Global Shares Advance Amid Strong Earnings

August 01 2017 - 4:17AM

Dow Jones News

By Justin Yang and Kenan Machado

Equity markets continued to be supported by strong earnings and

higher commodity prices on Tuesday.

The Stoxx 600 Europe rose 0.2% in morning trading ahead of a

reading on eurozone growth, while the FTSE 100 was up 0.5%.

Adding to raft of earnings reports, energy giant BP PLC rose

2.5% after the company returned to profitability in the second

quarter on recovering oil prices. That helped boost the Stoxx 600

Europe Oil and Gas sector 0.9%.

British aircraft-engine maker Rolls Royce Holdings PLC also

reported positive earnings after posting a first-half net profit,

sending its shares up 6.6%.

"Equities are in an earnings driven market, surprising to the

upside," said Terry Sandven, chief equity strategist at U.S. Bank

Wealth Management.

Improvement in a closely watched private gauge of manufacturing

in China helped Asian shares gain. The reading from Caixan and IHS

Markit rose for a second straight month in July and hit the highest

level since March. In contrast, Monday's government reading slowed

slightly.

"Today's unofficial PMI suggests that manufacturing activity has

held up better than previously thought and points to a pickup in

economic growth last month," said Julian Evans-Pritchard at Capital

Economics.

Chinese stocks were already higher ahead of the report, and the

Shanghai Composite Index was last up 0.6% after four consecutive

sessions of gains. In Hong Kong, the Hang Seng Index hit fresh

two-year highs, rising 0.7%, moving closer to 2015's peak.

Commodities also continued to climb Tuesday as global and U.S.

oil benchmarks added to more than a week straight of gains.

That all helped push Australia's S&P/ASX 200 up 0.9% after

the index lagged once again in July. Commodities-focused stocks

were posting outsize gains, with Woodside Petroleum rising

2.3%.

Australia's central bank on Tuesday warned over recent strength

in the Australian dollar and left its cash rate target on hold at a

record.

The currency is well above the central bank's "equilibrium

level," National Australia Bank said.

Korean stocks were also strong on Tuesday. The Kospi was up 0.8%

amid gains in index heavyweight Samsung as well as carriers Asiana

and Korean Air.

Japan's Nikkei rose just 0.3% as Tokyo equities continued to be

capped by the weaker dollar; it was recently around Yen110.20.

The WSJ Dollar Index, which tracks the dollar against a basket

of 16 currencies, was last up 0.1% after settling at its lowest

since August.

Grace Zhu contributed to this article.

Write to Kenan Machado at kenan.machado@wsj.com

(END) Dow Jones Newswires

August 01, 2017 04:02 ET (08:02 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

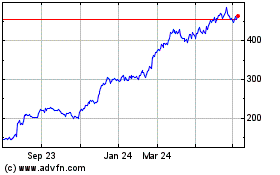

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Mar 2024 to Apr 2024

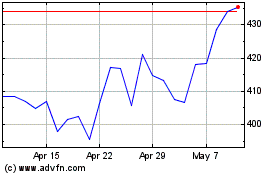

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Apr 2023 to Apr 2024