TIDMGEMD

RNS Number : 5017U

Gem Diamonds Limited

30 July 2015

30 July 2015

GEM DIAMONDS LIMITED

H1 2015 Trading Update

Gem Diamonds Limited (LSE: GEMD) is pleased to provide a Trading

Update detailing the Company's operational and sales performance

for the period 1 January 2015 to 30 June 2015 (H1 2015) (the

Period), ahead of its Half Yearly results which will be released on

19 August 2015.

Letšeng:

Successful delivery of projects and solid operational

performance; prices achieved for high value diamonds remain firm

despite difficult market conditions

-- Average price of US$ 2 264 per carat was achieved in H1 2015

(US$ 2 338 per carat in H2 2014)

-- 13 rough diamonds achieved a value of greater than US$ 1.0 million each

-- In addition to the 314 carat Type IIa white diamond

previously reported, another outstanding quality 357 carat Type IIa

white diamond was recovered and is expected to be sold in Q3

2015

-- Further four diamonds of over 100 carats each were sold in

the Period, including a top quality 108 carat Type IIa rough

diamond which sold for US$ 65 226 per carat

-- The Plant 2 Phase 1 upgrade and the Coarse Recovery Plant

construction were successfully completed on time and within budget.

On the first day of its operation, the new XRT unit recovered a

high quality 52 carat Type IIa diamond

Ghaghoo:

Recovered grade in latter part of H1 2015 was above reserve

grade; recovery of larger diamonds beginning to fill gaps in size

frequency distribution model

-- Recovered grade fluctuated between 28 and 30 cpht in the last

two months of H1 2015 (compared to the reserve grade of 27.8

cpht)

-- Small size blue and pink coloured diamonds recovered;

confirming presence of these valuable diamonds in the ore body

-- 5 stoping tunnels opened providing increased ore availability

-- A 48 carat diamond was recovered in July 2015 with an

increasing number of diamonds in the 10 to 30 carat size range

being recovered, albeit still below modelled frequencies

-- A second parcel of 29 891 carats of commissioning phase

production sold for US$ 4.9 million in July 2015 (US$ 165 per

carat) in a difficult market

Financial:

-- The Group had US$ 83.8 million cash on hand as at 30 June

2015, of which US$ 70.5 million is attributable to Gem Diamonds

-- The Group has drawn down US$ 34.2 million of its available

facilities, resulting in a net cash position of US$ 49.6

million

-- A maiden annual dividend of 5 US cents per share (US$ 6.9 million) was paid on 9 June 2015

Gem Diamonds' CEO, Clifford Elphick, commented:

"The recovery of large high quality diamonds continues to define

the Letšeng mine and it is pleasing to see that prices for these

goods have remained firm despite the current difficult diamond

market conditions. The Plant 2 Phase 1 upgrade was completed on

time and within budget and will achieve its increased head feed

target of an additional 250 000 tonnes on an annualised basis. In

addition, the construction of the Coarse Recovery Plant is

complete, and during commissioning, the first diamonds from run of

mine ore were recovered.

"The development of the Ghaghoo mine is progressing slower than

planned due to difficult ground conditions which have hampered slot

development in the first five production tunnels and constrained

production ramp-up. Specialist expertise has been employed to

ensure there is no further major ingress of water as the access

decline and rim tunnel on Level 1 both begin advancing through the

water fissure area in order to gain access to the second production

section. A second parcel of Ghaghoo commissioning goods was sold in

July for

US$ 4.9 million (US$ 165 per carat) in a difficult market.

Encouragingly, a number of larger diamonds and small coloured

diamonds have also been recovered during the Period."

1. Diamond Market

In H1 2015 the overall diamond market experienced high inventory

levels and continued liquidity concerns. This, combined with global

macro-economic uncertainties, has continued to place pressure on

both rough and polished diamond prices. Letšeng's high value large

production has remained resilient through the Period, however, the

current market conditions have had a negative effect on the pricing

achieved for the more commercial Ghaghoo production.

2. Lesotho

Gem Diamonds holds a 70% shareholding in Letšeng Diamonds (Pty)

Ltd (Letšeng) in partnership with the Government of the Kingdom of

Lesotho, which owns the remaining 30%.

2.1 Production

Q1 2015 Q2 2015 H1 2015 H2 2014 HoH Change %

------------------------- ---------- ---------- ----------- ---------- -------------

Waste stripped (tonnes) 5 299 922 6 064 862 11 364 784 9 863 293 15%

------------------------- ---------- ---------- ----------- ---------- -------------

Ore treated (tonnes) 1 427 656 1 682 695 3 110 351 3 192 613 -3%

------------------------- ---------- ---------- ----------- ---------- -------------

Carats recovered 22 472 27 547 50 019 53 890 -7%

------------------------- ---------- ---------- ----------- ---------- -------------

Grade recovered (cpht) 1.57 1.64 1.61 1.69 -5%

------------------------- ---------- ---------- ----------- ---------- -------------

During the Period, 11.4 million tonnes of waste was mined, up

15% compared with H2 2014. This is in line with the revised mine

plan (published in March 2015), which will allow increased levels

of higher grade ore from the Satellite pipe to be mined

annually.

As previously reported, the Plant 2 Phase 1 upgrade was

completed on schedule and within the budget of

M50 million (US$ 4.2 million), with the shutdown for the

changeover completed within 19 days. The shutdown of Plant 2

limited the production days available during February and March and

this is reflected in the lower production figures reported for Q1

2015.

Following the upgrade, Plant 2 is operating well and is on track

to achieve its increased head feed target of an additional 250 000

tonnes on an annualised basis. Letšeng is expected to deliver

against the new mine plan and guidance as updated on 17 March 2015

remains unchanged.

Letšeng's Plants 1 and 2 treated a total of 2.6 million tonnes

of ore during the Period, 67% of which was sourced from the Main

pipe and 33% from the Satellite pipe. The balance of the ore (0.5

million tonnes) was treated through the Alluvial Ventures

contractor plant, 80% of which was sourced from the Main pipe and

20% from stockpiles. Total treated tonnes were down 3% against H2

2014 due to the aforementioned shutdown. For the Period, the grade

was down 5% against H2 2014 due to more Satellite pipe higher grade

ore having been treated in H2 2014.

Although the power supply situation within South Africa and

neighbouring states continues to be unreliable, with frequent and

numerous power outages, the impact upon operations at Letšeng has

been minimal due to the additional on-site back-up power generating

capacity installed in 2014.

2.2 Rough Diamond Sales and Diamonds Extracted for Manufacturing

H1 2015 H2 2014 % Change

---------------------------- -------- -------- ---------

Carats sold 46 961 55 164 -15%

---------------------------- -------- -------- ---------

Total value (US$ millions) 106.3 129.0 -18%

---------------------------- -------- -------- ---------

Achieved US$/ct 2 264 2 338 -3%

---------------------------- -------- -------- ---------

As previously reported, a strategic revision to the number,

composition and timing of the Letšeng tenders was made, with eight

tenders now being held during the year (instead of 10). During the

Period, Letšeng held four tenders, achieving an average price of

US$ 2 264* per carat (compared to US$ 2 338* per carat in H2 2014).

This brings the 12 month rolling average to US$ 2 304* per

carat.

Letšeng's small commercial production from the second and third

exports, which had been held over for sale in June 2015, achieved

US$ 7.7 million (compared to the estimated value of US$ 7.3 million

which was reported in the Sales and Operational Update on 21 May

2015).

In H1 2015, 237 carats were extracted for manufacturing at a

rough value of US$ 3.0 million. US$ 6.9 million (at rough value)

remained in polished inventory at the end of the Period.

* Includes carats extracted at rough valuation for

polishing.

2.3 Projects

The construction of the Coarse Recovery Plant was completed on

schedule and within the budget of

M140 million (US$ 11.7 million) by the end of Q2 2015.

Commissioning continues and the first diamonds have been recovered

from run of mine ore.

3. Botswana

Gem Diamonds' wholly-owned subsidiary, Gem Diamonds Botswana, is

currently developing the Ghaghoo mine (Ghaghoo) in Botswana.

During the Period, 132 125 tonnes of ore were treated, sourced

mainly from Level 0, whilst work continued in establishing the

production section on the first production level (Level 1) and

ramping up to steady state production. Extraction of ore from Level

0 was completed in early June and since then all ore has been

sourced from Level 1.

Five tunnels on Level 1 have now been fully developed to the

northern orebody-country rock contact, with development having

commenced on the next two tunnels. Slot development and opening has

progressed steadily, albeit slower than anticipated due to

localised difficult ground conditions, but has now been completed

from Tunnel 1 to Tunnel 5 which will allow the retreat of the

production faces back along these tunnels. The slower than

anticipated progress in the slot opening has constrained the

production ramp-up.

Development of the decline down to the Level 2 production level

progressed to a point, but then was halted just short of the same

main water fissure that was intersected on Level 1. Both the

decline and the rim tunnel on Level 1 need to advance through the

fissure in order for development to continue in order to allow

access to the second production section. Specialists have been

deployed to ensure that the fissure is fully sealed prior to the

tunnels advancing, and work is progressing slowly and carefully in

order to avoid any further major ingress of water.

As the tonnage of ore from underground increases, the processing

plant will continue to ramp up to the name plate capacity of 60 000

tonnes per month. In both May and June, over 32 000 tonnes of ore

per month were treated, with recovered grades in excess of the

modelled reserve grade of 27cpht being consistently achieved,

resulting in a total recovery of 35 283 carats for the Period.

Optimisation of processing and recovery efficiencies within the

plant is on-going.

With the increasing tonnage being treated and the plant running

more consistently, it has been encouraging to see the gaps in the

larger sizes of the size frequency distribution starting to be

filled. During the Period, eight diamonds larger than 10.8 carats

were recovered, including a 41 carat and a 35 carat diamond. In

July a 48 carat diamond was recovered, the largest diamond

recovered at Ghaghoo to date. Importantly, a number of fancy colour

diamonds, ranging from Blues, Pinks, Orange, Lilacs and Yellows,

although predominantly in the smaller sieve sizes, were also

recovered during the Period.

The second sale of Ghaghoo commissioning production took place

in July, achieving a total value of US$ 4.9 million (US$ 165 per

carat). Although this was below the average price achieved for the

first sale of US$ 210 per carat (total value of US$ 2.1 million)

during the Period, the production was not comparable from a quality

perspective and this, together with a declining market for these

goods, had a negative effect on the price achieved.

It is anticipated that the next Ghaghoo sale will take place

before the end of the year and will include a higher proportion of

diamonds from the main body of the VKSE phase of the kimberlite

ore.

4. Health, Safety, Social and Environment (HSSE):

The Group continues to strive toward its goal of zero harm to

its people and the environment and to operate within the Group's

sustainable development framework.

For the Period, no lost time injuries were recorded, resulting

in a Group-wide Lost Time Injury Frequency Rate (LTIFR) of 0.00 and

the Group All Injury Frequency Rate (AIFR) was 3.26.

Gem Diamonds continues to work closely with its project affected

communities to ensure that the social projects implemented continue

to be sustainable.

Zero major or significant environmental incidents have occurred

across the Group for the year to date.

For further information:

Gem Diamonds Limited

Sherryn Tedder, Investor Relations

Tel: +44 (0) 203 0430 2080

Mob: +44 (0) 7778 246 321

Bell Pottinger

Daniel Thöle / Joanna Boon

Tel: +44 (0) 203 772 2500

About Gem Diamonds:

Gem Diamonds is a leading global diamond producer of high value

diamonds. The company owns 70% of the Letšeng mine in Lesotho and

100% of the Ghaghoo mine in Botswana. The Letšeng mine is famous

for the production of large, top colour, exceptional white

diamonds, making it the highest dollar per carat kimberlite diamond

mine in the world. Since Gem Diamonds' acquisition of Letšeng in

2006, the mine has produced four of the twenty largest white gem

quality diamonds ever recorded.

Gem Diamonds has a growth strategy based on the expansion of the

Letšeng mine and bringing the Ghaghoo mine into production, while

maintaining its strong balance sheet. The Company seeks to maximise

revenue and margin from its rough diamond production by pursuing

cutting, polishing and sales and marketing initiatives further

along the diamond value chain. With favourable supply/demand

dynamics expected to benefit the industry over the medium to long

term, particularly at the high end of the market supplied by Gem

Diamonds, this strategy positions the Company well to generate

attractive returns for shareholders in the coming years.

www.gemdiamonds.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTPKCDNCBKDFOB

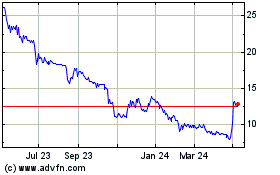

Gem Diamonds (LSE:GEMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

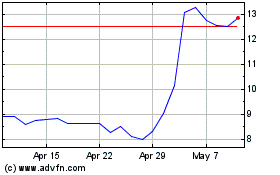

Gem Diamonds (LSE:GEMD)

Historical Stock Chart

From Apr 2023 to Apr 2024