Gevo Announces Stockholder Vote to Clear Way for Whitebox Debt Exchange

June 16 2017 - 9:00AM

Gevo, Inc. (NASDAQ:GEVO), announced today that stockholders

approved the potential issuance of more than 19.99% of Gevo’s

outstanding common stock upon conversion of, or related to, the

Company’s newly created 12.0% Convertible Senior Secured Notes due

2020 (the “2020 Notes”), at the Company’s Annual Meeting of

Stockholders held yesterday. This approval clears the way for WB

Gevo, Ltd. (“Whitebox”), the holder of the Company’s issued and

outstanding Senior Secured Convertible Notes, due June 23, 2017

(the “2017 Notes”), to exchange (the “Exchange”) all $16.5 million

of the existing 2017 Notes for $16.5 million of the Company’s 2020

Notes.

The Exchange is expected to close on June 20, 2017.

As previously disclosed, the key terms of the 2020 Notes are as

follows:

- Maturity Date: The 2020 Notes will

mature on March 15, 2020.

- Interest: The 2020 Notes will accrue interest

at 12% per annum, with 10% payable in cash and 2% payable as

Payment in Kind (“PIK”) interest. The PIK interest is paid by

increasing the principal amount of the 2020 Notes by the amount of

PIK interest due.

- Conversion and Conversion Price: The 2020

Notes are convertible, at the option of the holders, into shares of

the Company’s common stock. The 2020 Notes will have an initial

conversion price (the “Conversion Price”) equal to the lesser of

(i) $1.196 per share, or (ii) a premium of 15% to the closing price

of the Company’s common stock on the date of the Exchange.

- Conversion Price Reset and Adjustments: Upon

completion of certain equity issuances by the Company, the holders

will have a one-time right to reset the Conversion Price (i) in the

first 90 days following the Exchange, at a 25% premium to the

common stock price in the equity issuance and (ii) after 90 and

within 180 days following the Exchange, at a 35% premium to the

common stock share price in the equity issuance.

- Holder Option: The holders have an option,

subject to certain conditions, to purchase up to an additional $5.0

million aggregate principal amount of 2020 Notes within 90 days of

the closing of the exchange contemplated by the Exchange and

Purchase Agreement with Whitebox.

A Current Report on Form 8-K was filed on April 20, 2017, with

the U.S. Securities and Exchange Commission that contains a more

detailed description of the terms of the Exchange and Purchase

Agreement with Whitebox, the Exchange and the 2020 Notes and will

include a copy of the Exchange and Purchase Agreement with Whitebox

and the form of indenture pursuant to which the 2020 Notes would be

issued.

About Gevo

Gevo is a leading renewable technology, chemical products, and

next generation biofuels company. Gevo has developed proprietary

technology that uses a combination of synthetic biology, metabolic

engineering, chemistry and chemical engineering to focus primarily

on the production of isobutanol, as well as related products from

renewable feedstocks. Gevo’s strategy is to commercialize bio-based

alternatives to petroleum-based products to allow for the

optimization of fermentation facilities’ assets, with the ultimate

goal of maximizing cash flows from the operation of those assets.

Gevo produces isobutanol, ethanol and high-value animal feed at its

fermentation plant in Luverne, Minnesota. Gevo has also developed

technology to produce hydrocarbon products from renewable alcohols.

Gevo currently operates a biorefinery in Silsbee, Texas, in

collaboration with South Hampton Resources Inc., to produce

renewable jet fuel, octane, and ingredients for plastics like

polyester. Gevo has a marquee list of partners including The

Coca-Cola Company, Toray Industries Inc. and Total SA, among

others. Gevo is committed to a sustainable bio-based economy that

meets society’s needs for plentiful food and clean air and

water.

Forward-Looking Statements

Certain statements in this press release may constitute

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements, which include statements relating to whether the

Exchange contemplated by the Exchange and Purchase Agreement with

Whitebox will be completed and whether the closing of the Exchange

will occur on June 20, 2017, are made on the basis of the current

beliefs, expectations and assumptions of the management of Gevo and

are subject to significant risks and uncertainty. Investors

are cautioned not to place undue reliance on any such

forward-looking statements. All such forward-looking statements

speak only as of the date they are made, and Gevo undertakes no

obligation to update or revise these statements, whether as a

result of new information, future events or otherwise. Although

Gevo believes that the expectations reflected in these

forward-looking statements are reasonable, these statements involve

many risks and uncertainties that may cause actual results to

differ materially from what may be expressed or implied in these

forward-looking statements. For a further discussion of risks and

uncertainties that could cause actual results to differ from those

expressed in these forward-looking statements, as well as risks

relating to the business of Gevo in general, see the risk

disclosures in the Annual Report on Form 10-K of Gevo for the year

ended December 31, 2016, and in subsequent reports on Forms 10-Q

and 8-K and other filings made with the U.S. Securities and

Exchange Commission by Gevo.

Media Contact

David Rodewald

The David James Agency, LLC

+1 805-494-9508

gevo@davidjamesagency.com

Investor Contact

Shawn M. Severson

EnergyTech Investor, LLC

+1 415-233-7094

gevo@energytechinvestor.com

@ShawnEnergyTech

www.energytechinvestor.com

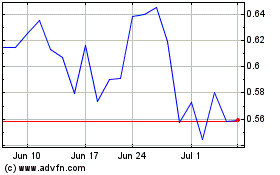

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

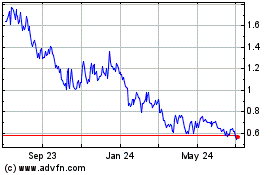

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Apr 2023 to Apr 2024