Global Stocks Mostly Steady

February 08 2016 - 5:30AM

Dow Jones News

Global stocks were mostly steady Monday as rising commodities

prices lifted mining shares.

Brent crude oil rose 1.5% to $34.55 a barrel, while copper

futures also moved higher.

Stock futures pointed to a small opening gain for the S&P

500. Changes in futures don't necessarily reflect market moves

after the opening bell.

While falling oil prices benefit consumers, a rise or

stabilization in oil prices "would alleviate strains from the

global financial system," said Mark Heppenstall, chief investment

officer at Penn Mutual Asset Management, which manages $20 billion

in assets.

"A lot of emerging market economies have revenues dependent on

oil and commodities and debt denominated in U.S. dollars—that mix

has proven pretty toxic," he added.

Despite Monday's rise, Brent crude prices are down nearly 8%

this year amid a continuing supply glut and fears over slowing

global growth.

Saudi oil minister Ali al-Naimi met with his Venezuelan

counterpart on Sunday but didn't announce any plans for a

production cut.

Meanwhile, the Stoxx Europe 600 was down 0.1% in early trade,

despite the lift in mining companies, following a downbeat finish

on Wall Street Friday.

A dive in technology shares and a mixed jobs report added to

uncertainty about the U.S. economy.

Job creation slowed in January after three consecutive months of

gains, data showed, but a slight fall in unemployment and a modest

uptick in wages left the prospect of further U.S. interest rate

increases this year on the table.

In Asian trade, Japan's Nikkei Stock Average gained 1.1% as the

yen fell against the dollar, while Australia's S&P ASX 200

ended flat.

Other markets in Asia were closed for the Lunar New Year

Holiday, but China remained in focus for global investors. Data

released over the weekend showed China's foreign-exchange reserves

fell to their lowest level in over three years, though many

analysts had expected an even larger drop.

The latest reserves data added to concerns over China may be

forced to further weaken its currency, which investors fear could

spur further devaluations across emerging markets in a bid to

defend export growth.

In currencies, the dollar was up 0.4% against the yen at ¥

117.2910, while the euro was down 0.1% against the dollar at

$1.1151.

Investors sold the dollar last week ahead of the jobs report, as

uneven U.S. data earlier in the week reduced expectations that the

Federal Reserve would raise benchmark interest rates in the coming

months.

Lower interest rates tend to reduce the appeal of a currency to

investors.

Attention now shifts to Federal Reserve Chairwoman Janet Yellen,

who is scheduled to deliver her semiannual testimony to Congress

Wednesday.

In other commodities, spot gold in London was down 0.6% at

$1166.75 a troy ounce.

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

February 08, 2016 05:15 ET (10:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

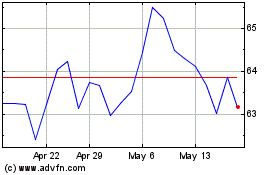

ASX (ASX:ASX)

Historical Stock Chart

From Mar 2024 to Apr 2024

ASX (ASX:ASX)

Historical Stock Chart

From Apr 2023 to Apr 2024