC. Royalties have been calculated on

the same barrels of oil equivalent basis as production

entitlements.

Summary of payments

Shaikan payments (1) (2) KRG

Sales entitlement in-kind

(bbls (3) ) 4,817,277

Estimated sales entitlement

in-kind ($) 115,375,342

Royalties in-kind (bbls) 1,274,399

Estimated royalties in-kind

($) 30,522,577

Payables to the MNR offset

against Revenue (4) 72,577,496

Total (bbls) 6,091,626

Total ($) 218,475,415

Notes

(1) Under the lifting arrangements implemented by the KRG, the

KRG takes title to crude at the Shaikan facility. During 2016,

Shaikan oil was then trucked to Fishkabour on the Turkish border

where it was injected into the export pipeline to Ceyhan in Turkey.

The crude is then sold by the KRG into the international market.

All proceeds of sale are received by or on behalf of the KRG, out

of which the KRG is then due to make payment for cost and profit

oil in accordance with the PSC to Gulf Keystone, in exchange for

the crude delivered to the KRG. Under these arrangements, payments

are in fact made by or on behalf of the KRG to Gulf Keystone,

rather than by Gulf Keystone to the KRG. For the purposes of the

reporting requirements under the Regulations however, we are

required to characterise the value of the KRG's entitlement under

the PSC (for which they receive payment directly from the market)

as a payment to the KRG.

(2) The realised prices on export sales remain subject to audit

and reconciliation and the establishment of a retroactive quality

bank for Kurdistan crude exports delivered through the

international pipeline to Turkey.

(3) Barrels of oil.

(4) GKP payables to the MNR include Shaikan Building Payments,

production bonuses, security invoices and PSC charges. These costs

were recognised as payables to the MNR but have been offset against

revenue arrears owed to GKP by the MNR.

Enquiries:

Gulf Keystone Petroleum: +44 (0) 20 7514 1400

Jón Ferrier, CEO

Sami Zouari, CFO

Celicourt Communications: +44(0) 20 7520 9266

Mark Antelme

Jimmy Lea

or visit: www.gulfkeystone.com

Notes to Editors:

-- Gulf Keystone Petroleum Ltd. (LSE: GKP) is a leading

independent operator and producer in the Kurdistan Region of Iraq

and the operator of the Shaikan field with current production

capacity of 40,000 barrels of oil per day

-- Further information on Gulf Keystone is available on its website www.gulfkeystone.com

Disclaimer

This announcement contains certain forward-looking statements

that are subject to the risks and uncertainties associated with the

oil & gas exploration and production business. These statements

are made by the Company and its Directors in good faith based on

the information available to them up to the time of their approval

of this announcement but such statements should be treated with

caution due to inherent risks and uncertainties, including both

economic and business factors and/or factors beyond the Company's

control or within the Company's control where, for example, the

Company decides on a change of plan or strategy. This announcement

has been prepared solely to provide additional information to

shareholders to assess the Group's strategies and the potential for

those strategies to succeed. This announcement should not be relied

on by any other party or for any other purpose.

This information is provided by RNS

The company news service from the London Stock Exchange

END

PGRGMGZVNRFGNZM

(END) Dow Jones Newswires

June 29, 2017 02:00 ET (06:00 GMT)

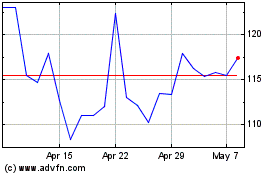

Gulf Keystone Petroleum (LSE:GKP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gulf Keystone Petroleum (LSE:GKP)

Historical Stock Chart

From Apr 2023 to Apr 2024