The troubles of commodities giant Glencore PLC are benefiting

global markets as the company shuts down its supply of many

actively traded commodities from zinc to copper, sparking rallies

in these resources.

The gains, however, are often short lived, with investors soon

returning to the view that most commodity markets are oversupplied

at a time when demand is falling. For Glencore's actions to have a

lasting effect, other miners must follow. But many analysts believe

that this won't happen in a way big enough to push prices higher in

an era when China, the world's biggest consumer of most mined

commodities, is slowing down.

"Glencore's announcement will not be sufficient to engineer a

major turnaround in sentiment towards base metals or indeed mining

firms," said Sebastien Marlier, a commodities analyst at the

Economist Intelligence Unit.

Glencore said Friday it will cut annual zinc production by

roughly a third, or 500,000 metric tons, including closing two

mines. That is the equivalent of roughly 4% of the market in a

metal primarily used in steel production. The changes will also

reduce its annual output of lead, which is produced at those mines,

by about 100,000 tons.

The news sent the price of zinc up by 11.4% to a two-month high

of $1,857.50. Lead climbed 7% to a three-month high, before

settling up 5.4% at $1,763. The news boosted other industrial

metals, all of which traded higher throughout Friday.

The mine closures are the latest in a string of cuts from

Glencore, including coal, copper, platinum and cobalt, as sliding

commodity prices make it harder for the company to turn a profit

and reduce its $30 billion debt burden. The announcement comes at a

time when Glencore has been under scrutiny by investors, concerned

that falling raw-material prices could strain the mining and

commodity-trading group's finances.

The company's share price closed up 7% at 129.10 pence.

Some market participants see these cuts as a marker in an

important shift in sentiment among major producers and a signal

that the market was waking up to the high levels of oversupply

faced by many commodity markets. According to Macquarie, five of

the six major metals will have a surplus this year. Aluminum

producers will oversupply their market by 2.8%, the most of all

metals.

Most analysts argue that more cuts need to follow to make a

fundamental difference in prices.

Last month, Glencore said that it will shut down two

money-losing copper mines in Africa for 18 months, taking more than

1% of global output off markets. That sent copper prices spiking by

around 4%, but the metal soon sank and is now trading at around the

same levels it was before Glencore's announcement.

There have been cuts by smaller miners in commodities such as

coal and copper. But Freeport-McMoRan Inc. has been one of the few

other big miners to reduce output, announcing in August that it was

cutting about 68,000 tons from its annual copper production over

the next two years.

Many of the major miners, like Rio Tinto PLC and BHP Billiton

Ltd., have so far resisted joining the cuts, including in the coal

market that Glencore is active in and which has seen significant

price declines.

"[The] Glencore cuts tell you where it was losing money," said

Hunter Hillcoat, a commodities analyst at Investec. "While the coal

prices impact BHP and Rio as well, their assets are generally

higher quality, and therefore they've no need to cut

production."

In other words, some of these larger miners are unlikely to

cutback because they can often still make money. Giants like BHP

and Rio also have held back to see if the pressure of low prices

would force smaller, higher-cost mining outfits out of business,

analysts said.

Now analysts are scouring Glencore's portfolio to see what else

can be cut.

In commodities markets as a whole, nickel is seen as one of the

metals that miners need to tighten the most. Only 25% of production

in this metal, which is used in the production of stainless steel,

is profitable, said Ben Davis, analyst at Liberum Capital.

Underscoring the difficulties of balancing global supply and

demand, a cut to aluminum production by its biggest miners could

only encourage Chinese suppliers to plug the gap as they continue

to expand capacity.

For all commodities, whether supply is cut or not, China will

have a say on the end price, given its outsize role in demand.

China accounts for nearly half of total global zinc consumption,

45% of global copper consumption and 40% of lead production. Fears

about China's slowing economy in recent months have been a major

factor in the recent commodity price weakness. After years of

double-digit expansion and despite a series of economic

interventions by the government, the country is struggling to

maintain a 7% economic growth rate.

"If demand does not increase, then it would be tough for…prices

to sustain the momentum," said Daniel Ang, an analyst at Phillip

Futures.

Rhiannon Hoyle contributed to this article.

Write to Ese Erheriene at ese.erheriene@wsj.com and Alex

MacDonald at alex.macdonald@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 09, 2015 13:55 ET (17:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

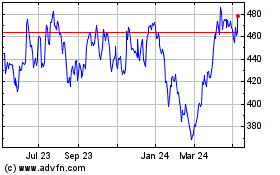

Glencore (LSE:GLEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

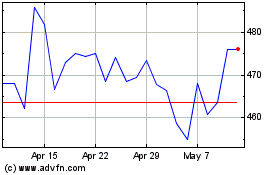

Glencore (LSE:GLEN)

Historical Stock Chart

From Apr 2023 to Apr 2024