TIDMGHE

RNS Number : 4653L

Gresham House PLC

28 April 2015

28 April 2015

Gresham House plc ("Gresham House" or "the Company")

(AIM: GHE)

AUDITED RESULTS FOR YEAR ENDED 31 DECEMBER 2014

IN-LINE WITH NEW MANAGEMENT'S EXPECTATIONS, GRESHAM HOUSE IS NOW

WELL POSITIONED FOR GROWTH AS A SPECIALIST ASSET MANAGER

Highlights

-- Results cover a period of transition for Gresham House

following the successful GBP10.6m (net) working capital fund raise

in December 2014 and admission to AIM

-- Experienced new management team installed

-- Trading losses halve to GBP0.6m (GBP1.5m 2013), NAV at 31

December 2014: 298p (2013: 378.5p)

-- Gresham House now has a clear mandate to develop as a

specialist asset manager, focused on shareholder value creation

through growth in profitability and AUM both organically and

through acquisitions

-- Appraisal of acquisition deal flow is in progress

-- Gresham House will execute this new strategy building on 3

pillars:

-- Philosophy - A disciplined Private Equity process based upon

a value investment philosophy

-- People - Team of highly capable investment and business

managers, including an Advisory Group of respected industrialists,

investors and financiers

-- Platform - Product development, distribution and structured

discretionary co-investment

-- Graham Bird joins the Gresham House team as Head of Strategic

Investments in June 2015, having previously occupied the same role

successfully at SVG Investment Managers

Tony Dalwood, CEO of Gresham House, comments:

"Gresham House is a quoted entity with a clear strategy for

growth and alignment of management interests with shareholders. We

have started the journey to evolve the Company, both organically

and through acquisitions, into a specialist asset manager. There is

a clear market opportunity to develop specialist and illiquid asset

management strategies to address demand for long-term and superior

investment returns. Gresham House has put together a highly capable

team to succeed in this area and we look forward to reporting as we

implement the strategy."

For further enquiries, please contact:

Gresham House plc

Tony Dalwood, Chief Executive

Officer 020 3837 6272

Duncan Abbot, Finance

Director 020 3837 6271

Westhouse Securities

Ltd 020 7601 6100

Robert Finlay

Richard Johnson

Montfort Communications,

PR Adviser

Gay Collins 0203 770 7906

Rory King 07917 086 227

Website: www.greshamhouse.com

Disclaimers

This announcement does not constitute an invitation to

underwrite, subscribe for, or otherwise acquire or dispose of any

Gresham House plc shares or other securities. This announcement

contains certain forward-looking statements with respect to the

financial condition, results, operations and businesses of Gresham

House plc. These statements and forecasts involve risk and

uncertainty because they relate to events and depend on

circumstances that will occur in the future. There are a number of

factors that could cause actual results or developments to differ

materially from those expressed or implied by these forward-looking

statements and forecasts.

Past performance is no guide to future performance and persons

needing advice should consult an independent financial adviser.

Financial calendar

Report & Accounts posted to shareholders

and available on Company website 1 May 2015

Annual General Meeting 25 June 2015

Registered office

5 New Street Square London EC4A 3TW

CHAIRMAN'S STATEMENT

It is a great pleasure to address our existing shareholders and

new investors as the new Chairman of this long established

company.

A new and exciting journey for Gresham House lies ahead. We are

seeking to compete and grow in a sophisticated and diverse market,

setting ourselves the goal of establishing a presence as a

specialist asset manager focused on illiquid and differentiated

assets, carving out our own niche within the asset management

industry.

This set of results covers a period of transition for Gresham

House.

The new management team took responsibility at the beginning of

December 2014 and the results reflect the efforts of the outgoing

management team in stewarding the assets of the Company as detailed

negotiations with the new team were taking place. Gresham House was

first listed in 1950 and, after becoming an investment trust on the

full market of the London Stock Exchange in 1966, the Company

joined the Alternative Investment Market of the London Stock

Exchange on 1 December 2014.

This set of accounts refers to the history of the Company in

2014 but we have taken the opportunity in the various reports

herein to point to the future direction of the Company.

As existing shareholders know, it had been the intention of the

directors of the Company to liquidate the Company's assets and

return the proceeds to shareholders. Following approval at a

General Meeting of shareholders on 31 October 2014, it was agreed

that the Company should take a change of direction.

I am delighted to chair the new Board of executive and

non-executive directors, who bring a wealth of experience to the

Company.

We have assembled a team of people with experience and skills in

developing and growing asset management businesses. A cash

injection of GBP10.6m (net) as well as the anticipated proceeds

from the existing assets positions the business well. The journey

will aim to address a growing market opportunity for co-investment

from family offices and other professional clients and we set about

that journey with enthusiasm and confidence.

I would like to put on record the thanks from the new management

team, led by Anthony (Tony) Dalwood, your CEO, for the gracious and

cooperative way in which the handover from the previous management

was conducted. I would also like to thank the former directors led

by Chairman Tony Ebel, Brian Hallett, John Lorimer and Rosemary

Chopin-John. I am pleased that Tony, Brian and John will continue

to work with us as consultants in respect of the legacy assets and

that Richard Chadwick will continue as non-executive director as

the new team establish themselves. In keeping with the experienced

backgrounds of the new executive team, we welcome Peter Moon as

senior independent non-executive, who brings additional investment

and business expertise on to the board.

2014 was a year of change for Gresham House, 2015 will be a year

of even greater change. In this report, you will find a commentary

from Tony Dalwood which deals with our future hopes and

expectations for the business as well as a Strategic Report where

we comment on the main events and drivers that influenced the

outcome for the year ended 31 December 2014.

The team is seeing considerable deal flow and already making

progress. I look forward to reporting future developments to you in

due course.

Anthony Townsend

Chairman

27 April 2015

CHIEF EXECUTIVE'S REPORT

It is a privilege to be writing to you as your new Chief

Executive. Gresham House has a very long history and tradition;

now, with a new and experienced management team at the helm, the

Company will address and profit from a growing market opportunity

within the differentiated or illiquid areas of asset

management.

I am excited to be working with a Chairman of Anthony Townsend's

calibre. Anthony brings to this new role a wealth of experience, an

extensive network and a deep knowledge of our industry.

Your new team took responsibility in December, the final month

of the year to which these accounts apply, and as such the "new

journey" begins from 2015.

The December 2014 fundraising and move to the Alternative

Investment Market of the London Stock Exchange ("AIM") raised

GBP10.6m (net of expenses) from new shareholders including

established institutions, family offices and other investors. This

has provided the working capital that will enable us to grow the

business organically and through targeted acquisitions. The

decision to move to AIM was based on that market being more

appropriate for the size of the Company at this stage and because

it provides a suitable environment in which to implement our new

strategy and investment policy; we can also appeal to a wider

investor base that may not be able to invest in authorised

investment trusts. Our AIM listing gives us the flexibility and the

currency of publicly quoted equity that will be useful for future

growth.

The new management team, Investment Committee and Advisory Group

are now also significant shareholders, aligned with the long term

objective of creating shareholder value.

Gresham House has, since incorporation in 1857, been primarily

focussed on asset value growth. We are now commencing a journey to

evolve the Company into a specialist asset manager, based on a long

term investment philosophy and disciplined process with capable

people at the core. In summary, "traditional values, modern

methods".

The 2008/2009 global financial crisis led to investors and

limited partners reappraising investment strategies and vehicle

structures, with particular attention on "blind pool" and long lock

up vehicles. Investors are increasingly demanding more

transparency, discretion and improved service levels, alongside a

sharper focus on fees and alignment with their asset manager. This

has resulted in a substantial increase in the desire for

co-investment opportunities. The sourcing, appraising, execution

and management of such opportunities is not always something family

offices and institutions are able to do, despite wanting to.

Gresham House will position itself to address this growing market

for investors seeking superior longer term returns through illiquid

or differentiated strategies, whilst also facilitating

co-investment demand where appropriate.

We are establishing the building blocks to develop a sustainable

long term asset management business and to use the balance sheet

with a merchant banking style approach, based on private equity

disciplines, to determine capital allocation. We will target

shareholder value growth through increasing assets under management

and a focus on profitability.

The Company will have three core pillars to support its growth.

Firstly, philosophy: disciplined Private Equity process based upon

a value investment philosophy. Secondly, people: a team of highly

capable investment and business managers, including an Advisory

Group of respected industrialists, investors and financiers.

Thirdly, platform: product development, distribution and structured

discretionary co-investment.

The results for the year ended 31 December 2014 which are in

line with management expectations are discussed in full in the

Strategic Report. The future Gresham House will be focussed on

growing profitability, performance fees and assets under

management. However, the historic results show the Group trading

result for the year ended 31 December 2014 as a loss of GBP615,000

against a loss of GBP1,503,000 in 2013. Net assets as at 31

December 2014 were GBP27.8m (2013: GBP20.3m) whilst net asset value

per share, reflecting in part the increased number of shares in

issue following completion of the placing in December 2014, has

decreased in the year to 31 December 2014 to 298.0p from 378.5p per

share at 31 December 2013 (331.7p as at 30 June 2014).

Since the beginning of December, the new management team has

implemented its own 90 day plan to initiate the new strategy and

has established an office in Austin Friars in the City of

London.

An exercise has been commenced to review the Group structure.

Gresham House had developed a complex group structure consisting of

a number of special purpose vehicles through which it held its

property assets and associated finance. The idea is to simplify the

structure and utilise whatever tax Iosses are available.

The Capital Reduction that was approved by shareholders at the

General Meeting has been approved by the High Court with the

consequence that the Share Premium Account can be utilised as part

of the Company's general revenue reserves and be available for

share buy-backs and dividend distribution in the future.

We have submitted an application to the Financial Conduct

Authority for authorisation of our newly formed subsidiary, Gresham

House Asset Management Limited.

On the people front we have also been active. Gresham House has

a long investment history and a crucial component of the future

long term success will be its capital allocation decisions.

Accordingly, Michael Phillips and I are pleased to have established

an experienced Investment Committee which includes Rupert Robinson,

former CEO and CIO of Schroder Private Bank, Bruce Carnegie Brown,

currently Chairman of Aon (UK) and Moneysupermarket.com plc and

formerly of 3i QPE and Matthew Peacock, Managing Partner of Hanover

Investors.

We are in the process of establishing an Advisory Group to

support the long term development of the business, including

appraisal, deal flow and strategy. We look forward to welcoming a

limited number of very experienced and successful individuals into

the Gresham House "family" and will say more on this in due

course.

I am particularly pleased to announce that my former colleague

Graham Bird will be joining as Head of Strategic Investments in

June. Graham occupied the same role at SVG Investment Managers, and

was an important member of the team, alongside me, that launched

the SVG 'Strategic Public Equity' products which included Strategic

Equity Capital plc. We anticipate developing this area of Gresham

House through an investment vehicle as a significant step towards

long term shareholder value creation. We have commenced work

towards launching this investment platform which will apply

disciplined private equity techniques in the public market, and we

are developing the offering in discussion with potential

investors.

We have also been busy with the existing portfolio of assets, of

which the vast majority is represented by property (Southern

Gateway in Speke and a large plot of land at Newton-le-Willows) and

an investment in SpaceandPeople plc (AIM quoted). We are looking at

ways to optimise the returns we can expect from our assets and have

identified some areas where the new management team can add value

at the margin whilst we appraise how to maximise the value of these

investments.

We are pleased to report that in respect of the sale of the site

at Newton-le-Willows to Persimmon Homes, although it has taken

longer than the previous management anticipated, we are progressing

towards completion. Documentation of the s.106 planning agreements

is now taking place and this should then lead to the local

authority giving detailed planning consent. As is standard

procedure, there will then be a 6 week period during which the

decision is subject to judicial review (we are not aware of any

objections to the planning application) and directly thereafter we

expect Persimmon to complete. Completion will trigger the initial

cash receipt and the subsequent receipts agreed in the contract.

Once the sale of the residential element of the Newton-le-Willows

site has completed, we will look to market the retail element in

earnest.

Since the year-end, the Attila contract has been signed with

Cala Homes in Edinburgh, as a result of which initial cash proceeds

of GBP335k are expected imminently. We will then receive two

further instalments of capital and interest in April 2016 and

October 2016 of GBP651k and GBP605k. In addition, further positive

developments include, at Memorial Holdings the signing of a

significant contract with the London Borough of Tower Hamlets to

provide cemetery places over the coming years and for,

SpaceandPeople plc, an improvement in the share price.

The landlord's improvements that we are committed to at Southern

Gateway have now commenced. The Group has reached an agreement with

the Co-op to extend the Group's existing GBP3.278m loan facility on

unchanged terms. The Co-op has also agreed to advance a further

GBP0.372m that will be applied to finance capital expenditure to

enhance the property. The enlarged facility will run for two years

from drawdown.

The financial markets in the UK and US are touching new highs

and headline valuations do not appear to offer attractive value,

particularly when we may well be towards the peak of the corporate

return on the equity cycle. However, the aggregate headline metrics

do mask significant valuation opportunities. This is the case

currently whereby the unprecedented interest rate policy and search

for yield has meant various areas are less highly valued. When

taken together with the long-term structural growth in demand for

alternative and specialist asset management product and client

service, Gresham House is attractively positioned.

It has been a year of major change for Gresham House and I feel

excited about the future. Gresham House is a quoted entity now

consisting of approximately GBP28m of net assets, including c.

GBP11m of cash plus properties in realisation, with a clear

strategy for growth and alignment of management interests with

shareholders. We have already seen a significant number of

opportunities that could lead to acquisitions that we continue to

explore and the journey is well underway for the new management

team to address the market opportunity both organically and through

selective acquisitions.

Anthony Dalwood

Chief Executive Officer

27 April 2015

STRATEGIC REPORT

This report has been prepared by the directors in accordance

with the requirements of section 414 of the Companies Act 2006. The

purpose of this report is to inform shareholders about how the

Company fared during the year ended 31 December 2014.

On 31 October 2014, shareholders of the Company approved a

change of direction for the Company. In December 2014 Gresham House

ceased being an Authorised Investment Trust, delisted from the

Official List and was admitted to the Alternative Investment Market

of the London Stock Exchange and adopted a new investing

policy.

The majority of the board of directors resigned and a new team

of directors took office with effect from 1 December 2014. Further

details are set out in the Report of the Directors.

The Company raised GBP10.6 million net of expenses, pursuant to

the placing of 3,973,510 new Ordinary Shares at 286.9 pence per

share and the subscription for the 850,000 unquoted supporter

warrants by various members of the incoming management team.

The information covers the year under review and the new

policies the Company has adopted following the October 2014 General

Meeting.

Investment objective

The directors intend to develop the Company as a quoted platform

principally for the investment in, and the investment management

of, relatively differentiated, specialist or illiquid assets in

order to generate superior risk adjusted returns for shareholders

over the longer term. Returns are expected to be principally

through capital growth. In addition the directors intend to develop

an asset management business, either organically or through one or

more acquisitions.

Investing policy

Gresham House plc will seek to use the expertise and experience

of its new board of directors and members of the Investment

Committee to invest according to a robust private equity-style

"value" investment philosophy. The Company's investing policy is to

invest in assets that will typically have a number of the following

characteristics:

- an illiquidity discount;

- a minimum target rate of return of 15 per cent;

- cash generative (or expected to generate cash within a reasonable investment horizon);

- relatively differentiated, specialist or illiquid;

- attractive management track records;

- potential for superior risk adjusted returns;

- potential for liquidity or exit within an identified time frame;

- potential for the Company to have a competitive advantage; and/or

- potential for the Company to add incremental value to an investment.

Investments may be either passive or active and the Company may

make investments directly or indirectly (including through any

asset management business, special purpose vehicle or underlying

fund) and for cash or share consideration. In particular the

Company may:

- invest in and take controlling or non-controlling stakes in

publically and/or privately held companies (primarily in equity and

related instruments) and also in convertible or non-convertible

debt instruments;

- set up and potentially co-invest in funds including

cornerstone investments in specialist funds on preferred terms

which may include lower management fees; and

- enter into derivative contracts (including but not limited to

currency hedging, or other portfolio risk management

techniques).

A majority of the direct investments made by the Company will be

in securities of small and medium sized companies. Initial

potential target areas may include small public (less than GBP250

million market capitalisation) and private companies.

The Company will not invest more than 35 per cent of the Group's

gross assets, at the time when the investment is made, in

securities issued by any single company other than in a single

collective investment undertaking or fund structure. Where such an

investment is made in a single collective investment undertaking,

due regard will be paid to the concentration of risk that such an

investment may entail. The investment will only be made after the

Investment Committee is convinced that the risk/return relationship

is acceptable.

The board of directors will consider investment in a number of

business areas, particularly those sectors in which the board of

directors collectively believes that it and/or members of the

Investment Committee has the necessary expertise and experience to

be able to manage the opportunity.

Investments may be made in any country globally.

The Company has no borrowing limits.

A typical direct investment (other than in connection with the

development of an asset management business or an investment in a

fund) will be expected to have a holding period of between three to

five years, but may be shorter or longer, as appropriate, to

develop realisable intrinsic value in order to maximise shareholder

value.

The directors' initial intention is to re-invest profits into

the Company rather than paying dividends and shareholder returns

are likely to be through capital appreciation. However the

directors may pay dividends in accordance with any alternative

dividend policy that they may adopt from time to time in order to

maximise shareholder value over the longer term.

Any material change in the Investing policy will require prior

shareholder approval in accordance with the AIM Rules for

Companies.

Whilst the Company now operates as an investing company, the

directors intend to develop an asset management business, either

organically or through one or more acquisitions. The development of

such an asset management business may lead to the Company ceasing

to be an investing company (as defined in the AIM Rules for

Companies) and instead become a trading company (i.e. it would

become a company which operates an asset management business with

some direct and indirect investments). The key expected

consequences of such a development would be as follows:

- NAV per share would cease to be an appropriate performance indicator;

- the Company may acquire businesses where the acquisition

involves recognising purchased goodwill and other intangible

assets, which may have to be amortised. Such amortisation would

have a negative impact on the Company's balance sheet, despite such

acquisitions being made in anticipation of contributing in time to

the Company's earnings;

- the Company's Standard Industrial Classification may change.

This would, in turn, alter the way in which it is classified for

various statistical and analytical purposes and may limit the

ability of some investors to hold the Company's shares where the

investors' investment mandates are specific as to the type of share

they are able to hold; and

- the new investing policy would cease to be applicable.

The Group continues to hold investments in commercial properties

and will invest further but only where this enhances or protects

the value of existing investments. As any of these assets are

realised the proceeds of realisation will be redeployed in

accordance with the investing policy and/or the development of an

asset management business.

Performance during the year

Up until 1 December 2014 the previous board continued to focus

on maximising shareholder returns by an orderly realisation of the

Group's assets, including the sale of the majority of the site at

Newton-le-Willows to Persimmon Homes Limited for GBP7.43m

conditional upon satisfactory detailed planning permission being

obtained (which is still ongoing) and the sale of the six acre

development site in Knowsley for GBP416,000 in May 2014. In

addition the value of the property known as Southern Gateway in

Speke, Liverpool was significantly enhanced by the letting of

Wellington House for a ten year period in October 2014.

Since that date the new Board has been seeking suitable

investment opportunities in accordance with its investment

objective.

The Group trading result for the year ended 31 December 2014 was

a loss of GBP615,000 against a loss of GBP1,503,000 in 2013.

The comparison between both years is as follows:

2014 2013

GBP'000 GBP'000

Rental income 858 999

Dividend and investment

income 248 268

Other income 66 76

Property outgoings (516) (1,243)

Administration overheads (1,062) (846)

Finance costs (209) (757)

Net trading loss (615) (1,503)

======== ========

The significant variances between the two years are as

follows:-

The decrease in rental income was as a result of (i) the sale of

Northern Gateway in late 2013 and (ii) reduced income from the site

at Newton-le-Willows as tenants left the site making it available

for development, offset by an increase in rental income of

GBP80,000 at Southern Gateway.

The significant reduction in property outgoings of GBP727,000

over the year ended 31 December 2013 was principally due to (i) a

reduction of costs of GBP423,000 on the development site at

Knowsley, (ii) a reduction of GBP158,000 in legal and professional

fees incurred and (iii) a reduction in other property related costs

amounting to GBP100,000.

Administration costs have remained overall fairly constant with

the previous year with the exception of the inclusion in 2014 of

GBP255,000 in respect of share based payments following the issue

of supporter warrants on 1 December 2014.

There has been a substantial decrease in finance costs as a

result of bank borrowings being significantly reduced during the

year ended 31 December 2013.

Net asset value

The net asset value per share ("NAV") has decreased in the year

to 31 December 2014 to 298.0p from 378.5p per share at 31 December

2013 (331.7p as at 30 June 2014).

This decrease in NAV is due to the net trading loss of

GBP1,293,000, the revaluation deficit on investment property of

GBP523,000 and the loss on investments held at fair value of

GBP2,188,000. The NAV was also diluted by the issue of 3,973,510

new ordinary shares as part of the fund raising which completed in

December 2014.

Property portfolio

The property portfolio consists of the property in Speke,

Liverpool, known as Southern Gateway, and the site at

Newton-le-Willows where, as previously reported, contracts were

exchanged with Persimmon Homes Limited on 29 April 2014 for the

sale of the majority of the site for GBP7.43m plus overage

conditional upon Persimmon obtaining satisfactory detailed planning

permission. In order to take into account the extended payment

terms over a period of 42 months from completion this asset has

been valued in the accounts at a discounted amount of GBP6.8m.

At Speke we continue with our strategy to maximise income over

the short term with a view to selling thereafter. As reported above

the value of the site has increased significantly during the year

from GBP5.35m to GBP7.25m, primarily as a result of increased

lettings.

Year-end valuations are overall virtually the same at GBP16.675m

as at 31 December 2014 against GBP16.7m as at 31 December 2013 and

GBP16.35m as at 30 June 2014 as confirmed on 28 November 2014 at

the time of the placing and admission to AIM. However there has

been significant movement between the two sites with the value of

Southern Gateway increasing by GBP1.9m and the value of

Newton-le-Willows decreasing by a similar sum primarily as a result

of the poor backdrop on food retail over the Christmas period and

into this current year impacting the valuation of the retail

element of the site.

Securities portfolio

At 31 December 2014 the value of the investment portfolio

decreased by GBP2,204,000 as a result of net disposals of GBP19,000

and net realised and unrealised losses of GBP2,185,000 reflecting

the significant fall in the value of our investment in

SpaceandPeople plc from GBP2,805,000 as at 31 December 2013 to

GBP928,000 as at 31 December 2014. Since the year end however the

value of this investment has increased and, as at 24 April 2015,

was valued at GBP1,237,500.The value of the securities portfolio as

at 31 December 2014 amounted to GBP2,955,000 with the principal

constituents continuing to be our investments in SpaceandPeople plc

(see above), Attila (BR) Ltd (valued at GBP945,000 at year end

compared with GBP935,000 as at 31 December 2013), Kemnal

Investments Ltd (valued at GBP466,000 for both 31 December 2014 and

2013) and Memorial Holdings Limited (the value of which has

decreased by GBP169,000 to GBP441,000 as at year end as a result of

trading losses incurred during the year).

Borrowings and cash at bank

Loans at 31 December 2014 amounted to GBP3,278,000 against

GBP3,746,000 at 31 December 2013. The loan is from the Co-operative

Bank and is secured against the property portfolio. This represents

a loan to value of 20% against the overall property investments.

The Co-op loan was informally extended by the bank until 31 March

2015 .The Group has reached an agreement with the Co-op to extend

the group's existing GBP3.278m loan facility on unchanged terms.

The Co-op has also agreed to advance a further GBP0.372m that will

be applied to finance capital expenditure to enhance the property

at Southern Gateway, Speke, Liverpool. The enlarged facility will

run for two years from drawdown.

Cash in hand at 31 December 2014 has increased from GBP1.625m at

31 December 2013 to GBP11.209m at 31 December 2014 following the

placing of new ordinary shares and issue of supporter warrants

during the year.

Key performance indicators

The Board considers the main key performance indicator

applicable to the Group to be net asset value per share ("NAV"). As

at 31 December 2014, the NAV was 298.0p (2013: 378.5p). The main

non-financial KPI is considered to be the amount of vacant space

within the property portfolio. As at 31 December 2014 this had

reduced significantly to 75,980 sq. ft. representing 20.1% of the

total available (2013: 157,657 sq. ft. and 34.9%), the percentage

decrease being principally as a result of additional lettings at

Southern Gateway.

The above KPIs will cease to be relevant in future years as the

Company transitions from an investing company (with a heavy

property bias) to an asset management operating company. In future,

it is likely that the KPIs will be guided by Earnings per Share,

other profitability metrics and Assets under Management. In the

year under review, however, there are no meaningful comparators to

discuss.

Principal risks, risk management and regulatory environment

The Board believes that the principal risks faced by the Group

in the year-ended 31 December 2014 were:

Economic risk

Events such as unfavourable economic conditions, industry

conditions, competition, changes in law, political events and

trends could affect trading conditions and consequently (i) the

Company's investment portfolio, particularly the value of smaller

company investments, and (ii) the value of the property

investments. In addition, negative economic conditions might also

have an adverse effect on the Group's rental revenues (either due

to tenant defaults, unlet properties or decreasing rental values)

and diminish its ability to dispose of properties (either at

acceptable values or at all) and its available cash.

Regulatory

The Company is required to comply with the Companies Act 2006,

the AIM Rules for Companies and International Financial Reporting

Standards. A breach of any of these might lead to a suspension of

the Company's Stock Exchange listing, financial penalties or a

qualified audit report. The property market is significantly

dependent upon changes in relevant areas of law or their

application and interpretation by the competent authorities,

including but not limited to, planning, lease and tax laws and

practices which cannot be reasonably foreseen. A significant part

of the site at Newton-le-Willows owned by the Group has been sold

to Persimmon conditional upon satisfactory planning permission

being granted. If such is not obtained then the transaction will

not proceed.

After the year-end, application has been made to the Financial

Conduct Authority ("FCA") to seek regulatory authorisation for the

Group's new subsidiary, Gresham House Asset Management Limited

("GHAM"). Once regulated, GHAM will have to comply with the rules

and principles of FCA. A breach of any of these regulations might

limit the Company's ability to develop as an asset management

business as well as expose it to fines and other penalties.

Key person risk

The future development of the Company will be highly reliant on

the ability of a small number of people to deliver the new

investment policy.

Financial and operating risk

Inadequate controls may lead to misappropriation of assets,

inappropriate accounting policies could lead to misreporting or

breaches of regulations.

Market price risk

There will always be uncertainty regarding future prices of

investments held within the Company's portfolio, particularly where

the investment is unquoted.

Market liquidity risk

Shareholders may find it difficult to sell their shares in the

Company at a price which is near to the net asset value.

Interest rate risk

The Group's investments and net revenue may be affected by

interest rate movements.

Credit risk

Any realisation of property assets is likely to be affected by

the payment terms currently being adopted by residential developers

which could involve payments being made in staged payments. In

particular, the sale proceeds from Persimmon are payable in four

instalments over a period of 42 months from completion which

exposes the Group to a credit risk with respect to the future

financial standing of Persimmon. In addition the repayment of loan

stock by Attila (BR) Ltd is anticipated to be over a period of 18

months from the date of the sale of its site in Edinburgh to Cala

Management Limited which again exposes the Group to a similar

risk.

Property - tenant associated risk

Any non-renewal of existing leases or early termination by

existing tenants could result in a significant decrease in the

Group's net rental income and the Group may not be able to secure a

replacement tenant on favourable terms, or at all, for the vacant

space. If the Group's net rental declines it would have less cash

available to service and repay its debts and the value of its

properties could decline further. In addition the Group is exposed

to the credit risk of its tenants and the creditworthiness of its

tenants can decline over the short term. This may result in less

rental income, delayed payments and/or costs or delay in taking

enforcement or repossession action.

Property - illiquidity risk.

Properties of the type included in the Group's portfolio can be

illiquid assets for reasons such as properties being tailored to

tenants' specific requirements and reduced demand for property on

the market. This may also affect the Group's ability to vary its

portfolio, dispose of or liquidate part of its portfolio on a

timely basis or at a satisfactory price, or to acquire other

properties, in response to changes in general economic conditions,

property market conditions or other conditions.

Securities - asset and liquidity risk

The Group invests predominately in smaller company securities.

Individual smaller companies can be expected, inter alia, in

comparison to larger companies, to have less mature businesses,

less depth of management and a higher risk profile. As a result

they may find it difficult to secure financing and/or overcome

periods of economic slowdown. As they are less likely to have the

financial resources of larger companies they may also find it more

difficult to retain key skilled individuals. Any of these events

may have a material adverse effect on the performance of that

smaller company and may make it difficult or impossible for such a

company to repay its debts or lead it to reduce dividends which

could reduce the Company's cash resources and ability to pay

dividends. A significant portion of the Groups securities portfolio

consists of unquoted investments for which there might not be any

market price - or even any market.. The Group may therefore not be

able to dispose of such investments for an acceptable price or a

specific time.

In addition a portion of the Group's securities portfolio is

admitted to trading on AIM and the ISDX Growth Market. The

typically smaller market capitalisation of companies admitted on

these markets can make the market in their securities very illiquid

and/or the Group may accumulate investment positions that represent

a significant multiple of the normal trading volumes of an

investment which may make it difficult for the Group to sell its

investments.

The Board seeks to mitigate these and other perceived risks by

setting policies and by undertaking a risk assessment at least

annually. Further details can be found in note 21.

For and on behalf of the Board

Anthony Dalwood

Chief Executive Officer

27 April 2015

FINANCIAL TABLES

GROUP STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 DECEMBER 2014

2014 2013

Notes Restated

GBP'000 GBP'000

Income: 2

Rental income 858 999

Dividend and interest income 248 268

Other operating income 66 76

--------- ---------

Total Income 1,172 1,343

Operating costs: 3

Property outgoings (516) (1,243)

Administrative overheads (1,062) (846)

Finance costs 4 (209) (757)

--------- ---------

Net trading loss (615) (1,503)

Exceptional items * (678) -

--------- ---------

Net loss after exceptional items (1,293) (1,503)

Gains & losses on investments:

Revaluation deficit on investment property 9 (523) (1,612)

Fair value movement of investments 8 (2,188) (468)

Profit on disposal of investment properties 9 - 173

Profit/(loss) on disposal of investments 8 3 (36)

Group operating loss before taxation (4,001) (3,446)

Taxation 5 - -

---------

Loss and total comprehensive income (4,001) (3,446)

========= =========

Attributable to:

Equity holders of the parent (4,753) (3,497)

Non-controlling interest 752 51

--------- ---------

(4,001) (3,446)

========= =========

Basic and diluted loss per ordinary share (pence) 6 (83.3) (65.1)

========= =========

* Exceptional items relate to professional fees incurred in

respect of the proposals which took effect from 1 December 2014

STATEMENTS OF CHANGES IN EQUITY

Group

YEAR ENDED 31 DECEMBER 2014

Equity

Ordinary Share attributable

share Share warrant Retained to equity Non-controlling Total

Notes capital premium reserve reserves share-holders interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at 31

December

2013 1,342 2,302 - 16,680 20,324 - 20,324

Loss for the period

being

total comprehensive

income

for the year - - - (4,753) (4,753) 752 (4,001)

Transfer of

non-controlling

interest

deficit - - - 752 752 (752) -

Issue of shares 994 10,206 - - 11,200 - 11,200

Share based

payments - - - 255 255 - 255

Share warrants

issued - - 64 - 64 - 64

Balance at 31

December

2014 2,336 12,508 64 12,934 27,842 - 27,842

========= ========= ======== ========= ============== ================ ==========

YEAR ENDED 31 DECEMBER 2013 (Restated)

Equity

Ordinary attributable

share Share Retained to equity Non-controlling Total

Notes capital premium reserves share-holders interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at 31

December

2012 1,342 2,302 20,260 23,904 - 23,904

Loss for the period being total

comprehensive income for the

year - - (3,497) (3,497) 51 (3,446)

Transfer of

non-controlling

interest

deficit - - 51 51 (51) -

Ordinary

dividends

paid 7 - - (134) (134) - (134)

Balance at 31

December

2013 1,342 2,302 16,680 20,324 - 20,324

========= ======== ========= ============== ================ ==========

Company

YEAR ENDED 31 DECEMBER 2014

Ordinary Share

share Share warrant Retained Total

capital premium reserve reserves equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at 31 December 2013 1,342 2,302 - 10,377 14,021

Loss for the period being total

comprehensive income for the year - - - (3,686) (3,686)

Issue of shares 994 10,206 - - 11,200

Share based payments - - - 255 255

Share warrants issued - - 64 - 64

Balance at 31 December 2014 2,336 12,508 64 6,946 21,854

========= ==================== ========== ========== ========

YEAR ENDED 31 DECEMBER 2013 (Restated)

Ordinary

share Share Retained Total

capital premium reserves equity

GBP'000 GBP'000 GBP'000 GBP'000

Balance as at 31 December 2012 1,342 2,302 12,111 15,755

Loss for the period being total comprehensive

income for the year - - (1,600) (1,600)

Ordinary dividends paid 7 - - (134) (134)

Balance at 31 December 2013 1,342 2,302 10,377 14,021

========= ========= ========== ==========

STATEMENTS OF FINANCIAL POSITION

AS AT 31 DECEMBER 2014

Group Company

Notes 2014 2013 2014 2013

Restated Restated

Assets GBP'000 GBP'000 GBP'000 GBP'000

Non-current assets

Investments - securities 8 2,955 5,159 2,955 5,159

Property investments 9 9,865 9,270 - -

Other investments 10 - - 322 322

12,820 14,429 3,277 5,481

-------- --------- -------- ---------

Current assets

Trade and other receivables 84 358 - -

Accrued income and prepaid expenses 913 639 519 370

Other current assets - 415 7,245 7,754

Cash and cash equivalents 11,209 1,625 10,883 631

Non-current assets held for sale

Property investments 9 6,810 7,430 - -

-------- --------- -------- ---------

Total current assets and non-current

assets held for sale 19,016 10,467 18,647 8,755

-------- --------- -------- ---------

Total assets 31,836 24,896 21,924 14,236

-------- --------- -------- ---------

Current liabilities

Trade and other payables 716 826 70 67

Short term borrowings 3,278 3,746 - 148

3,994 4,572 70 215

Total assets less current liabilities 27,842 20,324 21,854 14,021

Non-current liabilities

Deferred taxation - - - -

Net assets 27,842 20,324 21,854 14,021

======== ========= ======== =========

Capital and reserves

Ordinary share capital 2,336 1,342 2,336 1,342

Share premium 12,508 2,302 12,508 2,302

Share warrant reserve 64 - 64 -

Retained reserves 12,934 16,680 6,946 10,377

Equity attributable to equity

shareholders 27,842 20,324 21,854 14,021

Non-controlling interest - - - -

Total equity 27,842 20,324 21,854 14,021

======== ========= ======== =========

Basic and diluted net asset value

per ordinary share (pence) 11 298.0 378.5 233.9 261.1

======== ========= ======== =========

GROUP STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED 31 DECEMBER 2014

2014 2014 2013 2013

GBP'000 GBP'000 GBP'000 GBP'000

Cash flow from operating activities

Dividend income received 92 88

Interest received 7 108

Rental income received 762 1,037

Other cash payments (1,929) (2,118)

-------- ---------

Net cash utilised in operations (1,068) (885)

Interest paid on property loans (146) (600)

-------- ---------

(146) (600)

-------- ---------

Net cash flow from operating

activities (1,214) (1,485)

Cash flow from investing activities

Purchase of investments (10) (89)

Sale of investments 29 1,480

Sale of investment properties 148 11,466

Expenditure on investment properties (515) (1,227)

Purchase of developments in

hand (67) (22)

Sale of development in hand 417 -

-------- ---------

2 11,608

Cash flow from financing activities

Repayment of loans (468) (16,937)

Receipt of loans - 225

Equity dividends paid - (134)

Share issue proceeds 11,400 -

Share issue costs (200) -

-------- ---------

Supporter warrants issued 64 -

-------- ---------

10,796 (16,846)

-------- ---------

Increase/(decrease) in cash and cash equivalents 9,584 (6,723)

Cash and cash equivalents at start of year 1,625 8,348

Cash and cash equivalents at end of year 11,209 1,625

======== =========

COMPANY STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED 31 DECEMBER 2014

2014 2014 2013 2013

GBP'000 GBP'000 GBP'000 GBP'000

Cash flow from operating

activities

Investment income received 92 88

Interest received 7 106

Other cash payments (807) (85)

-------- --------

Net cash flow from operating

activities (708) 109

Cash flow from investing

activities

Purchase of investments (10) (89)

Sale of investments 29 1,480

Advanced to Group undertakings (1,857) (8,500)

Repaid by Group undertakings 1,184 -

Purchase of development

in hand (67) (22)

Sale of development in

hand 417 -

-------- --------

(304) (7,131)

Cash flow from financing

activities

Receipt of loans - 170

Repayment of loans - (494)

Equity dividends paid - (134)

Share issue proceeds 11,400 -

Share issue costs (200) -

-------- ------

Supporter warrants issued 64 -

-------- ------

11,264 (458)

------- --------

Increase/(decrease) in cash and cash

equivalents 10,252 (7,480)

Cash and cash equivalents

at start of year 631 8,111

Cash and cash equivalents

at end of year 10,883 631

======= ========

Notes on the Consolidated Financial Statements

1. BASIS OF PREPARATION

The financial statements set out in the announcement do not

constitute the Company's statutory accounts for the year ended 31

December 2014 or the year ended 31 December 2013. The financial

information for the year ended 31 December 2014 and the year ended

31 December 2013 are extracted from the statutory accounts of

Gresham House plc, with the balance sheet for 2013 having been

restated as referred to below. The auditor, BDO LLP has reported on

the accounts for both periods; their report was unqualified and did

not contain a statement under section 498(2) or 498(3) of the

Companies Act 2006 for the periods ended 31 December 2014 or 2013.

The auditor has raised an Emphasis of Matter in relation to going

concern in 2013 only as follows:

'Emphasis of matter - financial statements prepared other than

on a going concern basis

In forming our opinion on the financial statements, which is not

modified, we have considered the adequacy of the disclosures made

in the Basis of Preparation accounting policy concerning the basis

on which the financial statements were prepared. As the objective

of the directors is to achieve an orderly realisation of the

Group's assets over a relatively short period with a view to

returning capital to shareholders thereafter, the financial

statements have been prepared on a basis other than that of going

concern.'

There is no emphasis of matter in the auditor's report for the

year ended 31 December 2014 and the financial statements have been

prepared on a going concern basis.

The full statutory accounts will be available on the Company's

website at www.greshamhouse.com and will be posted to shareholders

shortly.

The financial statements of the Group and the Company have been

prepared in accordance with International Financial Reporting

Standards ("IFRS") as adopted by the European Union and those parts

of the Companies Act 2006 applicable to companies reporting under

IFRS.

The accounting policies used by the Group in these condensed

financial statements are consistent with those applied in its

financial statements for the year to 31 December 2013, as amended

to reflect the adoption of new standards, amendments and

interpretations which became effective in the year as shown

below.

The following standards and interpretations have been adopted in

2014 as they are mandatory for the year ended 31 December 2014:

(i) IFRS 10 Consolidated Financial Statements

(ii) IFRS 11 Joint Arrangements

(iii) IFRS 12 Disclosure of Interests in Other Entities

(iv) IFRS 13 Fair Value Measurement

(v) IAS27 Separate Financial Statements

(vi) IAS28 Investment in Associates and Joint Ventures

Other standards and interpretations have been issued which will

be effective for future reporting periods but have not been adopted

in these financial statements.

Restatement of prior year figures

As a result of the proposals which came into effect on 1

December 2014 including the delisting of the Company from the

Official List and admission to AIM, the adoption of a new Investing

Policy and the subsequent loss of investment trust status, the

comparative figures for 2013 have been restated as it is no longer

appropriate to reflect the presentational guidance set out in the

Statement of Recommended Practice for Investment Trusts issued by

the Association of Investment Companies. This restatement relates

purely to the presentation of the primary statements and has not

affected the net asset position or results of the Group as

previously reported.

2. INCOME

2014 2013

Income from investments GBP'000 GBP'000

Rental income 858 999

Dividend income - Listed UK 92 88

Interest receivable: Bank and brokers 7 46

Other 149 134

1,106 1,267

-------- --------

Other operating income

Dealing profits and losses 1 1

Management fees receivable 65 75

66 76

-------- --------

Total income 1,172 1,343

======== ========

Total income comprises:

Rental income 858 999

Dividends 92 88

Interest 156 180

Other operating income 66 76

-------- --------

1,172 1,343

======== ========

3. OPERATING COSTS

Operating costs comprise the following: 2014 2013

GBP'000 GBP'000

a) Property outgoings:

Directors' emoluments (excluding benefits in kind) 121 138

Wages and salaries 64 53

Other operating costs (net of service charges recoverable

from tenants

of GBP486,000 (2013: GBP687,000) 331 1,052

516 1,243

-------- --------

b) Administrative overheads:

Directors' emoluments (excluding benefits in kind) 352 399

Auditor's remuneration * 131 75

Wages and salaries 44 85

Redundancy costs 19 3

Social security costs 22 33

Operating lease rentals - land and buildings 24 39

Share based payments 255 -

Other operating costs 220 212

1,062 846

-------- --------

Staff costs (including directors' emoluments) were:

Wages, salaries and fees 555 667

Redundancy costs 33 3

Social security costs 29 33

Pension costs 5 8

---- ----

622 711

==== ====

* A more detailed analysis of auditor's remuneration 2014 2013

is as follows:

GBP'000 GBP'000

Audit fees 23 23

Auditor's other fees - category 1 (the auditing of

accounts of subsidiaries of the Company pursuant to

legislation) 39 41

Auditor's other fees - category 3 (other services relating

to taxation) 6 8

Auditor's other fees - category 10 (other services) 63 3

-------- --------

131 75

======== ========

The directors consider the auditor was best placed to provide

these other services. The Audit Committee reviews the nature and

extent of non-audit services to ensure that independence is

maintained.

The average number of persons employed by the Group, including

the executive directors, was 5 (2013: 6).

The Group has the following commitments under operating 2014 2013

leases:

GBP'000 GBP'000

Within 1 year - 16

1 - 2 years - -

- 16

========== ========

4. FINANCE COSTS

2014 2013

GBP'000 GBP'000

Interest payable on loans and overdrafts 146 504

Finance fees 63 253

209 757

======== ========

5. TAXATION

2014 2013

GBP'000 GBP'000

(a) Analysis of charge in period:

UK Corporation tax at 21.5% (2013: 23.25%) - -

Total tax charge - -

======== ========

(b) Factors affecting tax charge for period:

Loss on ordinary activities before tax multiplied

by standard rate of corporation tax in the UK of

21.5% (2013: 23.25%) (860) (801)

Tax effect of:

Investment losses not taxable 470 117

Dividend income not taxable (20) (21)

Expenses disallowed 1 14

Losses utilised in current year - (266)

Movement in losses carried forward 409 957

Actual tax charge - -

======== ========

The Group has unutilised tax losses of approximately GBP12.2

million (2013: GBP12.2 million) available against future

corporation tax liabilities. The potential deferred taxation asset

of GBP2.8 million (2013: GBP2.8 million) in respect of these losses

has not been recognised in these financial statements as it is not

considered sufficiently probable that the Group will generate

sufficient taxable profits from the same trade to recover these

amounts in full.

6. LOSS PER SHARE

Basic and diluted loss per share

The basic and diluted loss per share figure is based on the net

loss for the year attributable to the equity shareholders of

GBP4,753,000 (2013: GBP3,497,000) and on 5,707,356 (2013:

5,369,880) ordinary shares, being the weighted average number of

ordinary shares in issue during the period. No shares were deemed

to have been issued at nil consideration as a result of the

shareholder and supporter warrants granted.

The shareholder and supporter warrants are not dilutive as the

exercise price of the warrants is 323.27p which is higher than the

average market price of ordinary shares during the year.

7. DIVIDENDS

2014 2013

GBP'000 GBP'000

Amounts recognised as distributions to equity holders

in the period:

Final dividend for the year ended 31 December 2013

of nil (2012: 2.5p) per share - 134

- 134

========== ========

Set out below is the total dividend payable in respect of the financial

year.

Proposed final dividend for the year ended 31 December

2014 of nil (2013: nil) per share - -

========== ========

8. INVESTMENTS - SECURITIES

An analysis of total investments is as follows:

Group Company

2014 2013 2014 2013

GBP'000 GBP'000 GBP'000 GBP'000

Listed securities - on the London

Stock Exchange 106 93 106 93

Securities dealt in under

AIM 928 2,805 928 2,805

Securities dealt in under

ISDX 69 76 69 76

Unlisted securities 1,852 2,185 1,852 2,185

-------- ---------

Carrying value at 31 December 2,955 5,159 2,955 5,159

======== ========= ======== ========

Investments valued at fair value

through profit or loss 1,544 3,743 1,544 3,743

Loans and receivables valued

at amortised cost 1,411 1,416 1,411 1,416

-------- --------- -------- --------

2,955 5,159 2,955 5,159

======== ========= ======== ========

The movement in the investment portfolio can be analysed

as follows:

Group Company

2014 2013 2014 2013

GBP'000 GBP'000 GBP'000 GBP'000

Opening cost 6,316 7,743 6,558 7,985

Opening net unrealised

losses (1,157) (689) (1,399) (931)

-------- --------- -------- --------

Opening value 5,159 7,054 5,159 7,054

Movements in the year:

Purchases at cost 10 89 10 89

Sales - proceeds (29) (1,480) (29) (1,480)

Sales - realised gains

& (losses) on sales 3 (36) 3 (36)

Net unrealised losses (2,188) (468) (2,188) (468)

Closing value 2,955 5,159 2,955 5,159

======== ========= ======== ========

Closing cost 6,300 6,316 6,542 6,558

Closing net unrealised

losses (3,345) (1,157)9 (3,587) (1,399)

-------- --------- -------- --------

Closing value 2,955 5,159 2,955 5,159

======== ========= ======== ========

The cost of the investments held by the Company is different to

that of the Group as a result of unrealised gains on intra-group

transfers being eliminated on consolidation.

Gains and losses on investments held Group Company

at fair value

2014 2013 2014 2013

GBP'000 GBP'000 GBP'000 GBP'000

Realised gains & (losses) on sales 3 (36) 3 (36)

Net unrealised losses (2,188) (468) (2,188) (468)

Net losses on investments (2,185) (504) (2,185) (504)

======== ======== ======== ========

An analysis of investments is as follows: Group Company

2014 2013 2014 2013

GBP'000 GBP'000 GBP'000 GBP'000

Equity investments 1,438 3,639 1,438 3,639

Fixed income securities 106 104 106 104

Unquoted loan stock 1,411 1,416 1,411 1,416

-------- --------

2,955 5,159 2,955 5,159

======== ======== ======== ========

9. PROPERTY INVESTMENTS

Property investments have been classified as follows: Group

2014 2013

GBP'000 GBP'000

Non-current assets 9,865 9,270

Non-current assets held for sale 6,810 7,430

-------- --------

16,675 16,700

======== ========

A further analysis of total property investments is as

follows:

Group

2014 2013

Net book value and valuation GBP'000 GBP'000

At 1 January 16,700 28,896

Additions during the year - expenditure on existing

properties 498 942

Disposals during the year - (11,699)

Movement in fair value during the year (523) (1,439)

At 31 December 16,675 16,700

======== =========

Property investments are shown at fair value based on current

use and any surplus or deficit arising on valuation of property is

reflected in the Statement of Comprehensive Income.

All property investments were valued by Jones Lang LaSalle

Limited, Chartered Surveyors, as at 31 December 2014 at a combined

total of GBP16,675,000. These external valuations were carried out

on the basis of Market Value in accordance with the latest edition

of the Valuation Standards published by the Royal Institution of

Chartered Surveyors.

Operating leases

The future minimum lease payments receivable under

non-cancellable operating leases are as follows:

2014 2013

GBP'000 GBP'000

Not later than one year 561 654

Between 2 and 5 years 1,349 583

Over 5 years 872 34

2,782 1,271

======== ========

Rental income recognised in the Statement of Comprehensive

Income amounted to GBP858,000 (2013: GBP999,000).

The commercial leases vary with their location within the United

Kingdom, however wherever the market allows they are being

standardised where possible across the property portfolio. The

commercial units are leased on terms where the tenant has the

responsibility for repairs and running costs for each individual

unit (other than roof repairs in certain circumstances) with a

service charge payable to cover estate services provided by the

landlord.

The cost of the above properties as at 31 December 2014 is as

follows:

Group

GBP'000

Brought forward 17,3153

Additions during the year 498

Disposals during the year -

17,813

========

Capital commitments

Capital expenditure contracted for but not provided for in the

financial statements for the Group was GBP248,000 (2013:

GBP338,000) and for the Company was GBPnil (2013: GBPnil).

Movement in fair value of property Group

investments

2014 2013

GBP'000 GBP'000

Realised losses on disposal of property - 173

Decrease in fair value (523) (1,612)0

-------- ---------

Movement in fair value of property

investments (523) (1,439)

======== =========

10. OTHER INVESTMENTS

Company

2014 2013

Subsidiary undertakings GBP'000 GBP'000

Shares - at cost 322 322

Less provision - -

322 322

======== ========

The principal subsidiary undertakings of Gresham House plc, all

of which principally trade and are registered in England, are as

follows:

Held by

other

Held by Group

Parent companies

% %

Deacon Commercial Development and Finance Limited

- property investment 75 25

New Capital Developments Limited - property investment - 75

Newton Estate Limited - property investment - 100

Security Change Limited - finance and share dealing 100 -

11. NET ASSET VALUE PER SHARE

Basic and diluted

Basic and diluted net asset value per ordinary share is based on

equity attributable to equity shareholders at the year-end and on

9,343,390 (2013: 5,369,880) ordinary shares being the number of

ordinary shares in issue at the year-end. No shares were deemed to

have been issued at nil consideration as a result of shareholder

and supporter warrants granted.

The shareholder and supporter warrants are not dilutive as the

exercise price of the warrants is 323.27p which is higher than the

average market price of ordinary shares during the year.

GBP'000

The movement during the year of the assets attributable to

ordinary shares were as follows:

Total net assets attributable at 1 January 2014 20,324

Total recognised losses for the year (4,001)

Issue of shares 11,200

Share warrants issued 64

Share based payments 255

Total net assets attributable at 31 December 2014 27,842

========

12. POST BALANCE SHEET EVENT

On 4 February 2015 the High Court approved the cancellation of

the Company's share premium account (the "Cancellation"). As a

consequence of the Cancellation GBP12,508,206.76 standing to the

credit of the Company's share premium account was cancelled. This

will facilitate any share buyback or payment of dividends that the

board of the Company may in the future approve by creating a

reserve of an equivalent amount that, subject to certain creditor

protection undertakings, will form part of a distributable

reserve.

The Cancellation has no effect on the overall net asset position

of the Company.

The Cancellation proposals were contained in the Company's

shareholder circular and AIM Admission Document, each dated 8

October 2014, and approved by shareholders at the Company's General

Meeting on 31 October 2014

13. SEGMENTAL REPORTING

Investment Property Investment Elimination Consolidated

2014 2013 2014 2013 2014 2013 2014 2013

Revenue GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External income 301 310 864 987 - - 1,165 1,297

Inter - segment

income 128 637 - - (128) (637) - -

-------- -------- ---------- ---------- -------- -------- -------- --------

Total revenue 429 947 864 987 (128) (637) 1,165 1,297

Gains and

losses

on investments

at fair value (2,185) (504) - - - - (2,185) (504)

Movement on

property

investments at

fair value - - (523) (1,439) - - (523) (1,439)

Total income

and gains (1,756) 443 341 (452) (128) (637) (1,543) (646)

Segment

expenses - - (516) (1,243) - - (516) (1,243)

Inter - segment

expense - - (128) (637) 128 637 - -

Finance costs - (106) (209) (651) - - (209) (757)

Segment

(loss)/profit (1,756) 337 (512) (2,983) - - (2,268) (2,646)

======== ======== ========== ========== ======== ========

Unallocated

corporate

expenses (1,740) (846)

-------- --------

Operating loss (4,008) (3,492)

Interest income 7 46

Loss before

taxation (4,001) (3,446)

======== ========

For the year ended 31 December 2014 the Group's policy was to invest

in both securities and commercial properties. The future policy of

the Group can be found in the Strategic Report. Accordingly management

reporting for the year ended 31 December 2014 is split on this basis

under the headings "Investment" and "Property Investment" respectively.

Inter-segment income consists of management fees and interest on

inter-company loans. Unallocated corporate expenses relate to those

costs which cannot be readily identified to either segment.

All activity and revenue is derived from operations within the United

Kingdom. Four customers accounted for GBP313,000, GBP141,000, GBP100,000

and GBP93,000 respectively of the external income for the Property

Investment segment. Property operating expenses relating to property

investments that did not generate any rental income were GBP9,000

(2013: GBP18,000).

Other

Information Investment Property Investment Unallocated Consolidated

2014 2013 2014 2013 2014 2013 2014 2013

GBP'000 GBP'000 GBP\'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Segment assets 14,622 6,658 17,214 18,238 - - 31,836 24,896

Segment

liabilities (287) (194) (3,707) (4,378) - - (3,994) (4,572)

-------- -------- ---------- ---------- -------- -------- -------- --------

14,335 6,464 13,507 13,860 - - 27,842 20,324

--------

Capital

expenditure 10 89 498 942 - - 508 1,031

Depreciation - - - - - - - -

Non-cash

expenses

other than

depreciation - - - - 255 - 255 -

All non-current assets are located within the United Kingdom. Details

of the exchanges on which the non-current assets contained within

the Investment segment are traded can be found in note 8 of these

financial statements.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR IRMLTMBMTBFA

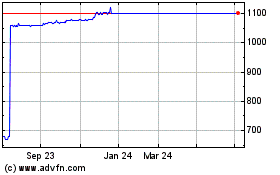

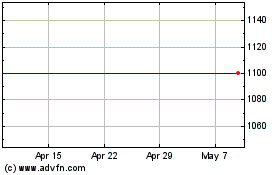

Gresham House (LSE:GHE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gresham House (LSE:GHE)

Historical Stock Chart

From Apr 2023 to Apr 2024