GE Profit Falls as Revenue Growth Less Than Expected--Update

October 21 2016 - 8:12AM

Dow Jones News

By Joshua Jamerson and Ted Mann

General Electric Co.'s oil and gas business continued to weigh

on revenue growth in the latest quarter, and the industrial giant

said it would increase its stock-buyback program by $4 billion

after disappointing Wall Street this year.

The company also said it is continuing to operate in a "slow

growth and volatile environment," and shares fell 1% to $28.77 in

premarket trading. The stock has fallen 11% in the past three

months through Thursday's close.

GE said organic orders fell 6% amid a focus toward industrial

businesses and away from banking.

GE's power, aviation and renewable energy segments drove

industrial revenue growth, as transportation and in oil and gas

continued to post declines.

The company is under increasing pressure to show results from

its industrial business after its decision to largely exit

financial services last year. A little more than one year ago,

activist investor Trian Fund Management LP announced a $2.5 billion

stake in the company and urged GE to take on $20 billion in

leverage in order to buy back its own shares. Trian also warned GE

against all but bolt-on acquisitions, citing what it said is a poor

track record on past deals.

GE says it is ahead of its targets for share buyback, but hasn't

yet boosted its borrowing to make either a large-scale share

repurchase or a significant acquisition, as some investors have

hoped.

Oil-and-gas revenue fell 25% in the latest quarter as it

grapples with depressed oil prices, and segment profit fell 42%.

Meanwhile, renewable energy revenue rose 66% and revenue from

power, its largest industrial segment, rose 37%.

Over all for the September quarter, GE reported a profit of

$2.03 billion, or 22 cents a share after the payout of preferred

dividends, compared with $2.51 billion, or 25 cents a share, a year

ago. Excluding items, the company earned 32 cents, compared with 29

cents a year ago. Analysts polled by Thomson Reuters projected 30

cents a share.

Revenue rose 4.4% to $29.27 billion. Analysts had expected

$29.64 billion.

GE said its total industrial profit slipped 4.6% to $4.32

billion in the quarter.

Earlier this year, the conglomerate's lending arm, GE Capital,

successfully shed its designation as a "systemically important"

financial institution -- a label that had required the company to

submit to stricter rules and supervision by the Federal Reserve --

after months of shedding assets of the business, long seen as a

distraction by investors who believed it dragged on the company's

share price. GE Chief Executive Jeff Immelt on Friday said in

prepared remarks that its GE Capital asset sales are "substantially

complete."

The company has already bought back $13.7 billion of its own

stock through the first half of the year, and the additional $4

billion in share repurchases announced Friday boosts its buyback

target for the year to $22 billion. The company has a market value

of roughly $260 billion.

So far this year, GE's performance has disappointed. It is

contending with a raft of Wall Street downgrades, a slipping stock

price and weak revenue in the first six months of the year. This

contrasts sharply with 2015, when Mr. Immelt won praise from

analysts and investors for selling most of GE's finance

operation.

The stock rose 24% in 2015, trading above $30 for the first time

since 2008. Shares are down 6.7% so far in 2016.

Write to Joshua Jamerson at joshua.jamerson@wsj.com and Ted Mann

at ted.mann@wsj.com

(END) Dow Jones Newswires

October 21, 2016 07:57 ET (11:57 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

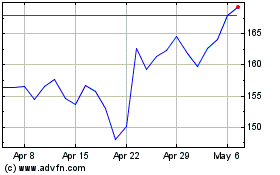

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Mar 2024 to Apr 2024

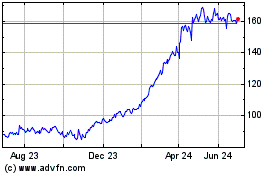

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Apr 2023 to Apr 2024