GlaxoSmithKline Posts GBP354 Million Net Loss in 4Q

February 03 2016 - 8:23AM

Dow Jones News

By Denise Roland

GlaxoSmithKline PLC swung to a net loss in the fourth quarter of

the year even as revenue increased, largely due to restructuring

costs following its three-part transaction with Novartis AG.

The U.K.-based drugmaker said its loss attributable to

shareholders was GBP354 million ($510 million) in the quarter

ending Dec. 31, compared with a GBP1 billion profit a year earlier,

while revenue climbed to GBP6.3 billion from GBP6.2 billion. Core

net profit, which strips out some one-time items, fell 34% to

GBP874 million. Analysts had expected revenue of GBP6.3 billion and

core net profit of GBP903 million.

The decline in core net profit was largely down to Glaxo's shift

to a higher-volume, lower-margin business following its $20 billion

asset-swap deal with Novartis. In that deal, which closed in the

first quarter of 2015, Glaxo traded its cancer drugs for the Swiss

company's vaccines business. The pair also formed a joint venture

for their consumer health care businesses which span

over-the-counter drugs, such as painkiller Panadol, as well as

non-pharmaceuticals like toothpaste.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

February 03, 2016 08:08 ET (13:08 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

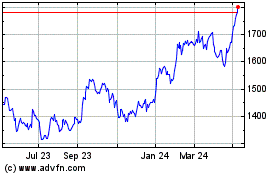

Gsk (LSE:GSK)

Historical Stock Chart

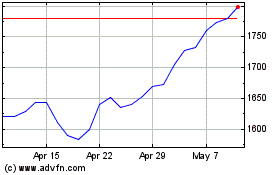

From Mar 2024 to Apr 2024

Gsk (LSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024