Jeff Immelt says General Electric Co. is a haven in a period of

economic doubt, political uncertainty and shareholder activism—and

one too few big investors have come to appreciate.

The GE chief executive's annual letter to shareholders this year

takes the form of a wide-ranging commentary on topics such as

political populism, shareholder activism and the ways in which GE

could take advantage of declining commodity prices to snap up

competitors.

GE is still "underowned" by institutional investors, Mr. Immelt

argues in the letter, despite efforts to learn from the demands of

activists driving change at big companies across the market

spectrum. The CEO is embracing "humbling" input from a cadre of

young GE workers as he tries to simplify the conglomerate and

recognize "the evil nature of corporate bureaucracy."

And Mr. Immelt is wary of the tense relations between business

and government around the world, charging that "most government

policy is anti-growth."

"In the U.S., we want exports but seem to hate trade and

exporters; globally, governments love small businesses but then

regulate them to death," he writes in the 19-page letter. "And so,

we perpetuate a cycle: slow growth, poor job creation, populism,

low productivity, higher regulation, poor policy and more slow

growth."

The state-of-the-company message comes amid what Mr. Immelt

portrays as a generational shift at GE—and after one of Mr.

Immelt's best years. Profit fell across most of GE's industrial

business in the fourth quarter and more pain is coming in oil and

gas. But GE shares were up more than 20% in 2015, in what GE says

is a reflection of confidence in Mr. Immelt's corporate pivot away

from finance.

GE last year launched and executed most of a plan to sell off

the bulk of its huge GE Capital lending arm, which once generated

half the company's profit but worried investors after nearly

imploding during the financial crisis. The company sealed a deal

for its largest industrial acquisition to date, the $10 billion

purchase of France-based Alstom SA's power assets.

And the company successfully managed the appearance of an

activist at its gates. Trian Fund Management LP, the activist firm

run by Nelson Peltz, disclosed a $2.5 billion stake in GE in

October. Trian called on the company to use its freedom from GE

Capital to increase its leverage and buy back more stock. In the

same breath, however, Mr. Peltz praised GE's management and Mr.

Immelt himself.

In his letter, Mr. Immelt suggests that GE should be diagnosing

the problems called out by activists, and criticizes some unnamed

investors for focusing on short-term results, rather than the

long-term industrial investments around which he increasingly seeks

to focus GE.

"To be honest, I don't think activists are necessarily bad for

companies," Mr. Immelt writes, adding that GE has "done a better

job of being our own activist."

"When a business team fails in GE, this is what you find:

complicated accountability, too much cost in the wrong places,

excessive priorities and low market awareness," he writes. "These

are factors activists point to when they criticize companies. Shame

on us if we need help from the outside to find this out."

While critical of activists seeking short-term payoffs, Mr.

Immelt also trains his fire on large institutional investors, who

he says have "allowed governance to become too legalistic, about

politics instead of protecting the average investor."

"We have delivered for you in the last five years," he writes.

"But we are still underowned by big investors."

Mr. Immelt's annual letter can hold clues to management's plans.

This year, Mr. Immelt suggests GE will continue to aggressively cut

costs from its operations, in keeping with guidance he offered

investors in December. He also signaled an appetite for

acquisitions, suggesting GE could find good assets for sale at low

valuations thanks to volatility in the global economy, especially

linked to the low price of oil.

That decline is hitting GE's oil and gas business too. Between

2014 and 2016, GE expects earnings in the unit, which makes

equipment for drilling, exploration and processing, to fall 20% to

25%, Mr. Immelt writes. But the unit will be able to retrench and

grow stronger through the downturn, he says, thanks to the

diversification provided by GE's structure, and because GE is

better positioned to weather a storm.

"Unlike the financial crisis, in this cycle GE has substantial

firepower to make strategic investments that create value," he

writes.

Mr. Immelt says GE can raise earnings 15% a year over the next

three years, to more than $2 a share. From 2015 through 2018, the

company will send about $100 billion back to shareholders through a

combination of share buybacks and dividends, he says.

The CEO also gave a defense against what has been a pervasive

criticism of GE, including from Trian: that the company hasn't had

a good track record on mergers and acquisitions under his watch. In

highlighting GE Healthcare's push into life sciences, Mr. Immelt

includes an oblique reference to the company's $9.5 billion

purchase of Amersham PLC, a deal where many analysts still believe

GE overpaid.

"Building this position was facilitated by an 'expensive'

acquisition that today looks like a bargain," the letter

states.

(END) Dow Jones Newswires

February 29, 2016 09:45 ET (14:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

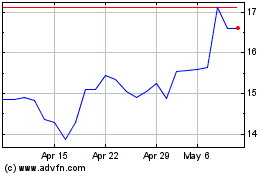

Alstom (EU:ALO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alstom (EU:ALO)

Historical Stock Chart

From Apr 2023 to Apr 2024