TIDMGEMD

RNS Number : 2169O

Gem Diamonds Limited

17 August 2017

Half Year 2017 results

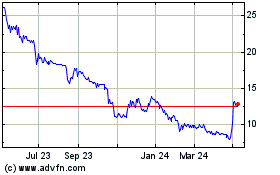

Gem Diamonds Limited (LSE: GEMD) (Gem Diamonds, the Company or

the Group) today announces its half-year results for the six months

ended 30 June 2017 (H1 2017 or the Period).

FINANCIAL RESULTS:

-- Revenue US$92.9 million (US$109.1 million in H1 2016)

-- Underlying EBITDA US$13.0 million (US$43.5 million in H1 2016)

-- Attributable net profit, before exceptional items US$49k

(US$13.4 million attributable net profit, before exceptional items,

in H1 2016)

-- Basic earnings per share 0.04 US cents before exceptional

items (Basic earnings per share 9.70 US cents before exceptional

items in H1 2016)

-- Cash on hand US$20.0 million

OPERATIONAL RESULTS:

LET ENG:

-- Waste tonnes mined of 15.0 million (15.3 million tonnes in H1 2016)

-- Ore treated of 3.2 million (3.3 million tonnes in H1 2016)

-- Carats recovered of 50 478 (57 380 carats in H1 2016)

-- Grade recovered of 1.59cpht (1.72cpht in H1 2016)

-- Rough tender revenue of US$88.8 million (US$106.2 million in H1 2016)

-- Average price of US$ 1 779 per carat achieved (US$1 899 per carat in H1 2016)

-- Recovered four diamonds greater than 100 carats

GHAGHOO:

-- Operation placed on Care and Maintenance on 31 March 2017

Commenting on the results today, Clifford Elphick, Chief

Executive of Gem Diamonds, said:

"The improvement in the greater than 100 carat diamond

recoveries at Letšeng is encouraging with the US$ per carat

achieved trending positively at US$1 779, up 20% from US$1 480 in

H2 2016. The latest sale in July achieved US$2 385 per carat. The

updated life of mine plan was implemented during the Period with

the objective of reducing waste tonnes mined and improve near term

cash flows, and mining progressed well against this plan during the

Period.

At Ghaghoo, the mine was successfully placed on care and

maintenance during the Period which will result in further cost

optimisation during the remainder of the year. Shareholders are

advised that an offer to acquire 100% of the Ghaghoo asset has been

received and the Board is considering the offer.

The cost reduction and transformation programme is firmly

underway and at this early stage US$15 million of annualised

efficiency and cost reduction initiatives have already been

identified for implementation from October 2017."

The Company will host a live audio webcast presentation of the

half year results today, 17 August 2017, at 09:30 BST. This can be

viewed on the Company's website:www.gemdiamonds.com

This announcement contains inside information for the purpose of

Article 7 of Regulation (EU) No596/2014.

The Gem Diamonds Limited LEI number is 213800RC2PGGMZQG8L67.

FOR FURTHER INFORMATION:

Gem Diamonds Limited

ir@gemdiamonds.com

Celicourt Communications

Mark Antelme / Jimmy Lea

Tel: +44 (0) 207 520 9265

ABOUT GEM DIAMONDS:

Gem Diamonds is a leading global diamond producer of high value

diamonds. The Company owns 70% of the Letšeng mine in Lesotho and

100% of the Ghaghoo mine in Botswana. The Letšeng mine is famous

for the production of large, top colour, exceptional white

diamonds, making it the highest dollar per carat kimberlite diamond

mine in the world. The Ghaghoo mine in Botswana has been placed on

care and maintenance until market conditions allow for

recommencement of production.

www.gemdiamonds.com

Interim Business Review

The first half of 2017 (the Period), saw an improvement in the

recovery of large diamonds at the Letšeng mine with four diamonds

greater than 100 carats being recovered during the Period. The

demand for Letšeng's high-value diamonds remained firm, achieving

an average price of US$1 779* per carat during the Period. This

average price is 20% higher than that achieved for the prior

six-month period (H2 2016) of US$1 480*.

Letšeng successfully implemented an updated Life of Mine plan

during the Period which is designed to reduce waste mined and

improve near term cash flows. Mining progressed well during the

Period and is in line with this mine plan. During the Period,

construction of the relocated mining complex, which is financed

through bank funding, commenced. Construction progressed well and

is expected to be completed in early 2018, on time and on budget.

Following the disbandment of the Lesotho Parliament in early 2017,

peaceful elections were concluded in June when a new government was

elected. Initial engagement with the new government has commenced

positively with the aim of developing effective relationships.

In February 2017, the Board decided to place the Ghaghoo mine on

care and maintenance to preserve the value of the asset while

continuing to monitor viable options for the mine. This decision

was based on the decrease in the prices achieved for its diamonds

from US$ 210 per carat in early 2015 to US$ 142 per carat at its

sale in December 2016, reflecting the weak state of the diamond

market for this category of diamonds. The care and maintenance

status was successfully achieved during the Period, in line with

management's objective to maintain the asset as a going concern.

The planned annual care and maintenance cost of US$3.0 million is

expected to be achieved in H2 2017.

As part of the Group's cash preservation focus, a Group-wide

cost efficiency and bench-marking review has commenced and has

already identified opportunities that are being actively

pursued.

The Group ended the Period with a cash balance of US$20.0

million which included utilised facilities of US$34.2 million,

resulting in a net debt position of US$14.2 million and unutilised

facilities of US$36.2 million. Subsequent to Period end, the Group

successfully restructured its existing US$35.0 million Revolving

Credit Facility at the corporate office into a new US$45.0 million

facility with a tenure of 3.5 years, thereby increasing the current

available facilities to US$45.1 million.

During the Period, Roger Davis stepped down as Chairman of the

Group and was succeeded by Harry Kenyon-Slaney who was appointed to

as Chairman to the Board on 6 June 2017. Harry's wide-ranging

experience, knowledge and contacts in the diamond mining industry

are perfectly suited to lead Gem Diamonds forward. During the

Period, the Letšeng Chief Executive Officer, Ms. Mazvi Maharasoa,

retired from the organisation after 10 years of diligent service.

As part of the restructuring following her retirement, a new Chief

Operating Officer, Jeremy Taylor, has been appointed. Jeremy brings

to Letšeng a wealth of experience that will drive Letšeng's focus

on improving operational excellence.

Diamond market

The global market for both rough and polished diamonds remained

cautious. Financing challenges persist and the volatile

macro-economic environment continues to create challenges for the

middle diamond market. In the medium to long term, rough diamond

prices are expected to be supported by favourable demand/supply

fundamentals, which are underpinned by a continued growth in demand

from emerging markets coupled with a limited growth in supply.

Against this background, Letšeng's large, high quality goods

continued to perform well, as demonstrated by the price achieved

for an exceptional high-value 8.65 carat pink diamond which was

sold for US$164 855 per carat, the sixth highest single diamond per

carat value achieved at Letšeng. In addition, one of the large high

value white diamonds achieved the highest price per carat for a

Letšeng white diamond since February 2016. A moderate increase was

also seen in the prices achieved for certain categories of the

smaller goods.

Health, safety, corporate social responsibility and environment

(HSSE)

The Group remains committed to its goal of zero harm to its

people and the environment and strives to achieve its operational

goals within its sustainable development framework. The Group

reports a fatality and lost time injury (LTI) free Period,

resulting in a Group-wide lost time injury frequency rate (LTIFR)

of 0.00. The Group-wide all injury frequency rate (AIFR) is 1.69

for the Period. No major or significant environmental or

stakeholder incidents were reported over the Period and the Group

continues to work closely with project affected communities to

implement sustainable community projects.

(* Includes carats extracted for manufacturing at rough

valuation)

Operating review: Letšeng

Sustainability overview

-- Zero LTI's

-- LTIFR 0.00

-- AIFR 1.67

-- Zero major or significant stakeholder and environmental incidents

Operational overview

-- Waste tonnes mined of 15.0 million (15.3 million tonnes in H1 2016)

-- Ore treated of 3.2 million (3.3 million tonnes in H1 2016)

-- Carats recovered of 50 478 (57 380 carats in H1 2016)

-- Grade recovered of 1.59cpht (1.72cpht in H1 2016)

-- Rough tender revenue of US$88.8 million* (US$106.2 million* in H1 2016)

-- Average price of US$ 1 779* per carat achieved (US$1 899* per carat in H1 2016)

-- Recovered four diamonds greater than 100 carats

(* Includes carats extracted for manufacturing at rough

valuation)

Operational performance

H1 2017 H1 2016

=============================== ========= =========

15 004 15 287

Waste mined (tonnes) 160 897

=============================== ========= =========

Ore treated (tonnes) 3 178 631 3 336 300

=============================== ========= =========

Carats recovered 50 478 57 380

=============================== ========= =========

Grade recovered (cpht) 1.59 1.72

=============================== ========= =========

Carats sold 49 930 55 948

=============================== ========= =========

Average price per carat (US$)* 1 779 1 899

=============================== ========= =========

(* Includes carats extracted for manufacturing at rough

valuation)

Gem Diamonds owns 70% of Letšeng Diamonds (Letšeng) in

partnership with the government of the Kingdom of Lesotho, which

owns the remaining 30%. Letšeng was acquired in July 2006. The

Letšeng mine, famous for its exceptional top-quality diamonds and

having the highest proportion of large, high-value diamonds, is the

highest average dollar per carat kimberlite diamond mine in the

world.

Letšeng started mining in line with its updated mine plan during

the Period with the aim to reduce and smooth the waste profile over

the remaining Life of Mine. This plan had a material positive

impact on the maximum annual volumes of waste stripping, improving

near term cash flows. The deferral of waste resulted in a reduction

of mining cash costs amounting to LSL100 million (US$7.6 million)

for 2017.

Letšeng treated a total of 2.6 million tonnes of ore through its

two main plants during the Period, of which 69% was sourced from

the Main pipe, and 31% from the Satellite pipe. Alluvial Ventures,

who operate a third plant at Letšeng, treated the balance of 0.6

million tonnes in the Period, 71% of which was sourced from the

Main pipe and 29% from ore stockpiles. The contract with Alluvial

Ventures was extended for a further two years, to the end of

2018.

The lower than planned ore tonnes treated during the Period was

due to reduced plant availability and downtime associated with the

installation and commissioning of the split front-ends for Plants 1

and 2. The availability issues have largely been addressed by mine

management and the processing contractor. A significant amount of

time and resources were utilised in addressing these issues and as

a consequence, availability of both plants have improved towards

the end of the Period.

The project to split the front ends of both plants was completed

in March 2017, on time and within budget, resulting in the

following benefits:

-- Increased ability to set up the individual plants to treat specific material;

-- Improved understanding of the performance of each plant

depending on the material being treated; and

-- Improved understanding of diamond damage related issues, specific to each plant.

During the Period, 50 478 carats were recovered (12% lower than

H1 2016), primarily due to lower tonnages treated and lower grades

recovered. The recovered grade for the Period was 1.59 carats per

hundred tonnes (cpht) against an expected reserve grade of 1.63

cpht. The lower than expected grade was mainly due to the

underperformance of the Main pipe contact material and internal

changes in the geology of this pipe.

Recovery of large diamonds has improved, with four greater than

100 carat diamonds and two exceptional D-colour Type IIa diamonds

of 98.42 and 80.58 carats being recovered during the Period. The

table below shows the frequency of large diamonds recovered in the

Period compared to prior years.

Frequency of recovery of large diamonds

2008 2009 2010 2011 2012 2013 2014 2015 2016 H1 2017

=============== ==== ==== ==== ==== ==== ==== ==== ==== ==== =======

Number of

diamonds

=============== ==== ==== ==== ==== ==== ==== ==== ==== ==== =======

>100 carats 7 6 7 6 3 6 9 11 5 4

=============== ==== ==== ==== ==== ==== ==== ==== ==== ==== =======

60-100 carats 18 11 11 22 17 17 21 15 21 8

=============== ==== ==== ==== ==== ==== ==== ==== ==== ==== =======

30-60 carats 96 79 66 66 77 60 74 65 70 34

=============== ==== ==== ==== ==== ==== ==== ==== ==== ==== =======

20-30 carats 108 111 101 121 121 82 123 126 83 50

=============== ==== ==== ==== ==== ==== ==== ==== ==== ==== =======

Total diamonds

> 20 carats 229 207 185 215 218 165 227 217 179 96

=============== ==== ==== ==== ==== ==== ==== ==== ==== ==== =======

The construction of the relocated mining complex, which is

required to make way for the expansion of the open pits, progressed

well and the project is currently on schedule and tracking against

budget. Bank funding has been secured for this project.

A core drilling programme will be implemented during the second

half of the year to improve confidence in the geology at depth,

including volume, grade, and revenue inputs of the resource.

Details of overall costs and capital expenditure incurred at

Letšeng during the Period are included in the Group financial

performance section.

Diamond sales

Four tenders were completed during H1 2017, with a total of 49

930 carats sold in Antwerp through Gem Diamonds Marketing Services,

a wholly owned Gem Diamonds subsidiary. Rough tender revenue of

US$88.8 million* with an average price of US$1 779* per carat was

achieved, bringing the 12-month rolling US$ per carat average to

US$1 625* per carat.

HSSE

No LTI's were recorded at Letšeng during the Period, resulting

in an LTIFR of 0.00. The AIFR for the Period was 1.67. Letšeng

continues to work towards its goal of zero harm and has implemented

various health and safety management initiatives aimed at building

on the existing culture of behaviour based care.

Zero significant or major environmental incidents have occurred

at the operation during the Period and Letšeng is continuing with

its environmental stewardship work through initiatives such as

rehabilitation trials, water protection programmes and waste

management plans.

Letšeng has continued with the successful implementation of its

corporate social investment (CSI) plan with the focus being on

small and medium enterprise development and support to projects

within the affected communities. These projects include the

Botha-Bothe Vegetable Project and the Dairy Project in

Mokhotlong.

No significant or major environmental or stakeholder incidents

were recorded in the Period.

H2 2017 and onwards

The focus at Letšeng will be on the following key areas:

-- engage and build relationships with the newly elected government in Lesotho;

-- continue to pursue and implement efficiency and cost reduction initiatives identified;

-- continue work streams on enhancing value through reducing diamond damage;

-- annual revision of the mining plan to further enhance value; and

-- deliver the mining complex on time and on budget.

(* Includes carats extracted for manufacturing at rough

valuation)

Operating review: Ghaghoo

Sustainability overview

-- Zero LTI's

-- LTIFR 0.00

-- AIFR 2.14

-- Zero major or significant stakeholder or environmental incidents

Operational overview

-- Operation placed on care and maintenance on 31 March 2017

Gem Diamonds owns 100% of Gem Diamonds Botswana (the Ghaghoo

mine) which lies within the Central Kalahari Game Reserve. The mine

was officially opened in September 2014. Owing to the suppressed

diamond market for the size and quality of goods produced by

Ghaghoo, the decision to place the operation on care and

maintenance was taken in February 2017, with full care and

maintenance status being achieved in March 2017. The mine is being

maintained in such a way to ensure that when the diamond market

recovers, the operation can be brought back into production. The

Ghaghoo resource is significant, with over 20 million carats and an

in-situ value in excess of US$4 billion.

The operational performance up until the operation was placed on

care and maintenance is set out in the table below.

Operational performance

H1 2017 H1 2016

=========================== ======= =======

Development mined (metres) 97 1 168

=========================== ======= =======

Ore treated (tonnes) 43 991 95 569

=========================== ======= =======

Carats recovered 8 084 20 876

=========================== ======= =======

Grade recovered (cpht) 18.4 21.8

=========================== ======= =======

Carats sold - 30 277

=========================== ======= =======

Average price per carat

(US$) - 157

=========================== ======= =======

During the Period, an earthquake of magnitude 6.5 with an

epicentre 25km from the mine, occurred. There was superficial

damage to the surface infrastructure, however the earthquake

damaged the seal of the underground water fissure. This led to a

large influx of water into the underground workings of the mine.

This water is successfully being pumped out of the mine and

rehabilitation of the seal will be completed in Q3 2017.

A significant amount of work has been done to put the operation

on care and maintenance. All contracts have been renegotiated and

modified for the new operating environment. The majority of the

once off costs relating to retrenchment and the renegotiated

contracts to place the operation on care and maintenance have been

incurred. Once the water fissure has been sealed, the operation's

annual care and maintenance costs will return to the anticipated

costs of US$3.0 million per annum.

The Company continues to evaluate the diamond market conditions

for the Ghaghoo diamonds. The sale of the final c.13 000 carats on

hand will be finalised in Q3 2017.

Operating review: Sales, marketing and manufacturing

Operational overview

-- Sales of US$88.8 million* with an average price of US$1 779*

per carat achieved for Letšeng's production

-- 18 rough diamonds sold for more than US$1.0 million each at a

total value of US$37.0 million

-- Sales of polished diamonds contributed US$0.7 million of additional margin to the Group

The Group's in-house sales and marketing function provides a

flexible sales strategy with multiple marketing channels to

maximise revenue from the Group's production. This is achieved

through competitive tenders and other targeted sales and marketing

channels for its rough and polished diamonds.

The Group's rough diamond analysis capabilities provide in-depth

knowledge of the value of Letšeng's large, rough diamonds and are

vital in the setting of appropriate reserve prices for the diamonds

to be sold at each tender.

The Group selectively manufactures some of its own high-value

rough diamonds and has the flexibility to place other exceptional

diamonds into strategic partnership arrangements with select

customers in order to achieve additional margins along the diamond

value chain.

Sales and marketing

Gem Diamonds owns 100% of Gem Diamonds Marketing Services (GDMS)

which markets and sells Letšeng's rough diamond production through

an electronic tender platform. The tender platform is designed to

enhance engagement with customers by allowing continual access,

flexibility and communication, as well as ensuring transparency

during the tender process. Although viewing of Letšeng's diamonds

take place in Antwerp, the electronic tender platform allows

customers the flexibility to participate in each tender from

anywhere in the world. This flexibility, together with the

professional and transparent manner in which the tenders are

managed and the reputable customers who participate in the tenders,

contribute to the strategy of achieving highest market-driven

prices for Letšeng's rough diamond production. A total of 367

clients viewed the diamonds during the four tenders held at the

GDMS premises during the Period.

During the first half of 2017, four Letšeng tenders were held

with 49 930 carats sold for a total value of US$88.8 million*,

achieving an average price of US$1 779* per carat. The highest US$

per carat achieved for a rough diamond was US$164 855 per carat for

an 8.65 carat pink diamond that was sold on tender. One of the

large high value white diamonds achieved the highest US$ per carat

for a white diamond since February 2016.

During the Period, nine diamonds totaling 464.3 carats were sold

into partnership arrangements at a total rough value of US$12.5

million. In addition to the rough value, Letšeng will share in the

revenue uplift at the time of the sale of the resultant polished

diamonds.

Analysis and manufacturing

Rough diamonds selected for own manufacturing are analysed,

planned and managed by Baobab Technologies (Baobab), a 100% owned

subsidiary of Gem Diamonds. The final polished diamonds are sold by

GDMS through direct selling channels to reputable high-end

diamantaires.

Baobab analysed 27 of Letšeng's large, exceptional quality rough

diamonds during the Period and 42 third-party diamonds.

(* Includes carats extracted for manufacturing at rough

valuation)

Group financial performance

Results overview

-- Revenue US$92.9 million (US$109.1 million in H1 2016)

-- Underlying EBITDA(1) US$13.0 million (US$43.5 million in H1 2016)

-- Attributable net profit, before exceptional items(2) US$49k

(US$13.4 million attributable net profit, before exceptional

items(2) , in H1 2016)

-- Basic earnings per share 0.04 US cents before exceptional

items(2) (Basic earnings per share 9.70 US cents before exceptional

items(2) in

-- H1 2016)

-- Cash on hand US$20.0 million

-- After the Ghaghoo once-off costs of US$3.0 million,

attributable loss for the Period was US$2.9 million resulting in a

loss per share of 2.11 US cents

H1 2017 H1 2017 H1 2017

Pre-exceptional Exceptional Post-exceptional

(US$ million) items Items(1) items H1 2016

================================ ================ ============ ================= =========

Revenue 92.9 - 92.9 109.1

Royalty and selling costs (8.4) - (8.4) (9.8)

Cost of sales(2) (66.7) (3.0) (69.7) (48.7)

Corporate expenses (4.8) - (4.8) (7.1)

================================ ================ ============ ================= =========

Underlying EBITDA(3) 13.0 (3.0) 10.0 43.5

================================ ================ ============ ================= =========

Depreciation and mining asset

amortisation (5.9) - (5.9) (5.0)

Share-based payments (0.8) - (0.8) (0.9)

Other income 0.1 - 0.1 0.1

Foreign exchange gain 1.1 - 1.1 1.9

Net finance costs (2.2) - (2.2) (0.4)

Impairment(1) - - - (40.0)

================================ ================ ============ ================= =========

Profit/(loss) before tax 5.3 (3.0) 2.3 (0.8)

================================ ================ ============ ================= =========

Income tax expense (1.7) - (1.7) (15.1)

================================ ================ ============ ================= =========

Profit/(loss) for the Period 3.6 (3.0) 0.6 (15.9)

Non-controlling interests (3.5) - (3.5) (10.7)

================================ ================ ============ ================= =========

Attributable Profit/(loss) 0.1 (3.0) (2.9) (26.6)

================================ ================ ============ ================= =========

Earnings/(loss) per share (US

cents) 0.04 (2.15) (2.11) 9.70

================================ ================ ============ ================= =========

Loss per share after impairment - - - (19.23)

================================ ================ ============ ================= =========

(1 Exceptional costs relate to once-off costs associated with

placing Ghaghoo on care and maintenance during the Period. In 2016

the exceptional items related to an impairment charge to the

carrying) (value of the Ghaghoo development asset)

(2 Including waste stripping costs amortisation but excluding

depreciation and mining asset amortisation)

3 Underlying earnings before interest, tax, depreciation and

mining asset amortisation (EBITDA) as defined in Note 5 of the

condensed notes to the consolidated interim financial

statements

During the Period, there was a continued focus on cash

generation which was aided by the successful implementation of the

updated Life of Mine plan at Letšeng and the decision to place

Ghaghoo on care and maintenance. The updated Life of Mine plan had

a positive impact on the near term cashflows as a result of

optimising the waste profile by reducing the maximum annual volumes

of waste stripping. The improved recovery of greater than 100 carat

diamonds during the Period (four in H1 2017) was encouraging and

aligned with management's expectation that the variability in the

resource would revert back to normalised levels during the year

when compared to the previous year. Care and maintenance status at

Ghaghoo was achieved during the Period and will result in reduced

costs for the operation in the latter half of the year. As part of

the Group's continued focus on cost discipline, a Group-wide

efficiency and cost reduction review has commenced and has already

identified various opportunities which will be actively

pursued.

Revenue

The Group continues with its objective of maximising the value

achieved on rough and polished diamond sales. The Group's revenue

during the Period was primarily derived from its mining operations

in Lesotho (Letšeng) and to a lesser extent through additional

margin generated from its rough diamond manufacturing operation in

Belgium. The market for both rough and polished diamonds remained

cautious for the first six months of the year. Letšeng's large

high-quality white rough diamonds however continued to be in strong

demand and the improvement in the frequency of the recovery of

these types of diamonds saw four diamonds greater than 100 carats

being recovered during the Period, compared to a total of five for

the full 2016 year.

Group revenue of US$92.9 million in the Period was 15% lower

than that achieved in H1 2016. Letšeng achieved an average of

US$1 779* per carat (US$1 899* per carat in H1 2016) during the

Period which was 20% higher than that achieved for the immediately

preceding six-month period, H2 2016, of US$1 480*. During the

Period, two of the greater than 100 carat diamonds which were

recovered, were sold, with the remaining two recovered late in Q2

2017 sold after Period end. In addition to the two greater than 100

carat diamonds sold, exceptional high-value diamonds which

contributed to the increased average price achieved (compared to H2

2016), included an 8.65 carat pink diamond which was sold for

US$164 855 per carat and two exceptional D-colour Type IIa diamonds

of 98.42 and 80.58 carats.

Letšeng revenue

H1 2017 H1 2016

=============================== ======= =======

Carats sold 49 930 55 948

=============================== ======= =======

Average price per carat (US$)* 1 779 1 899

=============================== ======= =======

(* Includes carats extracted for manufacturing at rough

valuation)

The Group's manufacturing operation contributed additional

revenue of US$3.9 million, comprising US$0.7 million polished

margin and US$3.2 million from the effect of recognising Group

revenue from the movement in own manufactured closing inventory for

the Period. There were no sales of Ghaghoo production in the

Period. The final production of c.13 000 carats is anticipated to

be sold in Q3 2017.

Group revenue summary

H1 2017 H1 2016

============================ ======= =======

Sales - rough 88.8 106.2

============================ ======= =======

Sales - polished margin 0.7 1.2

============================ ======= =======

Sales - other 0.2 0.1

============================ ======= =======

Impact of movement in

own manufactured inventory 3.2 1.6

============================ ======= =======

Group revenue 92.9 109.1

============================ ======= =======

Royalties consist of an 8% levy paid to the Lesotho Revenue

Authority on the sale of diamonds in Lesotho. Diamond selling and

marketing-related expenses are incurred by the Group's sales and

marketing operation in Belgium. During the Period, royalties and

selling costs decreased by 14% to US$8.4 million, driven by lower

sales.

Operations

While revenue is generated in US dollars, the majority of

operational expenses are incurred in the relevant local currency in

the operational jurisdictions. The Lesotho loti (LSL) (pegged to

the South African Rand) and Botswana Pula (BWP) were stronger

against the US dollar during the Period (compared to the same

period in 2016) which negatively impacted the Group's US dollar

reported costs. Group cost of sales for the Period was US$66.7

million, compared to US$48.7 million in H1 2016, the majority of

which was incurred at Letšeng.

Exchange rates H1 2017 H1 2016 % change

============================== ======= ======== ========

LSL per US$1.00

============================== ======= ======== ========

Average exchange rate for the

Period 13.21 15.41 (14%)

============================== ======= ======== ========

Period-end exchange rate 13.10 14.65 (11%)

============================== ======= ======== ========

BWP per US$1.00

============================== ======= ======== ========

Average exchange rate for the

Period 10.41 11.13 (6%)

============================== ======= ======== ========

Period-end exchange rate 10.26 10.85 (5%)

============================== ======= ======== ========

US$ per GBP1.00

============================== ======= ======== ========

Average exchange rate for the

Period 1.26 1.43 (12%)

============================== ======= ======== ========

Period-end exchange rate 1.30 1.34 (3%)

============================== ======= ======== ========

Letšeng mining operation

Cost of sales for the year was US$61.7 million, up 33.0% from

US$46.4 million in H1 2016, an increase of US$15.3 million of which

US$13.7 million represents an increase in waste stripping

amortisation costs due to the mining mix. Total waste stripping

costs amortised of US$31.7 million were incurred compared to

US$18.0 million in H1 2016.

In line with the updated mine plan, 15.0 million tonnes of waste

were mined during the Period. Ore tonnes treated of 3.2 million

tonnes were 4.7% lower than H1 2016. Of the total ore treated, 2.6

million tonnes were treated through the Letšeng Plants, with a

Satellite to Main pipe ratio of 31:69, compared to 34:66 in H1

2016. Carats recovered during the Period of 50 478 were 12.0% lower

than H1 2016 driven by the lower tonnes treated.

H1 2017 H1 2016 % change

==================================== ======= ======= ========

US$ (per unit)

==================================== ======= ======= ========

Direct cash cost (before waste)

per tonne treated(1) 12.23 9.48 (29%)

==================================== ======= ======= ========

Operating cost per tonne treated(2) 19.81 14.26 (39%)

==================================== ======= ======= ========

Waste cash cost per waste tonne

mined 2.53 1.80 (41%)

==================================== ======= ======= ========

Local currency (per unit) LSL

==================================== ======= ======= ========

Direct cash cost (before waste)

per tonne treated(1) 161.57 146.15 (11%)

==================================== ======= ======= ========

Operating cost per tonne treated(2) 261.63 219.70 (19%)

==================================== ======= ======= ========

Waste cash cost per waste tonne

mined 33.38 27.80 (20%)

==================================== ======= ======= ========

(1 Direct cash costs represent all operating costs, excluding

royalty and selling costs)

(2 Operating costs include waste stripping cost amortised,

inventory and ore stockpile adjustments, and excludes

depreciation)

Total direct cash costs (before waste costs) in local currency

increased by 5.3% to LSL513.6 million in H1 2017 compared to

LSL487.6 million in H1 2016. This resulted in a unit cost per tonne

treated of LSL161.57 relative to the prior year of LSL146.15,

representing an effective increase of 10.6%. This increase was

impacted by local country inflation and longer hauling distances as

a result of mining in deeper sections of both pits. The additional

increase in the unit costs is due to the lower ore tonnes treated

of 4.7% during the Period compared to H1 2016 with no commensurate

saving in fixed costs.

Operating costs per tonne treated of LSL261.63 were 19.1% higher

than H1 2016's cost of LSL219.70 per tonne treated. The increase

was mainly driven by higher waste amortisation costs during the

Period, as a result of the different waste to ore strip ratios for

the particular Satellite pipe ore mined. During the year, ore was

sourced from a cut within the Satellite pipe with a significantly

higher strip ratio compared to H1 2016. The amortisation charge

attributable to the Satellite pipe ore accounted for 76% of the

total waste stripping amortisation charge in the Period (H1 2016:

64%).

The increase in the local currency waste cash cost per waste

tonne mined of 20.1% was impacted by local country inflation costs

and longer haul distances for the various waste cut, in line with

the new mine plan adopted.

Other operating information

(US$ million) H1 2017 H1 2016

======================== ======= ========

Waste cost capitalised 42.9 31.3

======================== ======= ========

Waste stripping cost

amortised 31.7 18.0

======================== ======= ========

Depreciation and mining

asset amortisation 5.9 5.0

======================== ======= ========

Capital expenditure 7.2 3.7

======================== ======= ========

Ghaghoo mining operation

With the ongoing difficult market conditions for Ghaghoo's

production and the Company's focus on profitable production, the

decision was made to place the operation on care and maintenance.

As a result, all costs for the Period amounting to US$6.1 million

have been recognised in the income statement. The majority of these

costs related to the operating cost up to the date of care and

maintenance of US$2.6 million and once-off costs associated to

achieve care and maintenance status of US$3.0 million. These

once-off costs mainly relate to retrenchment costs and costs

associated with renegotiating and modifying existing contracts

under the new care and maintenance environment. These once-off

costs have been classified as exceptional items in the income

statement, having an overall effect of US Cents 2.15 on earnings

per share in the Period. The prior Period exceptional item relates

to the US$40.0 million impairment on Ghaghoo's development

asset.

Diamond manufacturing operation

The Group generated additional margin on selected high-value

diamonds through its manufacturing facilities and partnership

arrangements. The diamond manufacturing operation in Antwerp

contributed US$0.7 million to Group revenue (through additional

polished margin generated) and US$0.4 million to underlying EBITDA.

Extracted diamond inventory on hand at the end of the Period was

US$1.2 million compared to US$4.4 million at 31 December 2016,

further increasing recognised Group revenue by US$3.2 million.

Corporate office

Corporate costs relate to central costs incurred by the Group

through its technical and administrative offices in South Africa

and the United Kingdom and are incurred in both South African Rand

and British Pound. Corporate costs for the Period amounted to

US$4.8 million (H1 2016: US$7.1 million).

The share-based payment charge for the Period amounted to US$0.8

million (H1 2016: US$0.9 million). On 4 July 2017 (post the Period

end), 1 335 000 nil-cost options were granted to certain key

employees and Executive Directors under the Long-term Incentive

Plan of the Company with similar conditions as previous awards

granted under this scheme. The charge of the new award will be

recognised in the income statement from its grant date.

Underlying EBITDA(1) and attributable profit

Based on the above operating results, the Group generated an

Underlying EBITDA(1) of US$13.0 million. The profit attributable to

shareholders for the Period was US$49k before exceptional items,

equating to an earnings per share of 0.04 US cents on a weighted

average number of shares in issue of 138.3 million. After including

the effect of the exceptional items of US$3.0 million, the Group's

attributable loss was US$2.9 million.

The forecast effective tax rate for the full year is 32.60% and

has been applied to the actual results for the Period. This rate is

the result of profits generated by Letšeng being taxed at 25.0%,

deferred tax assets not recognized on losses incurred in

non-trading operations which is partially offset by a reduction in

the deferred tax liability on unremitted earnings.

Financial position and funding review

The Group continued its prudent cash management and ended the

Period with cash on hand of US$20.0 million (31 December 2016:

US$30.8 million) of which US$16.1 million is attributable to Gem

Diamonds and US$0.2 million is restricted. At Period end, the Group

had utilised facilities of US$34.2 million, resulting in a net debt

position of US$14.2 million. Furthermore, standby undrawn

facilities of US$36.2 million remain available, comprising US$9.9

million at Gem Diamonds and US$26.3 million (of which US$11.0

million relates to the mining complex project funding) at

Letšeng.

The Group generated cash from operating activities

(pre-exceptional items) of US$37.1 million (30 June 2016: US$44.5

million) before investment in waste stripping costs at Letšeng of

US$42.9 million and capital expenditure of US$8.8 million, incurred

mainly at Letšeng.

After placing the Ghaghoo mine on care and maintenance, its

US$25.0 million fully accessed facility was settled by utilising

the available Gem Diamonds Limited US$35.0 million Revolving Credit

Facility (RCF). The Gem Diamonds Limited RCF was subsequently

restructured post Period end to increase it from a US$35.0 million

to a US$45.0 million facility. This restructured facility consists

of two tranches with the first tranche relating to the Ghaghoo

US$25.0 million debt whereby quarterly capital repayments have been

re-scheduled to commence in September 2018 with final repayment on

31 December 2020. The second tranche of US$20.0 million is a

revolving facility and includes an upsize mechanism whereby the

available facility of this tranche will increase by a ratio 0.6:1

for every repayment made under the first tranche.

During the Period, construction of the relocated mining complex,

which is bank funded, commenced. The loan is an unsecured project

debt facility for LSL215.0 million (US$16.4 million) which was

signed jointly with Nedbank Limited and the Export Credit Insurance

Corporation (ECIC). The loan is repayable in equal quarterly

payments commencing in September 2018. At Period end, LSL70.1

million (US$5.4 million) has been drawn down resulting in LSL144.9

million (US$11.0 million) being available.

At Period end US$3.8 million on the LSL250.0 million (US$19.1

million) revolving credit facility at Letšeng was utilised.

During the Period, no dividends were paid by Letšeng.

Outlook

Capital and cash management discipline remains a high priority

in the short term and the Company remains committed to generating

cash and strengthening its balance sheet.

The various opportunities identified through the efficiency and

cost reduction review will be actively pursued.

Options for the Ghaghoo asset will be considered and focus will

remain on further optimising the care and maintenance costs.

(1 Underlying earnings before interest, tax, depreciation and

mining asset amortization)

Risks to our business

The Group is exposed to a number of risks and uncertainties that

could have a material impact on its performance and long-term

growth. The effective identification, management and mitigation of

these risks and uncertainties are a core focus of the Group as they

are key to achieving the Company's strategic objectives.

Many of these risks are beyond the control of the Group but a

formal risk management process exists to assist in identifying and

reviewing potential risks. Mitigating plans are formulated and

reviewed regularly to understand their effectiveness and progress.

The Group is focused on continuously analysing and assessing the

risks faced and improving the risk management process

accordingly.

The Group internal audit function carries out a risk-based

programme approved by the Audit Committee to evaluate the

effectiveness and contribute to the improvement of risk management

controls and governance processes.

A reassessment of the principal risks and uncertainties, which

have been previously reported in the Business Overview in the 2016

Annual Report, has been performed to take into account the current

market and operational conditions. These may impact the Group over

the medium to long term; however, the following key risks (in no

particular order of priority) may impact the Group over the next

six months.

Cash generation (financial risk)

The lack of cash flow generation may negatively affect the

Group's ability to effectively operate, fund capital projects and

repay debt.

Cash flows which were negatively impacted by lower than expected

revenues achieved resulted in additional utilisation of debt

facilities. This was due to a lower number of high value diamonds

being recovered during the latter part of 2016 and Q1 2017

impacting the overall US$ per carat, and lower plant availability

impacting tonnage treated and carats recovered. Although a

significant amount of time and resources were utilised in

addressing the plant availability issues which have resulted in

improvements towards the end of the Period, the possibility of

further unplanned maintenance issues could further impact tonnage

treated in the short term. In Q2 2017, there has been an

improvement in the recoveries of the larger higher value diamonds

resulting in an increased overall US$ per carat, positively

contributing to cash flows. The Group has the ability to reassess

its capital projects and operational strategies. Strict treasury

management procedures are in place to monitor cash and capital

project expenditure.

In February 2017, the Board made a decision to place the Ghaghoo

mine on care and maintenance to preserve the value of the asset and

to reduce cash consumed. Although once off costs have been incurred

during the Period to bring the operation into care and maintenance

status it is expected that the reduction in cash consumption will

be realised in H2 2017.

Following the placing of Ghaghoo on care and maintenance, the

Company's US$35.0 million short term Revolving Credit Facility

(RCF) was utilised to repay the Ghaghoo US$25.0 million long term

facility. The Group successfully restructured its short term RCF

into a new US$45.0 million facility, deferring debt repayment

commitments. Refer to note 14, Interest-bearing loans and

borrowings for details of the tenure and structure.

To further improve cash generation, a Group-wide efficiency and

cost reduction review has commenced and has already identified

opportunities that are being actively pursued.

Currency volatility (financial risk)

The Group receives its revenue in US dollars, while its cost

base is incurred in the local currency of the various countries

within which the Group operates. The volatility of these currencies

trading against the US dollar impacts the Group's profitability and

cash. In order to mitigate currency risk, these fluctuations are

closely monitored and, when weaknesses in the local currency reach

levels where it would be appropriate, the Group enters into

exchange rate contracts to protect future cash flows.

Extreme volatility between the Lesotho loti and US dollar has

been experienced during the Period, and this is expected to

continue into H2 2017.

Rough diamond demand and prices (market risk)

While the medium to long-term fundamentals of the diamond market

remain intact, with demand forecast to outpace supply, in the short

term the prevailing climate of global economic uncertainty may

cause some volatility in rough diamond pricing. The cautious

approach adopted by rough and polished diamantaires and

manufacturers is expected to continue into the second half of the

year. Market conditions are constantly monitored to identify

current trends that pose a threat or create an opportunity for the

Group. The Group has flexibility in its sales processes.

Mineral resource risks (operational risk)

The Group's mineral resources influence the mine plans.

Uncertainty or underperformance of mineral resources could affect

the Group's ability to operate profitably. With Letšeng being the

world's lowest grade operating kimberlite mine, the risk of

resource underperformance is elevated. Various bulk sampling

programmes, combined with geological mapping and modelling methods,

significantly improve the Group's understanding of and confidence

in optimising the mining of its resources.

The short-term volatility in the mineral resource is evidenced

by the lower number of high quality diamonds which were recovered

in 2016. During the Period, an increase in the recovery of these

higher value diamonds contributed to an improved US$ per carat in

line with expectations.

A major production interruption (operational risk)

The Group may experience material mine and/or plant shut downs

or periods of decreased production due to numerous events. Any such

event could negatively affect the Group's operations and impact its

profitability and cash flows. The likelihood of possible

interruption events is continually reviewed and the appropriate

controls, processes and business continuity plans are in place to

immediately mitigate this risk.

Country and political risks (operational risk)

The political environments of the various jurisdictions that the

Group operates within may adversely impact the ability to operate

effectively and profitably. Emerging market economies are generally

subject to greater risks, including regulatory and political risk,

and can be exposed to a rapidly changing environment. Changes to

the political environment and regulatory developments are closely

monitored. Where necessary, the Group engages in dialogue with

relevant government representatives to remain well informed of all

legal and regulatory developments impacting its operations.

Following the disbandment of the Lesotho Parliament in early

2017, peaceful elections were concluded in June 2017 where a new

government was elected. Engagement with the new government has

commenced positively with the aim of developing effective

relationships.

Clifford Elphick

Chief Executive Officer

16 August 2017

Half-yearly financial statements

30 June 2017

Contents

Responsibility Statement of the Directors in Respect of the

Half-yearly Report and the Financial Statements

Independent Review Report to the Members of Gem Diamonds

Limited

Interim Consolidated Income Statement

Interim Consolidated Statement of Comprehensive Income

Interim Consolidated Statement of Financial Position

Interim Consolidated Statement of Changes in Equity

Interim Consolidated Statement of Cash Flows

Condensed Notes to the Consolidated Interim Financial

Statement

Responsibility Statement of the Directors in Respect of the

Half-yearly Report and Financial Statements

PURSUANT TO DISCLOSURE AND TRANSPARENCY RULES (DTR) 4.2.10

The Directors confirm that, to the best of their knowledge, this

condensed set of financial statements has been prepared in

accordance with IAS 34 Interim Financial Reporting and that the

Half-yearly Report includes a fair review of the information

required by DTR 4.2.7R and DTR 4.2.8R, namely:

(a) an indication of important events that have occurred during

the first six months of the financial year and their impact on this

condensed set of financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

(b) material related-party transactions in the first six months

of the year and any material changes in the related-party

transactions described in the Gem Diamonds Limited Annual Report

2016.

The names and functions of the Directors of Gem Diamonds are

listed in the Annual Report for the year ended 31 December 2016 and

updates have been disclosed in the Interim Business Review on pages

1 to 11.

For and on behalf of the Board

Michael Michael

Chief Financial Officer

16 August 2017

Independent Review Report to the Members of Gem Diamonds

Limited

We have been engaged by Gem Diamonds Limited (the Company) to

review the condensed consolidated set of financial statements

of the Company and its subsidiaries (the Group) in the

Half-yearly Report for the six months ended 30 June 2017 which

comprises the interim consolidated income statement, interim

consolidated statement of comprehensive income, interim

consolidated statement of financial position, interim

consolidated statement of changes in equity, interim

consolidated

statement of cash flows and the related explanatory notes. We

have read the other information contained in the Half-yearly Report

and considered whether it contains any apparent misstatements or

material inconsistencies with the information

in the condensed set of financial statements.

This report is made solely to the Company in accordance with

guidance contained in International Standard on Review Engagements

2410 (UK and Ireland) Review of Interim Financial Information

Performed by the Independent Auditor of the Entity issued by the

Auditing Practices Board. To the fullest extent permitted by law,

we do not accept or assume responsibility to anyone other than

the

Company, for our work, for this report, or for the conclusions

we have formed.

Directors' responsibilities

The Half-yearly Report is the responsibility of, and has been

approved by, the Directors. The Directors are responsible for

preparing the Half-yearly Report in accordance with the

Disclosure and Transparency Rules of the United Kingdom's

Financial

Conduct Authority. As disclosed in note 1.2.1 in the 2016

audited annual financial statements, the Annual Financial

Statements of

the Group are prepared in accordance with International

Financial Reporting Standards (IFRS). The condensed consolidated

set

of financial statements included in this Half-yearly Report have

been prepared in accordance with International Accounting

Standard 34 Interim Financial Reporting.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed consolidated set of financial statements in the

Half-yearly Report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 Review of

Interim

Financial Information Performed by the Independent Auditor of

the Entity issued by the Auditing Practices Board for use in

the

United Kingdom.

A review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing

(UK) and consequently does not enable us to obtain assurance that

we would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed consolidated set of

financial statements in the Half-yearly Report for the six months

ended 30 June 2017 are not prepared, in all material respects, in

accordance with International Accounting Standard 34 and the

Disclosure and Transparency Rules of the United Kingdom's Financial

Conduct Authority.

Ernst & Young LLP

London

16 August 2017

Interim Consolidated Income Statement

for the six months ended 30 June 2017

30 June 30 June

2017(1) 30 June 2016(1) 30 June

Before 2017(1) 30 June Before 2016(1) 30 June

exceptional Exceptional 2017(1) exceptional Exceptional 2016(1)

Notes item item Total item item Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

=========================================================== =================== =============== =================== ================= ================ =================

Revenue 3 92 908 - 92 908 109 140 - 109 140

(2 971) (53 (53

Cost of sales (72 458) (2) (75 429) 649) - 649)

=========================================================== =================== =============== =================== ================= ================ =================

Gross profit/(loss) 20 450 (2 971) 17 479 55 491 - 55 491

Other operating income 131 - 131 69 - 69

Royalties and selling

costs (8 397) - (8 397) (9 782) - (9 782)

Corporate expenses (4 937) - (4 937) (7 214) - (7 214)

Share-based payments

13 (842) - (842) (914) - (914)

Foreign exchange

gain 1 079 - 1 079 1 936 - 1 936

(40 000)

Impairment of asset - - - - (2) (40 000)

=========================================================== =================== =============== =================== ================= ================ =================

Operating profit/(loss)

3 7 484 (2 971) 4 513 39 586 (40 000) (414)

Net finance costs (2 218) - (2 218) (422) - (422)

Finance income

Finance costs

=========================================================== =================== =============== =================== ================= ================ =================

285 - 285 972 - 972

(2 503) - (2 503) (1 394) - (1 394)

=========================================================== =================== =============== =================== ================= ================ =================

Profit/(loss) before

tax 5 266 (2 971) 2 295 39 164 (40 000) (836)

Income tax expense

7 (1 717) - (1 717) (15 052) - (15 052)

=========================================================== =================== =============== =================== ================= ================ =================

(15

Profit/(loss) 3 549 (2 971) 578 24 112 (40 000) 888)

=========================================================== =================== =============== =================== ================= ================ =================

Attributable to:

Equity holders of (26

parent 49 (2 971) (2 922) 13 417 (40 000) 583)

Non-controlling interests 3 500 - 3 500 10 965 - 10 965

=========================================================== =================== =============== =================== ================= ================ =================

Earnings/(loss) per

share (cents)

0.04 - (2.11) 9.70 - (19.23)

* Basic earnings/(loss) for the Period attributable to

ordinary equity holders of the parent 0.04 - (2.11) 9.70 - (19.23)

- Diluted earnings/(loss)

for the Period

attributable to

ordinary equity holders

of the parent

=========================================================== =================== =============== =================== ================= ================ =================

1 Unaudited

2 Refer to Note 4, Exceptional items

Interim Consolidated Statement of

Comprehensive Income

for the six months ended 30 June 2017

30 June 30June

20171 20161

US$'000 US$'000

======================================= ============== ================

Profit/(loss) for the Period

Other comprehensive income that could

be classified to the income statement

in subsequent periods 578 (15 888)

Exchange differences on translation

of foreign operations 6 880 11 488

======================================= ============== ================

Other comprehensive income net of tax 6 880 11 488

======================================= ============== ================

Total comprehensive income/(expense) 7 458 (4 400)

Attributable to:

Equity holders of parent 4 797 (21 512)

Non-controlling interests 2 661 17 112

======================================= ============== ================

Total comprehensive income/(expense)

net of tax 7 458 (4 400)

======================================= ============== ================

1 Unaudited

Interim Consolidated Statement of

Financial Position

as at 30 June 2017

30 June 31 December

20171 2016(2)

Notes US$'000 US$'000

======================================= ================= ====================

ASSETS

Non-current assets

Property, plant and equipment 9 281 921 257 199

Investment property 615 615

Intangible assets 14 572 14 014

Receivables and other assets 10 27 31

======================================= ================= ====================

297 135 271 859

======================================= ================= ====================

Current assets 34 293 30 911

Inventories 5 695 6 557

Receivables and other assets 10 2 385 4 636

Income tax receivable 20 046 30 787

Cash and short-term deposits 11

======================================= ================= ====================

62 419 72 891

======================================= ================= ====================

Total assets 359 554 344 750

======================================= ================= ====================

EQUITY AND LIABILITIES

Equity attributable to equity holders

of the parent

Issued capital 12 1 386 1 384

885 648

Share premium (1) 885 648(1)

(134 937) (143 498)

Treasury shares3 (613 251) (610 329)

Other reserves (610 329)

Accumulated losses

======================================= ================= ====================

138 845 133 204

======================================= ================= ====================

Non-controlling interests 73 284 70 623

======================================= ================= ====================

Total equity 212 129 203 827

======================================= ================= ====================

Non-current liabilities

Interest-bearing loans and borrowings

14 5 354 -

Trade and other payables 1 709 1 409

Provisions 17 968 16 630

Deferred tax liabilities 69 297 65 676

======================================= ================= ====================

94 328 83 715

======================================= ================= ====================

Current liabilities

Interest-bearing loans and borrowings

14 28 895 27 757

Trade and other payables 23 903 29 012

Income tax payable 299 439

======================================= ================= ====================

53 097 57 208

======================================= ================= ====================

Total liabilities 147 425 140 923

======================================= ================= ====================

Total equity and liabilities 359 554 344 750

======================================= ================= ====================

1 Unaudited

2 Audited

3 Shares held by Gem Diamonds Limited Employee Share Trust

Interim Consolidated Statement of Changes in Equity

for the six months ended 30 June 2017

Attributable

to equity

holders

of the parent

Accu-

Issued Share Own Other mulated Non-controlling Total

capital premium Shares(2) reserves losses Total interests equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

==================== ======== ======== ========== ========= ======== ========= =============== =========

Balance at 885 (143 (610 133 203

1 January 2017 1 384 648 (1) 498) 329) 204 70 623 827

Total comprehensive

income/(expense) - - - 7 719 (2 922) 4 797 2 661 7 458

======== ======== ========== ========= ======== ========= =============== =========

(Loss)/profit (2

for the Period - - - - (2 922) 922) 3 500 578

Other comprehensive

income/(expense) - - - 7 719 - 7 719 (839) 6 880

======== ======== ========== ========= ======== ========= =============== =========

Share capital

issued (Note

12) 2 - - - - 2 - 2

Share-based

payments

(Note 13) - - - 842 - 842 - 842

==================== ======== ======== ========== ========= ======== ========= =============== =========

Balance at 885 (134 (613 138 212

30 June 20171 1 386 648 (1) 937) 251) 845 73 284 129

==================== ======== ======== ========== ========= ======== ========= =============== =========

Balance at 885 (163 (439 283 343

1 January 2016 1 383 648 (1) 420) 764) 846 59 923 769

======== ======== ========== ========= ======== ========= =============== =========

Total comprehensive (26 (21 (4

income/(expense) - - - 5 071 583) 512) 17 112 400)

======== ======== ========== ========= ======== ========= =============== =========

Loss/(profit) (26 (26 (15

for the Period - - - - 583) 583) 10 695 888)

Other comprehensive 11

income - - - 5 071 - 5 071 6 417 488

======== ======== ========== ========= ======== ========= =============== =========

Share-based

payments

(Note 13) - - - 954 - 954 - 954

Dividends paid (11 (11 (18

(Note 8) - - - - 755) 755) (6 246) 001)

==================== ======== ======== ========== ========= ======== ========= =============== =========

Balance at 885 (157 (478 251 322

30 June 2016(1) 1 383 648 (1) 395) 102) 533 70 789 322

==================== ======== ======== ========== ========= ======== ========= =============== =========

1 Unaudited

2 Shares held by Gem Diamonds Limited Employee Share Trust

Interim Consolidated Statement of Cash Flows

for the six months ended 30 June 2017

30 June 30 June

20171 20161

Notes US$'000 US$'000

=============================================== ==================== =========================

Cash flows from operating activities

Cash generated by operations 15.1

Working capital adjustments 15.2 34 202 44 454

=============================================== ==================== =========================

42 070 59 463

(7 967) (529)

=============================================== ==================== =========================

34 103 58 934

285 1 089

(1 890) (1 839)

1 704 (13 730)

=============================================== ==================== =========================

Interest received Interest paid

Income tax received/(repaid)

=============================================== ==================== =========================

Cash flows used in investing activities

Purchase of property, plant and equipment

9

Ghaghoo costs capitalised 9

Letšeng waste cost capitalised

9

Proceeds from sale of property, plant

and equipment (51 685) (45 599)

=============================================== ==================== =========================

(8 808) (5 982)

(8 375) (31

- (42 877) 269)

- 27

=============================================== ==================== =========================

Cash flows from/(used in) financing

activities 6 346 (20 669)

==================== =========================

Financial liabilities raised 49 318 -

Financial liabilities repaid (42 972) (2 667)

==================== =========================

Net financial liabilities raised/(repaid) 6 346 (2 667)

Dividends paid to equity holders of

the parent Dividends paid to non-controlling

interests - (11 755)

- (6 247)

==================== =========================

Net decrease in cash and cash equivalents

Cash and cash equivalents at beginning

of Period

Foreign exchange differences (11 137) (21 814)

==================== =========================

30 787 85 719

396 2 551

==================== =========================

Cash and cash equivalents at end of

Period

Cash and cash equivalents at end of

Period held with banks

Restricted cash at end of Period

Cash and cash equivalents at end of

Period 11 20 046 66 456

=============================================== ==================== =========================

19 879 63 785

167 2 671

=============================================== ==================== =========================

20 046 66 456

=============================================== ==================== =========================

1 Unaudited

Condensed Notes to the Consolidated

Interim Financial Statements

for the six months ended 30 June 2017

1. Corporate information

1.1 Incorporation and authorisation

The holding company, Gem Diamonds Limited (the Company), was

incorporated on 29 July 2005 in the British Virgin

Islands. The Company's registration number is 669758.

The financial information shown in this report relating to Gem

Diamonds Limited and its subsidiaries (the Group) was

approved by the Board of Directors on 16 August 2017, is

unaudited and does not constitute statutory financial

statements.

The report of the auditors on the Group's 2016 Annual Report and

Accounts was unqualified.

The Group is principally engaged in operating of diamond

mines.

2. Basis of preparation and accounting policies

2.1 Basis of presentation

The condensed consolidated interim financial statements for the

six months ended 30 June 2017 (the Period) have been

prepared in accordance with IAS 34 Interim Financial Reporting.

The condensed consolidated interim financial statements

do not include all the information and disclosures required in

the annual financial statements and should be read in

conjunction with the Group's Annual Financial Statements for the

year ended 31 December 2016.

Going concern

The Group's business activities, together with the factors

likely to affect its future development, performance and

position

are set out in the Interim Business Review on pages 1 to 11. The

financial position of the Group, its cash flows and liquidity

position are described in the Interim Business Review on pages 6

to 11.

After making enquiries which include reviews of forecasts and

budgets, timing of cash flows, borrowing facilities and

sensitivity analyses and considering the uncertainties described

in this report either directly or by cross reference, the

Directors

have a reasonable expectation that the Group and the Company

have adequate financial resources to continue in operational

existence for the foreseeable future. For this reason, they

continue to adopt the going concern basis in preparing this

half-yearly

report and accounts of the Group.

2.2 Significant accounting policies

The accounting policies adopted in the preparation of the

condensed consolidated interim financial statements are

consistent

with those followed in the preparation of the Group's Annual

Financial Statements for the year ended 31 December 2016,

except for the adoption of new standards and amendments as of 1

January 2017. The Group has not early adopted any other

standard, interpretation or amendment that has been issued but

is not yet effective.

2. Basi s of preparation and accounting policies (continued)

2.2 Significant accounting policies (continued)

Standards issued but not effective

The standards and interpretations that are

issued, but not yet effective, up to the date

of issuance of the Group's financial statements

are disclosed below. The Group intends to adopt

these standards if applicable when they become

effective.

Standard, amendment

interpretation Effective date*

IFRS Classification Amendments to IFRS 1 January

2 and measurement 2 in relation to the 2018

of Share-based classification and

Payment Transactions measurement of share-based

payment transactions.

The Group will assess

the impact prior to

the effective date.

===== ====================== ============================ ==========

IFRS Financial Classification and 1 January

9 Instruments measurement of financial 2018

assets and financial

liabilities that replaces

IAS 39. The Group

will assess the impact

prior to the effective

date.

===== ====================== ============================ ==========

IFRS Revenue from The new revenue standard 1 January

15 Contracts introduces a single, 2018

with Customer principles- based,

five-step model for

the recognition of

revenue when control

of a good or service

is transferred to

the customer. The

Group is currently

reviewing the potential

impact of IFRS 15.

===== ====================== ============================ ==========

IFRS Leases The new standard requires 1 January

16 lessees to recognise 2019

assets and liabilities

on their balance sheets

for most leases, many

of which may have

been off balance sheet

in the past. The Group

will assess the impact

prior to the effective

date.

===== ====================== ============================ ==========

Annual periods beginning on or after

3. Segment information

For management purposes, the Group is organised into

geographical units as its risks and required rates of return are

affected predominantly by differences in the geographical regions

of the mines and areas in which the Group operates. Other regions

where no direct mining activities take place are organised into

geographical regions in the areas where the operations are managed.

The main geographical regions and the type of products and services

from which each reporting segment derives its revenue from are:

-- Lesotho (diamond mining activities);

-- Botswana (diamond mining activities through Ghaghoo, which

was placed on care and maintenance in February 2017, and sales

and marketing of diamonds through Gem Diamonds Marketing

Botswana (Proprietary) Limited);

-- Belgium (sales, marketing and manufacturing of diamonds);

and

-- BVI, RSA and UK (technical and administrative services).

Management monitors the operating results of the geographical

units separately for the purpose of making decisions about resource

allocation and performance assessment.

Segment performance is evaluated based on operating profit or

loss. Inter-segment transactions are entered into under normal

arm's-length terms in a manner similar to transactions with third

parties. Segment revenue, segment expenses and segment results

include transactions between segments. Those transactions are

eliminated on consolidation.

Segment revenue is derived from mining activities, polished

manufacturing margins and Group services.

The following tables presents revenue and profit, and asset and

liability information from operations regarding the Group's

geographical segments:

BVI,

Lesotho Botswana Belgium RSA and Total

Six months ended US$'000 US$'000 US$'000 UK(2) US$'000

30 June 2017(1) US$'000

======================= ========== =========== ========== ========= ==========

Revenue

88 185

Total revenue 068 - 92 776 4 913 757

(87 (92

Inter-segment 713) - (388) (4 748) 849)

======================= ========== =========== ========== ========= ==========

92

External customers 355 - 92 388 165(2) 908

======================= ========== =========== ========== ========= ==========

Segment operating 16

profit/(loss) 328 (5 824) 109 (6 100) 4 513

(2

Net finance costs 218)

======================= ========== =========== ========== ========= ==========

Profit before tax 2 295

(1

Income tax expense 717)

======================= ========== =========== ========== ========= ==========

Profit for the Period

after exceptional