GM's Opel Exit Is Rare No-Confidence Vote in European Market

March 06 2017 - 11:15AM

Dow Jones News

By Mike Colias and John D. Stoll

General Motors Co. sent a message Monday with the sale of its

money-losing Adam Opel AG operation to Peugeot SA: the world's

third-largest auto market isn't worth the trouble.

GM executives said pulling out of Europe allows the Detroit car

maker to slash engineering costs and lower the amount of cash it

needs to keep on hand. European buyers have fickle tastes and

European Union regulators have drawn up rules that would have

forced GM to spend heavily to meet mandates in a market where it

only has 6% market share.

The move is a rare vote of no-confidence in the continued

globalization in the auto industry, out of step with most industry

peers. Many executives have argued car companies need to get bigger

to pay for what is expected to be a convergence of consumer tastes

and regulatory mandates around the world.

Only a few years ago, GM appeared to be steering the

relationship with Peugeot in another direction. In 2012, GM took a

7% stake in then-struggling Peugeot, saying the deal could be the

start of a potentially broader alliance.

Less than two years into that agreement, however, GM sold its

stake. The two companies continued, however, to collaborate on

vehicles and technology.

GM's inability to reverse nearly two decades of losses in Europe

doesn't reflect the broader trend. Ford Motor Co., with 7.7% market

share in Europe, made $1.2 billion in 2016, representing 12% of

global profit.

"It was more than just the bottom line," GM President Dan Ammann

said in an interview, noting a multiyear turnaround plan put Opel

on a path to eventually breaking even. "It became clear the

European market was diverging from the rest of our business

elsewhere in the world."

Europe represents about 20% of global sales volume, slightly

less than North America's share.

Mary Barra, chief executive officer, said GM found only 20% of

the portfolio in Europe overlapped with the rest of GM's product

line, lessening opportunities to find commonality across regions.

Unlike American and Chinese buyers, European customers prefer

diesel engines and passenger-car body styles.

GM said it would continue to collaborate with Peugeot on certain

technology endeavors, including autonomous vehicles or

electrification.

The decision comes as U.S. auto makers are getting positive

signals from the Trump administration regarding corporate tax

reform and relief on emissions standards. GM will use savings from

the Opel exit for share buybacks and to sharpen focus on areas

where it aims to dominate -- the U.S. truck market, China and

autonomous vehicles.

GM Chief Executive Mary Barra, a member of President Donald

Trump's economic policy advisory team, in January announced more

than $1 billion in fresh U.S. investment. The auto maker earned $12

billion in North America last year and took about $2 billion in

dividends from its China joint ventures; it lost $300 million in

Europe, part of a $15-billion losing streak since 2000.

Over the past one or two years, Europe, which has always been

cutthroat due to a glut of capacity and national interests in auto

makers, became even more difficult from political, regulatory and

consumer-preference standpoints, Mr. Ammann said. Developing "a

winning plan in that environment" was too steep.

The U.K.'s vote to leave the European Union last year prevented

Opel from its first annual profit since before 2000. Meanwhile,

European environmental scrutiny has tightened amid the fallout from

Volkswagen AG's emissions scandal, forcing what many analysts

expect to be a broad and costly transition toward electrification

and away from diesel as the dominant engine technology in

Europe.

"Despite the strong progress in recent years, as we look forward

we see risks potential outweighing opportunities" for Opel without

adding the scale that PSA can provide, Mr. Ammann said. Peugeot

will now hold 16% of the European market, compared with 10% before

the deal.

Peugeot will pay EUR1.32 billion ($1.4 billion) for the Opel and

its sister Vauxhall U.K. brand, and it will team with BNP Paribas

SA to pay an additional EUR900 million for Opel's finance arm.

Write to Mike Colias at Mike.Colias@wsj.com and John D. Stoll at

john.stoll@wsj.com

(END) Dow Jones Newswires

March 06, 2017 11:00 ET (16:00 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

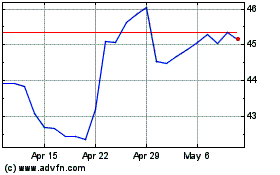

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

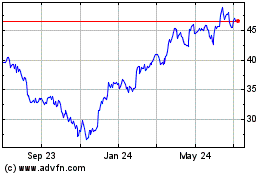

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024