G-III Cuts Earnings View Amid Surprise Loss

August 30 2016 - 9:00AM

Dow Jones News

G-III Apparel Group Ltd. swung to a surprise loss in the latest

quarter as sales unexpectedly fell, and the company cut its

earnings forecast for the year amid retail softness at outlet

centers.

Shares fell 14% to $36 in premarket trading.

The producer of apparel and products under labels such as Calvin

Klein, Kenneth Cole and Tommy Hilfiger now sees full year per-share

earnings in a range of $2.20 to $2.30. It previously expected a

range between $2.55 and $2.65 a share.

New York City-based G-III said poor performance in outerwear

offset strengths in other parts of the business during the quarter.

However, Chief Executive Morris Goldfarb said there is opportunity

for better wholesale outerwear performance in the second half of

the year, given forecasted cool weather trends.

The results from the appeal maker come as retailers throughout

the country, from department stores and specialty shops, have

reported sliding sales mostly because of dwindling traffic, as

shoppers increasingly turn to online shopping and fast-fashion.

In July, LVMH Moë t Hennessy Louis Vuitton SE said it agreed to

sell Donna Karan International Inc. to G-III for $650 million,

including debt. The Donna Karan and DKNY lines delivered lackluster

growth for years amid stiff competition, but G-III has said the

acquisition would increase the scale and diversification of its

portfolio.

Over all for the July period, G-III posted a loss of $1.3

million, or 3 cents a share, compared a profit of $12.5 million, or

27 cents a share, a year ago. The company said its results included

fees in connection with the ongoing Donna Karan acquisition, which

dented profited by about 4 cents a share. The company guided for

per-share profit between 15 cents and 19 cents.

Revenue fell 7% to $442.3 million. The company expected sales to

grow to $485 million.

For the current third period that ends in October, the company

said it expects to earn between $1.50 and $1.60 a share on sales of

about $940 million. Analysts expected per-share profit of $2.02 on

$1 billion in revenue, according to Thomson Reuters.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

August 30, 2016 08:45 ET (12:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

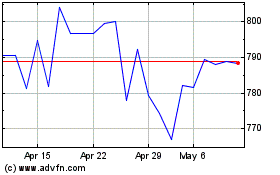

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Mar 2024 to Apr 2024

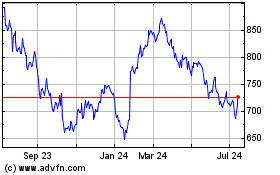

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Apr 2023 to Apr 2024