- Continued gross margin expansion supported by cost reductions

and sales mix

- Record 70 megawatts of production sold during the year

- Utility sale of 3.4 megawatt high efficiency power plant for

gas pipeline application

- Six fuel cell modules totaling 8.4 megawatts sold to POSCO

Energy to meet Asian demand

- Multiple projects selected as Finalists for consideration under

utility RFP for Long Island, New York

FuelCell Energy, Inc. (Nasdaq:FCEL), a global leader in the design,

manufacture, operation and service of ultra-clean, efficient and

reliable fuel cell power plants, today reported results for its

fourth quarter and fiscal year ended October 31, 2014 along with an

update on key business highlights.

Financial Results

FuelCell Energy (the Company) reported total revenues for the

fourth quarter of 2014 of $54.4 million compared to $55.2 million

for the fourth quarter of 2013.

- Product sales for the fourth quarter of 2014 totaled $42.4

million, comprising $35.8 million of power plant revenue, fuel cell

module and fuel cell kit sales, and $6.6 million of power plant

component sales and site engineering and construction services.

Product sales for the comparable prior year period totaled $36.2

million.

- Service and license revenues for the fourth quarter of 2014

totaled $6.7 million. Service and license revenues totaled $15.4

million for the fourth quarter of 2013 or $5.2 million excluding

$10.2 million of revenue recognized in conjunction with the

execution of a revised multi-year service agreement with Asian

partner POSCO Energy.

- Advanced technologies contract revenue was $5.3 million for the

fourth quarter of 2014 compared to $3.6 million for the prior year

period.

The gross profit generated in the fourth quarter of 2014 totaled

$6.0 million compared to $2.6 million in the fourth quarter of

2013. The fourth quarter 2014 gross margin was 10.9 percent

compared to 4.7 percent for the prior year period. The current

period gross margin of 10.9 percent reflects continued sequential

margin expansion, improving from the 9.2 percent gross margin of

the third quarter of 2014, and is a record gross margin since the

Company began commercializing fuel cells. Margin expansion is

reflective of a sales mix transitioning to a larger percentage of

revenues from turn-key projects in the United States as well as

lower product costs from sustained production at 70 megawatts

annually combined with continued manufacturing efficiencies.

Operating expenses increased year-over-year primarily due to

higher administrative and selling costs related to an increased

level of project development and bidding on utility RFP's. Interest

expense decreased year-over-year due to the previously announced

conversion of the 8.0% Senior Unsecured Convertible Notes. Net loss

attributable to common shareholders for the fourth quarter of 2014

totaled $5.5 million, or $0.02 per basic and diluted share. For the

comparable prior year period, net loss attributable to common

shareholders totaled $10.5 million or $0.06 per basic and diluted

share.

Fiscal Year 2014

For the twelve months ended October 31, 2014, the Company

reported revenue of $180.3 million compared to $187.7 million for

the prior year period. Product sales were $136.8 million compared

to $145.1 million for the prior year period. Service agreement and

license revenues were $26.0 million compared to $28.1 million for

the prior year period. Advanced technologies contract revenues

totaled $17.5 million, compared to $14.4 million for the prior year

period.

For the twelve months ended October 31, 2014, gross profit was

$13.7 million compared to $7.1 million for the twelve months ended

October 31, 2013. The gross margin for the twelve months ended

October 31, 2014 was 7.6 percent compared to 3.8 percent for the

prior year period. Cost reductions from volume purchasing combined

with a more favorable sales mix supported expanding margins.

Net loss attributable to common shareholders for the twelve

months ended October 31, 2014 was $41.3 million or $0.17 per basic

and diluted share. Excluding the expense associated with the

conversions of Senior Unsecured Convertible notes and the related

embedded derivative adjustment, the adjusted net loss attributable

to common shareholders totaled $32.9 million or $0.13 per basic and

diluted share. For the comparable prior year period, net loss

attributable to common shareholders totaled $37.6 million or $0.20

per basic and diluted share, or excluding the non-cash fair value

adjustment required on the embedded derivatives in the Senior

Unsecured Convertible notes, the adjusted net loss attributable to

common shareholders totaled $36.2 million or $0.19 per basic and

diluted share.

Revenue Backlog

During 2014, the backlog mix continued to transition to higher

margin turnkey projects in the U.S. as well as longer term service

agreements.

Total backlog was $333.9 million at October 31, 2014 compared to

$355.4 million at October 31, 2013. The recently announced 3.4 MW

utility contract adds approximately $31 million to total backlog

for the first quarter of 2015.

- Product sales backlog was $113.1 million at October 31, 2014.

This compares to $170.1 million at October 31, 2013.

- Service backlog was $196.8 million at October 31, 2014. This

compares to $166.8 million at October 31, 2013. The average

term for service agreements now exceeds 10 years.

- Advanced technologies contracts backlog was $24.0 million at

October 31, 2014 compared to $18.5 million at October 31,

2013.

Liquidity and Capital Resources

Cash and cash equivalents and restricted cash totaled $108.8

million at October 31, 2014 which compares to $77.7 million as

October 31, 2013. The Company also had approximately $43

million of availability under its loan agreements as of the end of

the fiscal year compared to $1.5 million of availability at October

31, 2013.

Adjusted EBITDA in the fourth quarter totaled ($3.7) million

compared to ($5.6) million in the fourth quarter of 2013.

Refer to the discussion of Non-GAAP financial measures below

regarding the Company's calculation of Adjusted EBITDA. Net

cash used by operating activities in the fourth quarter of 2014 was

$25.9 million as a result of changes in working capital, including

an increase in accounts receivable of $11.0 million primarily

related to invoicing for sales made at the end of the fourth

quarter of 2014. Capital spending was $3.0 million and

depreciation expense was $1.1 million for the fourth quarter of

2014.

Business Highlights

"We maintained focus on expanding margins as we continue to

pursue cost reductions," said Chip Bottone, President and Chief

Executive Officer, FuelCell Energy, Inc. "We sold 2014

production and are marketing distributed power generation solutions

that are more competitive and affordable compared to bids we were

submitting just last year, this combined with increasing

recognition in the marketplace has led to a high level of

activity."

Market Developments

United Illuminating purchased a 3.4 megawatt (MW) DFC-ERG system

and accompanying multi-year service agreement in November, 2014 for

installation at a natural gas pressure let-down station. These

types of let-down stations are numerous in and near populated areas

and represent a sizeable global market opportunity. The high

efficiency Direct FuelCell – Energy Recovery Generator® (DFC-ERG®)

helps utilities drive demand for clean natural gas, add ultra-clean

distributed power generation, and meet sustainability

goals.

The Company and its business partners submitted multiple fuel

cell park projects, under the Long Island Power Authority (LIPA)

Request for Proposal (RFP) for 280 MW of on-island renewable power

generation. Each of the submitted projects is 19.6

MW. LIPA recently selected a number of projects using the

Company's power plants as "Finalists" to be considered for

selection under the RFP and requested "Best and Final" offers for

the projects. These best and final offers were recently

submitted. Construction on these projects could begin in 2015

for completion in 2016.

In addition to the LIPA opportunity, the Company has developed a

significant pipeline of projects for on-site 'behind-the-meter'

applications and for grid support fuel cell parks. Behind-the-meter

applications provide end users with predictable long-term

economics, on-site power including micro-grid capabilities and

reduced carbon emissions. On-site projects being developed are for

project sizes ranging from 1.4MW – 14.0 MW for end users such as

pharmaceuticals, technology companies, hospitals and universities.

In addition, a number of multi-megawatt utility grid support

projects are being developed for utilities and independent power

producers to support the grid where power is needed. These projects

help both utilities and states meet their renewable portfolio

standards. The 15 MW project in Bridgeport, Connecticut owned by

Dominion has now been operating for twelve months and demonstrates

the Company's development and operational capabilities. Power

output from the fuel cell park is meeting the expectations of

Dominion.

Operational Developments

The recently announced multi-year two phase expansion of the

North American manufacturing facility will support further cost

reductions and position the company for further growth. The

first phase expands the building and will lead to lower expenses as

logistics efficiencies are realized and further material handling

automation implemented. The second phase involves the

installation of manufacturing equipment to increase capacity to at

least 200 megawatts annually and will only be undertaken in support

of backlog. The State has committed $20 million of low

interest/long term loans for the two phases that are up to 50

percent forgivable if certain job retention and job creation goals

are attained. The State commitment also includes $10 million

of tax credits which vest over time as the Company executes on its

expansion plans.

The POSCO Energy Asian manufacturing building is completed and

manufacturing equipment is currently being installed with

production expected by mid-2015. Partner POSCO Energy is

adding the capacity and once operational, increased levels of

purchasing from the integrated global supply chain, whether by

POSCO Energy or the Company will benefit both parties by obtaining

lower pricing tiers from suppliers from the greater combined

purchasing volume. This facility will have initial capacity of 100

MW but is sized to accommodate up to 200 MW of annual production as

the Asian market continues to grow.

Advanced Technologies Developments

The Advanced Technologies group is progressing towards

commercialization of both carbon capture and distributed hydrogen

solutions. Carbon capture attracted private industry funding

from a global energy company with a multi-million dollar contract

for evaluating the integration of fuel cells into a large scale

combined cycle gas power plant to achieve only trace carbon

emissions from combustion-based natural gas power

generation. U.S. Department of Energy (DOE) advanced

additional funding during the fourth quarter of 2014 for coal-fired

power plant carbon capture studies. Separately, a tri-generation

fuel cell power plant is undergoing commissioning at the Company's

manufacturing facility, providing ultra-clean power and heat to the

facility and on-site hydrogen generation for the manufacturing

process. This installation will result in cost savings and

supports the Company's sustainability objectives.

Cautionary Language

This news release contains forward-looking statements within the

meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, including, without limitation,

statements with respect to the Company's anticipated financial

results and statements regarding the Company's plans and

expectations regarding the continuing development,

commercialization and financing of its fuel cell technology and

business plans. All forward-looking statements are subject to risks

and uncertainties that could cause actual results to differ

materially from those projected. Factors that could cause such a

difference include, without limitation, changes to projected

deliveries and order flow, changes to production rate and product

costs, general risks associated with product development,

manufacturing, changes in the regulatory environment, customer

strategies, unanticipated manufacturing issues that impact power

plant performance, changes in critical accounting policies,

potential volatility of energy prices, rapid technological change,

competition, and the Company's ability to achieve its sales plans

and cost reduction targets, as well as other risks set forth in the

Company's filings with the Securities and Exchange Commission. The

forward-looking statements contained herein speak only as of the

date of this press release. The Company expressly disclaims any

obligation or undertaking to release publicly any updates or

revisions to any such statement to reflect any change in the

Company's expectations or any change in events, conditions or

circumstances on which any such statement is based.

Non-GAAP Financial Measures

Financial Results are presented in accordance with accounting

principles generally accepted in the United States ("GAAP").

Management also uses non-GAAP measures to analyze the business.

Earnings before interest, taxes, depreciation and amortization

(EBITDA) is an alternate measure of cash utilization. The

table below calculates Adjusted EBITDA and reconciles these figures

to the GAAP financial statement measure Net loss attributable to

FuelCell Energy, Inc.

| |

Three Months

Ended October 31, |

Fiscal Year Ended

October 31, |

| (Amounts in thousands) |

2014 |

2013 |

2014 |

2013 |

| Net loss attributable to

FuelCell Energy, Inc. |

$ (4,700) |

$ (9,700) |

$ (38,125) |

$ (34,358) |

| Depreciation and

amortization |

1,086 |

1,053 |

4,384 |

4,097 |

| Provision for income taxes |

219 |

349 |

488 |

371 |

| Other income (expense), net

(1) |

(957) |

941 |

7,523 |

1,208 |

| Interest expense |

660 |

1,755 |

3,561 |

3,973 |

| Income from equity

investment |

-- |

-- |

-- |

(46) |

| Adjusted EBITDA |

$ (3,692) |

$ (5,602) |

$ (22,169) |

$ (24,755) |

| |

|

|

|

|

| (1) Other

income (expense), net includes gains and losses from transactions

denominated in foreign currencies, fair value changes in embedded

derivatives, make-whole interest charges on the Senior Unsecured

Convertible notes and receipt of research and development tax

credits. These items are not the result of the Company's normal

business operations and as a result are excluded from EBITDA to

arrive at Adjusted EBITDA. |

Adjusted EBITDA is a non-GAAP measure of financial performance

and should not be considered as an alternative to net income or any

other performance measure derived in accordance with GAAP, or as an

alternative to cash flows from operating activities.

The Company also calculates net loss and earnings per share

which exclude non-recurring items in order to measure operating

periodic performance. This is described in more detail in the

Reconciliation of GAAP to Non-GAAP Consolidated Statements of

Operations following the Financial Statements.

About FuelCell Energy

Direct FuelCell® power plants are generating ultra-clean,

efficient and reliable power at more than 50 locations

worldwide. With more than 300 megawatts of power generation

capacity installed or in backlog, FuelCell Energy is a global

leader in providing ultra-clean baseload distributed generation to

utilities, industrial operations, universities, municipal water

treatment facilities, government installations and other customers

around the world. The Company's power plants have generated

more than three billion kilowatt hours of ultra-clean power using a

variety of fuels including renewable biogas from wastewater

treatment and food processing, as well as clean natural

gas. For more information, please visit

www.fuelcellenergy.com

See us on YouTube

Direct FuelCell, DFC, DFC/T, DFC-H2 and FuelCell Energy, Inc.

are all registered trademarks of FuelCell Energy, Inc.

DFC-ERG is a registered trademark jointly owned by Enbridge,

Inc. and FuelCell Energy, Inc.

Conference Call Information

FuelCell Energy management will host a conference call with

investors beginning at 10:00 a.m. Eastern Time on December 16, 2014

to discuss the fourth quarter and fiscal year 2014 results.

An accompanying slide presentation for the earnings call will be

available at http://fcel.client.shareholder.com/events.cfm

immediately prior to the call.

Participants can access the live call via webcast on the Company

website or by telephone as follows:

- The live webcast of this call will be available on the Company

website at www.fuelcellenergy.com. To listen to the call,

select 'Investors' on the home page, then click on 'Events &

presentations' and then click on 'Listen to the webcast'

- Alternatively, participants can dial 678-809-1045

- The passcode is 'FuelCell Energy'

The replay of the conference call will be available via webcast

on the Company's Investors' page at www.fuelcellenergy.com

approximately two hours after the conclusion of the call.

| FUELCELL ENERGY,

INC. |

| Consolidated Balance

Sheets |

| (Unaudited) |

| (Amounts in thousands,

except share and per share amounts) |

| |

|

|

| |

October 31,

2014 |

October 31,

2013 |

| ASSETS |

|

|

| Current assets: |

|

|

| Cash and cash equivalents -

unrestricted |

$ 83,710 |

$ 67,696 |

| Restricted cash and cash

equivalents – short-term |

5,523 |

5,053 |

| Accounts receivable, net |

50,465 |

49,116 |

| Inventories, net |

55,895 |

56,185 |

| Other current assets |

7,528 |

11,279 |

| Total current assets |

203,121 |

189,329 |

| |

|

|

| Restricted cash and cash equivalents –

long-term |

19,600 |

4,950 |

| Property, plant and equipment, net |

26,609 |

24,225 |

| Goodwill |

4,075 |

4,075 |

| Intangible assets |

9,592 |

9,592 |

| Other assets, net |

3,729 |

5,465 |

| Total assets |

$ 266,726 |

$ 237,636 |

| |

|

|

| LIABILITIES AND EQUITY

(DEFICIT) |

|

|

| Current liabilities: |

|

|

| Current portion of long-term

debt |

$ 1,439 |

$ 6,931 |

| Accounts payable |

22,969 |

24,535 |

| Accrued liabilities |

12,066 |

21,912 |

| Deferred revenue |

23,716 |

51,857 |

| Preferred stock obligation of

subsidiary |

961 |

1,028 |

| Total current liabilities |

61,151 |

106,263 |

| |

|

|

| Long-term deferred revenue |

20,705 |

18,763 |

| Long-term preferred stock obligation of

subsidiary |

13,197 |

13,270 |

| Long-term debt and other liabilities |

13,367 |

52,675 |

| Total liabilities |

108,420 |

190,971 |

| Redeemable preferred stock (liquidation

preference of $64,020 at October 31, 2014 and October 31,

2013) |

59,857 |

59,857 |

| Total Equity (Deficit): |

|

|

| Shareholders' equity

(deficit) |

|

|

| Common stock ($.0001 par value;

400,000,000 and 275,000,000 shares authorized at October 31,

2014 and October 31, 2013, respectively; 287,160,003

and 196,310,402 shares issued and outstanding at October 31,

2014 and October 31, 2013, respectively) |

29 |

20 |

| Additional paid-in capital |

909,431 |

758,656 |

| Accumulated deficit |

(809,314) |

(771,189) |

| Accumulated other comprehensive

income (loss) |

(159) |

101 |

| Treasury stock, Common, at cost

(45,550 and 5,679 shares at October 31, 2014 and October 31, 2013,

respectively) |

(95) |

(53) |

| Deferred compensation |

95 |

53 |

| Total shareholders' equity

(deficit) |

99,987 |

(12,412) |

| Noncontrolling interest in

subsidiaries |

(1,538) |

(780) |

| Total equity (deficit) |

98,449 |

(13,192) |

| Total liabilities

and equity (deficit) |

$ 266,726 |

$ 237,636 |

| |

| FUELCELL ENERGY,

INC. |

| Consolidated Statements

of Operations |

| (unaudited) |

| (Amounts in thousands,

except share and per share amounts) |

| |

|

|

| |

Three Months

Ended October 31, |

| |

2014 |

2013 |

| Revenues: |

|

|

| Product sales |

$ 42,360 |

$ 36,190 |

| Service agreements and license

revenues |

6,741 |

15,358 |

| Advanced technologies contract

revenues |

5,308 |

3,609 |

| Total revenues |

54,409 |

55,157 |

| |

|

|

| Costs of revenues: |

|

|

| Cost of product sales |

37,922 |

33,039 |

| Cost of service agreements and

license revenues |

5,491 |

15,867 |

| Cost of advanced technologies

contract revenues |

5,041 |

3,654 |

| Total cost of revenues |

48,454 |

52,560 |

| |

|

|

| Gross profit |

5,955 |

2,597 |

| |

|

|

| Operating expenses: |

|

|

| Administrative and selling

expenses |

6,628 |

5,147 |

| Research and development

expenses |

4,295 |

4,402 |

| Total operating expenses |

10,923 |

9,549 |

| |

|

|

| Loss from operations |

(4,968) |

(6,952) |

| |

|

|

| Interest expense |

(660) |

(1,755) |

| Other income (expense),

net |

957 |

(941) |

| |

|

|

| Loss before provision for income taxes |

(4,671) |

(9,648) |

| |

|

|

| Provision for income taxes |

(219) |

(349) |

| |

|

|

| Net loss |

(4,890) |

(9,997) |

| |

|

|

| Net loss attributable to

noncontrolling interest |

190 |

297 |

| |

|

|

| Net loss attributable to FuelCell Energy,

Inc. |

(4,700) |

(9,700) |

| |

|

|

| Preferred stock dividends |

(800) |

(800) |

| |

|

|

| Net loss to common shareholders |

$ (5,500) |

$ (10,500) |

| |

|

|

| Loss per share basic and diluted |

|

|

| Basic |

$ (0.02) |

$ (0.06) |

| Diluted |

$ (0.02) |

$ (0.06) |

| |

|

|

| Weighted average shares outstanding |

|

|

| Basic |

280,563,763 |

187,918,612 |

| Diluted |

280,563,763 |

187,918,612 |

| |

| FUELCELL ENERGY,

INC. |

| Consolidated Statements

of Operations |

| (unaudited) |

| (Amounts in thousands,

except share and per share amounts) |

| |

|

|

| |

Twelve Months

Ended October 31, |

| |

2014 |

2013 |

| Revenues: |

|

|

| Product sales |

$ 136,842 |

$ 145,071 |

| Service agreements and license

revenues |

25,956 |

28,141 |

| Advanced technologies contract

revenues |

17,495 |

14,446 |

| Total revenues |

180,293 |

187,658 |

| |

|

|

| Costs of revenues: |

|

|

| Cost of product sales |

126,866 |

136,989 |

| Cost of service agreements and

license revenues |

23,037 |

29,683 |

| Cost of advanced technologies

contract revenues |

16,664 |

13,864 |

| Total cost of revenues |

166,567 |

180,536 |

| |

|

|

| Gross profit |

13,726 |

7,122 |

| |

|

|

| Operating expenses: |

|

|

| Administrative and selling

expenses |

22,797 |

21,218 |

| Research and development

expenses |

18,240 |

15,717 |

| Total operating expenses |

41,037 |

36,935 |

| |

|

|

| Loss from operations |

(27,311) |

(29,813) |

| |

|

|

| Interest expense |

(3,561) |

(3,973) |

| Income from equity

investment |

-- |

46 |

| Other income (expense),

net |

(7,523) |

(1,208) |

| |

|

|

| Loss before provision for income taxes |

(38,395) |

(34,948) |

| |

|

|

| Provision for income taxes |

(488) |

(371) |

| |

|

|

| Net loss |

(38,883) |

(35,319) |

| |

|

|

| Net loss attributable to

noncontrolling interest |

758 |

961 |

| |

|

|

| Net loss attributable to FuelCell Energy,

Inc. |

(38,125) |

(34,358) |

| |

|

|

| Preferred stock dividends |

(3,200) |

(3,200) |

| |

|

|

| Net loss to common shareholders |

$ (41,325) |

$ (37,558) |

| |

|

|

| Loss per share basic and diluted |

|

|

| Basic |

$ (0.17) |

$ (0.20) |

| Diluted |

$ (0.17) |

$ (0.20) |

| |

|

|

| Weighted average shares outstanding |

|

|

| Basic |

245,686,983 |

186,525,001 |

| Diluted |

245,686,983 |

186,525,001 |

| |

| FUELCELL ENERGY,

INC. |

| Reconciliation of GAAP

to Non-GAAP Consolidated Statements of Operations |

|

(Unaudited) |

| (Amounts in thousands,

except share and per share amounts) |

| |

|

|

|

|

|

|

|

|

| |

Three

Months Ended October 31, |

| |

2014 |

2013 |

| |

GAAP As Reported |

Non-GAAP Adjustments |

|

Non-GAAP As Adjusted |

GAAP As Reported |

Non-GAAP Adjustments |

|

Non-GAAP As Adjusted |

| Loss before provision for income taxes |

$ (4,671) |

$ -- |

|

$ (4,671) |

$ (9,648) |

$ 1,091 |

(2) |

$ (8,557) |

| Net loss |

$ (4,890) |

$ -- |

|

$ (4,890) |

$ (9,997) |

$ 1,091 |

|

$ (8,906) |

| Net loss to common shareholders |

$ (5,500) |

$ -- |

|

$ (5,500) |

$ (10,500) |

$ 1,091 |

|

$ (9,409) |

| |

|

|

|

|

|

|

|

|

| Net loss per share to common

shareholders |

|

|

|

|

|

|

|

|

| Basic |

$ (0.02) |

|

|

$ (0.02) |

$ (0.06) |

|

|

$ (0.05) |

| Diluted |

$ (0.02) |

|

|

$ (0.02) |

$ (0.06) |

|

|

$ (0.05) |

| |

|

|

|

|

|

|

|

|

| |

Twelve Months

Ended October 31, |

| |

2014 |

2013 |

| |

GAAP As Reported |

Non-GAAP Adjustments |

|

Non-GAAP As Adjusted |

GAAP As Reported |

Non-GAAP Adjustments |

|

Non-GAAP As Adjusted |

| Loss before provision for income taxes |

$ (38,395) |

$ 8,418 |

(1) |

$ (29,977) |

$ (34,948) |

$ 1,383 |

(2) |

$ (33,565) |

| Net loss |

$ (38,883) |

$ 8,418 |

|

$ (30,465) |

$ (35,319) |

$ 1,383 |

|

$ (33,936) |

| Net loss to common shareholders |

$ (41,325) |

$ 8,418 |

|

$ (32,907) |

$ (37,558) |

$ 1,383 |

|

$ (36,175) |

| |

|

|

|

|

|

|

|

|

| Net loss per share to common

shareholders |

|

|

|

|

|

|

|

|

| Basic |

$ (0.17) |

|

|

$ (0.13) |

$ (0.20) |

|

|

$ (0.19) |

| Diluted |

$ (0.17) |

|

|

$ (0.13) |

$ (0.20) |

|

|

$ (0.19) |

Notes to Reconciliation of GAAP to

Non-GAAP Consolidated Statements of Operations For

the Three and Twelve Months Ended October 31, 2014 and

2013

Results of Operations are presented in accordance with

accounting principles generally accepted in the United States

("GAAP"). Management also uses non-GAAP measures which

exclude non-recurring items in order to measure operating periodic

performance. We have added this information because we believe

it helps in understanding the results of our operations on a

comparative basis. This adjusted information supplements and

is not intended to replace performance measures required by U.S.

GAAP disclosure.

Notes to the reconciliation of GAAP to non-GAAP Consolidated

Statements of Operations information are as follows:

(1) Adjustment for the twelve months ended

October 31, 2014 represents expense associated with the conversion

of the $38.0 million Senior Unsecured Convertible notes, partially

offset by a favorable impact from the fair value adjustment

required on the embedded derivatives in the Senior Unsecured

Convertible notes in accordance with Accounting Standards

Codification (ASC) 815 – Derivatives and Hedging.

(2) Adjustment for the three and twelve months

ended October 31, 2013 represents the impact from the fair value

adjustment required on the embedded derivatives in the Senior

Unsecured Convertible notes in accordance with Accounting Standards

Codification (ASC) 815 – Derivatives and Hedging.

CONTACT: FuelCell Energy, Inc.

Kurt Goddard, Vice President Investor Relations

203-830-7494

ir@fce.com

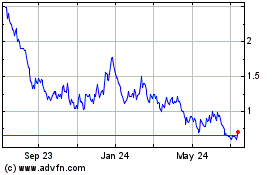

FuelCell Energy (NASDAQ:FCEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

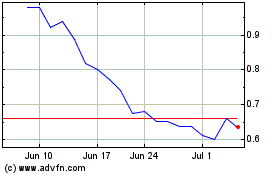

FuelCell Energy (NASDAQ:FCEL)

Historical Stock Chart

From Apr 2023 to Apr 2024