Golfsmith International Files For Chapter 11 Protection

September 14 2016 - 10:50AM

Dow Jones News

Golfsmith International Inc. filed for chapter 11 bankruptcy

protection Wednesday after negotiating a restructuring plan that

calls for store closures in the U.S. and the sale of its Canadian

retail chain.

Court papers show the Austin, Texas-based specialty golf

retailer reported assets and debts each in the range of $100

million to $500 million in its chapter 11 petition, which it filed

in the U.S. Bankruptcy Court in Wilmington, Del.

The Wall Street Journal had earlier reported the company's plans

to file for chapter 11 protection as well as to seek protection

under Canada's Companies' Creditor Arrangement Act.

According to people familiar with the matter, the filings

include an agreement to sell its Canadian chain of about 50 stores,

operating under the brand Golf Town, to two of its largest

creditors. The buyers are Toronto fund manager CI Financial Corp.

and Fairfax Financial Holdings Ltd., controlled by Canadian

financier Prem Watsa.

CI Financial and Fairfax, which own about 40% of Golfsmith's

secured debt, have agreed to support Golfsmith's move to seek court

protection from its creditors in the U.S. and Canada.

The Canadian chain is healthier than its U.S. counterpart

because it has a larger market share in a less crowded golf retail

sector.

U.S. stores have suffered because of either over saturation in

certain markets or being too large in general, said a source close

to the matter.

As part of the bankruptcy filing, Golfsmith will likely close

some of these U.S. locations, as well as a small number of stores

in Canada, the person added. The company also plans to renegotiate

some of its leases with landlords, the person said.

Golfsmith has been in advanced discussions with potential

bidders for its U.S. chain of about 100 stores, but according to

one person familiar with these talks, a sale was unlikely unless

the company closed a number of its stores and trimmed its debt.

Golfsmith's planned breakup comes four years after it was

acquired by Toronto-based Golf Town for about $97 million, a deal

that was backed by the private equity arm of the Canadian pension

fund OMERS. Following the merger, Golfsmith launched an ambitious

expansion across the U.S. with large golf emporiums, some of which

featured indoor putting greens and golf simulators.

The strategy quickly unraveled as U.S. golf participation levels

declined and increased competition from big box and online

retailers eroded profit. The tough competitive environment has

prompted other sports retailers such as Nike Inc. to shift away

from golf equipment sales, while others sports retailers sought

bankruptcy protection or closed operations.

Since David Roussy took the helm as chief executive of Golfsmith

in 2015 he has focused on beefing up the company's e-commerce side

of the business and integrating it with its brick-and-mortar

stores, the person close said. Still, the fruits of this labor have

yet to be fully realized and are expected to take effect more so

over the long-term, said the person.

Goldsmith hired Jeffries LLC and Alvarez & Marsal earlier

this year to solicit potential buyers and review various

restructuring strategies. More recently it has been advised by Weil

Gotshal & Manges LLP And Goodmans LLP.

Write to Jacquie McNish at Jacquie.McNish@wsj.com and Lillian

Rizzo at Lillian.Rizzo@wsj.com

(END) Dow Jones Newswires

September 14, 2016 10:35 ET (14:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

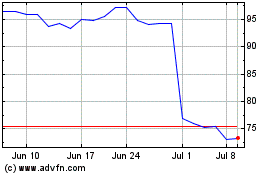

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

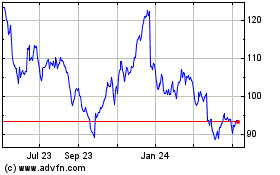

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024