Amdocs, the leading provider of customer experience solutions,

today released the results from a new global survey around mobile

financial services (MFS) which revealed that more than 68 percent

of the respondents have yet to use mobile financial services, and

that new innovative solutions for savings, loans, and insurance

will drive the next phase of mobile financial services growth

across emerging and mature markets.

Conducted by analyst and consultancy firm Ovum on behalf of

Amdocs, the survey focused on both users and non-users of mobile

financial services worldwide. 8,500 consumers were surveyed in 17

countries across emerging and mature markets including UK, Denmark,

Finland, Norway, Sweden, US, Canada, India, Philippines, Malaysia,

Indonesia, Mexico, Brazil, Colombia, Guatemala, South Africa, and

Ghana.

"Consumers who have adopted mobile financial services appreciate

the benefits these services can bring. The ubiquity and convenience

– the ability to use mobile financial services anytime, anywhere –

was the overwhelming benefit cited by survey respondents in both

emerging and mature markets. These are immediate, tangible benefits

and a powerful riposte to those who say there is no value in mobile

financial services," said Eden Zoller, principal analyst with Ovum.

"This represents positive progress but mobile financial services

providers can't afford to be complacent as the research clearly

shows that there are fundamental issues and challenges that still

need to be addressed, ranging from security concerns and ease of

use, to lack of awareness."

Key findings include:

- Lack of market awareness and misperceptions about

mobile financial services are still key concerns – The

majority of the survey respondents either do not use mobile

payments or financial services applications, or are unaware of them

– this is more pronounced in emerging markets (73 percent) compared

to mature markets (62 percent). While 31 percent of respondents in

emerging markets said that they were unaware of mobile payments or

financial services, this figure was lower in mature markets (23

percent). 34 percent of respondents in emerging markets said that

they were aware but had no plans to use the services, compared to

30 percent of respondents in mature markets. Respondents who have

downloaded the application or subscribed the service but still

don't use it showed similar trends in mature (9 percent) and

emerging (8 percent) markets.

- Savings, loans, insurance & payment solutions for

medical treatment and education services will drive the next level

of growth in mobile financial services – 25 percent of

respondents in emerging markets said they're likely to adopt

advanced mobile financial services products – savings, loans, and

insurance – in the next year, compared to 16 percent in mature

markets. In some mature markets such as the UK and Sweden, the

likelihood was much higher, ranging from 17 to 30 percent. Emerging

markets (22 percent) are more likely to adopt mobile financial

services for making payments for medical treatment and education

services than the mature markets (15 percent).

- Increased security, low transaction charges, ease of

use, rewards for using the service, and service ubiquity are key

adoption drivers – Increased security was identified as

the most important factor for driving adoption in both mature (40

percent) and emerging (39 percent) markets. The preference for low

transaction charges and fees show a similar trend in both mature

and emerging markets (30 percent). What is perhaps more

surprising is that almost a third of respondents in both mature (30

percent) and emerging (29 percent) markets would adopt the services

if they were easier to use, illustrating the fact that ease of use

is still an issue. One third of the mature market respondents (30

percent) would use mobile financial services if they were offered

rewards, compared to 25 percent in emerging markets. A quarter of

the respondents in both mature (24 percent) and emerging (25

percent) markets said they would use mobile financial services if

they could use them anywhere, and at any time.

"Driving the next phase of growth is the biggest challenge,

globally, for mobile financial service providers," said Patrick

McGrory, division president for Amdocs' emerging offerings. "While

the mature markets such as the US, Norway, and the UK need

compelling value propositions, emerging markets such as Ghana,

South Africa, Brazil, India, Philippines, and

Mexico need innovative solutions that can deliver a range of

affordable mobile financial services that are a viable alternative

to traditional banking services. Communications service providers

who take the lead in overcoming these challenges are set to reduce

churn, improve customer stickiness, and tap new revenue

streams.

"Amdocs' MFS solution, which powers more than 30 customers'

systems, serving 500 million users across the globe, is designed to

better address the need for financial inclusion in the emerging

markets as well as offer innovative and exciting new services to

mature markets, which will accelerate adoption, encourage active

usage, and drive loyalty."

Supporting Resources

- Learn more about Amdocs Mobile Financial Services

- Learn more about the Amdocs-Ovum MFS Global Consumer

Survey

- Keep up with Amdocs news by visiting the company's website

- Subscribe to Amdocs' RSS Feed and follow us on Twitter,

Facebook, Google+, LinkedIn and YouTube

About Ovum

Ovum was founded in 1986 and has its HQ in the UK with further

offices across all regions. Ovum is comprised of two core business

areas: consultancy along with research and analysis (R&A)

teams. R&A is organized around key practices that together

cover the whole of the communications; media, digital commerce and

IT value chains. Ovum's expertise includes market sizing and

forecasting, surveys, trend analysis, competitor, product and

strategy assessment. Clients include retail banks, online players,

advertising agencies, broadcast and media companies, telecom

operators, technology and software vendors, device manufacturers,

regulators and enterprises.

For more information, visit Ovum at www.ovum.com

About Amdocs

Amdocs is the market leader in customer experience software

solutions and services for the world's largest communications,

entertainment and media service providers. Our portfolio

powers The New World of Customer Experience™, where a wide array of

innovative and personalized services are delivered seamlessly to

end users, regardless of device or network. For more than 30 years,

Amdocs solutions, which include BSS, OSS, network control and

optimization, coupled with our professional and managed services,

have accelerated business value for our customers by streamlining

complex operating environments, reducing costs and speeding time to

market for new products and services. Amdocs and our more

than 24,000 employees serve customers in over 90 countries. Listed

on the NASDAQ Global Select Market, Amdocs had revenue of $3.6

billion in fiscal 2014.

Amdocs: Embrace Challenge, Experience Success.

For more information, visit Amdocs at www.amdocs.com.

Amdocs' Forward-Looking Statement

This press release includes information that constitutes

forward-looking statements made pursuant to the safe harbor

provision of the Private Securities Litigation Reform Act of 1995,

including statements about Amdocs' growth and business results in

future quarters. Although we believe the expectations reflected in

such forward-looking statements are based upon reasonable

assumptions, we can give no assurance that our expectations will be

obtained or that any deviations will not be material. Such

statements involve risks and uncertainties that may cause future

results to differ from those anticipated. These risks include, but

are not limited to, the effects of general economic conditions,

Amdocs' ability to grow in the business markets that it serves,

Amdocs' ability to successfully integrate acquired businesses,

adverse effects of market competition, rapid technological shifts

that may render the Company's products and services obsolete,

potential loss of a major customer, our ability to develop

long-term relationships with our customers, and risks associated

with operating businesses in the international market. Amdocs may

elect to update these forward-looking statements at some point in

the future; however, the Company specifically disclaims any

obligation to do so. These and other risks are discussed at greater

length in the Company's filings with the Securities and Exchange

Commission, including in our Annual Report on Form 20-F for the

fiscal year ended September 30, 2014 filed on December 8, 2014 and

our quarterly 6-K form furnished on February 9, May 11 and August

10, 2015.

Media Contact: Sara Preto Fusion PR for Amdocs

Tel: +1-212-651-4214 E-Mail: sara.preto@fusionpr.com

| Amdocs 1390 Timberlake Manor

Parkway Chesterfield, MO 63017 USA www.amdocs.com |

+1-314-212-7000 tel

+1-314-212-7500 fax |

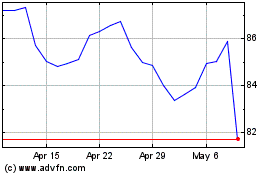

Amdocs (NASDAQ:DOX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amdocs (NASDAQ:DOX)

Historical Stock Chart

From Apr 2023 to Apr 2024