Guilt-Free' Products Boost PepsiCo -- WSJ

February 16 2017 - 3:02AM

Dow Jones News

'Guilt-free' foods and drinks account for 45% of net revenue;

global challenges remain

By Jennifer Maloney

PepsiCo Inc.'s push into healthier foods and drinks is helping

lift revenue amid a slowdown in global demand for traditional

soda.

Chief Executive Indra Nooyi said the Purchase, N.Y., maker of

Frito Lay snacks, Gatorade and its namesake cola expects global

economic challenges to continue this year but "we are making

considerable progress" in diversifying the company's portfolio.

Products that the company calls "guilt-free" accounted for 45%

of net revenue in 2016. Those products include diet sodas as well

as snacks with low levels of sodium and saturated fat. The

company's namesake cola accounted for 12% of net revenue in

2016.

In October, PepsiCo revised its goal for revenue generated from

nutritious foods and drinks. It is now aiming for sales growth of

those products to outpace the rest of its portfolio by 2025.

Organic revenue rose 3.7% in the fourth quarter, stripping out

currency fluctuations, acquisitions and an extra week of sales

because of timing. Revenue rose 5% to $19.52 billion.

The company's research and development spending has increased

45% since 2011 and is focused on "sugar, calorie, fat and sodium

reduction and more sustainable packaging alternatives," Ms. Nooyi

said Wednesday during a call with investors.

In 2016, the company launched a reformulated version of 7UP with

30% less sugar, now rolling out in more than 80 markets outside the

U.S., Ms. Nooyi said. ( Dr Pepper Snapple Group Inc. sells 7UP in

the U.S.)

PepsiCo also launched a line of Tropicana fruit juices with

probiotics, and a line of healthy snack bars called Quaker

Breakfast Flats, which will be in more than a dozen countries over

the next two years, Ms. Nooyi said. The company is broadening its

lineup of baked snacks and is expanding Sabra from hummus to a

range of products including guacamole, salsa and Greek yogurt

dips.

PepsiCo's food and snack volumes rose 3% in the fourth quarter.

Its beverage volumes increased 1%, beating rival Coca-Cola Co.,

whose volumes world-wide fell 1% in the same period.

Hugh Johnston, PepsiCo's finance chief, said in an interview

that to drive more growth, "we're going to continue doing what

we've been doing, which is we'll want to innovate, particularly in

the area of lower sugar. We'll continue to invest behind

interesting brands."

Mr. Johnston pointed to the recent launch of LIFEWTR, which this

month was highlighted in Pepsi's first-ever Super Bowl ad devoted

to a bottled-water brand. LIFEWTR is intended to compete with

Coke's fast-growing premium brand, smartwater.

Ms. Nooyi acknowledged "a bit of a hiccup" in 2016 on Diet

Pepsi, which PepsiCo reformulated with sucralose, then reintroduced

with the controversial sweetener aspartame. She said the company

has now shifted its focus from Diet Pepsi to Pepsi Zero Sugar,

which the company featured as the sponsor of this year's Super Bowl

half-time show.

The company saw organic growth of 9% in Latin America despite

the impact of the strong dollar, with a 4% increase in food and

snack volumes offsetting a 3% decline in beverage volumes.

In North America, its Frito-Lay group posted 3% organic growth.

Quaker Foods was flat.

PepsiCo forecasts 2017 earnings per share to be $5.09 with

organic revenue growth of at least 3%.

Write to Jennifer Maloney at jennifer.maloney@wsj.com

(END) Dow Jones Newswires

February 16, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

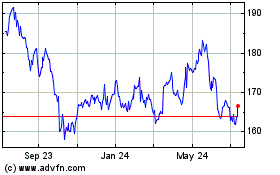

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

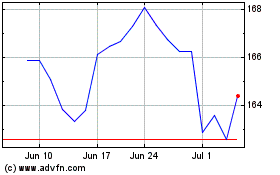

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Apr 2023 to Apr 2024