Glencore Cutbacks Shift to Zinc in Metal Rout -- Update

October 08 2015 - 9:20PM

Dow Jones News

By Rhiannon Hoyle

SYDNEY-- Glencore PLC stepped up production cutbacks, this time

slashing zinc output including the suspension of two mines after a

collapse in prices for the industrial metal.

The Switzerland-headquartered commodities group said it would

cut annual zinc production by roughly a third, or 500,000 metric

tons, including closing its Lady Loretta mine in Australia and

Iscaycruz mine in Peru. The changes will also reduce its annual

output of lead, also produced at those mines, by about 100,000

tons, it said.

They are the latest in a string of mine closures for Glencore,

from coal to platinum deposits, as sliding commodity prices make it

harder for the resources giant to turn a profit. It comes at a time

when the company has been under intense scrutiny by investors,

concerned that falling raw-material prices could strain the mining

and commodity-trading group's finances.

Zinc is primarily used for steel coatings, but goes into many

products including car tires and sunscreen, and has few

substitutes.

The company, which has zinc operations across Australia,

Kazakhstan and South America, said it would be better off holding

on to the resource until market prices improve. In addition to

closing the two mines, its operations at George Fisher and McArthur

River in Australia and various sites in Kazakhstan will pare

production, it said.

It forecast fourth-quarter zinc output to fall by about 100,000

tons.

"Glencore believes that current prices do not correctly value

the scarcity of our zinc resources," it said in a statement on

Friday. "Our finite resources are valuable and reducing production,

in response to current prices, preserves value and optionality for

all stakeholders."

The company said it was upbeat on the longer-run prospects for

zinc and lead prices.

Earlier this week, Glencore said it was closing its Eland

platinum mine in South Africa, citing falling platinum prices and

rising energy and labor costs there.

Last month, it said it would suspend operations at two copper

mines, Katanga and Mopani, in the Democratic Republic of the Congo

and Zambia, respectively, until it completes cost-reduction

projects, which are due to end in the first half of 2017.

It has also closed coal mines in Australia in recent years amid

a protracted slump in the market for that commodity, and has been

trimming output at other mines this year as the market remains

oversupplied.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

October 08, 2015 21:05 ET (01:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

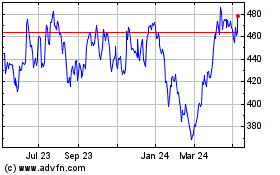

Glencore (LSE:GLEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

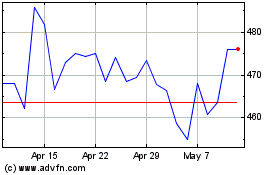

Glencore (LSE:GLEN)

Historical Stock Chart

From Apr 2023 to Apr 2024