GMI Ratings’ Governance and Accounting Risk Data Now Available Through FactSet

November 06 2013 - 9:12AM

Business Wire

Investors Can Now Seamlessly Integrate ESG

and Accounting Risk Into Their Investment Process

GMI Ratings, the leading provider of research, data and

analytics on environmental, social, governance and

accounting-related risks, today announced that FactSet, (NYSE: FDS

| NASDAQ: FDS), a leading provider of integrated financial

information data and analytical applications, will deliver GMI’s

governance and accounting risk data to investors through the

FactSet workstation.

Increasingly, investment professionals are integrating

governance and accounting risk factors into their investment

processes and models as more empirical evidence validates the

linkage between governance and performance.

The unique GMI data sets now accessible to FactSet subscribers

include elements of GMI’s Forensic Alpha Model (FAM™), its

Accounting and Governance Risk (AGR®) model and GMI’s ESG research

and ratings, including the 150 ESG KeyMetrics® that drive the

ratings. FAM is designed to use forensic accounting and

governance-related measures of issuer risk to efficiently gain

exposures to sustainable drivers of investment return, while AGR is

used by investors for risk mitigation and ESG ratings and research

are used for portfolio sustainability screening and management.

“With our robust data now available through FactSet, investment

managers, pension funds, hedge funds and other institutional

investors can integrate GMI’s ESG and Accounting risk data and

analytics into their own models and investment process”, said Dan

Concannon, President and Chief Executive Officer of GMI. “FactSet

clients can also leverage elements of GMI’s Forensic Alpha Model

for portfolio construction and optimization and ultimately,

performance enhancement.”

GMI data will be accessible to FactSet subscribers through the

platform’s Alpha Testing, Portfolio Analysis, Universal Screening,

Data Downloading, and MS Office integration functions and can be

permissioned globally or by geographic region.

“FactSet is pleased to add GMI Ratings’ three core models to our

content offerings and analytics suite,” said Rick Barrett,

FactSet’s Senior Vice President of Quantitative Analytics. “As

GMI’s ESG and AGR models have gained traction in the marketplace

through the years, we’ve heard from more and more clients looking

to combine that content with FactSet’s powerful analytics. The

newly-released Forensic Alpha Model will let our clients add unique

and uncorrelated factors to their existing alpha models within our

screening, backtesting, and optimization tools.”

FactSet’s highly regarded platform, which delivers real-time and

historical content and robust analytical and charting capabilities,

is a preferred channel through which institutional investors

support and manage their investment process.

GMI will conduct a brief webinar to review the integration of

GMI’s data on Thursday, November 14 at 11:00am. To register, please

click here.

About GMI Ratings

GMI Ratings is an independent provider of research and ratings

on environmental, social, governance and accounting-related risks

affecting the performance of public companies. The firm’s ESG

ratings for more than 6,000 companies worldwide incorporate 150 ESG

KeyMetrics® to help investors assess the sustainable investment

value of corporations. The firm also provides Accounting and

Governance Ratings (AGR®) for approximately 19,000 public companies

worldwide. AGR metrics reflect the accuracy and reliability of a

company’s financial reporting. Clients of GMI Ratings include

leading institutional investors, banks, insurers, auditors,

regulators and corporations seeking to incorporate accounting and

ESG factors into risk assessment and decision-making. The firm’s

Forensic Alpha Model (FAM™) helps investors predict stock returns

using forensic accounting and governance-related measures of issuer

risk. In the 2012 and 2013 Independent Research in Responsible

Investment (IRRI) Survey conducted by Thomson Reuters Extel and

SRI-CONNECT.com, GMI Ratings was named “The Best Independent

Corporate Governance Research Provider”. For more information

please visit www.gmiratings.com.

About FactSet

FactSet Research Systems Inc. (NYSE: FDS | NASDAQ: FDS) combines

integrated financial information, analytical applications, and

client service to enhance the workflow and productivity of the

global investment community. The Company, headquartered in Norwalk,

Connecticut, was formed in 1978 and now conducts operations along

with its affiliates from more than twenty-eight locations

worldwide, including Boston, New York, Chicago, San Francisco,

London, Amsterdam, Frankfurt, Paris, Milan, Hyderabad, Mumbai,

Dubai, Manila, Tokyo, Hong Kong, and Sydney. To learn more about

FactSet, visit www.factset.com and follow on Twitter:

www.twitter.com/factset.

GMI Ratings Media ContactsCheryl Gustitus, Chief

Marketing OfficerO: +1 212/949-1313 ext 316M: +1

240/507-0823cgustitus@gmiratings.comorJoyce Brown, Marketing

Communications+1 207-553-5679jbrown@gmiratings.com

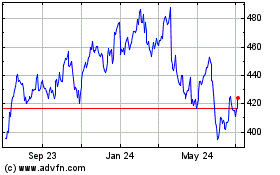

FactSet Research Systems (NYSE:FDS)

Historical Stock Chart

From Mar 2024 to Apr 2024

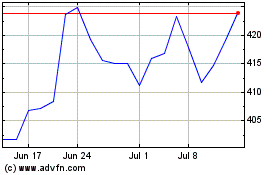

FactSet Research Systems (NYSE:FDS)

Historical Stock Chart

From Apr 2023 to Apr 2024