GE Facilitates Genesis' Purchase - Analyst Blog

January 07 2013 - 9:50AM

Zacks

GE Capital, Healthcare Financial

Services, an operating unit of General Electric

Company (GE), has recently facilitated the acquisition of

the Sun Healthcare Group Inc. by Genesis HealthCare. The company

acted as an administrative agent on an asset-based revolving credit

facility worth $400 million, and as a syndication agent on a $325

million cash flow term loan credit facility, both of which were

utilized to fund the acquisition.

Kennett Square, Pennsylvania based Genesis is one of the largest

skilled nursing and rehabilitation therapy providers in the U.S.

With about 80,000 employees, the company has over 400 Skilled

Nursing Centers and Assisted/Senior Living Communities in 29

states, while its Genesis Rehab Services division provides therapy

services to over 1,500 health care providers in 46 states.

On the other hand, Sun Healthcare provides long-term, sub-acute,

and related health care services primarily to the senior

population. Based in Irvine, California, the company has 190

managed inpatient facilities in 23 states. The company mostly

operates skilled nursing centers for seniors, besides offering

assisted and independent living facilities and behavioral health

services.

With the acquisition, Genesis has become a behemoth of sorts in the

skilled nursing segment of the healthcare industry with 422 skilled

nursing centers in 29 states. At the same time, the strategic

purchase has extended its presence in the rehabilitation therapy

business to over 1,500 contracts in 46 states. Besides expanding

its geographic footprint, the acquisition is also expected to

result in operational synergies and improve the efficiency with

combined annual revenue of approximately $4.6 billion and employee

strength of nearly 80,000.

General Electric is one of the largest and the most diversified

technology and financial services corporations in the world. With

products and services ranging from aircraft engines, power

generation, water processing, and security technology to medical

imaging, business and consumer financing, media content and

industrial products, it serves customers in more than 100 countries

and employs more than 287,000 people worldwide.

Its segments include Energy Infrastructure, Aviation, Healthcare,

Transportation, Home & Business Solutions and GE Capital,

Healthcare Financial Services. With more than $60 billion in

financing over ten years to various companies in the healthcare

sector, GE Capital, Healthcare Financial Services has an in-depth

industry know-how and expertise.

General Electric currently has a Zacks #4 Rank (Sell). We have a

long-term Neutral recommendation on the stock. We also have a

Neutral recommendation and a Zacks #3 Rank (Hold) for 3M

Company (MMM), one of the peers of General Electric.

GENL ELECTRIC (GE): Free Stock Analysis Report

3M CO (MMM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

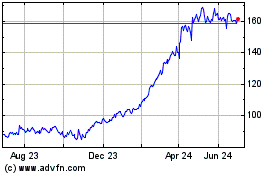

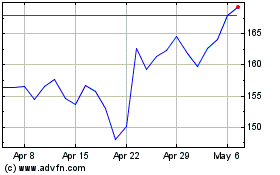

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Mar 2024 to Apr 2024

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Apr 2023 to Apr 2024