TIDMGEMD

RNS Number : 1627D

Gem Diamonds Limited

27 January 2015

27 January 2015

GEM DIAMONDS LIMITED

Trading Update for Q4 2014

Letšeng ends a good year with continued strong performance.

Ghaghoo production ramp-up progressing.

Gem Diamonds Limited (LSE: GEMD) is pleased to report a Trading

Update detailing the Company's operational and sales performance

for Q4 2014 (1 October to 31 December 2014) (the Period).

Highlights:

Letšeng:

Continued strong performance at Letšeng

-- 25 525 carats were recovered in Q4 2014 (28 365 carats in Q3 2014).

-- The year ended very positively, with the December tender

achieving an average of US$ 2 799* per carat. This resulted in an

average value of US$ 2 140* per carat being achieved in Q4 2014

(US$ 2 603* per carat in Q3 2014), bringing the average for 2014 to

US$ 2 540* per carat (US$ 2 043* per carat for FY 2013).

-- 13 rough diamonds achieved a value of greater than US$ 1.0

million each during the Period, including a 112.6 carat white

diamond and a 90.4 carat white diamond which sold for US$ 5.8

million and US$ 4.2 million, respectively.

-- A 299.3 carat yellow diamond was recovered and extracted at

rough valuation during the Period. It was sold into a partnership

arrangement in January 2015 with Letšeng to share in 50% of the

polished uplift.

*Includes carats extracted at rough valuation for polishing.

Ghaghoo:

Ghaghoo mine development progresses well with encouraging

initial diamond recoveries

-- A total of 10 167 carats were recovered during commissioning

up to Period end, including a 20 carat white diamond, a 17 carat

white diamond, and a 3 carat orange diamond which confirms the

presence of valuable coloured diamonds in the orebody.

-- A 35 carat diamond was recovered in January 2015, the largest

diamond recovered at Ghaghoo to date.

-- An initial sale of c.10 000 carats will be held in Gaborone

and Antwerp during January and February 2015.

-- The development of Phase 1 is progressing well and the

ingress of water has been arrested and steps taken to prevent any

further interruption to production from water intersections.

Financial:

Robust operational results generates positive cashflows,

providing financial flexibility to meet medium to long-term

objectives

-- The Group ended the year with US$ 110.7 million cash as at 31

December 2014, of which US$ 99.4 million is attributable to Gem

Diamonds.

-- The Group has drawn down US$ 37.1 million of its total

available facilities of US$ 78.7 million, resulting in a net cash

position of US$ 73.6 million at Period end.

-- In December 2014, Letšeng paid dividends of US$ 51.8 million,

which resulted in a net cash flow of US$ 32.6 million to Gem

Diamonds and a cash outflow from the Group as a result of

withholding taxes of US$ 3.6 million and payment of the Government

of Lesotho's dividend portion of US$ 15.6 million. In total for the

year, Letšeng paid dividends of US$ 92.0 million of which US$ 57.9

million flowed to Gem Diamonds.

-- The Group remains on track to declare a maiden dividend to

shareholders following its final results announcement in March

2015.

Gem Diamonds' CEO, Clifford Elphick, commented:

"The fourth quarter of 2014 saw an encouraging end to a very

positive year for Gem Diamonds, with the December Letšeng tender

achieving an average of US$ 2 799 per carat. At Letšeng, a year of

solid operational performance saw an improvement over the prior

year's production results, with costs well controlled. Both the

implementation of the Plant 2 Phase 1 upgrade and the new Coarse

Recovery Plant projects remain on track for commissioning in Q1 and

Q2 of 2015 respectively - on time and budget.

At Ghaghoo the development of Phase 1 has progressed well and

significant work was undertaken to arrest the fissure water

intersected in the basalt country rock and to ensure that any

further water ingress is handled efficiently. The production

ramp-up has begun and the first sale of diamonds recovered from

commissioning will take place in February. There have been some

encouraging recoveries made of larger and coloured diamonds during

this commissioning period.

The long term outlook for the diamond market remains strong,

however during the fourth quarter the diamond market saw a

weakening of prices following a year of price growth. This trend

may continue into the first quarter of 2015.

Based on the positive results achieved in 2014, Gem Diamonds

remains on track to declare a maiden dividend to shareholders

following the 2014 full year results announcement in March

2015."

1. Diamond Market

The announcement of the closure of the Antwerp Diamond Bank

(ADB) in October 2014 has led to concerns over the availability of

liquidity in the rough diamond market. Although the market has for

a while been aware of the continuing issue of constrained

liquidity, the official announcement of ADB's closure weakened

market sentiment during the Period. The overall sentiment in both

the rough and polished diamond market leading up to and following

the Hong Kong Jewellery Show in September 2014 was cautious,

resulting in downward pressure on the price of rough diamonds

during the Period. Notwithstanding these market conditions,

Letšeng's high value rough production remained relatively resilient

during the Period, with high value large rough diamonds achieving

strong prices in the quarter. It is, however, expected that this

cautious approach in the market will continue into Q1 2015.

2. Lesotho

Gem Diamonds holds a 70% shareholding in Letšeng Diamonds (Pty)

Ltd (Letšeng) in partnership with the Government of the Kingdom of

Lesotho which owns the remaining 30%.

2.1 Production

Q4 2014 Q3 2014 QoQ Full year 2014 Full year 2013 YoY

% Change % Change

------------------------- ---------- ---------- ---------- --------------- --------------- ----------

Waste stripped (tonnes) 5 075 503 4 787 791 6% 19 884 721 19 072 657 4%

------------------------- ---------- ---------- ---------- --------------- --------------- ----------

Ore treated (tonnes) 1 590 855 1 601 758 -1% 6 421 704 6 225 821 3%

------------------------- ---------- ---------- ---------- --------------- --------------- ----------

Carats recovered 25 525 28 365 -10% 108 569 95 053 14%

------------------------- ---------- ---------- ---------- --------------- --------------- ----------

Grade recovered (cpht) 1.60 1.77 -9% 1.70 1.53 11%

------------------------- ---------- ---------- ---------- --------------- --------------- ----------

Improved efficiencies in the use of larger load and haul

equipment which had been commissioned during Q3 2014, resulted in a

6% increase in waste being stripped in Q4 2014 compared to the

previous quarter.

Letšeng's Plants 1 and 2 treated a total of 1.37 million tonnes

of ore in Q4 2014, 64% of which was sourced from the Main pipe and

36% from the Satellite pipe. The balance of ore was treated through

the Alluvial Ventures contractor plant, 93% of which was sourced

from the Main pipe and 7% from stockpiles. For the full year 2014,

a total of 69% of ore was sourced from the Main pipe and 31% from

the Satellite pipe.

The increase in the total carats recovered year on year is due

to the increased percentage of Satellite ore treated compared to

2013 and the grade over performance of the Reserve.

2.2 Rough Diamond Sales and Diamonds Extracted for Manufacturing

Q4 2014* Q3 2014* QoQ Full year 2014* Full year 2013* YoY

(3 tenders) (2 tenders) % Change % Change

---------------------------- ------------- ------------- ---------- ---------------- ---------------- ----------

Carats sold 31 614 23 550 34% 108 963 97 294 12%

---------------------------- ------------- ------------- ---------- ---------------- ---------------- ----------

Total value (US$ millions) 67.7 61.3 10% 276.8 198.8 39%

---------------------------- ------------- ------------- ---------- ---------------- ---------------- ----------

Achieved US$/ct 2 140 2 603 -18% 2 540 2 043 24%

---------------------------- ------------- ------------- ---------- ---------------- ---------------- ----------

*Includes carats extracted at rough valuation for polishing.

Three Letšeng tenders were held during the Period, achieving an

average price of US$ 2 140* per carat (compared to two tenders in

Q3 2014, which achieved US$ 2 603* per carat). This brings the 12

month rolling average to 31 December 2014 to US$ 2 540* per carat,

up 24% from US$ 2 043* per carat in the prior year.

*Includes carats extracted at rough valuation for polishing.

During Q4 2014, 13 exceptional rough diamonds achieved prices

greater than US$ 1 million each, including a 299.3 carat yellow

diamond, which was extracted in the Period and subsequently sold

into a partnership arrangement in January 2015 with Letšeng to

share in 50% of the polished uplift; a 112.6 carat white diamond

which sold on tender for US$ 5.8 million (US$ 51 833 per carat);

and a 90.4 carat white diamond which sold on tender for US$ 4.2

million (US$ 46 003 per carat).

For the full year, 1 232 carats (including the 299.3 carat

yellow diamond) were extracted for manufacturing at a rough value

of US$ 17.2 million. US$ 15.2 million (at rough value) remained in

polished inventory at the end of the year, compared to US$ 2.9

million at the end of 2013. The net impact of this polished

inventory movement on the overall Group revenue in 2014 is a

decrease of US$ 12.3 million.

2.3 Projects

The new Coarse Recovery Plant project remains on track for

completion in Q2 2015 for a total budget of Maloti 140.0 million

(US$ 12.1 million), of which Maloti 62.2 million (US$ 5.7 million)

was spent in 2014. The majority of the equipment is now on site,

with construction underway. The Coarse Recovery Plant project will

optimise the treatment of the high value, coarse fraction of ore

and is expected to improve the recovery of the high value Type II

diamonds and improve security measures.

Implementation of the Plant 2 Phase 1 upgrade project (which is

planned to deliver an increase in treatment capacity of 250 000

tonnes per annum, as well as further reducing diamond damage),

commenced in Q3 2014 and is on track to be completed at the end of

Q1 2015 following a planned three week implementation shutdown.

Maloti 9.8 million (US$ 0.9 million) of the total project capital

cost of Maloti 50.0 million (US$ 4.3 million) was spent in 2014.

Subsequent phases of the Plant 2 upgrade project will be considered

once Phase 1 has been implemented and plant performance has been

evaluated.

2.4 Costs

Cost management has continued to be a key focus area and Letšeng

has managed to maintain its costs within expected targets,

notwithstanding power cost increases experienced during the year.

Costs are in-line with the full year 2014 guidance and are expected

to be approximately in line with the figures below:

Direct cash costs (before waste) per tonne treated: Maloti

137

Operating costs per tonne treated*: Maloti 215

Mining waste cash costs per tonne of waste: Maloti 24

*Operating costs excludes royalty, selling costs, depreciation

and mine amortisation but includes inventory, waste and ore

stockpile adjustments.

2.6 Letšeng guidance for 2015

FY 2015

-------------------------------------- ---------

Waste tonnes mined (Mt) 20 - 22

-------------------------------------- ---------

Ore treated (Mt) 6.3 - 6.5

-------------------------------------- ---------

Carats recovered (Kct) 100 - 105

-------------------------------------- ---------

Carats sold (Kct) 100 - 105

-------------------------------------- ---------

Direct cash costs (before waste) per

tonne treated (Maloti) 145 - 155

-------------------------------------- ---------

Mining waste cash costs per tonne of

waste mined (Maloti) 28 - 30

-------------------------------------- ---------

Operating costs per tonne treated(1)

(Maloti) 195 - 215

-------------------------------------- ---------

Stay in business capital (US$m) 8 - 10

-------------------------------------- ---------

Project capital(2) (US$m) 13 - 15

-------------------------------------- ---------

1. Operating costs per tonne excludes royalty, selling costs,

depreciation and mine amortisation, but includes inventory, waste

and ore stockpile adjustments.

2. Letšeng project capital includes the coarse recovery plant

and the first phase Plant 2 upgrade and second phase feasibility

studies. Exchange rates applied at Maloti 11.00.

3. Botswana

Gem Diamonds' wholly-owned subsidiary, Gem Diamonds Botswana, is

currently developing the Ghaghoo mine (Ghaghoo) in Botswana.

Development of Phase 1 at Ghaghoo has continued to progress

well. Three kimberlite tunnels on the first main production level

(Level 1) have been fully developed to the northern orebody-country

rock contact, while the fourth tunnel is nearing completion.

Development of the access ramp to Level 2 has commenced and is

scheduled to reach Level 2 by June 2015. Development of the

ventilation system is progressing satisfactorily.

The sealing of fissure water intersected in the basalt country

rock has been completed and a significant amount of work has been

done to provide adequate water storage and pumping facilities

underground so that any potential further water intersections can

be handled efficiently. Six de-watering boreholes from surface are

now in place and operating satisfactorily.

The training stope and access tunnels in the kimberlite on Level

0 have continued to provide ore for the plant during the

commissioning period and will continue to do so until replaced by

steady state production from Level 1 later in 2015.

As at the end of the December 2014, 48 023 tonnes of ore had

been treated, with 10 167 carats having been recovered. The

recovered grade during the commissioning period has averaged just

over 21cpht compared to an expectation of c.27cpht. Grade was

negatively impacted by highly diluted ore derived from the margins

of the pipe and normal plant inefficiencies during early

commissioning. During the latter part of the Period, following

commissioning processes at the treatment plant, the grade improved

as expected and management anticipates that reserve grades will be

achieved as both the plant and mining operations achieve steady

state.

An initial sale of c.10 000 carats recovered from all ore during

commissioning will be held in Gaborone and Antwerp during January

and February 2015.

As the operation is in its commissioning phase, with planned

ramp-up scheduled for the first part of the year, guidance with

respect to operating costs, production and development will be

provided after the achievement of steady state production at the

end of Q2 2015.

4. Health, Safety, Social and Environment (HSSE):

The Group continues to strive toward its goal of zero harm to

its people and environment and to operate within the Group's

sustainable development framework.

For the whole of 2014, the Group-wide Lost Time Injury Frequency

Rate (LTIFR) was 0.2 and the Group All Injury Frequency Rate (AIFR)

was 3.0.

Gem Diamonds continues to work closely with its project affected

communities to ensure that the social projects implemented continue

to be sustainable.

Zero major or significant environmental incidents have occurred

across the Group during 2014.

For further information:

Gem Diamonds Limited

Sherryn Tedder, Investor Relations

Tel: +44 (0) 203 0430 2080

Mob: +44 (0) 7778 246 321

Bell Pottinger

Daniel Thöle / Joanna Boon

Tel: +44 (0) 203 772 2500

About Gem Diamonds:

Gem Diamonds is a leading global diamond producer of high value

diamonds. The company owns 70% of the Letšeng mine in Lesotho and

100% of the Ghaghoo mine in Botswana. The Letšeng mine is famous

for the production of large, top colour, exceptional white

diamonds, making it the highest dollar per carat kimberlite diamond

mine in the world. Since Gem Diamonds' acquisition of Letšeng in

2006, the mine has produced four of the twenty largest white gem

quality diamonds ever recorded.

Gem Diamonds has a growth strategy based on the expansion of the

Letšeng mine and bringing the Ghaghoo mine into production, while

maintaining its strong balance sheet. The Company seeks to maximise

revenue and margin from its rough diamond production by pursuing

cutting, polishing and sales and marketing initiatives further

along the diamond value chain. With favourable supply/demand

dynamics expected to benefit the industry over the medium to long

term, particularly at the high end of the market supplied by Gem

Diamonds, this strategy positions the Company well to generate

attractive returns for shareholders in the coming years.

www.gemdiamonds.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTBUGDBCSDBGUL

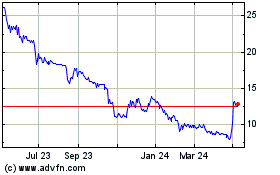

Gem Diamonds (LSE:GEMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

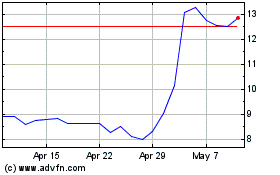

Gem Diamonds (LSE:GEMD)

Historical Stock Chart

From Apr 2023 to Apr 2024