- Total third quarter 2013 revenue was $22.5 million compared to

$20.5 million in 2012, an increase of 10%; service revenue

increased 11% with equipment revenue increasing 6%

- Duplex ARPU increased 29% to $24.50 during third quarter of

2013 compared to the third quarter of 2012; Duplex equipment

revenue increased over 80% during the same comparable periods

- Simplex and SPOT service revenue increased by 27% and 6%,

respectively, during the third quarter of 2013 from the third

quarter in 2012

- COFACE senior debt facility agreement successfully amended and

all events of default cured

- Second-generation constellation completely in service and

Duplex capabilities fully restored; minutes of use on the

Globalstar network increased 23% during the third quarter of 2013

compared to the third quarter in 2012

- On November 1, 2013, the Federal Communications Commission

("FCC") voted unanimously to release a Notice of Proposed

Rulemaking ("NPRM") for Globalstar's provision of low power mobile

broadband services over 22 MHz of spectrum

Globalstar, Inc. (OTCQB:GSAT) today announced its financial results

for the three-month period ended September 30, 2013.

THIRD QUARTER FINANCIAL REVIEW

Jay Monroe, Chairman and CEO of Globalstar, commented, "The

third quarter marked a momentous time for Globalstar as the Company

achieved milestones across our operating, financial and regulatory

efforts. In August, we placed the final satellite from our February

launch into service, completing the MSS industry's first

second-generation Low Earth Orbit ("LEO") constellation years ahead

of the competition. This event not only physically restores quality

Duplex service but also symbolizes our perseverance in the face of

great challenges over the past few years. We have experienced both

a material increase in network usage and the acquisition of a

growing number of new subscribers as the combination of restored

service and attractive pricing drives increased demand. The

introduction of the SPOT Global Phone helped total Duplex equipment

revenue grow 80%. We are succeeding in expanding MSS into the

nascent consumer market. Major Duplex data points including ARPU,

minutes of use, service revenue, equipment revenue and gross

subscriber additions are rebounding and provide strong evidence of

our future financial performance. The FCC's recent release of

proposed new rules permitting Globalstar to offer mobile broadband

services is the culmination of a nearly year-long effort that, once

concluded, should greatly enhance Globalstar's future profitability

while meaningfully increasing the nation's spectrum available for

terrestrial broadband service and reduce acute Wi-Fi congestion. We

look forward to working through the comment cycle in collaboration

with all stakeholders to obtain a favorable FCC order."

Revenue

Revenue was $22.5 million for the third quarter of 2013 compared

to $20.5 million for the third quarter of 2012, an increase of 10%,

which was due to increases in both service revenue and subscriber

equipment sales.

Service revenue was $17.1 million for the third quarter of 2013

compared to $15.4 million for the third quarter of 2012, an

increase of $1.7 million, or 11%. The primary driver of this

increase was growth in Duplex revenue, which increased $1.2

million, or 25%. The growth in Duplex service revenue was due

primarily to higher usage, an increase in revenue-generating

subscribers and the continued migration of subscribers to higher

rate plans that reflect improved network performance. These factors

drove a 29% increase in Duplex ARPU to $24.50. Third quarter 2013

service revenue growth also reflected SPOT revenue growth, which

increased 6% as revenue-generating subscribers increased. SPOT ARPU

increased 13% to $10.64 due in part to deactivations of non-revenue

generating subscribers beginning in the first quarter of 2013. As

previously announced, the Company initiated a process to deactivate

certain suspended (non-paying) subscribers in its subscriber base

beginning in 2013; approximately 36,000 subscribers were

deactivated during the first quarter. If suspended subscribers were

excluded from the 2012 subscriber count, average subscribers for

the third quarter of 2013 would have increased by 8%. Simplex

service revenue increased 27% due to a 24% increase in the average

subscriber base. These increases were offset slightly by a decrease

in other service revenue of $0.5 million due primarily to the

timing and amount of service revenue recognized from engineering

contracts in the third quarter of 2013 compared to the third

quarter of 2012.

Subscriber equipment revenue was $5.5 million in the third

quarter of 2013, an increase of 6% from the third quarter of 2012.

Duplex equipment revenue increased 80% from the third quarter of

2012 which was driven by the success of SPOT Global Phone sales.

Comparing the third quarter of 2013 to the same period in 2012,

Simplex equipment sales decreased $0.6 million and SPOT equipment

sales decreased $0.1 million. Simplex sales were impacted by the

change in the mix of products sold during the third quarter of 2013

compared to the third quarter of 2012. SPOT sales were impacted by

the delayed introduction of SPOT Gen 3™.

Net Loss

Net loss increased during the third quarter of 2013 reflecting

the substantial impact of multiple aggregating non-cash items

resulting from the Company's debt transactions and related

derivative instruments. The Company reported a net loss of $205.0

million for the third quarter of 2013 compared to $41.2 million for

the third quarter of 2012. Increased net loss was due primarily to

the impact of non-cash derivative losses driven by a significant

increase in the Company's stock price from June 30, 2013 to

September 30, 2013. The increased net loss was due also to the

recognition of a non-cash loss on extinguishment of debt of $63.6

million resulting from transactions executed in connection with the

Amended and Restated Loan Agreement with Thermo, which was

completed in July 2013 as a condition precedent to closing the

Amended and Restated COFACE Facility. Also contributing to the

increased net loss was higher interest expense as the amount of

interest being capitalized decreased and note conversion activity

increased, in addition to higher depreciation expense as the

Company placed additional satellites into service.

Adjusted EBITDA

Adjusted EBITDA was $2.5 million for the third quarter of 2013

compared to $3.1 million in the third quarter of 2012. This

decrease was due to an increase in total operating expenses of $2.6

million (excluding EBITDA adjustments) offset partially by an

increase in revenue of $2.0 million. The increase in operating

expenses was due to strategic investments made for sales and

marketing initiatives, including new product launches and the

expansion of the Company's distribution network, as well as

investments in its gateway infrastructure in anticipation of

increased Duplex demand.

FINANCING UPDATE

During the third quarter, Globalstar successfully completed the

amendment and restatement of its COFACE Facility Agreement. The

amended agreement provides for a material improvement to the debt

amortization schedule and covenant levels with a total deferral of

$235 million of principal payments through 2019.

OPERATIONAL AND REGULATORY UPDATE

Second-Generation Constellation

- As previously announced, all satellites launched on February 6,

2013 have been placed into service, successfully completing the

Company's second-generation constellation and fully restoring its

Duplex capabilities.

Regulatory Reform for Terrestrial Spectrum Authority

- On November 1, 2013, the FCC voted unanimously to release

proposed rules that would permit Globalstar to provide low-power

terrestrial mobile broadband services over 22 MHz of spectrum,

including 11.5 MHz of Globalstar's licensed S‐band spectrum at

2483.5-2495 MHz, as well as the adjacent 10.5 MHz of unlicensed

spectrum at 2473‐2483.5 MHz. The comment period is 75 days

following the publication of the proposal in the Federal Register

with reply comments due 30 days thereafter.

Mr. Monroe concluded, "With both the refinancings and

constellation restoration now in the rear view mirror, we are fully

engaged in leveraging our restored duplex service capability to

re-acquire and retain high-value subscribers. We can now dedicate

100% of our operational focus to driving revenue by investing in

aggressive customer acquisition and retention strategies and

continuing to develop and launch exciting new products like the new

consumer asset tracking device, SPOT Trace™. And finally, let me

reiterate how pleased we are with the proposed new rules issued by

the FCC last week. These rules are extremely positive for our

future plans and hold enormous potential for both consumers and the

Company in the months and years ahead."

CONFERENCE CALL

The Company will conduct an investor conference call today at

5:00 p.m. EST to discuss third quarter 2013 financial results.

| |

| Details are as

follows: |

|

| Conference Call: |

5:00 p.m. EST Investors and the media are

encouraged to listen to the call through the Investor Relations

section of the Company's website at www.globalstar.com/investors.

If you would like to participate in the live question and answer

session following the Company's conference call, please dial 1

(800) 446-2782 (US and Canada), 1 (847) 413-3235 (International)

and use the participant pass code 36024771. |

| Audio Replay: |

A replay of the earnings call will be

available for a limited time and can be heard after 7:30 p.m. EST

on November 13, 2013. Dial: 1 (888) 843-7419 (US and Canada), 1

(630) 652-3042 (International) and pass code 3602 4771#. |

About Globalstar, Inc.

Globalstar is a leading provider of mobile satellite voice and

data services. Globalstar offers these services to commercial

customers and recreational consumers in more than 120 countries

around the world. The Company's products include mobile and fixed

satellite telephones, simplex and duplex satellite data modems,

flexible airtime service packages and the SPOT family of mobile

satellite consumer products including the SPOT Satellite GPS

Messenger. Many land based and maritime industries benefit from

Globalstar with increased productivity from remote areas beyond

cellular and landline service. Global customer segments include:

oil and gas, government, mining, forestry, commercial fishing,

utilities, military, transportation, heavy construction, emergency

preparedness, and business continuity as well as individual

recreational users. Globalstar data solutions are ideal for various

asset and personal tracking, data monitoring and SCADA

applications. Note that all SPOT products described in this press

release are the products of Spot LLC, which is not affiliated in

any manner with Spot Image of Toulouse, France or Spot Image

Corporation of Chantilly, Virginia.

For more information regarding Globalstar, please visit

Globalstar's web site at www.Globalstar.com.

Safe Harbor Language for Globalstar Releases

This press release contains certain statements that are

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements are based on current expectations and assumptions that

are subject to risks and uncertainties which may cause actual

results to differ materially from the forward-looking statements.

Forward-looking statements, such as the statements regarding our

expectations with respect to actions by the FCC, future increases

in our revenue and profitability and other statements contained in

this release regarding matters that are not historical facts,

involve predictions.

Any forward-looking statements made in this press release are

accurate as of the date made and are not guarantees of future

performance. Actual results or developments may differ materially

from the expectations expressed or implied in the forward-looking

statements, and we undertake no obligation to update any such

statements. Additional information on factors that could influence

our financial results is included in our filings with the

Securities and Exchange Commission, including our Annual Report on

Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K.

| |

| |

| |

| GLOBALSTAR,

INC. |

| CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS |

| (Dollars in thousands, except

per share data) |

| (unaudited) |

| |

|

|

| |

Three Months

Ended September 30, |

| |

2013 |

2012 |

| Revenue: |

|

|

| Service revenues |

$ 17,056 |

$ 15,368 |

| Subscriber equipment sales |

5,493 |

5,169 |

| Total revenue |

22,549 |

20,537 |

| Operating expenses: |

|

|

| Cost of services (exclusive of

depreciation, amortization, and accretion shown separately

below) |

8,181 |

7,413 |

| Cost of subscriber equipment sales |

4,148 |

4,040 |

| Cost of subscriber equipment sales -

reduction in the value of inventory |

-- |

660 |

| Marketing, general, and

administrative |

9,079 |

7,425 |

| Depreciation, amortization, and

accretion |

23,715 |

18,654 |

| Total operating expenses |

45,123 |

38,192 |

| Loss from operations |

(22,574) |

(17,655) |

| Other expense: |

|

|

| Loss on extinguishment of debt |

(63,569) |

-- |

| Loss on equity issuance |

(2,733) |

-- |

| Interest income and expense, net of

amounts capitalized |

(16,901) |

(6,565) |

| Derivative loss |

(97,534) |

(16,473) |

| Other |

(1,540) |

(439) |

| Total other expense |

(182,277) |

(23,477) |

| Loss before income taxes |

(204,851) |

(41,132) |

| Income tax expense |

118 |

56 |

| Net loss |

$ (204,969) |

$ (41,188) |

| |

|

|

| Loss per common share: |

|

|

| Basic |

$ (0.30) |

$ (0.10) |

| Diluted |

(0.30) |

(0.10) |

| |

|

|

| Weighted-average shares outstanding |

|

|

| Basic |

673,546 |

394,344 |

| Diluted |

673,546 |

394,344 |

| |

| |

| |

| GLOBALSTAR,

INC. |

| RECONCILIATION OF GAAP

NET LOSS TO ADJUSTED EBITDA |

| (Dollars in thousands) |

| (unaudited) |

| |

|

|

| |

Three Months

Ended September 30, |

| |

2013 |

2012 |

| |

|

|

| Net loss |

$ (204,969) |

$ (41,188) |

| |

|

|

| Interest income and expense, net |

16,901 |

6,565 |

| Derivative loss |

97,534 |

16,473 |

| Income tax expense |

118 |

56 |

| Depreciation, amortization, and

accretion |

23,715 |

18,654 |

| EBITDA |

(66,701) |

560 |

| |

|

|

| Reduction in the value of long-lived

assets and inventory |

-- |

660 |

| Non-cash compensation |

1,171 |

323 |

| Research and development |

189 |

46 |

| Foreign exchange and other |

1,541 |

421 |

| Thales arbitration expenses |

-- |

224 |

| Loss on extinguishment of debt |

63,569 |

-- |

| Loss on equity issuance |

2,733 |

-- |

| Write off of deferred financing

costs |

-- |

833 |

| Adjusted EBITDA (1) |

$ 2,502 |

$ 3,067 |

| |

|

|

| (1) EBITDA

represents earnings before interest, income taxes, depreciation,

amortization, accretion and derivative (gains)/losses. Adjusted

EBITDA excludes non-cash compensation expense, reduction in the

value of assets, foreign exchange (gains)/losses, R&D costs

associated with the development of new consumer products, and

certain other significant charges. Management uses Adjusted EBITDA

in order to manage the Company's business and to compare its

results more closely to the results of its peers. EBITDA and

Adjusted EBITDA do not represent and should not be considered as

alternatives to GAAP measurements, such as net income/(loss). These

terms, as defined by us, may not be comparable to a similarly

titled measures used by other companies. |

|

|

| |

|

|

| The Company uses

Adjusted EBITDA as a supplemental measurement of its operating

performance. The Company believes it best reflects changes across

time in the Company's performance, including the effects of

pricing, cost control and other operational decisions. The

Company's management uses Adjusted EBITDA for planning purposes,

including the preparation of its annual operating budget. The

Company believes that Adjusted EBITDA also is useful to investors

because it is frequently used by securities analysts, investors and

other interested parties in their evaluation of companies in

similar industries. As indicated, Adjusted EBITDA does not include

interest expense on borrowed money or depreciation expense on our

capital assets or the payment of income taxes, which are necessary

elements of the Company's operations. Because Adjusted EBITDA

does not account for these expenses, its utility as a measure of

the Company's operating performance has material

limitations. Because of these limitations, the Company's

management does not view Adjusted EBITDA in isolation and also uses

other measurements, such as net income/(loss), revenues and

operating profit, to measure operating performance. |

|

|

| |

| |

| |

| GLOBALSTAR,

INC. |

| SCHEDULE OF SELECTED

OPERATING METRICS |

| (Dollars in thousands, except

subscriber and ARPU) |

| (unaudited) |

| |

|

|

|

|

| |

Three Months

Ended September 30, |

| |

2013 |

2012 |

| |

Service |

Equipment |

Service |

Equipment |

| Revenue |

|

|

|

|

| Duplex |

$ 6,235 |

$ 2,124 |

$ 4,993 |

$ 1,176 |

| SPOT |

6,969 |

1,217 |

6,552 |

1,314 |

| Simplex |

2,147 |

1,856 |

1,690 |

2,429 |

| IGO |

251 |

189 |

199 |

355 |

| Other |

1,454 |

107 |

1,934 |

(105) |

| |

$ 17,056 |

$ 5,493 |

$ 15,368 |

$ 5,169 |

| |

|

|

|

|

| Average Subscribers |

|

|

|

|

| Duplex |

84,821 |

|

87,819 |

|

| SPOT |

218,416 |

|

231,310 |

|

| Simplex |

215,691 |

|

173,781 |

|

| IGO |

39,859 |

|

41,576 |

|

| |

|

|

|

|

| ARPU (1) |

|

|

|

|

| Duplex |

$ 24.50 |

|

$ 18.95 |

|

| SPOT |

10.64 |

|

9.44 |

|

| Simplex |

3.32 |

|

3.24 |

|

| IGO |

2.10 |

|

1.60 |

|

| |

|

|

|

|

| (1) Average

monthly revenue per user (ARPU) measures service revenues per month

divided by the average number of subscribers during that month.

Average monthly revenue per user as so defined may not be similar

to average monthly revenue per unit as defined by other companies

in the Company's industry, is not a measurement under GAAP and

should be considered in addition to, but not as a substitute for,

the information contained in the Company's statement of income. The

Company believes that average monthly revenue per unit provides

useful information concerning the appeal of its rate plans and

service offerings and its performance in attracting and retaining

high value customers. |

|

|

|

|

CONTACT: Investor contact information:

Email

InvestorRelations@Globalstar.com

Phone

(985) 335-1538

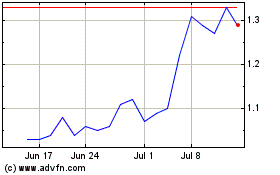

Globalstar (AMEX:GSAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

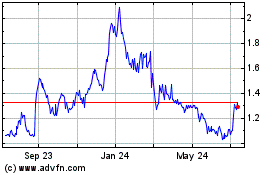

Globalstar (AMEX:GSAT)

Historical Stock Chart

From Apr 2023 to Apr 2024