Gresham House PLC Proposed Acquisition of Hazel Capital LLP (6109F)

May 19 2017 - 2:00AM

UK Regulatory

TIDMGHE

RNS Number : 6109F

Gresham House PLC

19 May 2017

19 May 2017

Gresham House Plc ("Gresham House" or "the Company")

(AIM: GHE)

Proposed Acquisition of Hazel Capital LLP, the Renewable Energy

Infrastructure Asset Manager, and Loan Investment

Gresham House, the specialist asset manager, is pleased to

announce that it has entered into exclusivity arrangements and

conditional heads of terms (the "Agreement") to acquire Hazel

Capital LLP ("Hazel Capital"), a leading UK asset manager of new

energy infrastructure.

The proposed acquisition, expected to complete in the third

quarter of this year, is in line with Gresham House's strategy to

grow both organically and through acquisition, and is highly

complementary to Gresham House's existing Real Assets division and

the objectives of the recently announced British Strategic

Investment Fund. The acquisition is intended to be funded using

shares issued at a premium to the current share price, plus a

deferred earn out in cash and shares. Gresham House has been

granted a period of exclusivity until 31 December 2017 to finalise

its due diligence and the terms of the proposed acquisition.

Hazel Capital advises on more than GBP100 million of assets with

a product portfolio including Venture Capital Trusts ("VCT") and

Enterprise Investment Schemes ("EIS") designed to generate

attractive yields with downside protection provided by strong real

asset backing. The Hazel Renewable Energy VCTs launched in 2010

have achieved market leading performance, with net returns of over

50% before any tax benefit considerations.

In conjunction with the Agreement and following ongoing due

diligence, Gresham House has agreed to provide growth capital in

the form of a secured loan ("the Loan") to Hazel Capital during the

exclusivity period for up to GBP4.6 million, including arrangement

fees, to develop its immediate pipeline of Energy Storage System

("ESS") projects. The Loan accrues interest in-line with Gresham

House's criteria and is secured against Hazel Capital. Full

repayment is due on or before 31 December 2017.

Further announcements will be made as appropriate in due

course.

Tony Dalwood, CEO of Gresham House, said:

"We see a substantial growth opportunity in renewables and new

energy infrastructure-related assets and today's announcement is

the first step towards bringing a recognised expert investor in

this growing sector into our Group. Hazel Capital's success in

generating market leading returns through its VCT and EIS platform

within the growth areas of infrastructure related asset management,

fits well with our strategy to develop our range of alternative and

illiquid investment solutions for long term investors."

Ben Guest, Managing Partner of Hazel Capital, said:

"In Gresham House, the Hazel Capital team has found an exciting

new home to realise its future growth potential in the new energy

and infrastructure markets. The complementary skills,

entrepreneurial drive and overlapping investment philosophy ensures

an excellent fit. We are very excited about our future as part of

Gresham House."

ENDS

Background

Hazel Capital is an FCA authorised asset management business

focused on the rapidly growing new energy infrastructure sector and

was founded ten years ago by Ben Guest after a successful fund

management career at Lazard Asset Management and hedge fund manager

Cantillon Capital. Since 2010, it has developed or acquired c.300

megawatts (MW) in the UK solar market across 28 projects.

In 2015, Hazel Capital entered the battery storage or ESS market

as well as the electric car charging infrastructure markets. Hazel

Capital has been developing ESS projects, combining battery

technology and engines, for the purpose of offering "Grid

Enhancement" services to the National Grid which are expected to

grow to at least 1GW over the next ten years. There is also the

opportunity to offer alternative services to the National Grid

including load/peak shifting and other services which have a

potential market size significantly above 1GW.

In 2017, Hazel Capital is expecting to commission three ESS

projects serving the National Grid, totaling 85MW. The first 20MW

project became commercially operational in May 2017.

Each ESS project is grid-connected, typically with a lease of 25

years which matches a planning permission for the same duration.

Each project is expected to operate throughout this period subject

to market conditions and enjoys multiple revenue streams.

Further details can be found on Hazel Capital's website:

www.hazelcapital.com

Enquiries

Gresham House plc +44 (0) 20 3837

Anthony (Tony) Dalwood 6270

Liberum Capital Ltd +44 (0) 20 3100

Neil Elliot/Jill Li 2000

Montfort Communications greshamhouse@montfort.london

Gay Collins/Rory King +44 7798 626282

+44 203 770 7906

Note

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation ("MAR"). Upon the publication of this

announcement via Regulatory Information Service ("RIS"), this

inside information is now considered to be in the public domain. If

you have any queries on this, then please contact John-Paul

Preston, Chief Operating Officer of the Company (responsible for

arranging release of this announcement) on +44 (0) 20 3837

6270.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQGGUPPAUPMPUR

(END) Dow Jones Newswires

May 19, 2017 02:00 ET (06:00 GMT)

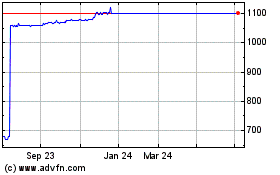

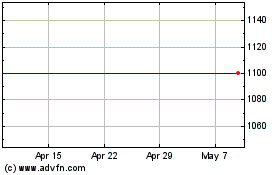

Gresham House (LSE:GHE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gresham House (LSE:GHE)

Historical Stock Chart

From Apr 2023 to Apr 2024