Glencore to Deliver Gold and Silver to Franco-Nevada

February 10 2016 - 6:21PM

Dow Jones News

By Scott Patterson

CAPE TOWN, South Africa-- Glencore PLC said it entered a $500

million deal to deliver gold and silver to Franco-Nevada Corp., the

latest installment in the Swiss mining firm's plans to rebuild its

troubled balance sheet.

The deal builds on Glencore's agreement in November to deliver

silver from its Antamina mine in Peru in exchange for $900

million.

The agreement is part of the $10 billion debt reduction plan

Glencore unveiled in September as the Swiss miner and commodities

trader scrambles to pare down its debt load amid concerns that

prices for the commodities it mines and sells will continue to

decline.

Glencore said Franco-Nevada will make payments of 20% of the

gold and silver delivered from its Antapaccay mine in Peru. The

payments will increase to 30% after Glencore delivers 750,000

ounces of gold and 12.8 million ounces of silver, the company

said.

The deal with Glencore is "another step in strengthening and

diversifying Franco-Nevada's portfolio," said David Harquail, chief

executive of the Toronto-based firm.

Streaming companies typically provide a chunk of cash upfront to

miners in exchange for a "stream" of precious metals down the road.

Streaming deals have become increasingly popular of late, since

miners have had trouble raising cash on stock and bond markets.

The deals can also be seen as signs of desperation, indicating

trouble with mining operations and concerns about a miner's ability

to fund its business in a commodity downturn.

Write to Scott Patterson at scott.patterson@wsj.com

(END) Dow Jones Newswires

February 10, 2016 18:06 ET (23:06 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

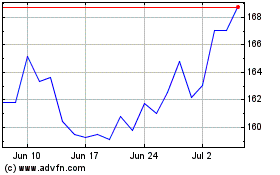

Franco Nevada (TSX:FNV)

Historical Stock Chart

From Mar 2024 to Apr 2024

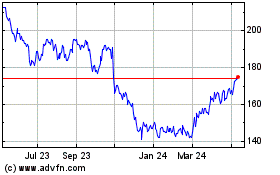

Franco Nevada (TSX:FNV)

Historical Stock Chart

From Apr 2023 to Apr 2024