General Mills Continues to Face Declining Sales -- Update

March 21 2017 - 12:59PM

Dow Jones News

By Joshua Jamerson

General Mills Inc. said sales of Yoplait yogurt and Progresso

soup suffered in the latest quarter because they were priced higher

than competing brands.

"We just missed this year," Chief Operating Officer Jeff

Harmening said in an interview. "Our pricing just wasn't in line

with the marketplace."

The Minneapolis-based food giant gave a grim outlook for

comparable sales for the rest of its fiscal year ending in May.

That metric fell 5% in the recent period, marking nine months of

steady erosion.

Lower food costs and other savings helped General Mills and its

peers deliver solid earnings on the lower revenues for a time. Now

sales declines are catching up with them, and falling food prices

are sparking price wars on some products.

In its fiscal third quarter, General Mills' North American

retail sales fell 7%, dragged down by meals like Hamburger Helper,

baking products like Pillsbury refrigerated dough, and Yoplait.

The decline was larger than Wall Street expected, and shares

fell about 2% Tuesday morning before recovering. The shortfall

underscored the company's struggle to win over consumers who are

increasingly looking for healthier and fresher brands.

General Mills in recent years has made Cheerios gluten-free,

removed artificial colors from Trix cereal, bought Annie's

Homegrown natural and organic snacks, and removed aspartame from

Yoplait Light. But Bernstein analyst Alexia Howard said concerns

about added sugar and artificial sweeteners may partly explain

General Mills' continued problems in the yogurt aisle.

Mr. Harmening said competition over prices was a bigger problem

than the shift to healthier foods.

"I don't think that has been the biggest issue we've had over

the past year. It's been the competitiveness of our pricing," he

said.

General Mills doesn't want its brands to be the cheapest, but it

does have to do a better job of getting stores to offer it a "fair

share" of holiday promotions, executives said.

Overall, for the quarter that ended Feb. 26, General Mills

reported net income of $357.8 million, down 1.1% from $361.7

million in the year-ago period. Revenue fell 5% to $3.79 billion,

lower than analysts' estimates of $3.82 billion.

General Mills also booked $78 million in restructuring and

impairment charges, which dented profit. Excluding restructuring

and other charges, the company's adjusted profit rose 10.8% to 72

cents a share from a year ago. Analysts polled by Thomson Reuters

expected per-share profit of 71 cents.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

March 21, 2017 12:44 ET (16:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

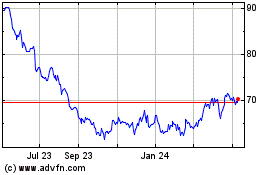

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

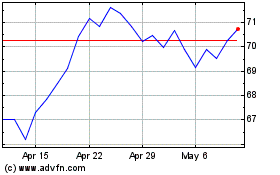

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024