General Mills to Sell Green Giant, Le Sueur for $765 Million

September 03 2015 - 9:30AM

Dow Jones News

General Mills Inc. has agreed to sell its Green Giant and Le

Sueur frozen and canned vegetable brands to B&G Foods Inc. for

$765 million in cash.

B&G, which owns food brands like Molly McButter cheese

flavoring and Pirate's Booty corn puffs, also expects $137 million

in tax benefits from the deal.

Shares of B&G added 1.8% to $31 a share in premkaret

trading, while General Mills shares were inactive.

The sale comes as General Mills, the maker of brands including

Cheerios cereal and Hamburger Helper, struggles with changing

consumer tastes and a strong dollar. The Minneapolis-based company

has been cutting jobs and closing plants as it struggles with

Americans' growing aversion to packaged foods.

During the quarter that ended in May, General Mills took a $260

million charge to write down the value of the Green Giant brand by

13%. At the the time, General Mills pegged the carrying value of

the brand at $425.9 million. The company said it redirected

resources away from supporting Green Giant, which caused it to

review the business and determine it wasn't worth what it once

was.

For B&G's part, the deal will add significantly to its sales

and earnings and give it a foothold in the frozen-food market.

After a transition period, the brands are expected to add $550

million to B&G's net sales and 60 cents a share to its

earnings. For its 2014 fiscal year, B&G reported net sales of

$848 million, up 17% from the prior year, while per-share earnings

fell to 76 cents from 98 cents on big impairment charge.

The deal is expected to close in the fourth quarter.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 03, 2015 09:15 ET (13:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

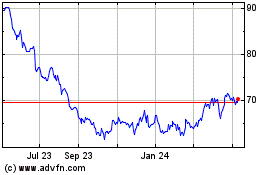

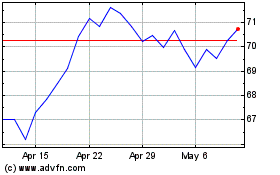

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024