Gulf Keystone Petroleum Ltd. Notice to Noteholders (3030D)

October 23 2015 - 10:45AM

UK Regulatory

TIDMGKP

RNS Number : 3030D

Gulf Keystone Petroleum Ltd.

23 October 2015

Not for release, publication or distribution, directly or

indirectly, in whole or in part in or into the United States or any

jurisdiction other than the United Kingdom and Bermuda where to do

so would constitute a contravention of the relevant laws or

regulations of such jurisdiction. This announcement (and the

information contained herein) does not contain or constitute an

offer to sell or the solicitation of an offer to purchase, nor

shall there be any sale of securities in any jurisdiction where

such offer, solicitation or sale would constitute a contravention

of the relevant laws or regulations of such jurisdiction.

23 October 2015

Gulf Keystone Petroleum Ltd. (LSE: GKP)

("Gulf Keystone" or "the Company")

Notice to Noteholders

US$250,000,000

13.0 per cent. Guaranteed Notes due 2017

(ISINs: Regulation S XS1056559245, Rule 144A XS1056559088)

Further to the Company's announcement of 15 October 2015, Gulf

Keystone confirms today that the Company has made the coupon

payments on its US$250 million 13.0 per cent. guaranteed notes due

2017 ("Guaranteed Notes") and US$325 million 6.25 per cent.

convertible notes due 2017 ("Convertible Notes") in an aggregate

amount of US$26.4 million, which were due in October 2015.

Following the coupon payments, the Company confirms it is in

full compliance with all terms and conditions of its Guaranteed

Notes and Convertible Notes agreements. This includes provisions

agreed during the April 2015 Consent Solicitation as announced on 2

April 2015.

As of 23 October 2015, the Company's cash position is US$48.4

million.

A notice to the holders of the Guaranteed Notes was published on

the website of the Luxembourg Stock Exchange on 23 October 2015, a

copy of which is appended.

Commenting on today's announcement, Sami Zouari, CFO, said:

"As per the terms agreed during the April 2015 Consent

Solicitation, today's announcement concerns a technical requirement

to notify holders of the Guaranteed Notes that our cash balance has

been below US$50 million for over five consecutive business days.

In practice, we are pleased to have recently met our debt

obligations with the US$26.4 million interest payments and we

continue to manage expenditure prudently, working to restore value

in the business and continuing a constructive dialogue with all our

stakeholders.

Shaikan continues to perform well and we are encouraged by the

progress being made towards the establishment of a regular payment

cycle for Shaikan crude exports."

Enquiries:

Gulf Keystone Petroleum: +44 (0) 20 7514 1400

Jón Ferrier, CEO

Sami Zouari, CFO

Anastasia Vvedenskaya, Head

of Investor Relations +44 (0) 20 7514 1411

Celicourt Communications: +44(0) 20 7520 9266

Mark Antelme

Jimmy Lea

or visit: www.gulfkeystone.com

Notes to Editors:

-- Gulf Keystone Petroleum Ltd. (LSE: GKP) is an independent oil

and gas exploration and production company with operations in the

Kurdistan Region of Iraq.

-- Gulf Keystone Petroleum International (GKPI) holds Production

Sharing Contracts for four exploration blocks in Kurdistan, the

Shaikan, Sheikh Adi, Ber Bahr and Akri-Bijeel blocks.

-- GKPI is the operator of the Shaikan block, which is a major

commercial discovery, with a working interest of 75% and is

partnered with MOL Kalegran Limited (a 100% subsidiary of MOL

Hungarian Oil and Gas plc.) and Texas Keystone Inc., which have

working interests of 20% and 5% respectively.

-- Following the establishment of a regular payment cycle for

all oil sales and arrears, Gulf Keystone plans to move into the

large-scale phased development of the Shaikan field targeting

100,000 bopd of production capacity during Phase 1 of the Shaikan

Field Development Plan.

Disclaimer

This announcement contains certain forward-looking statements.

These statements are made by the Company's Directors in good faith

based on the information available to them up to the time of their

approval of this announcement but such statements should be treated

with caution due to inherent uncertainties, including both economic

and business factors, underlying such forward-looking information.

This announcement has been prepared solely to provide additional

information to shareholders to assess the Group's strategies and

the potential for those strategies to succeed. This announcement

should not be relied on by any other party or for any other

purpose.

GULF KEYSTONE PETROLEUM LIMITED

(incorporated in Bermuda with limited liability)

US$250,000,000

13.0 per cent. Guaranteed Notes due 2017

(ISINs: Regulation S XS1056559245, Rule 144A XS1056559088) (the

"Notes")

Notice of Total Cash Amount

To the holders of the outstanding Notes (the "Noteholders)

NOTICE IS HEREBY GIVEN to the Noteholders in accordance with

Condition 4.16.1 of the trust deed constituting the Notes (the

"Trust Deed") that the Total Cash Amount has been less than

US$50,000,000 in the aggregate for a period exceeding five

consecutive Business Days. Capitalised terms used but not defined

in this notice have the meanings ascribed to them in the Trust

Deed.

Dated 23 October 2015

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUOOSRVWARUAA

(END) Dow Jones Newswires

October 23, 2015 10:45 ET (14:45 GMT)

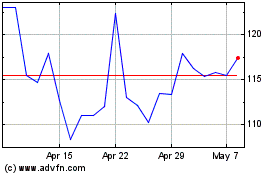

Gulf Keystone Petroleum (LSE:GKP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gulf Keystone Petroleum (LSE:GKP)

Historical Stock Chart

From Apr 2023 to Apr 2024