Global Logistic Properties to Buy U.S. Warehouse Portfolio for $1.1 Billion

September 12 2016 - 9:00PM

Dow Jones News

Global Logistic Properties Ltd. said it has agreed to buy

distribution centers from Hillwood Development Co. for $1.1

billion.

GLP, a large industrial property company part-owned by

Singapore's sovereign-wealth fund, has been aggressively expanding

in the U.S. over the last two years, as the rise of online shopping

drives up the values of distribution centers.

The Hillwood portfolio, with 15 million square feet, solidifies

GLP's position as the second-largest owner of warehouses in the

U.S., after San Francisco-based real-estate investment trust

Prologis Inc. Upon completion of the deal, GLP will own nearly 200

million square feet of warehouse property in the U.S., compared

with about 325 million for Prologis.

Hillwood, which is controlled by Ross Perot Jr., a Dallas-based

property investor and son of the former U.S. presidential

candidate, is selling properties in Ohio, Pennsylvania, Dallas,

Atlanta, Los Angeles and Chicago.

The largest tenants in the portfolio are Amazon.com Inc.,

Starbucks Corp., NFI, Williams-Sonoma Inc. and Wayfair Inc.

Charles Sullivan, GLP's chief operating officer, said the

purchase reflects the rising importance of online shopping, which

has shortened delivery times for consumer products and forced

retailers to offer more shipping options to customers.

"There was a time when warehousing and distribution was just

another part of the supply chain," Mr. Sullivan said.

"Logistics…has moved up in its importance in corporate strategy.

The customer is more a part of the distribution than they were 10

or 15 years ago."

Deal-making in the real-estate sector has slowed from its record

pace last year. Investors bought nearly $78 billion worth of

warehouses and distribution centers in 2015, according to data firm

Real Capital Analytics. Through July of this year, however, only

$29.2 billion worth of industrial property had changed hands, Real

Capital said.

GLP has been one of the market's biggest buyers in recent years,

including its $4.6 billion purchase of 200 U.S. warehouses from

Industrial Income Trust in 2015 and its $8.1 billion purchase of

IndCor Properties, a large portfolio owned by Blackstone Group LP

in late 2014. Most of the company's properties are in Asia.

In April of last year, Prologis announced its $5.9 billion

purchase of KTR Capital Partners, another large warehouse

owner.

Analysts say the rush for property in 2015 was the result of

investors looking for alternatives to low bond-market yields amid a

surfeit of large industrial property portfolios arranged during the

real-estate downturn that followed the financial crisis of 2008 and

2009. After a spate of blockbuster deals, there are fewer large

portfolios for sale.

Last year was "the busiest year in history in terms of pure

acquisitions," said Eric Frankel, an analyst with Green Street

Advisors. "The challenge to industrial real estate is that it's a

low cost-per-square-foot business, and it takes a lot of time to

assemble a big enough portfolio to interest large institutional

investors. You are seeing a lot of smaller portfolios out

there."

Like many real-estate firms, GLP raises funds from large

institutional investors, then uses a mix of those funds and debt to

buy and manage properties, while keeping a small equity stake for

themselves. For most of its U.S. deals, GLP retains around a 10%

stake in the properties after it buys them.

The latest GLP deal is expected to close in two rounds:

acquisition of about two-thirds of the property will be completed

in December, while the remainder will close in the next 18 to 24

months. The warehouses in the first round of closings are 100%

leased, while the second round of closings is contingent on a full

lease-up the properties.

Write to Robbie Whelan at robbie.whelan@wsj.com

(END) Dow Jones Newswires

September 12, 2016 20:45 ET (00:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

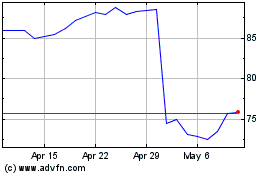

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

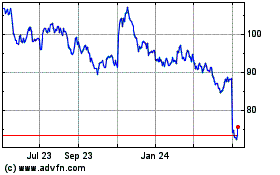

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Apr 2023 to Apr 2024