NOT FOR DISTRIBUTION IN OR INTO THE UNITED STATES, ITS

TERRITORIES AND POSSESSIONS (INCLUDING PUERTO RICO, THE U.S. VIRGIN

ISLANDS, GUAM, AMERICAN SAMOA, WAKE ISLAND AND THE NORTHERN MARIANA

ISLANDS), ANY STATE OF THE UNITED STATES OR THE DISTRICT OF

COLUMBIA (the “United States”) OR IN OR INTO ANY OTHER JURISDICTION

WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.

GE Capital Australia Funding Pty. Ltd. (ACN 085 675 467)

(“GECAF”), GE Capital Canada Funding Company (“GECCF”) and GE

Capital UK Funding Unlimited Company (“GECUKF” and, together with

GECAF and GECCF, the “Offerors”) today announced that they had

commenced cash tender offers to purchase any and all of the

securities set forth in the table below (each an “Offer” and

collectively the “Tender Offer”).

AUDFixedRateSecurities

Securities ISIN

Aggregate Principal

AmountOutstanding

FixedSpread

Reference Benchmark

BloombergReferencePage

GE CapitalAustraliaFundingPty. Ltd.

4.000%Notes dueMay 2018

XS0934529768 AUD200,000,000 50 bps

The relevant interpolated mid-swap rate

calculated inaccordance with the Australiandollar market

convention

IAUS10

4.125%Notes dueJuly 2018

XS1023248203 AUD150,000,000 55 bps IAUS10

5.000%Notes dueSeptember2019

XS0972856917 AUD150,000,000 55 bps IAUS10

CADFixedRateSecurities

Securities ISIN CUSIP

Aggregate PrincipalAmount

Outstanding

FixedSpread

Reference Benchmark

BloombergReferencePage

GE CapitalCanadaFundingCompany

5.530%Notes dueAugust2017

CA36158ZBH88 36158ZBH8 CAD1,350,000,000 45 bps

1 ½ per cent. Government ofCanada Bond due

September2017 (ISIN: CA135087A461)

RBCB

4.400%Notes dueFebruary2018

CA36158ZBR60 36158ZBR6 CAD400,000,000 55 bps

1 ¼ per cent. Government ofCanada Bond due

March 2018(ISIN: CA135087A875)

RBCB

2.420%Notes dueMay 2018

CA36158ZCA27 36158ZCA2 CAD1,000,000,000 35 bps

4 ¼ per cent. Government ofCanada Bond due

June 2018(ISIN: CA135087YL25)

RBCB

3.550%Notes dueJune2019

CA36158ZBX39 36158ZBX3 CAD350,000,000 55 bps

3 ¾ per cent. Government ofCanada Bond due

June 2019(ISIN: CA135087YR94)

RBCB

5.680%Notes dueSeptember2019

CA36158ZBN56 36158ZBN5 CAD700,000,000 55 bps

1 ¾ per cent.Government ofCanada Bond due

September2019 (ISIN: CA135087C855)

RBCB

5.730%Notes dueOctober2037

CA36158ZBK18 36158ZBK1 CAD1,350,000,000 110 bps

3 ½ per cent. Government ofCanada Bond due

December2045 (ISIN: CA135087ZS68)

RBCB

GBPFixedRateSecurities

Securities ISIN

Aggregate Principal

AmountOutstanding

FixedSpread

Reference Benchmark

BloombergReferencePage

GE

CapitalUKFundingUnlimitedCompany(1)

4.125%Notes dueSeptember2017

XS0544837676 GBP600,000,000 70 bps

1 per cent. UK Treasury Stockdue September

2017(ISIN: GB00B7F9S958)

DMO2

2.375%Notes dueDecember2018

XS1078758833 GBP300,000,000 70 bps

1 ¼ per cent. UK Treasury Stockdue July

2018 (ISIN:GB00B8KP6M44)

DMO2

5.625%Notes dueApril 2019

XS0297507773 GBP300,000,000 50 bps

4 ½ per cent. UK Treasury Stockdue March

2019 (ISIN:GB00B39R3F84)

DMO2

4.375%Notes dueJuly 2019

XS0740772420 GBP625,000,000 85 bps

1 ¾ per cent. UK Treasury Stockdue July

2019 (ISIN:GB00BDV0F150)

DMO2

5.125%Notes dueMay 2023

XS0254673964 GBP425,000,000 55 bps

2 ¼ per cent. UK Treasury Stockdue

September 2023 (ISIN:GB00B7Z53659)

DMO2

6.250%Notes dueMay 2038

XS0361336356 GBP650,000,000 70 bps

4 ¾ per cent. UK Treasury Stockdue

December 2038(ISIN: GB00B00NY175)

DMO2

GBPFloatingRateSecurities

Securities ISIN

Aggregate Principal

AmountOutstanding

FixedPrice

GE

CapitalUKFundingUnlimitedCompany(1)

FloatingRate Notesdue March2017

XS0286359582 GBP160,000,000 100.000%

FloatingRate Notesdue January2018

XS1167300497 GBP325,000,000 100.000%

(1) On 13 April 2016 GE Capital UK Funding changed its name to

GE Capital UK Funding Unlimited Company.

Overview of the Tender Offer

The Tender Offer is made pursuant to the terms and subject to

the conditions set forth in the Tender Offer Memorandum dated today

(as it may be amended or supplemented from time to time, the

“Tender Offer Memorandum”).

In respect of floating rate Securities, the fixed price offered

for each GBP1,000 principal amount of Securities purchased pursuant

to the Tender Offer is set forth in the table above (the “Floating

Rate Consideration”). In respect of fixed rate Securities, the

fixed spread over the relevant Reference Benchmark offered for

Securities purchased pursuant to the Tender Offer is set forth in

the table above (the “Fixed Rate Consideration” and, together with

the Floating Rate Consideration, the “Consideration”). The Fixed

Rate Consideration will be determined by reference to the Reference

Benchmarks at Pricing. For the AUD Fixed Rate Securities, Pricing

will occur at or around 11.00 am London time on 5 May 2016. For the

GBP Fixed Rate Securities, Pricing will occur at or around 1.00 pm

London time on 5 May 2016. For the CAD Fixed Rate Securities,

Pricing will occur at or around 10.00 am Toronto time on 5 May

2016.

Holders whose Securities are purchased pursuant to the Tender

Offer will also be paid an amount equal to the accrued and unpaid

interest thereon from the applicable last interest payment date up

to, but not including, the date (the “Settlement Date”) on which

payment is made for Securities that have been validly tendered (and

not validly revoked) (the “Accrued Interest”). Interest will cease

to accrue on the Settlement Date for all Securities accepted in any

Offer.

The Tender Offer will expire at (i) 4.00 p.m. London time on

4 May 2016 in the case of the AUD Securities and the GBP Securities

and (ii) 5.00 p.m. Toronto time on 4 May 2016 in the case of the

CAD Securities, unless extended by the Offerors (such time and

date, as the same may be extended, the “Expiration Time”). Holders

of Securities must validly tender and not validly revoke their

Securities prior to the Expiration Time to be eligible to receive

the Consideration. Tendered Securities are irrevocable except in

the limited circumstances described in the Tender Offer

Memorandum.

The Offerors expect that the Settlement Date for each Offer will

be on or about 12 May 2016. Interest will cease to accrue on the

Settlement Date for all Securities accepted in any Offer.

If you hold Securities through a broker, dealer, custodian bank,

depositary, trust company or other nominee, you should keep in mind

that this entity may require you to take action with respect to an

Offer a number of days before the Expiration Time in order for such

entity to tender Securities on your behalf prior to the Expiration

Time.

Each Offeror’s obligation to pay the Consideration plus Accrued

Interest is conditioned, among other things, on the satisfaction or

waiver of certain conditions set forth in the Tender Offer

Memorandum. No Offer is conditioned on any minimum amount of

Securities being tendered or on the consummation of any other

Offer, and each Offer may be amended, extended or terminated

separately.

The purpose of the Tender Offer is to retire a portion of

certain of the Offerors’ outstanding debt securities and reduce

cash interest expense as part of General Electric Company’s (“GE”)

plan, announced on 10 April 2015, to reduce the size of its

financial services businesses through the sale of most of General

Electric Capital Corporation’s assets and to focus on continued

investment and growth in GE’s industrial businesses. Any Securities

that are purchased in the Tender Offer will be retired and

cancelled.

The Offerors have retained Deutsche Bank AG, London Branch

(“Deutsche Bank”) to act as global coordinator for the Tender

Offer, and Deutsche Bank, Barclays Bank PLC (“Barclays”), Royal

Bank of Canada, Sydney Branch, RBC Dominion Securities Inc. and RBC

Europe Limited (collectively, “RBC”) to act as Dealer Managers

(collectively, the “Dealer Managers”) for the Tender Offer.

Deutsche Bank may be contacted at +44 (0) 207 545 8011; Barclays

may be contacted at +44 (0) 203 134 8515; and RBC may be contacted

at +1 416 842 6311. None of Deutsche Bank or Barclays or their

respective affiliates will directly solicit or advertise in Canada

with respect to the Offers for Securities of GECCF or otherwise

with any Canadian holder of Securities of GECCF and any

solicitation or advertisement with respect to the Offers in Canada

for Securities of GECCF or otherwise with Canadian holders of

Securities of GECCF will be conducted by RBC.

The Offerors have also retained Lucid Issuer Services Limited to

serve as global tender agent and information agent (the “Global

Tender Agent” and “Information Agent” respectively) for the Tender

Offer and TMX Equity Transfer and Trust Company to serve as the

Canadian tender agent (the “Canadian Tender Agent” and, together

with the Global Tender Agent, the “Tender Agents”).

Any requests for additional electronic copies of the Tender

Offer Memorandum and any questions concerning tender procedures

relating to any AUD Securities or GBP Securities should be directed

to the Global Tender Agent at Lucid Issuer Services Ltd., Tankerton

Works, 12 Argyle Walk, London WC1H 8HA, United Kingdom (telephone:

+44 (0) 207 704 0880; Email: ge@lucid-is.com). Any questions

concerning tender procedures for CAD Securities should be directed

to the Canadian Tender Agent at its address or telephone number

listed on the back cover of the Tender Offer Memorandum. You may

also contact your broker, dealer, custodian bank, depositary, trust

company or other nominee for assistance concerning the Tender

Offer. Any questions concerning the terms and conditions of the

Tender Offer should be directed to the Dealer Managers at the

telephone numbers listed on the back cover of the Tender Offer

Memorandum.

Copies of the Tender Offer Memorandum are available from the

Global Tender Agent at its address set out above.

None of the Offerors, the Dealer Managers, the Tender Agents

or the Information Agent is making any recommendation as to whether

Holders should tender Securities in response to the Tender

Offer.

This communication does not constitute an offer to purchase

or a solicitation of tenders of Securities from any person located

in the United States or in any jurisdiction in which, or to or from

any person to or from whom, it is unlawful to make such offer or

solicitation under applicable securities or blue sky laws or

otherwise. This communication does not constitute an offer to sell

any securities or the solicitation of an offer to buy any

securities (other than the Securities set forth in the table

above).

The distribution of this communication and the Tender Offer

Memorandum in certain jurisdictions may be restricted by law.

Persons into whose possession this communication and/or the Tender

Offer Memorandum comes are required by each of the Offerors, the

Dealer Managers and the Tender Agents to inform themselves about,

and to observe, any such restrictions.

This distribution of this communication, the Tender Offer

Memorandum and any other documents or materials relating to the

Tender Offer is not being made and such documents and/or materials

have not been approved by an authorized person for the purposes of

section 21 of the Financial Services and Markets Act 2000.

Accordingly, such documents and/or materials are not being

distributed to, and must not be passed on to, the general public in

the United Kingdom. The communication of such documents

and/or materials as a financial promotion is only being made to and

directed at, and may only be acted upon by, those persons in the

United Kingdom falling within the definition of investment

professionals (as defined in Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005, as

amended (the “Financial Promotion Order”)) or persons who are

within Article 43 of the Financial Promotion Order or any other

persons to whom it may otherwise lawfully be made under the

Financial Promotion Order.

Forward-Looking Statements

This communication contains “forward-looking statements”—that

is, statements related to future, not past, events. In this

context, forward-looking statements often address our expected

future business and financial performance and financial condition,

and often contain words such as “expect,” “anticipate,” “intend,”

“plan,” “believe,” “seek,” “see,” “will,” “would,” or “target.”

Forward-looking statements by their nature address matters that

are, to different degrees, uncertain, such as statements about the

Tender Offer. Uncertainties that could cause our actual results to

be materially different than those expressed in our forward-looking

statements include the failure to consummate any of these

transactions or to make or take any filing or other action required

to consummate any such transaction on a timely matter or at all.

These or other uncertainties may cause our actual future results to

be materially different from those expressed in our forward-looking

statements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160425005640/en/

GE CapitalInvestors:Matt Cribbins, +1

203-373-2424matthewg.cribbins@ge.comorMedia:Susan Bishop, +1

203-750-5362Susan.bishop@ge.com

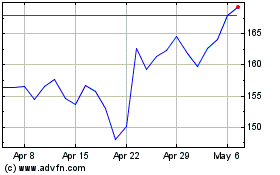

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Mar 2024 to Apr 2024

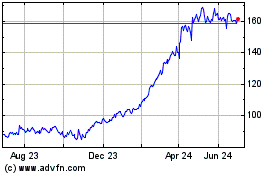

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Apr 2023 to Apr 2024