Global Stocks Broadly Higher, While Dollar Strengthens

May 24 2016 - 11:01AM

Dow Jones News

By Riva Gold

Global stocks climbed Tuesday, while the dollar strengthened

against the euro and yen.

The Dow Jones Industrial Average rose 201 points, or 1.2%, to

17694. The S&P 500 climbed 1.1% and the Nasdaq Composite added

1.4%.

The Stoxx Europe 600 reversed early losses to rise 2.2%.

Eurozone finance ministers were meeting Tuesday to discuss

options for Greek debt relief, after the country's parliament

approved taxes and austerity measures over the weekend needed to

unlock further rescue loans.

"For once, there's good news on Greece," said Mike Bell, global

market strategist at J.P. Morgan Asset Management, noting investor

sentiment was lifted by hopes that Greece will receive relief

before major debts fall due in July.

Corporate news continued to drive stock moves. Best Buy issued a

soft profit forecast for the current quarter, helping drive shares

down 7.2%.

Toll Brothers, a luxury home builder, on Tuesday reported

better-than-expected profit and revenue in its second quarter. "We

continue to believe the drivers are in place to sustain the current

housing market's slow but steady growth," said Robert I. Toll,

executive chairman. Shares of Toll Brothers rose 5.7%. New home

sales for April are due later this morning.

In currencies, the euro slipped 0.5% against the dollar to

$1.1154. German economic growth accelerated at the start of the

year, data showed Tuesday, but a separate report from German think

tank ZEW showed financial analysts grew more pessimistic about the

country's economic outlook.

The dollar rose 0.5% against the yen to Yen109.82. Japan's

finance minister said Tuesday that the country has no plans to

weaken the yen to try to boost exports, following weeks of market

speculation.

The British pound rose 0.9% against the dollar to $1.4610 after

an opinion poll pointed to a lower chance of the U.K. voting to

leave the European Union in a June 23 referendum.

"The pound has had a little jump for joy on fact that Brexit

risk is reducing, but sterling could fall quite a bit more if

Britain left [the EU]," Mr. Bell said.

Tuesday's moves came on the heels of a lackluster close for Wall

Street. Trading volumes were the second-lowest this year, following

weeks of listless trade.

"Retail investors are pretty much on the sidelines," said

Stephen Kalayjian, strategist at KnowVera. "There's clear

uncertainty here and no reason to jump in the markets when you have

lackluster corporate earnings and you see gross domestic product

numbers as weak as they are, " he said.

Later this week, investors will focus on a speech from Federal

Reserve Chairwoman Janet Yellen on Friday as they struggle to parse

the central bank's next move.

Philadelphia Fed President Patrick Harker said Monday he could

"easily" see the U.S. central bank raising rates two to three times

this year, possibly as soon as June.

Shares in Asia mostly ended lower as oil prices fell and

investors continued to grapple with the prospect of higher U.S.

interest rates.

Japan's Nikkei Stock Average fell 0.9%, while the Shanghai

Composite Index fell 0.8%. Hong Kong's Hang Seng Index added

0.1%.

U.S. crude oil added 0.2% to $48.15 a barrel. Gold fell 1.2% to

$1,236.50 an ounce.

Ian Talley contributed to this article

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

May 24, 2016 10:46 ET (14:46 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

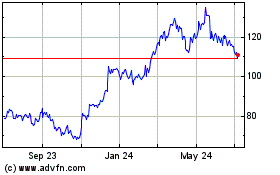

Toll Brothers (NYSE:TOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

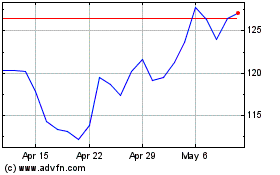

Toll Brothers (NYSE:TOL)

Historical Stock Chart

From Apr 2023 to Apr 2024