General Mills Revenue Falls, but Less Than Expected -- Update

June 29 2016 - 2:09PM

Dow Jones News

By Annie Gasparro

General Mills Inc. has made progress reviving its cereal sales,

but now it has a mess to clean up in the yogurt aisle.

The company's fiscal-fourth-quarter revenue fell 8.6% to $3.93

billion, hurt by lower sales of its Yoplait yogurt. The strong U.S.

dollar devaluing international sales and the sale of its Green

Giant frozen-vegetable business also weighed on its results.

Still, that decline was less steep than analysts expected, as

U.S. cereal sales rose for the first time in four years. Shares

were up 1% in midday trading Wednesday.

The Minneapolis-based food giant, which makes Cheerios cereal,

Bisquick pancake batter, and Progresso soup, has tried to reshape

itself as consumers increasingly shun packaged and processed foods

in favor of more fresh and natural options.

In late 2014 General Mills bought natural and organic snack

maker Annie's Inc. and last fall it announced it was selling Green

Giant.

Meanwhile, it has overhauled its cereal brands -- making

Cheerios gluten free, removing artificial colors from Trix, and

coming out with Annie's organic cereals. In the latest quarter,

which ended May 29, U.S. retail sales of General Mills' cereal rose

3%.

Cereal sales have struggled for years industrywide as Americans

shifted to alternative breakfasts like Greek yogurt and granola

bars.

Now that General Mills has stabilized cereal, which is one of

its biggest businesses, it is turning its attention to Yoplait, its

latest challenge.

"Consumers are kind of switching their behavior to protein --

just generally, more substantial, more filling yogurt -- as the way

to weight management," Chief Executive Ken Powell said in an

interview.

General Mills says it sees more potential for its Greek-style

yogurts, which have more protein and less sugar than traditional

varieties.

In 2014 the company removed the artificial sweetener aspartame

from Yoplait Light, replacing it with sucralose, another artificial

sweetener, but sales have still suffered.

General Mills expects its core businesses like yogurt and cereal

to post sales growth in the low-single-digit percentages for its

newly started fiscal year. But it said its slower-growing

businesses -- like Betty Crocker baking mixes and Progresso soup --

would remain soft. Overall, sales will be flat to down 2% this

year, and then will rise modestly in fiscal 2018, the company

said.

Because of its sluggish sales growth, General Mills -- like many

of its peers in the packaged-food business -- is rapidly and

aggressively cutting costs to boost profitability.

On Wednesday, General Mills said it now expects its various

programs aimed at reducing administrative and manufacturing costs

will generate annual savings of $600 million by fiscal 2018, up

from the previous target of $500 million.

The company, which has laid off hundreds of corporate employees

and closed several factories as part of these programs, said it is

also taking further action to reduce the complexity of its

operations and be more stringent with investing in the business. As

a result, it now expects its adjusted operating profit margin will

reach 20% by fiscal 2018, up from 16.8% for fiscal 2016.

For its fourth quarter, General Mills reported a profit of

$379.6 million, or 62 cents a share, up from $186.8 million, or 30

cents a share, a year earlier. Adjusted for certain tax gains and

restructuring costs, among other items, per-share earnings fell to

66 cents from 75 cents.

Lisa Beilfuss contributed to this article.

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

June 29, 2016 13:54 ET (17:54 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

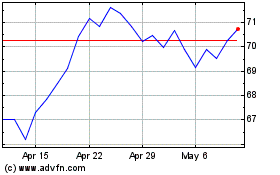

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

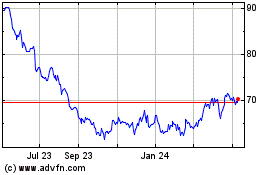

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024