By Scott Patterson and Alex MacDonald

LONDON--A year of debt cuts, asset sales and rising commodity

prices have pulled Glencore PLC back from the brink of crisis. Now,

the mining and trading giant's shareholders have a new concern:

That Chief Executive Ivan Glasenberg might return to his

free-spending ways.

Mr. Glasenberg spent much of the last decade as the commodities

industry's biggest deal maker, snapping up coal, copper and gold

mines in places such as East Africa, South America and Australia.

After a mounting debt pile and sagging commodities prices sent

Glencore shares tumbling last year--the price fell 29% on a single

day, Sept. 28--investors pressured a chastened Mr. Glasenberg to

slash borrowing and unload unprofitable mines. He suspended the

company's dividend, laid off workers to cut costs, and trimmed the

company's debt load to more sustainable levels, investors say.

With shares up about 180% since the free fall, Baar,

Switzerland-based Glencore recently emerged as a contender in

bidding for several big properties, including Australian coal

assets that Rio Tinto PLC and Anglo American PLC were looking to

sell, say people familiar with the sales talks.

Investors say Mr. Glasenberg has work to do before he can

responsibly start buying, and are hoping to hear more about cost

savings than new spending when the company reports earnings on Aug.

24.

"First, we have to finish the deleveraging, then we have to

restore the dividend," said David Herro, a fund manager for Harris

Associates LP who controls about 6% of Glencore's stock, worth

about $2 billion.

Mr. Herro snapped up billions of dollars' worth of Glencore's

stock last autumn as it cratered, and said Glencore should consider

whether stock buybacks make more sense than deals.

A spokesman for Glencore declined to comment.

Mr. Glasenberg transformed Glencore from a trading house into

one of the world's biggest miners, with deals like the $29.5

billion acquisition of coal miner Xstrata in 2013. But his big bets

fell flat over the past two years, when commodities prices crashed.

Coal, despite a rebound this year, remains under pressure due in

part to world-wide attempts to curb global warming by reducing

carbon emissions from coal-burning power plants.

Glencore lost $5 billion in 2015, and its stock remains over 60%

below its 2011 offering price.

There is little question Glencore's situation has improved from

a year ago, when Mr. Glasenberg was fending off investor fears that

his mining and trading house was a debt-bloated powder keg on the

verge of exploding.

At the end of 2015, Glencore's net debt--which doesn't include

billions of dollars of borrowing that fuels its trading

business--had dipped to $25.9 billion from $29.6 billion midyear.

Glencore says it plans to reduce the debt load to $17 billion-$18

billion by the end of 2016.

"Management is doing exactly what they should be doing," said

Mr. Herro.

Last week, Glencore reported lower copper, coal and zinc output

in the second quarter, compared with a year earlier, due largely to

voluntary mine closures.

Glasenberg & Co. have already raised $2.5 billion in a share

offering and $1.4 billion in a pair of "streaming" deals, which

give Glencore upfront cash in exchange for gold or silver down the

road. The dividend suspension has saved about $2.4 billion in cash.

In the second half of the year, Glencore says it expects to book

about $3.13 billion from the sale of nearly half of its

agricultural business and another $100 million from the sale of a

Kazak gold deposit.

Glencore is also exploring the sale of another Kazakh gold mine

that could fetch $2 billion and Australian rail assets that could

raise another $750 million or more, analysts say.

Charl Malan, a portfolio manager for Van Eck Global, which holds

roughly $200 million worth of Glencore stock, said the company

should continue cutting debt and return cash to shareholders before

looking for new investments. He said Glencore should restore the

dividend by sometime next year, depending on commodity prices.

"Management is not going to be driven by, 'I want more coal, I

want more copper,' " he said. "Management will be driven by what is

best for shareholders."

One risk is that commodity prices could fall. Some analysts say

a round of Chinese stimulus this year has fueled prices, and they

could dip once that stimulus ends.

Other investors harbor concerns about the long-term value of

coal, in which Glencore says it plans to invest more. Hermès

Investment Management partner Bruce Duguid said his clients who

have invested in Glencore worry the company hasn't adequately

calculated the risks of policies intended to curb global

warming.

Glencore said it expects demand for thermal coal--which is used

to produce power--to increase for decades, especially in Southeast

Asia.

"We're wary of the idea that you can predict the world with

great confidence, given the commodity crash that just happened was

based on the misunderstanding of demand," Mr. Duguid said.

Write to Scott Patterson at scott.patterson@wsj.com and Alex

MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

August 17, 2016 05:28 ET (09:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

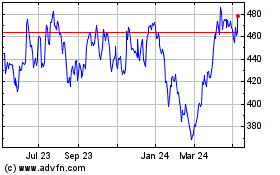

Glencore (LSE:GLEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

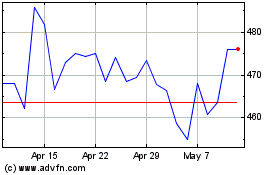

Glencore (LSE:GLEN)

Historical Stock Chart

From Apr 2023 to Apr 2024