Germany's E.ON Faces Renewed Criticism for Uniper Spinoff

October 09 2016 - 9:50PM

Dow Jones News

FRANKFURT—Germany's E.ON SE came under renewed criticism on the

weekend from investors who compared its breakup strategy

unfavorably with that of RWE AG, a rival utility that floated its

renewable power business on Friday.

"RWE's move to spin off the renewables unit was the smarter

move," said Thomas Deser, a portfolio manager with Union

Investment, which holds 0.5% in E.ON.

Both E.ON and RWE have pursued radical splits in response to

changes in German energy policy, with the government pushing the

country toward renewable power and away from fossil fuels and

nuclear energy. The shift has left utilities with billions in

losses and liabilities related to shutting down nuclear plants.

RWE spun off 25% of its renewables, retail and grid operations

in Innogy SE Friday, giving the unit a clean break from

conventional energy and raising 5 billion euros ($5.6 billion) in

proceeds. E.ON did the opposite in September, floating more than

50% of its conventional coal and gas activities as Uniper SE.

Mr. Deser and analysts said RWE took a better path. The proceeds

raised from floating new shares in Innogy ensured RWE was

well-funded and could meet future liabilities, Mr. Deser said. The

proceeds will help RWE pay potential liabilities connected to

winding down nuclear plants and storing waste.

E.ON's spinoff of Uniper didn't generate funds because the

utility distributed Uniper shares to its own shareholders. E.ON

itself now focuses on renewables but also retains German nuclear

operations, meaning both E.ON and Uniper are saddled with troubled

businesses.

Knight Vinke, another large investor in E.ON, is also

disappointed. Founder Eric Knight told The Wall Street Journal this

weekend his fund presented an alternative deal structure in August

that would have brought well above €2 billion in fresh capital to

E.ON and Uniper.

Knight Vinke said it would have injected €600 million into E.ON

and acquired the 47% Uniper stake E.ON still holds in a step that

valued the unit at €3 billion.

People familiar with the matter said Knight Vinke's plan piqued

the interest of potential co-investors, including Warren Buffett's

Berkshire Hathaway Inc. The investment company didn't respond to an

email seeking comment.

E.ON decided against the plan because it would have triggered a

hefty tax payment and because the company believed the proposal

undervalued Uniper, according to people familiar with the matter.

E.ON declined to comment.

"There are more uncertainties around E.ON because they need to

raise capital for nuclear liabilities at a depressed share price

level. They could alternatively sell some assets but not too many

because that could compromise the attractiveness of their shares,"

Union Investment's Mr. Deser said.

Analysts have echoed those concerns. Barclays Capital said in a

recent note that worries about E.ON's capital strength would

persist even it if launched a "€2.4 billion capital increase to

cover the expected nuclear" expenses.

Knight Vinke continues to push E.ON management to consider other

measures aimed at cleaning house, including selling its grid unit,

people familiar with the matter said.

Knight Vinke declined to comment except to say it looked forward

"to continuing the very cordial and constructive relationship with

both E.ON and Uniper."

Monica Houston-Waesch contributed to this article.

Write to Eyk Henning at eyk.henning@wsj.com and Giles Turner at

giles.turner@wsj.com

(END) Dow Jones Newswires

October 09, 2016 21:35 ET (01:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

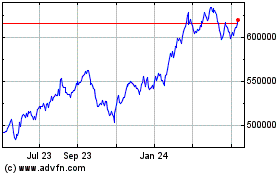

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

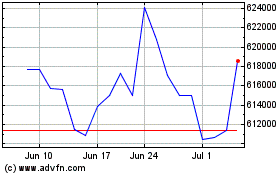

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Apr 2023 to Apr 2024