Genworth Financial Agrees to Takeover

October 23 2016 - 9:10PM

Dow Jones News

Chinese investment firm China Oceanwide Holdings Group Co. said

it agreed to buy U.S.-based insurer Genworth Financial Inc. for

about $2.7 billion.

China Oceanwide has been pouring hundreds of millions of dollars

into U.S. commercial and residential property in the past two

years. The privately held firm which is based in Beijing, was

founded by Lu Zhiqiang. China Oceanwide will pay $5.43 a share in

cash for shares of Genworth, which closed trading on Friday at

$5.21.

The deal comes as Genworth struggles under a money-losing

long-term care business and has already stopped selling traditional

life and fixed annuities as part of a cost-cutting move. Genworth,

which is based in Richmond, Va., traces its roots back to 1871 and

became a public company in 2004.

As part of the transaction, China Oceanwide will contribute

about $600 million of cash to address Genworth's debt maturing in

2018 and $525 million of cash to the firm's U.S. life insurance

businesses.

Separately, Genworth disclosed preliminary charges unrelated to

the transaction of $535 million to $625 million associated with

long-term care insurance claim reserves and taxes.

"The China Oceanwide transaction is the result of an active and

extensive review process conducted over the past two years under

the supervision of the Board and with guidance from external

financial and legal advisers," said James Riepe, nonexecutive

chairman of Genworth.

China Oceanwide said the transaction will help facilitate

Genworth's ability to complete its previously announced U.S.

life-insurance restructuring plan. Following completion of the

deal, Genworth will be a stand-alone subsidiary of China Oceanwide

and Genworth's senior management team will continue to lead the

business from its current headquarters in Richmond.

"In acquiring Genworth and contributing $1.1 billion of

additional capital, we are providing crucial financial support to

Genworth's efforts to restructure its U.S. life insurance

businesses," said Mr. Lu, adding "we have structured the

transaction with the intention of increasing the likelihood of

obtaining regulatory approval."

The transaction, which has been approved by both companies'

boards, is expected to close by the middle of 2017, subject to the

receipt of regulatory approvals. Both China Oceanwide and Genworth

have initiated discussions with regulators in key jurisdictions,

according to the companies.

Write to Geoffrey Rogow at geoffrey.rogow@wsj.com

(END) Dow Jones Newswires

October 23, 2016 20:55 ET (00:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

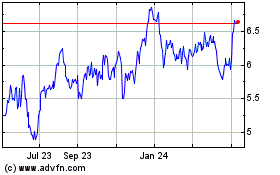

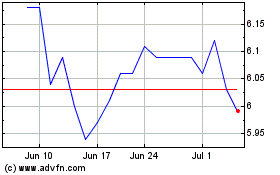

Genworth Financial (NYSE:GNW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Genworth Financial (NYSE:GNW)

Historical Stock Chart

From Apr 2023 to Apr 2024