By William Boston

BERLIN -- After fixing a French car manufacturer long derided by

the industry as an eternal also-ran, Carlos Tavares is turning his

attention to the business General Motors Corp could never fix.

Mr. Tavares, who on Wednesday unveiled another quarter of solid

growth at PSA Group, maker of Peugeot and Citroen cars, is turning

up the pressure on Opel, the loss-making German brand he acquired

from GM this summer.

Over the past three years, the 59-year-old native of Portugal

has taken PSA from near death to Europe's most profitable maker of

large volume cars. The acquisition in August of GM's European

businesses Opel and Vauxhall hoisted the French car maker into the

number two spot in Europe by sales behind Volkswagen AG.

Mr. Tavares hasn't wasted time in moving to improve returns.

In response to sluggish sales of some Opel and Vauxhall models,

Peugeot said it would cut nearly a quarter of the 1,800 employees

at Vauxhall's Ellesmere Port plant in the U.K.

Peugeot said it would be in "a better position to consider

future investments" in the Vauxhall business once the terms of any

post-Brexit trade deal between the U.K, and the European Union

become clear.

Mr. Tavares has also been pressing the German management at Opel

to accelerate efforts to return to profit as Europe's booming car

market is beginning to plateau.

Since the acquisition closed in August, Peugeot and Opel

managers have hammered away at a restructuring plan that German

labor leaders warn could put thousands of Opel engineers out of a

job.

Peugeot's path to profitability was painful.

After Mr. Tavares took control in 2013, the company was bailed

out by the French state and Chinese auto group Dongfeng Motor

Group, now its two biggest shareholders. Peugeot, running big

losses amid mounting labor costs and falling sales, slashed jobs

and production to cut costs, skidding past a looming

bankruptcy.

But the efforts paid off. On Wednesday, Peugeot reported a 31%

rise in third-quarter revenue to EUR15 billion ($17.64 billion),

driven by strong growth in all regions except China and healthy

demand for its new Peugeot 3008 and 5008 sport-utility vehicles.

The revenue includes two months of business from the Opel Vauxhall

division. Without Opel Vauxhall, Peugeot sales rose 7% to EUR12.2

billion in the quarter.

Peugeot didn't report third-quarter profit. On a call with

analysts, Jean-Baptiste de Chatillon, the company's finance chief,

said losses at Opel Vauxhall would weigh on Peugeot's earnings in

the second half of the year, saying: "The recovery plan will kick

off beginning in 2018."

Peugeot's share price dipped 0.6% on the news to EUR20.27. The

company's share price has nearly quadrupled since Mr. Tavares was

appointed chief executive in November 2013.

With Peugeot's core business profitable again, Mr. Tavares

embarked on an expansion strategy earlier this year, acquiring GM's

German Opel unit and its British Vauxhall subsidiary for EUR2.2

billion.

After years of losses at Opel, GM Chief Executive Mary Barra

pulled the plug on the German business after running it for more

than 80 years. On Tuesday, GM said it took a $2.3 billion charge

related to the sale of Opel Vauxhall.

Opel's German managers have traditionally blamed GM for the

company's history of losses and the brand's failure to keep up with

its more illustrious European peers -- an argument Mr. Tavares has

dismissed as a convenient but disingenuous excuse.

"Opel's results are mainly the consequence of Opel's decisions,"

he told German daily newspaper Die Welt last week. He has

previously said that Opel's production costs were 50% higher than

those at Peugeot's French plants.

Peugeot sells 35 new cars per employee, compared to 30.4 for an

Opel or Vauxhall employee, according to a recent study by Ferdinand

Dudenhöffer, head of the Center for Automotive Research at

Duisburg-Essen University. He said that Opel would need nearly

5,000 fewer employees if its factories were as productive as

Peugeot's French plants.

Once they looked under the hood at Opel, Peugeot officials were

also surprised to discover that the German car maker was on a

trajectory to miss the European Union's 2020 greenhouse-gas

emissions targets, which could result in significant fines.

"We are working very hard on the team to change that," said Mr.

Chatillon, Peugeot's finance chief. "We have to meet the

targets."

Mr. Tavares wants Peugeot and Opel to share technology and

development to eliminate duplication, particularly in high-cost

areas such as engine design and production. As a first project, the

next generation of Opel's popular Corsa compact will use Peugeot

technology.

Opel uses nearly three times as many individual model platforms

as Peugeot, requiring a larger number and variety of components

from engines and transmissions to steering wheels and brakes.

Taking a page from Volkswagen's playbook -- which shares

technology development across its eight car brands to avoid

duplication -- Mr. Tavares plans to create technology centers that

share development between Peugeot, Citroen, Opel and Vauxhall.

However, while efficient, the changes could affect thousands of

jobs at Opel.

--Max Bernhard contributed to this article.

Write to William Boston at william.boston@wsj.com

(END) Dow Jones Newswires

October 25, 2017 05:52 ET (09:52 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

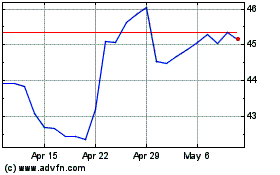

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

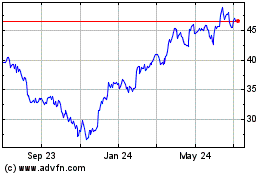

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024