Gresham House plc Supplementary Notice - Property Update

November 28 2014 - 2:00AM

UK Regulatory

TIDMGHE

GRESHAM HOUSE PLC ('Gresham' or the 'Company')

Supplementary Notice - Property Update

The board of the Company would like to make the following

corrections pertaining to some of the details in the Admission

Document and the Circular published on 8 October 2014 and sent to

shareholders on the same day. The board together with the Proposed

Directors (together the "Board") believes there is no material

change to the valuation of the Group's property assets as at 30

June 2014. Admission to AIM of the Company's Ordinary Shares

(including the Placing Shares) and Shareholder Warrants is expected

on 1 December 2014.

In connection with an ongoing review of the Group's property

assets, the Board has become aware of adjustments required to

information previously announced in relation to these assets. The

Board does not view these changes, in aggregate, as being material

in relation to the Company, Admission or the Placing. The net

impact is a minor downward revision of the valuation of the

property at Newton-le-Willows as at 30 June 2014.

Following a review of the site details in relation to the

Group's holding of land at Newton-le-Willows by Jones Lang LaSalle,

it has come to the Board's attention that the Group retains a

residual area of 5 acres, rather than the previously announced

figure of 8 acres. This is because the Group has agreed to sell a

total of approximately 25.8 acres of land to Persimmon rather than

the 22.8 acres as stated in the Admission Document.

In light of this, the Board asked Jones Lang LaSalle to review

its valuation of the Group's property assets contained in the

Admission Document. Following this review, the entire

Newton-le-Willows site, including both the residential land to be

sold to Persimmon and the Group's interest in the retained land,

has now been valued by Jones Lang LaSalle at GBP9.75 million as at

30 June 2014, compared with GBP9.95 million as previously stated.

This revised amount includes GBP250,000 of value relating to

anticipated overage payments in respect of the land sold to

Persimmon which had not previously been taken into account.

Accordingly, the aggregate valuation of the Group's property assets

as at 30 June 2014 was GBP16.35 million rather than GBP16.55

million as stated in the Admission Document. Had the revised

valuation by Jones Lang LaSalle of the Newton-le-Willows site been

reflected in the Company's interim accounts as at 30 June 2014, the

NAV Per Ordinary Share would have been 328.0 pence rather than

331.7 pence as stated in the Admission Document, a difference of

1.12 per cent. The Adjusted NAV Per Ordinary Share would have been

319.54 pence rather than 323.27 pence as stated in the Admission

Document, a difference of 1.2 per cent.

Therefore the Board believes there is no material change to the

valuation of the Group's property assets as at 30 June 2014.

As part of their review, Jones Lang LaSalle have also considered

movements in the value of the Group's property assets since 30 June

2014 and have indicated that the current valuation of the Southern

Gateway site following signing of long term lease agreements since

8 October 2014 is approximately GBP7 million, compared with GBP6.6

million as at 30 June 2014. The aforementioned lease agreements are

(i) as previously announced, a 10 year lease agreement dated 16

October 2014 with a new tenant for the letting of the building

known as Wellington House (or the Liverpool Science Centre) at a

value over the period of the lease of approximately GBP1.3 million

net of tenant incentives and (ii) an agreement dated 18 November

2014 to extend an existing lease with a significant tenant to 15

November 2018.

For illustrative purposes only, if the Adjusted NAV Per Ordinary

Share had been calculated using the revised value of the

Newton-le-Willows site as at 30 June 2014 and the current indicated

valuation of the Southern Gateway site, it would have been 326.99

pence.

Expected Timetable and Placing Statistics

(following the passing of all Resolutions at

the General Meeting on 31 October 2014):

Date of Admission 1 December 2014

Record Date for Shareholder Warrants 28 November 2014

Number of existing Ordinary Shares 5,369,880

Number of Placing Shares 3,973,510

Enlarged number of Shares at Admission 9,343,390

Placing Price 286.9p

Market capitalisation at Placing Price GBP26.8 million

Number of Shareholder Warrants at Admission up to 1,073,976

Number of Supporter Warrants at Admission 850,000

Gross proceeds of Placing and GBP11.46 million

Supporter Warrant Issue

ISIN / Ticker for Ordinary Shares GB0003887287 / GHE

ISIN / Ticker for Shareholder Warrants GB00BPYP3515 / GHEW

For further enquiries, please contact:

Gresham House plc

Brian Hallett, Director and Company Secretary 01489 570 861

John Lorimer, Director 020 7592 7020

Westhouse Securities Ltd 020 7601 6100

Robert Finlay

Richard Johnson

Further information, including the Company's Admission Document,

may be found at www.greshamhouse.com.

Unless otherwise defined herein, terms capitalised in this

supplementary notice have the same meaning as in the Admission

Document published on the Company's website on 8 October 2014.

IMPORTANT NOTICE

Westhouse, which is authorised in the UK under the FSMA and

which is regulated by the Financial Conduct Authority, is acting as

financial adviser, nominated adviser and broker in connection with

the Proposals. Westhouse is acting exclusively for Gresham House

plc and for no-one else and will not be responsible to anyone other

than Gresham House plc for providing the protections afforded to

the clients of Westhouse nor for providing any advice in relation

to the Proposals or the contents of this supplementary notice or

any transaction, arrangement or matter referred to herein.

Overseas Shareholders

The distribution of this supplementary notice in or into

jurisdictions other than the United Kingdom may be restricted by

law and therefore any persons who are subject to the laws of any

jurisdiction other than the United Kingdom should inform themselves

about, and observe, such restrictions. Any failure to comply with

the applicable restrictions may constitute a violation of the

securities laws of any such jurisdiction. Subject to certain

exceptions, this supplementary notice is not for release,

publication or distribution, directly or indirectly, in or into the

United States, Australia, Canada, the Republic of South Africa,

Japan or any jurisdiction where to do so might constitute a

violation of local securities laws or regulations.

Forward-looking statements

This supplementary notice may include 'forward-looking

statements'. All statements other than statements of historical

fact included in this supplementary notice, including without

limitation, those regarding the Company's financial position,

business strategy, plans and management objectives for future

operations are forward-looking statements. Forward-looking

statements are subject to risks and uncertainties and accordingly

the Company's actual future financial results and operational

performance may differ materially from the results and performance

express in, or implied by, the statements. These factors include

but are not limited to those described in the formal admission

document.

This information is provided by Business Wire

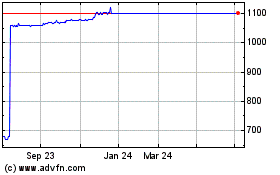

Gresham House (LSE:GHE)

Historical Stock Chart

From Mar 2024 to Apr 2024

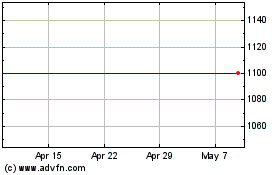

Gresham House (LSE:GHE)

Historical Stock Chart

From Apr 2023 to Apr 2024